BDC Market Update: Wednesday October 19, 2022

Premium Free

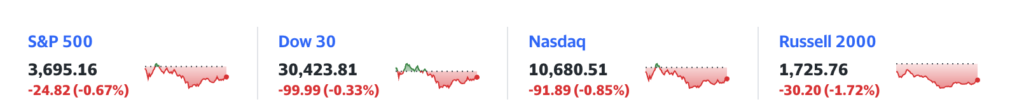

The two day “winning streak” that the major indices were on ended on Wednesday. Here’s a screenshot of the reason why:

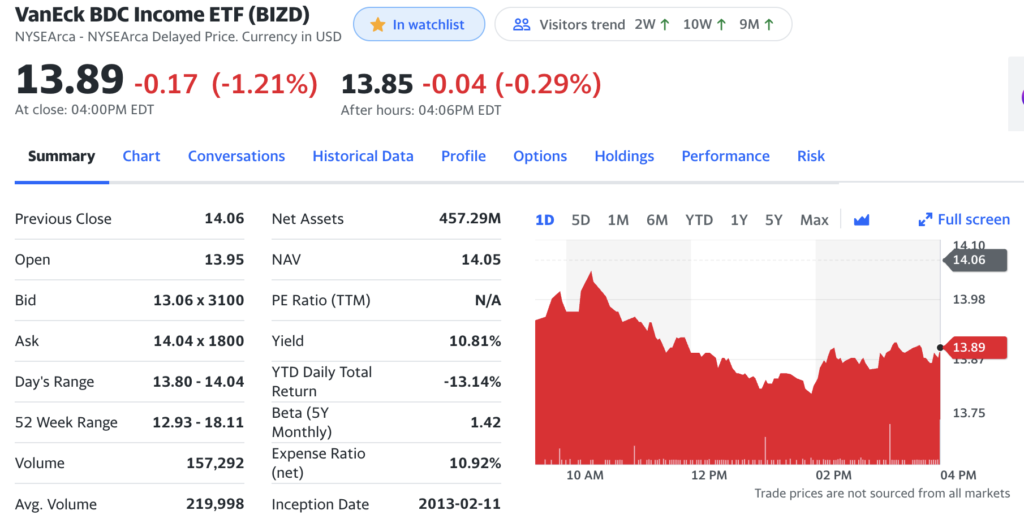

The BDC sector joined in the general stock market retreat, dropping (1.2% to $13.89.

8 BDCs managed to increase in price, 2 stood still but 33 were in the red. The two Biggest Losers – over (3.0%) – were diametrically different BDCs by size and strategy: BXSL (4.3%) and GECC (3.3%). There were no price gainers over 2%.

Over in BDC Fixed Income, you can imagine what happened when the 10 year yield went to 4.2%: prices dropped. For the week – after being up 0.1% through Tuesday – the 20 issues we track dropped (0.3%). Still, 7 issues are up in price this week – a little surprising. See the BDC Fixed Income Table.

The news of the days for the BDC sector related to fixed income. SAR came to market with a new, publicly traded, 5 year unsecured bond issue, which we briefly discussed on these pages. After the close, we learned the amount ($40mn) and the yield (8.0%). With the 5 year “risk-free” rate at 8.0%, debt investors are getting a 3.65% premium and the highest rate the prolific borrower has paid for this kind of debt. Clearly, with floating rates rising, SAR believes the increased debt service cost is worthwhile. By the way, the average SAR debt yield is 9.0% as of August 2022 and likely to be in the low teens shortly – or higher for new loans.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.