BDC Common Stocks Market Recap: Week Ended November 25, 2022

BDC COMMON STOCKS

Week 48

Back On The Horse

After a brief moment of doubt, the major markets – and the BDC sector – revived during the Thanksgiving week.

Even the publication of the Fed minutes did not throw a wrench in the works as the S&P 500 moved up 1.53%.

BDCZ – the UBS sponsored exchange traded note which owns only public BDC stocks and serves as a price guide of sorts for the sector – moved up even more – 2.30%.

The S&P BDC index – calculated on a “total return” basis – went one better – up 2.39%.

Big Movers

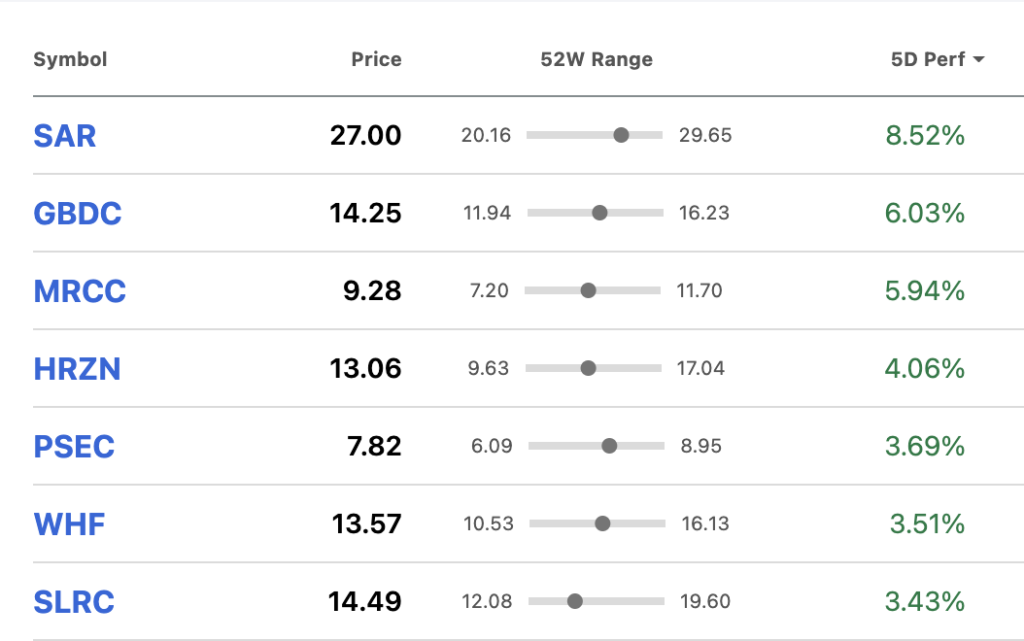

Confirming the cheerier market tone is that 39 of the 43 BDCs we track moved up in price for the week.

In fact, 8 individual BDCs increased in price by 3.0% plus and only 1 fell by (3.0%) ore more.

As you can see the 8 top performers this week are a motley crew.

Cause And Effect

We understand Saratoga Investment’s (SAR) appeal – the lower middle market oriented BDC recently increased its quarterly distribution by 26%.

This is the rarest of percentage increases in BDC dividend history and one that came out of left field after years of cautious tiny increases and – one one occasion – a temporary payout suspension due to concerns about the Covid pandemic.

Apparently SAR has no such caution at the moment.

Golub Capital (GBDC) – the second best performer in terms of percentage price increase – appears to have surprised some market participants with its just announced 10% increase in its own regular quarterly distribution – much discussed in a BDC Reporter article just before the turkey stuffing began.

Harder To Parse

However, distribution increases are not the only motivator of these prices increases.

After all, WhiteHorse Finance (WHF) offered no increase in its very steady $0.3550 quarterly payout when reporting results on November 14, 2022.

Nor, for that matter, did Prospect Capital (PSEC) or SLR investment (SLRC) up their distributions either.

Neither Here Or There

Overall, like last week, BDC stock prices remain in a no man’s land between lows – mostly set in late September – and highs – mostly set in April.

We count 4 BDCs still trading within 10% of their 52 week lows, versus 5 last week.

Likewise, the number of BDCs trading within 10% of their 52 week highs is up to 7, from 6.

(Only Fidus Investment – FDUS – trades within 5% of its 52 week peak).

The number of BDCs with a price above net book value per share is a decent 12, unchanged from last week, but down from a high of 20 on April Fool’s Day.

On a 2022 year-to-date basis, there are still only 4 BDCs that can boast a higher stock price on the day after Thanksgiving over the New Year’s Eve 2021 level.

Overall – by our calculations – the 43 BDCs we track are trading at 89% of net book value.

Nothing To Sneeze At

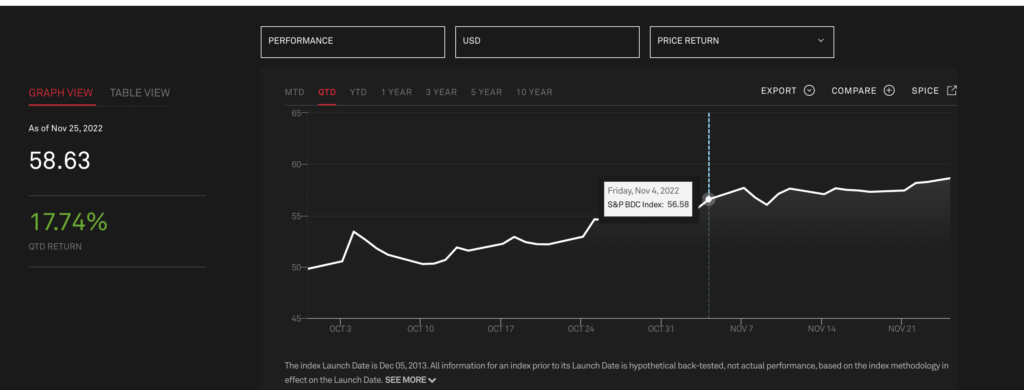

It’s been a solid rally since September 30 when the S&P BDC Index – calculated by price only – was at its nadir.

Since then, as the chart below shows, the sector has increase nearly 18% in price.

Still, this same index is (13.2%) below the highest point of the year on April 20, 2022, despite the fact that a majority of BDCs are reporting higher earnings and distributions than ever before.

Short Term Outlook

There is still a chance that on a “total return” basis the BDC sector might yet break into the black in 2022.

As of November 25, 2022, this index at least is only (3.85%) down for the year, thanks to all those juicy dividend payouts.

Just one good week of sector price increases – especially amongst the largest BDCs that are heavily weighted in the index – could bring us to break-even or better.

Less likely – but not impossible – is that the S&P BDC index on a price basis might increase 12.7% to match by year end 2022 the level reached 12/31/2021.

Forces At Play

Much will depend on sentiment around the debate about how virulent the Fed is going to be in raising rates – come what may.

In an ironic twist, BDC investors are excited about the prospect of another 0.5%-1.00% increase, which will boost income even further, but decidedly nervous if the Fed Funds rate perks up much above 5.0%, which is deemed to be untenable for many borrowers.

EBITDA Line

As always, we would argue to worry less about the level of interest rates and more about how the several thousand BDC companies perform, as measured by EBITDA – that spurious, but ubiquitous measure of cash flow performance.

The risk is that the Fed – in its well meaning attempt to curb inflation – successfully implodes companies profitability.

Hanging In There

Everything we’ve heard so far from the BDC managers is that this has not happened as yet.

Companies – like U.S. consumers – have been very “resilient” – mostly passing on cost increases to customers; muddling through supply chain troubles and finding enough staff at the right cost to keep on keeping on.

Undoubtedly there has been weakness showing up at the edges, and we’ve noticed a distinct increase in the number of underperforming companies popping up in the last two quarters with a rating of 3 in our 5 point investment rating scale.

Nonetheless – and seemingly through as late as September – the number of borrowers troubled by lower earnings has remained low – even lower than historical averages.

Future Is Not Bright

The above notwithstanding, damage ahead is being promised by the ratings groups; some analysts and even the BDCs themselves.

Here is what Fitch has to say about that segment of the leveraged loan market they cover:

Fitch Ratings forecasts the institutional leveraged loan default rate will finish 2023 at 2.0%–3.0%, an increase from our previous 1.5%-2.0% projection, reflecting growing macroeconomic headwinds, including our expectation of a U.S. recession. The new forecast would be in line with the historic, 2.5% 15-year average. The 2023 anticipated default rate equates to roughly $45 billion of volume, and would mark the third-highest total since Fitch began tracking in 2007, though well below the 2009 and 2020 amounts. We also believe 2023 produces roughly 60 defaults, nearly double the 36 averaged over 2016–2019 and a sharp acceleration from the 21 YTD defaults. We project the large middle market (LMM) default rate could finish as high as 5.0% in 2023 compared with the broadly syndicated loan segment (BSL) at roughly 2.5%. This is a reversal from the YTD rate (BSL is at 1.4% versus LMM at 0.8%) and also goes against the trend in which the two rates have run fairly equal since 2015. Nevertheless, LMM is more vulnerable to rising interest rates, given a higher share of floating-rate debt in capital structures and limited use of hedges. The LMM segment makes up only 9% of the index, so the effect on the overall default rate is quite low.

Fitch Ratings – September 30, 2022

Here is what S&P is predicting, according to the WSJ:

Default rates for low-rated U.S. companies will likely reach 3.75% for the 12 months ending in September 2023, up from 1.6% in September 2022, but lower than the long-term average of 4.1% and the 6.3% default rate in September 2020, ratings firm S&P Global Ratings said in a report earlier this week.

Wall Street Journal – November 25, 2022

Deutsche Bank has gone even further, according to MarketWatch:

Deutsche Bank has forecast that U.S. high-yield corporate bond defaults could climb to 4.5% by the end of 2023, with U.S. leveraged loans potentially seeing a higher rate of 5.6%, according to Reid’s note. But by the second half of 2024, “we forecast peak defaults” of 9% in U.S. high yield and 11.3% in U.S. loans, he wrote.

MarketWatch – November 22, 2022

Barclays is putting out similar numbers:

Going forward, the rate of defaults on leveraged loans is expected to more than triple from around 1 percent in early September to about 3.25 percent in mid-2023, according to Barclays PLC. By September 2023, that number could rise to 4.5 percent.

Financier Worldwide – November 2022

Here is GBDC David Golub on the credit outlook:

If we’re going to see a continuation of [bumbling] growth and perhaps a continuing slowdown from here and perhaps a recession, those are at the risk of stating the obvious, those are negatives from a credit perspective. And those would reasonably be expected to increase credit losses, defaults, nonaccruals, worsened performance ratings, increased volatility around credit results. All of which are negatives from a risk-reward standpoint.

Golub Capital – IIIQ 2022 Earnings Conference Call – November 23, 2022

Undeterred

Here is why the BDC Reporter is not panicking and running for the exits given all these portents of higher defaults:

First, much of what is being predicted relates to the very largest borrowers and not the thousands of lower and middle market private companies in some BDC portfolios.

Some would argue that their credit performance will be worse than their larger brethren, others would say the opposite. We will just avoid the subject for now.

Second, a default is not a realized loss. Admittedly, in most cases income is interrupted for a period and – eventually – there may be a restructuring, bankruptcy or liquidation that results in a loss of capital.

The BDCs, though, sit mostly at the top of borrowers balance sheets and – more often than not – have a critical say in how matters turn out and are unlikely to incur more than modest realized losses on average.

Recoveries – once a resolution is achieved – will be plowed back into a lending market where rates and spreads and terms are the best they’ve been in a generation.

Third, the great majority of loans not in default will continue to pay record high interest income thanks to the Fed – and for some time to come.

We’ve done the math, taking into account how BDC costs operate, and – as a rule of thumb – 10% of loans will have to go on non accrual and stay there to offset every 100 basis point increase in the Fed Funds rate.

In regards to the latter, BDC income works with a delay and even if the Fed tops out at 5%, most BDCs have 40%-60% increases in their reference rate yet to charge.

If BDC portfolios remain unchanged in size, earnings will continue to increase even if defaults reach the worst levels predicted above.

Yes, even if Deutsche Bank is right.

We See No Signal

Besides boosting their own management fees, these economics may explain why virtually all BDCs have kept their foot on the gas in recent quarters where asset formation is concerned.

There will be losses but – to quote Ares Capital – they will be “manageable”.

Anyway, that is the debate underway between BDC bears and bulls, with neither side gaining an overwhelming advantage.

That explains best of all why BDC prices are neither very low nor very high at the moment.

Just A Feeling

Between now and the end of the year, though, we could envisage the bulls gaining the upper hand if inflation, wage growth and all those macro data points that dominate the headlines continue to improve, as they have of late.

The “soft landing” scenario – once seemingly dead and buried – seems to be coming back.

That’s probably much to the dismay of Chairman Powell who needs a little more despair in the air for a while longer to achieve the Fed’s goals.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.