BDC Common Stocks Market Recap: Week Ended September 23, 2022

BDC COMMON STOCKS

Week 39

Deja Vu All Over Again

The meltdown in BDC prices during the week ended September 23, 2022 bears more than a striking resemblance to what happened the last time investors panicked en masse.

That was in the week June 17, 2022, with the nadir on June 16.

In the earlier downturn, BDCZ – the exchange traded note sponsored by UBS which owns most BDC stocks and which we use as a price guide – fell (3.2%) in the two weeks prior, before plummeting (7.5%) on that fateful week of June 17.

At the very bottom, 41 BDCs were trading within 10% of their 52 week low and none were even within 10% of their 52 week highs.

8 BDCs still traded above net book value per share, but 35 did not.

BDCZ ended the week at $16.73.

The major indices, too, were in a world of hurt, reaching new 52 week and YTD lows, with the S&P 500 off (5.8%) for the week and (23.7%) below its highest level.

Now, 14 weeks later, the metrics are very similar.

BDCZ fell (2.8%) in the week before, and plummeted once again thereafter (7.2%).

At week’s end, 38 BDCs were trading within 10% of their 52 week lows, and none were within even 10% of their highs.

7 BDCs traded above net book value per share and 36 did not.

Bigger Picture

The S&P 500 also took a tumble, by (4.7%) and was (23.4%) below its highest level of 2022.

This chart of BDCZ and the S&P 500 through 2022 shows the two indices moving in a synchronized way:

Much The Same

BDCZ ended the week at $16.45, (1.2%) down from the June 17 level.

At its lowest point intra-day on Friday, BDCZ reached $16.30.

Both the BDC sector and the S&P 500 – and the other major indices – are below or just slightly above their 52 week lows, right back where we were in mid-June.

The S&P BDC “total return” index – which had managed to keep its 2022 loss to the single digit level thanks to the high distributions BDCs pay – has moved into “correction” territory, dropping from (6.6%) to (13.6%).

On June 17, 2022 the S&P BDC Index was (14.0%) down.

Are We There Yet ?

As you might imagine, trading volumes were high – sometimes 3x-4x the normal level.

On Friday, we count 38 BDCs whose trading volume was higher than usual.

Was this the “capitulation” investors are always looking for in a bear market – ever eager for a ray of sunlight – or just another step down ?

It’s impossible to say, of course, but back in mid-June, BDCZ moved up 7.42% in the next 3 weeks, offsetting in aggregate the price drop of the June 17 week.

As usual where the BDC sector goes price-wise will be dictated by the broader sentiment in the markets, whatever is happening to BDC fundamentals.

When Good News Is Bad News

Ironically, this week the latest update on the possible medium and long term path of interest rates only bolstered our thesis that the BDC sector will benefit for a long time from the Fed’s shift in approach.

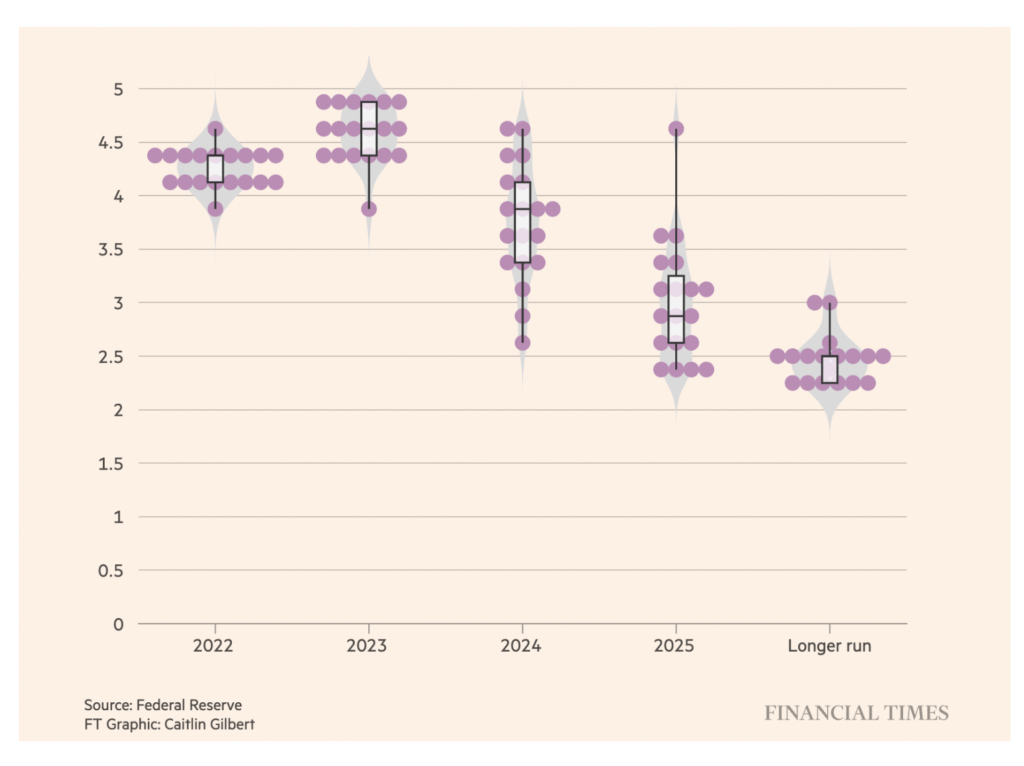

Going by the “dot plot” of the Federal Reserve participants projected interest rates in the future, a higher reference rate is here to stay:

Even in 2025, the expectation that the Fed Funds rate will be between 2.4%- 4.6%, and remains above 2.0% in the “longer run”.

Maybe over time lenders will negotiate/demand lower spreads on new and existing loans but the implication of this “dot plot” is that loan yields – already moving up – are headed higher for longer. More importantly, this historic shift in rate levels is here to stay.

This confirms our argument that BDC yields, ROE, ROA and distributions are not only headed higher in the second half of 2022, but will continue to sharply exceed 2021 levels for many years to come.

Ghost Of Crisis Past

The market does not seem to care that BDC earnings and payouts – at least on paper – are headed higher. Perhaps remembering what happened in the Great Recession, markets may be expecting “private credit” to rack up outsized losses over the next several quarters as the Fed brakes the economy.

As we’ve said before, we don’t expect that to happen under virtually any of the recession scenarios being thrown out there – which range from the mild to the dire.

Subtleties

Not that there couldn’t be a very large uptick in the number of defaults by BDC portfolio companies.

After all, the credit waters have been very calm of late (thanks – ironically enough – to the policies of the Fed and Treasury in 2020-2021).

Expect to see alarmist headlines about huge increases in the percentage of distressed or defaulted loan assets, but remember it’s from a very low base.

Moreover, even a large number of “troubled” companies in absolute terms because of this surge in borrowing costs may not translate into much in the way of realized losses down the road.

BDCs are – almost without exception – sitting at the top of their borrowers balance sheets and are the least likely of all creditors to take a permanent loss.

Kept Busy

We do expect a great deal of balance sheet restructuring to go on, including capital infusions by PE groups (which, after all, have been extracting dividend recaps for years).

Most At Risk

Second lien/mezzanine/subordinated debt lenders, and holders of preferred stock – as is ever the case – will be at risk of being squeezed down or out in these restructurings. BDCs do participate in junior capital but far, far less than they did in 2008-2009.

At times, BDC lenders will have to choose between walking away from a company or stepping in as owner-lenders. Most of the time, even when more capital is needed, we expect the BDCs to take over. After all, this is something of a manufactured recession we’re being promised and most of the companies whose excess levels of debt may cause them trouble are still viable businesses.

Generally speaking, BDC management has shown that they have the experience, and the financial insight to differentiate between a truly busted business and one which only needs a financial tune-up.

The greatest casualties we expect will come from the ranks of companies that were underperforming at the beginning of the pandemic – whose troubles date back to 2019 or earlier – but were “saved” by the huge rescue efforts of the public and private sector.

This time round, facing new needs for capital in a shrinking economy, both owners and lenders might decide to fold their tents and move on. This could result in losses, but many of those have already been largely reserved for on BDC balance sheets.

In Focus

What we’ll be looking for on the credit front above all else amongst the 7,000 or so BDC portfolio companies are newly minted underperformers where exposure at cost is material and is principally in income yielding junior capital.

We do track the public record about developments at hundreds of underperforming companies every day and have been grinding through the portfolios of all the public BDCs as best we can, updating our database as we go.

For what it’s worth – and so far – we’ve not yet seen any significant increase in credit underperformance across the sector, either as reported by the BDCs themselves or through independent reports.

Even the ratings groups – which only cover a portion of the markets BDCs operate in – continue to project only modest deterioration in expected credit losses – more of a “reversion to the mean” than the catastrophic results the recent BDC price drop might imply.

Still, with future credit conditions on everyone’s mind, we’re going to start to write a weekly summary of all material credit developments we’ve encountered for our Premium subscribers.

This will be drawn from the research we undertake at our sister publication – the BDC Credit Reporter – and from our ongoing research for the BDC Reporter, which is summarized in the BDC Credit Table.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.