BDC Market Update: Tuesday October 18, 2022

Premium Free

Markets

As shown above, all the major indices were up on the day. There appears to be a sense amongst investors that the Fed has been causing so much damage to the U.S. and global economy that Chairman Powell will effectively blink and loosen the screws a little going forward. This could take any number of forms, including increasing rates by a smaller percentage than the recent 0.75% or – shortly – pausing any increase till the economic impact can be assessed. This would not be a Fed “pivot”, but something less than the torrent of cold water that’s been applied of late. The S&P 500 is up 6.5% in four days from its lowest point of the year on these sort of suppositions. The bond market seems to agree, as risk free yields are staying high as if to say bond investors are worried that inflation is far from licked.

BDC

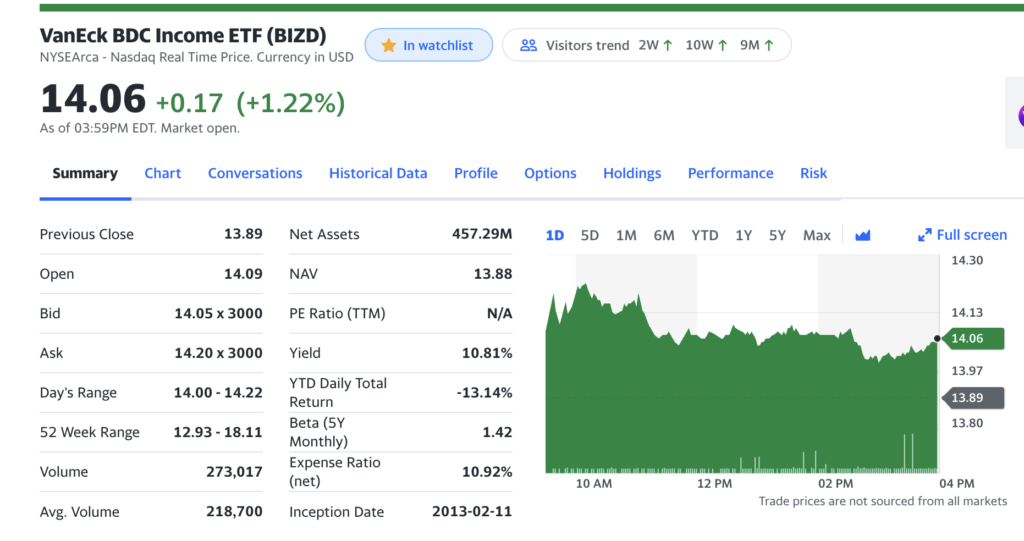

Anyway, the BDC sector – as measured by the Van Eck sponsored exchange traded fund which owns most BDC stocks with the ticker BIZD – fell in line with the major indices, up 1.2%. Volume was modestly above average.

As a result 35 BDCs were up in price on the day, 2 were unchanged and only 6 were in the red. The Biggest Gainer was HTGC, up 5.9% on high trading volume. As we reviewed in an article today, the leading venture debt announced – once again – an increase in its regular distribution and a now expected $0.15 per share “Supplemental” distribution. We’re not sure why investors reacted quite as well as they did given that HTGC has been signaling for some time that its earnings and distributions are likely headed higher.

This contrasts with the ho-hum reaction to MAIN’s announcement of record earnings per share AND a higher net asset value per share in the IIIQ, also discussed on these pages. The stock was up 1.9% on the day – more than BIZD – but nothing special. Curiously, MAIN – long an investor favorite – has fallen in popularity and is much closer – even after today – to its 52 week low than 52 week high.

Other than HTGC there were no other 3.0% plus movers in either direction.

Fixed Income Update

Over in BDC Fixed Income, prices were essentially unchanged on the day. As was the case yesterday, the 20 publicly traded unsecured notes we track – see the BDC Fixed Income Table for the latest prices- are up 0.1% this week. The 10 year Treasury yield moved up slightly to a yield just over 4.0%, only to drop a smidgeon below by day’s end. 8 Baby Bonds were up on the day, 8 were down and 4 were unchanged. The current average yield on BDC debt at market is 6.2%. For comparison purposes, the 5 year risk-free rate is 4.2%.

Credit Update

On the credit side, we were busy re-publishing an article from the BDC Credit Reporter about a FCRD portfolio company which is in poor shape and may result in a complete write-off for the BDC as it prepares to be acquired by CCAP. We expect to post several similar articles about FCRD’s underperforming companies in the next few days.

Other News

Finally, there was a little bit of good news over at SAR about the sale of one of its portfolio companies, which should result in a modest realized gain.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.