BDC Common Stocks Market Recap: Week Ended October 28, 2022

BDC COMMON STOCKS

Week 44

Rebound

For a second week, BDC prices were in rally back mode, as were the broader indices.

Even the NASDAQ was higher from Friday to Friday despite with the miserable performance of many of its most famous technology stocks.

The S&P 500 was up 3.95%.

The BDC sector – as measured by BDCZ – the exchange traded note which owns virtually all the public stocks – was up even more: 6.74%.

That’s the best weekly percentage increase for BDC all year.

Also, the total return S&P BDC Index was up 6.16%, also the best weekly performance all year.

Virtual Unanimity

41 of the 43 BDCs we track increased in price and only 2 were down.

No less than 36 individual BDCs moved up 3.0% or more in price and only 1 decreased by greater than (3.0%). More on that later.

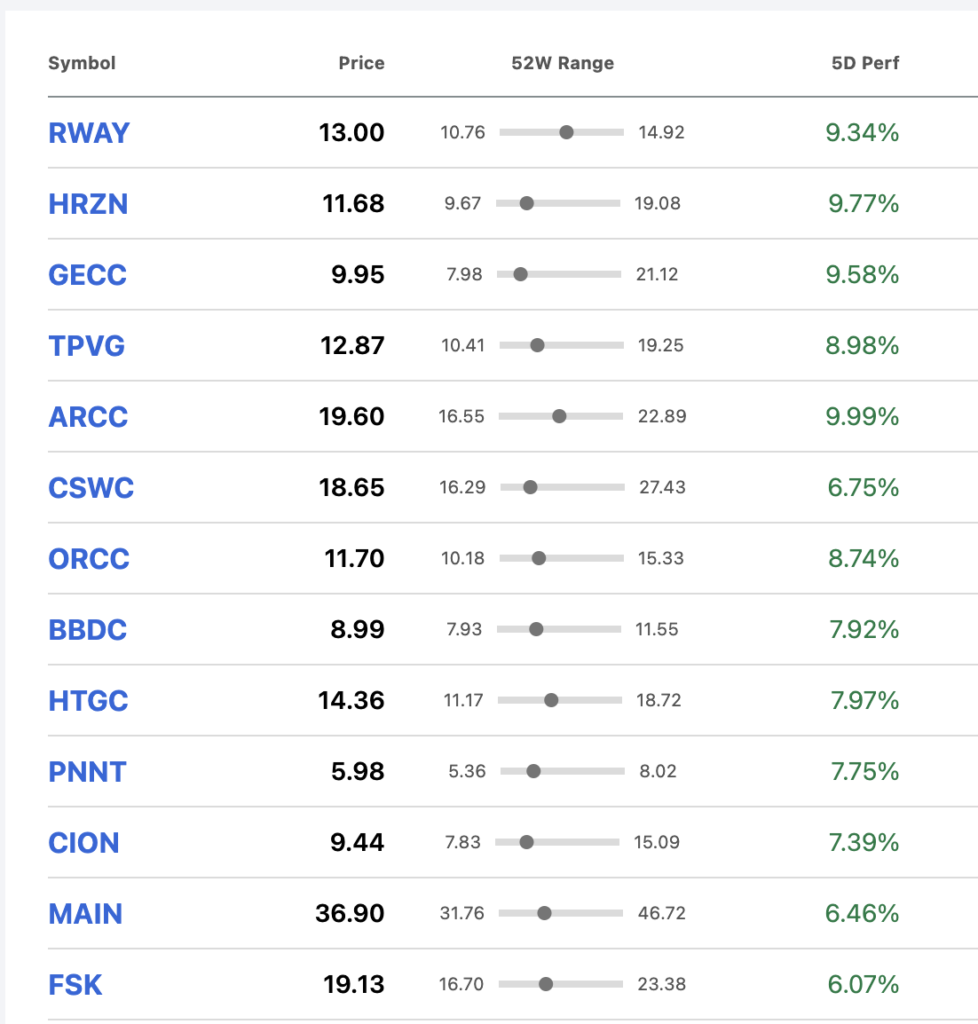

Included in the 42 3.0% plus gainers, 15 were up 6.0% or more – see below:

Diversity

You’ll see from the list above that these outperforming BDCs come in all sorts and sizes, with a plethora of different strategies, target markets, capital structures and dividend outlooks.

Yay

Clearly – on this first week of BDC earnings season and after encouraging results by Ares Capital (ARCC) – investors were in a buying mood.

Ways To Go

Nonetheless, the BDC sector remains very far from its best metrics earlier in the year.

The number of BDCs trading above net book value per share barely increased – going from 5 to 6.

Also, the number of BDCs trading within 5%% of their 52 week high price remained zero.

Only 1 BDC is trading between 5%-10% of its 52 week high, up from zero last week.

Using a 200 day moving average, there are only 3 BDCs who price is in the black and the same number whose stock price is up versus December 31, 2022.

For the year to date, BDCZ is still down (15.5%) in price.

[The most encouraging metric is that the SP& BDC index – counting in all dividends received through these 44 weeks – is off just (9.52%).That’s not even in “correction” territory – albeit by a hair].

BDC investors will have to maintain their enthusiasm for awhile longer before the sector gets back to break-even, or to garner a gain.

Object Lesson

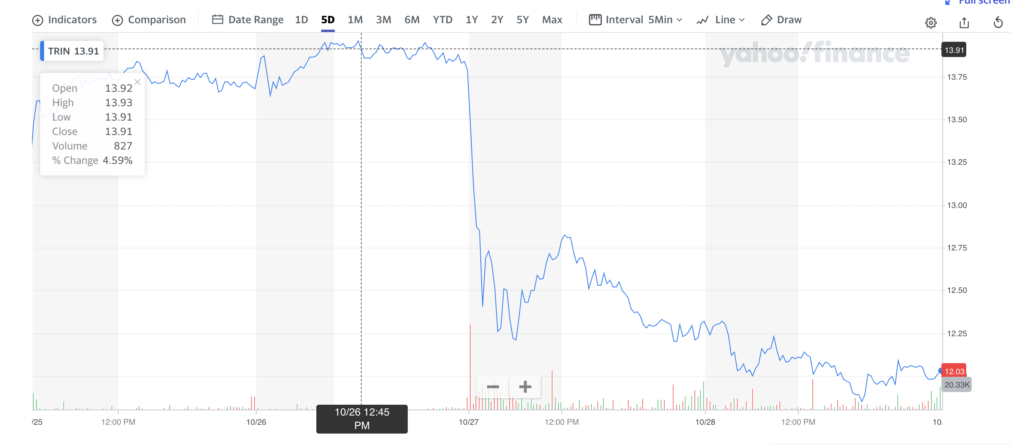

We were reminded this week, though, how fragile price gains can be and what can happen on bad credit news.

Trinity Capital (TRIN) saw its stock price drop (15%) in the twinkling of an eye on October 27.

The trigger point: one of the BDC’s larger portfolio companies – and publicly listed – Core Scientific (CORZ) announced that a bankruptcy filing was possible.

CORZ’s stock price – already in trouble – dropped (75%).

At Risk

As we detailed in a BDC Credit Reporter on October 28, 2022, TRIN has advanced $26mn to the company, and must be in danger of both losing income and capital.

At cost, the exposure amounts to 2.4% of the entire TRIN portfolio and 6% of its equity at par.

The company is a “crypto miner” in what TRIN calls the “digital asset sector”.

Soothing Words

As recently as the latest TRIN earnings conference call on August 5, 2022 the BDC’s management sought to allay any concerns investors might have about its involvement in this controversial sector, which some consider more “Ponzi scheme” than a legitimate and sustainable business.

This is what management said:

With respect to our exposure in the digital asset sector, we have made equipment loans totaling $69.6 million on a cost basis to 3 publicly traded digital asset mining and hosting companies, representing approximately 6.9% of debt portfolio at cost. These loans are secured by a first position lean on the underlying digital mining assets, which are mission-critical to their operations and they represent contractual obligations of the public company borrowers.

As with our other equipment loans, these are not traditional equipment leases and the assets are held on the balance sheets of the borrowers, not Trinity. It is also important to note that these are 36-month fully amortizing facilities primarily deployed throughout 2021. We believe that our underwriting thesis on these assets remains intact despite the recent volatility in the sector, and we are confident in our positions.

Just two months later and TRIN’s confidence in their positions – in at least one case and potentially for all three – seems misplaced.

Multiple Voices

The TRIN price blow-up comes in a week when we’ve become aware of ever more problematic credit situations developing in leveraged lending from a variety of sources.

Fitch Ratings Market Concern “for U.S. institutional leveraged loans rose to $228.0 billion from $201.3 billion in September, representing the largest one-month increase since the onset of the pandemic… The Market Concern total is up 39% since end-1Q22 and is the highest amount since YE 2020”.

Legal (Credit) Beagle

Likewise, “leading international law firm Proskauer” on October 25, 2022 also weighed in on changing credit conditions in the leveraged lending space.

Here is an extract from the press release, which gives a flavor of the results, but we suggest reading the entire article to get a full picture:

Leading international law firm Proskauer today released the results of its Private Credit Default Index for the third quarter of 2022, revealing an overall default rate of 1.56%, an increase from 1.18% in the second quarter. This is the first notable increase over the past 18 months. The quarterly index has shown a downward trend since peaking at 8.1% in the second quarter of 2020.

Companies with more than $50 million of EBITDA at the time of origination had a 1.1% default rate, down from a high of 5.3% in Q2 2020. Companies with $25-49.9 million of EBITDA had a 2.1% default rate, an increase from 1.8% in Q2 2022. Those with less than $25 million of EBITDA had a 1.5% default rate, an increase from 1.3% in Q2 2022. As noted previously, the higher default rate for smaller companies likely reflects the fact that on average these companies have a greater number of financial covenants than loans to larger companies.

Proskauer – IIQ 2022 Private Credit Default Index Press Release

Oaktree – which also keeps a quarterly eye on non investment grade credit trends – also had worrying words to offer in a October 27 report, which we are quoting a paragraph of:

In the second quarter, roughly two-thirds of sectors in the leveraged loan market experienced year-over-year margin erosion – and this figure has likely risen in the third quarter.4 Consequently, downgrades in the loan market have been accelerating: The upgrade/downgrade ratio in August fell to the lowest level since June 2020.5 Meanwhile, the universe of distressed U.S. loans (i.e., those trading below 80 cents on the dollar) has risen markedly in recent months. The par value reached $102.5 billion at the end of September, after spiking by $43.7 billion, the largest monthly increase since March 2020.6

Oaktree- Performing Credit Quarterly 3Q2022 – October 27, 2022

Best For Last

Closer to home, our own BDC Credit Reporter was busy this week with significant new developments at several BDC-financed borrowers.

Besides the previously mentioned Core Scientific, we discussed the near ($100mn) of realized loss at anesthesiology company PhyMed Management LLC, which occurred in the IIIQ 2022. Ares Capital (ARCC) booked a ($55mn) realized loss and SLR Investment (SLRC) – which has not reported yet – should follow suit with a ($37mn) or so loss as well.

Gas services company Artera appears to be headed to a restructuring or bankruptcy, based on trade reports, which we discussed on October 28, 2022. New Mountain Finance (NMFC) is the public BDC with exposure to Artera.

Over at Rug Doctor, where 4 public BDCs have nearly $100mn of exposure, the insights we received from Ares Capital’s latest results were not encouraging. Tens of millions of dollars in realized losses are possible there. See the BDC Credit Reporter’s October 27, 2022 article.

Then there’s $179mn of BDC exposure at well known Shutterfly, owned by Apollo Global. The only public BDC there is Prospect Capital (PSEC) who must be worrying about the private company’s apparently worsening financial results. For what it’s worth, the BDC Credit Reporter downgraded the company to CCR 4 from CCR 3 on our 5 point scale.

This is just a selection of BDC related credit updates that occurred this week. The pace of new credit stories seemed higher than usual partly because we’ve been updating the ARCC IIIQ 2022 Schedule Of Investments. However, there were several non-ARCC stories as well.

Being Clear

By no means are we arguing that a tsunami of credit troubles have hit our shores- or is about to. In fact, Fitch, Proskauer and Oaktree – all in their own ways – made clear that the level of underperforming or defaulting credits remains well below historic levels, and the same is true in our own research.

We just wonder – based on the TRIN example – whether investor enthusiasm for BDC stocks will be able to withstand a steady drip, drip of bad credit news, not to mention the ever present threat of a recession.

More/Longer

Unfortunately, this week’s strong GDP number for the IIIQ 2022 only seems to ensure the Fed will continue to increase rates – this coming week and in the months to come.

That raises the risk – obvious to everyone but difficult to quantify as to its true impact – of a policy mistake that will – or will not – tampen down inflation but also result in saddling leveraged companies with debt service numbers many cannot bear and could not have projected they would have to face.

Asked And Answered

Will the self same investors quickly pushing up BDC prices this week retreat just as quickly if and when that prospect comes more clearly into view ?

We think so.

Crunch Time

In any case, we’ll find out soon enough because exceptionally high levels of rates may only be a few months away and then the rubber will meet the road.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.