BDC Common Stocks Market Update: Week Ended November 11, 2022

BDC COMMON STOCKS

Week 46

Historic

Week 46 of 2022 will go down in the BDC history books as a (possible) turning point.

October’s consumer price index rose just 0.4% for the month and 7.7% from a year ago, its lowest annual increase since January and a slowdown from the 8.2% annual pace in the prior month. Economists were expecting increases of 0.6% and 7.9%, according to Dow Jones. Excluding volatile food and energy costs, so-called core CPI increased 0.3% for the month and 6.3% on an annual basis, also less than expected.

CNBC – November 10, 2022

For the first time in a long time the rate of inflation growth moderated, and by more than the dismal scientists had anticipated.

For the markets – and for the BDC sector – that implied future Fed rate increases might also moderate.

Brownie Points

More importantly, maybe, is that this was the first evidence, after many long months, that the Fed’s actions were having some of their intended effect in bringing down inflation.

(An argument could be made that the lower increase in the interest rate could have to do with a host of other factors besides interest rates but the Fed gets both the blame and the credit for everything these days).

Happy Enough

The S&P 500 jumped 5.9%, its best weekly percentage price increase since mid-June and all the other major indices joined in the party atmosphere.

The BDC sector was not left out, but the celebrations were more muted.

The UBS ETRACS Wells Fargo Business Development Company Index ETN, ticker BDCZ, was up 1.92%.

This was the fourth week in a row that BDCZ was up.

The S&P BDC Index – the total return version – was up 2.08%, up for 6 weeks in a row after the sector plumbed new price depths in late September.

Jumping

Overall BDC prices may not have matched the major indices in terms of the week’s percentage price growth, but there was plenty of upward momentum.

37 of the 43 BDCs we track were up in price, including 19 up 3.0% or more.

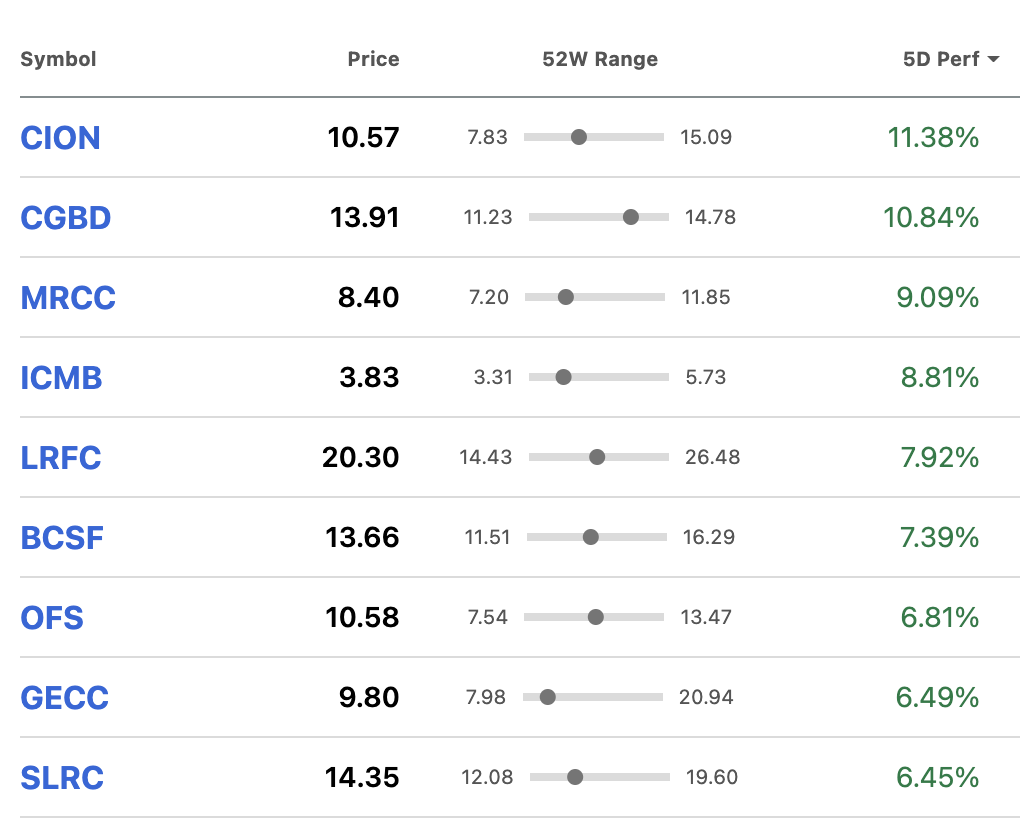

In fact, two BDCs were up by double digit percentages and 7 between 6%-10%:

In Passing

Curiously, despite all this upward surging, the number of BDCs trading above net book value per share remained unchanged at 11.

Monthly View

It’s been a good last 4 weeks for BDC stocks and that near-death experience in late September:

42 of the 43 are up in price.

The S&P BDC Index – this time on a price basis only – has jumped 11.7% in that brief time frame.

Room To Grow

Nonetheless – and good news for BDC investors with FOMO – prices remain well off individual or sector highs.

Only 1 BDC (FIDUS) is priced within 5% of its 52 week high, and 2 between 5%-10% (SCM and TCPC).

Admittedly, the huge number of BDCs that were priced at or close to their 52 week lows has resolved.

There are no BDCs within 5% of their nadir and just 5 between (5%)-(10%) off.

Most BDCs are priced in the great in-between as investors try to decide if the ever higher EPS and dividends being churned out are a tainted chalice, or not.

Kept Busy

We spent most of the week reviewing the many latest BDC earnings releases, 10-Qs, Investor Presentations and conference calls and inputting the key data into our proprietary database.

This – besides consuming a huge amount of time – provides us insights into the trends unfolding in the BDC sector.

So far, 35 BDCs have reported, with 8 yet to come.

When all the numbers are in, we’ll offer up our more interesting findings in a quarterly review of earnings, dividends, net asset value and credit.

Preview

What can be said already – and probably obvious to any of our readers paying any sort of attention to the spate of releases – is that there have been many spectacular increases in EPS announced and much upping of distribution levels, both regular and irregular.

That was to be expected given the increase in interest rates – although some of the BDCs themselves seem surprised by their good fortune.

Surprising

What was not expected is how well most of the reporting BDCs have done in terms of changes in NAV Per Share.

Drops in the key metric have mostly been modest and a few outliers even reporting increases.

This occurred even as the market prices of floating rate leveraged loans in the more highly liquid markets dropped substantially.

There was much sound and fury about some big banks getting stuck with big ticket newly originated leveraged loans and having to go to great lengths to find willing takers, but none of that is reflected in BDC asset valuations.

Not Much

Likewise, a first glance at the BDC Reporter’s assembly of the credit information offered up by the 35 BDCs that have reported shows very little increased credit stress. See the BDC Credit Table.

In fact, several BDCs managed to reduce their number of non accruing loans (and not just by writing them off) as well as reporting lower percentages of their portfolios underperforming than in prior quarters.

The number of new non accruals, or even just underperformers, is very low.

Keeping On

The fact of the matter – as far as we can tell from the spotty and 36,000 feet disclosures offered by the BDCs who would be drawn on the subject – is that most companies are still growing their sales and EBITDA.

Yes, interest bills are going up, but very rare – at this point – is the company where borrowing costs are overtaking EBITDA.

In our coming article, we’ll discuss when things might get more worrisome for borrowers – and thus for BDCs – but we can say it won’t be in 2022.

Muted

You might reasonably expect with earnings and distributions headed higher; asset values holding up and credit conditions mild that BDC prices might have increased more.

As we’ve said before – and the latest results confirm this continually – the BDC sector’s fundamental earnings performance and ROE is at a record high, and is only going to get better in the quarters ahead.

Dread

Holding investors back – and this is reflected in almost every question we heard on the conference calls in the last 3 weeks – is that higher interest rates will submerge borrowers in higher debt service costs that will be untenable and result in a tsunami of defaults/bankruptcies/losses.

The dam has not yet broken but if and when that occurs, investors are sensibly worried that leveraged borrowers will get hit by a double whammy of lower EBITDA/earnings and higher borrowing costs.

Making The Case

BDC managers have worked hard throughout this earnings season and the last reassuring everyone this will not the case.

Or – at the very worst – whatever damage that occurs will be “manageable” – whatever that means.

We’re convinced by the BDC managers “pitch” regarding how they will be able to manage through their borrowers higher borrowing costs.

There’s still plenty of margin between what most borrowers are generating in cash flow and their debt service. Moreover, lenders can agree to accept Pay-In-Kind interest for a portion of their income; look to PE groups to inject additional capital and borrowers can draw on unused revolvers. Assets/divisions can be sold; working capital can be accelerated; capital expenditures reduced or delayed and operating costs reduced.

Moreover, an argument can be made that with the lower inflation pace, the Fed is unlikely to push the reference rate up very much higher, reducing the chances of extreme rates being charged.

On The Horizon

What BDC managers cannot speak to with as much confidence because of it’s unknowable nature is what will happen to the economy in the months ahead.

So far most companies have continued to expand, passing on in part or in full higher costs to their customers.

As many BDC managers have said very explicitly: “there is no recession”.

This is true now – but every Tom, Dick and economist is predicting a 2023 downturn.

Both Sides

Should that occur, borrower revenues and EBITDAs – on average – should be expected to drop and just at a time when debt service expenses are reaching maximum intensity.

When a recession takes hold, nobody can say how the economy will play out and who will be swept away and who survive.

Guesswork

The future of BDC prices is likely to hang on how investors collectively evaluate the likelihood of this much promised recession in the weeks ahead.

The sentiment/mood – currently brightening – could turn on a dime if an economic contraction appears to be truly taking hold – as opposed to just a slowdown in growth which is the current state of affairs.

Nope

We are not bold or clever enough to predict “what rough beast” – to quote Yeats – slouches towards us.

Even at this late date we may get the “soft landing” that has mostly been derided and discounted.

Hinge

We will say, though, that what happens in the broader U.S. economic sphere will decide if we get the mother of all rallies or yet another step down in BDC prices.

A Word To The Long Term Investor

Where we are optimistic is down the road – even if a recession should be in our 2023 future.

There might be some bloodletting; possibly a couple of BDCs liquidating or selling off at a discount; substantial drops in net book value and many more non accruals than at present but no disaster scenario.

BDC balance sheets are strong; their liquidity sufficient and with their investments mostly high up on borrowers balance sheets, the BDCs should be able to weather any storm we can envisage – even conditions reminiscent of 2008-2009.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.