Capital Southwest: IIQ 2022 Credit Review

CREDIT REVIEW

Portfolio Metrics

For Capital Southwest (CSWC) at the end of the IIQ 2022 total investment assets at cost amounted to $1.019 bn and the fair market value to $1.007nn – a (1%) discount, or ($12mn).

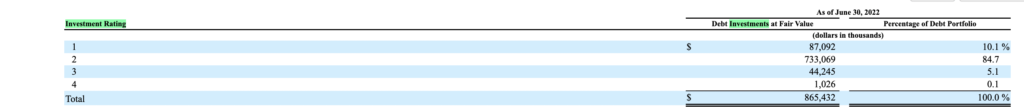

Investment Rating

There are 75 portfolio companies in the CSWC portfolio. The BDC does offer investors a traditional quarterly investment rating of its portfolio, using a 4 point system. However, only debt investments are evaluated, rr 86% of the entire portfolio.

Total underperforming loans at FMV to $45mn, 5.2% of total debt and 4.5% of the portfolio as a whole. The BDC – like most of its peers – does not calculate how many companies are underperforming or identify them by name.

However, the BDC Reporter – drawing on research undertaken by the BDC Credit Reporter – has utilized its own 5 point rating system to evaluate CSWC’s credit status.

Underperformers

We have identified 12 underperforming portfolio companies. See the attached database with all the Company Files. We value the cost of all investments held by underperforming companies at $193mn and their fair market value at $139mn. Our methodology is different from CSWC’s and cannot be usefully compared.

We use a 5 point scale, where ratings 3-5 are for companies underperforming. A rating of CCR 3 means the likelihood of full recovery is higher than that of eventual loss; CCR 4 means the likelihood of an eventual loss is greater than full recovery and CCR 5 relates to non accruals. To save everyone’s time, we also break up the underperformers between material and non material. The latter are for investments of little or no remaining value or importance, allowing us to focus on the companies and investments that might materially impact a BDC’s financial performance.

CCR 3

There are 5 companies rated CCR 3, with a total cost of $69mn, and a FMV of $58mn – a (16%) discount. These consist of:

AAC Holdings, Inc: This mental health provider that operates under the American Addiction Centers banner is a former public company that was restructured and taken private two years ago in a debt for equity swap, and after the BDC booked a significant realized loss. Bowen Diehl, the head of CSWC, serves as Chairman of the restructured company and the BDC owns an equity stake, warrants and is also a first lien lender.

Given the troubled history of the company, we maintained AAC on our watchlist with a CCR 3 rating even after the restructuring till we could be sure a true sustainable improvement had occurred. Unfortunately – and going mostly by the valuations offered by different BDCs in the intervening quarters, we get the impression performance may not be meeting plan. In the most recent quarter, the equity stakes – previously discounted by (34%) fell sharply in value – discounted (75%) by MAIN. Between its on balance sheet position and its I-45 JV CSWC has $16.8mn invested and a FMV of $13.9mn.

There is no immediate cause for concern and seemingly no threat to the income from the senior debt which yields 10%. Nonetheless, this turnaround effort and that of Delphi – which we’ll discuss shortly – deserves to be closely monitored.

Ace Gathering Inc. is an energy investment in a midstream business. Most energy investments have been performing well of late but the subordinated debt CSWC provides was written down (12%) in the IIQ 2022, placing the company on the underperformers list for the first time. We don’t know anything more.

Delphi Behavioral Health is a company which has gone through a very similar arc as AAC Holdings. CEO Diehl has considerable experience in this industry segment, which might explain why CSWC has two such similar portfolio companies. The restructuring occurred in late 2020, but starting in the IVQ 2021 we noted a decrease in the valation of the equity CSWC holds and the advance of new monies in the form of a “Protective Advance” – a term that speaks volumes. This quarter the valuation trend is stable but – as just mentioned – Delphi deserves continued attention. Very recently a new CEO was appointed, which might suggest changes are a-foot.

Dynamic Communities – like Ace Gathering – is also new to the underperformers list. Again, its presence there is based on tripping a valuation limit, with the preferred held discounted by (58%) – the worse result ever. “Dynamic Communities develops and manages technology and business-centric conferences, events, online community groups, and training courses specifically related to Microsoft’s suite of business software” says the CSWC 10-Q.Most of CSWC’s exposure is in debt, but even a first lien loan is discounted (9%). Overall, the cost is $13.8 and the value $11.7mn. This may be a passing weakness in the valuation, or the beginning of something else.

Grammatech, Inc. is a software company and CSWC has been providing debt and equity since IVQ 2019. Starting in late 2021, we noted valuations dropped to underperforming levels, but nothing much has changed recently. By the way here is how Grammatech describes itself:

At GrammaTech, we help our customers, partners, and government sponsors solve the most challenging software issues of today and tomorrow, safeguarding embedded mission-critical devices from failure and cyber attack. With our security-first software design philosophy, you can rely on GrammaTech to help you design, develop, and deploy trusted software applications – minimizing corporate risks and maximizing your competitive position.

LGM Pharma has also been on the underperformers list since 2021, but has not deteriorated of late. Still, we will be keeping an eye on the company given that CSWC’s exposure at cost is material: $15.5mn in debt and equity. LGM Pharma is what we would call a contract manufacturer for pharmaceuticals.

CCR 4

There are only two names in this important category where an ultimate loss seems likely.

I-45 JV: CSWC is in a joint venture with MAIN. This is the BDC’s largest commitment with $76mn invested and an FMV of $52mn as of June 2022 and a major source of revenue. Unfortunately, due to the use of leverage at a time when asset values are dropping, the JV is valued well below cost. As management itself admit, though, at least a third of the unrealized write-down in the most recent quarter was due to actual “credit issues”. This may be because some troubled on balance sheet companies are also on the books of I-45.

We’re not concerned about the receipt of income from the JV, but with the valuation already cut by one-third, we have to wonder when this vehicle is eventually whether a significant realized loss might have to booked – hence the CCR 4 valuation. The JV investment represents 37j% of all underperforming assets.

Wahoo Fitness is a recent and worrying addition. The fitness technology company was already rated CCR 3 after the first lien debt positions CSWC owns on its just discussed JV – with a total cost of $4.8mn – was discounted (16%) in the IIQ 2022. Even more recently, we’ve heard that the company has been downgraded to CCC by a ratings group and that it’s EBITDA is likely to drop by (75%). That was enough for us to rate Wahoo CCR 4. At risk for the I-45 SLF JV is annual investment income of about $0.350mn.

CCR 5

CSWC has a modestly larger number of non performing loans than many of its peers: 4. That’s up from 3 in the prior quarter. The total cost of the non performers is $39mn and the FMV $21mn, suggesting a recovery rate of just over half advances. CCR 5 assets account for only 15% of total underperforming assets and make no contribution to income.

The newest addition is Dunn Paper – a company the BDC Credit Reporter wrote about most recently on April 28, 2022. CSWC has a small $3.0mn second lien loan, currently not receiving interest. There’s a theoretical ($0.330mn) in annual investment income not being received, which was previously being booked. The BDC has valued its position at a (77%) discount. Conservatively – given the company’s multiple problems and the second lien status – we are assuming a realized loss of 75%-100% of the cost.

The other three non accruals have been in that state for some time: American Teleconferencing Services (AFS); Lighting Retrofit International and SIMR, LLC. The first name – non performing for a year – has been further written down and for CSWC has become non material. Its latest value for the BDC was only $0.7mn. No recovery seems in sight. There’s a little more value left in Lighting Retrofit and SIMR, LCC (aka STATinMED Research). This quarter the former continued to drop in value while the latter ticked up. In both cases, we don’t know why.

At Risk

From a capital loss standpoint, we’re reserving for a potential realized loss of ($38mn) from the I-45 JV , as losses gradually erode invested capital. That’s (14mn) more than already in place. This will include any damage caused by Wahoo Fitness, if any. We expect a full ($5.7mn) realized loss from American Teleconferencing, ($0.7mn) more than currently valued. Likewise, we budget for a ($3.0mn) realized loss at Dunn Paper, (0.7mn) more than currently. Lighting Retrofit and SIMR LLC are harder to handicap, so we’ll just assume no change from the current situation, which would imply realized losses of ($10mn) between them. This adds up to ($57mn) in realized losses but “only” ($29mn) of incremental losses. That’s about ($1.0) a share and would bring CSWC NAV Per Share down from $16.54 to $15.54, a (6%) drop. At time of writing CSWC trades at $18.21.

By the way, the BDC has $63mn invested in preferred and equity, with a current value of $89mn. Over time, these investments might grow further in value and offset some or all these pro-forma losses. In the last 3 fiscal years and one quarter, CSWC has recorded $40mn in net realized gains. However, it’s worth noting that one investment inherited at the time the BDC split away accounts for much of the gain and is unlikely to be repeated.

Performing Risk Profile

As noted, 63 companies and $868mn of investment assets are performing as planned or better. The yield on income producing investments is currently 9.3%, which suggests moderate risk for lower middle market lending. 81% of portfolio assets at cost are directly invested in first lien debt , and another 6% in junior debt. Another 8% is invested indirectly in first lien debt through the I-45 JV, but the leverage on that vehicle – as we’ve seen – is a cause for credit concern. 6% of the portfolio at cost is in preferred and equity, but whether that’s a positive or negative – as discussed above – is hard to say. In the short term one would expect outsized drops in value if we face a downturn but potential gains in an expanding economy – especially as the equity stakes owned are highly diversified, present in 58% of companies.

For those $868mn of performing assets, we’d apply a general loss reserve of (3%) given the risk profile of the portfolio and the possibility that some losses may be offset by equity gains down the road. We take some comfort from CSWC’s credit track record over the years. Like many of its peers, management has been prepared to take a long term view with underperforming companies when necessary, changing managers; adding new capital; making add-on acquisitions, etc. There is no guarantee of success and the process can result in very long time frames – 2x or more the normal lifespan. This reserve amounts to ($26mn) and added to the specific reserves for the CCR 4 and CCR 5 companies of ($29mn) comes to total reserves of ($55mn). That amounts to ($1.8) per share and would on a pro-forma basis drop CSWC’s NAV Per Share from $16.54 to $14.74. That’s a potential loss of (11%).

Follow Up

There are a large number of CSWC under-performing portfolio companies to track, even if American Teleconferencing and Dunn Paper have become immaterial. We will be tracking every underperformer daily for any new development and update the valuations quarterly. Judging the investment in the I-45 SLF JV will remain an important – but difficult – component of our credit analysis. We fully recognize that we may have been too conservative about a vehicle whose assets are still only discounted (8%) off cost and include many larger borrowers, but also include duplicates of underperforming on balance sheet companies.

Conclusion

We have the highest regard for the senior managers of CSWC – who we’ve had the opportunity to break bread with in the past and whose progress we’ve followed since the switch was made to BDC status. However, the nearly 14% of assets underperforming – by our way of counting – and the relatively high number of companies involved, as well as the arrival of a new non accrual in the most recent quarter are worrisome elements to us. Also, three new underperformers were added in the most recent quarter and the valuation trend was in the red for half the 12 underperformers. The problem may lie in the strategic decision taken years ago – but being soft pedaled of late – to invest in larger cap borrowers, as well as in the lower middle market. A number of these loans have resulted in realized losses in the past and several such companies remain amongst the underperformers. Not that CSWC – or anybody else – can claim a flawless record in lending into the lower middle market, but the overall record seems better in that segment of the market.

The reason we undertake credit reviews is to determine where most to worry about potential negative credit outcomes, but this is always on a spectrum. No BDC’s portfolio is trouble free, but in this case we’re a little more concerned than we expected to be before undertaking the exercise. We may be slow to realize what the market has already determined as CSWC is down (28%) YTD, versus only (9%) for the BDC sector as a whole.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.