BDC Common Stocks Market Update: Week Ended November 4, 2022

BDC COMMON STOCKS

Week 45

Contrasts

For the broader indices, the week ended November 4, 2022 was not one to remember.

The S&P 500 – for example – slipped (3.35%) – its worst performance in 6 weeks.

The BDC sector – as measured by the price change of BDCZ, the UBS sponsored Exchange Traded Note which owns most BDC stocks – performed much better.

BDCZ was up 1.65% and the S&P BDC index “total return” increased by 2.2%.

Second Time This Year

In fact, the BDC sector has been in what we call “re-rally mode” since September 29, 2022 using – in this case – the S&P BDC index on a price return basis.

As of last Friday, that index is up 14.4%. By comparison, the S&P 500 is up only 5.4% in the same stretch of time.

Obvious

Undoubtedly, the catalyst are BDC earnings – now in week two of the IIIQ 2022 results.

More on those results – half of which have already been announced – in a minute.

Metrics

Right now, let’s look at some of the week’s regular metrics:

29 BDCs were up in price and 14 were down.

(The fact that there was not an almost universal increase of individual BDC prices is a little surprising, but may mean nothing).

Of the 29 BDCs in the black, 10 were up 3% or more.

That’s far less than the 36 the week before, but still impressive.

In Common

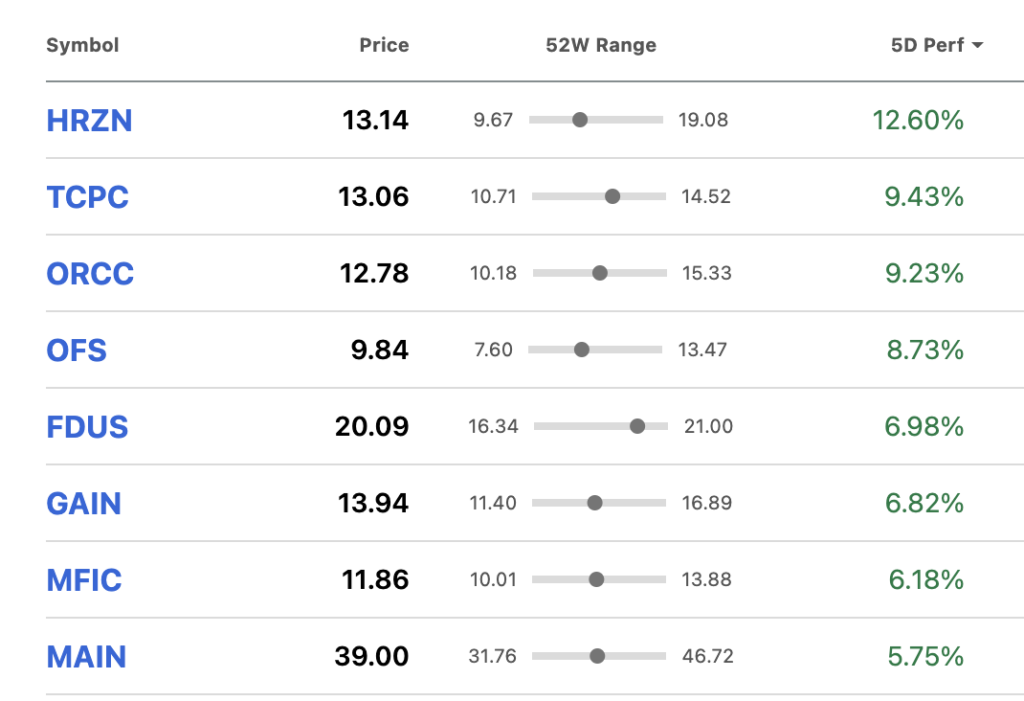

Of those 3.0% plus price gainers, the top 8 – as the chart above shows – were all BDCs that reported results this past week.

It seems that many investors were in a “show me” mindset, waiting for confirmation that all was well at these BDCs before diving in.

In fact, all 8 raised their payouts – even OFS Capital (OFS) which registered the biggest percentage decline in NAV Per Share of any BDC that has reported s far : (6.8%).

No Love

Likewise, investors were ready to punish BDCs that did not perform to expectations.

Trinity Capital (TRIN) – which made the mistake of investing in no less than 3 crypto “miners” and saw it’s own NAV Per Share drop (6.0%) – the second worst performer by this metric- fell (8.6%).

The newly public venture BDC has seen its stock price drop (20%) since October 26, 202 and has lost nearly half of its market value since the end of March 2022.

At this point, TRIN trades at 5.6x its projected 2023 earnings and 20% below net book value per share.

In fact, TRIN was the only BDC this week to reach a new 52 week low – most BDCs were headed the other way – of $10.42.

Ever Lower

Also punished by the markets was Great Elm Capital (GECC) – down (6.6%).

The BDC kept its dividend unchanged for the IQ 2023 at $0.45 but NAV Per Share dropped (2.2%).

The pint sized BDC continues to add new finance companies to its roster – which involves up front costs – but cannot yet show any bottom line benefit from the new strategy.

Net Investment Income Per Share – already low in the IIQ 2022 at $0.23 – fell even further in the IIIQ 2022 to $0.14.

The analyst consensus for 2023 EPS is $1.40, which makes one wonder how long the BDC can maintain a $1.80 per annum dividend payout pace.

GECC trades at 6.7x its 2023 consensus earnings and a (23%) discount to that just reduced net book value per share.

Waiting

Overall, outside of TRIN, there are 10 BDCs trading within 10% of their 52 week lows.

Coincidentally or otherwise (we lean to the latter) all 10 have not yet reported IIIQ 2022 results.

Again investors may be waiting for confirmation that all is well before buying.

Looking down the list of these BDCs (which include BXSL, CGBD, CCAP, PPNt and PFLT) we’d guess that investors may be pleased with what they are shortly to hear.

Historic

The fact of the matter is that the BDC sector is enjoying its greatest quarter over quarter earnings and dividend boom in its history.

We track every regular dividend announcement and found that of the 41 players actually paying a distribution (LRFC and PFX do not), 21 have recorded an increase in their payout over the prior period and 20 were unchanged.

More To Come

Nor is this earnings/dividend boon a flash in the pan.

At the very least, we might see BDC profits and payouts increase well into 2023 – and possibly beyond.

For what it’s worth, the BDC has projected likely 2023 total distributions (regular + specials) for 20 BDCs so far and compared the payout to the 2022 level.

We project 16 – or 80% of the group – will be paying out more to shareholders in 2023 than they have this year.

3 are unchanged and in only 1 case do we foresee a drop. (Yes, we are concerned about GECC).

Out Of Sync

This sort of growth in BDC profitability and distributions is unprecedented and all the more intriguing at a time when analysts are saying S&P 500 earnings are likely to grow not all in 2023 over 2022 levels.

Tough

Moreover – and bad news for Chairman Powell and the fight against inflation – there are no obvious signs in the many BDC IIIQ 2022 filings we’ve seen of slowing economic conditions or financial stress.

There are idiosyncratic credit troubles here and there as is always the case, but there is no syrge in underperforming or non performing assets; no swelling up in the number of borrowers seeking covenant dispensation and – apparently – not even any drop in underlying portfolio company EBITDA levels – calculated on average.

Hypothetically Speaking

With this sort of fact set, BDC prices should be at all-time highs.

One example will suffice:

Ares Capital (ARCC) has historically traded as high as 14.0x its earnings.

With 2023 EPS estimated to be $2.21 (and probably a low ball given the analysts proven conservatism), this means ARCC could be trading as high as $30.94.

Instead, the market leader and well regarded BDC, closed Friday at $19.39.

There’s a 56% price upside if PE multiples still apply.

Asked And Answered

Why are BDC investors holding back – the 14% increase since September 29 notwithstanding ?

Clearly, there’s a concern that a recession will come along in 2023 of unknown size and duration and wreak havoc with BDCs book values, earnings and distributions.

Very reasonably, given this is one of those phenomena which is unknowable in advance, many BDC investors (but not all) are holding back as a result.

Resilience

In the weeks ahead – and especially when BDC earnings season ends in the next 10 days or so – we’ll see if investor enthusiasm for BDC stocks will be tempered by the fear of recession, or not.

As we’ve seen, this week BDC investors forged on as the major indices held back.

Historically this has rarely continued for long.

Exception To Rule ?

On the other hand – as has been said – this prospective recession is like no other one we’ve ever seen before.

The Fed is using lenders as a cudgel to weaken the financial strength of borrowers, causing higher debt service; lower business spending: increasing unemployment, etc.

At the moment BDCs are willing accomplices in squeezing more and more debt service dollars out of their borrowers.

Beware What You Wish For

At some point, though, the Fed and the lenders recruited into this unique experiment will find out if they have been the willing agents of their own destruction as debt service costs become untenable at the same time as revenues and EBITDA start to turn negative.

Will that bring inflation down and allow the Fed to begin cutting rates and permit a “soft landing” for the BDCs involved ?

Or will the Fed lose control of the economy and drag us all into a recession or depression and – ironically – not even succeed in bringing inflation under control ?

Puzzlement

We don’t know the answer – and more importantly – nor does the investment community.

There may be different answers at different times in the months ahead, but we’re coming upon a critical period when these questions will be answered.

In terms of a timeline we doubt that the process of bringing inflation back to the Fed’s 2% target will be accomplished before 2024 at the earliest.

Buckle Up

The principal battlefield, though, lies in 2023.

Judging by the resilience of the thousands of BDC borrowers we’ve heard from through earnings season, we doubt that any credit strains will show up in 2022 (7 weeks till Christmas !).

In fact, the rubber may not hit the road from a credit strain standpoint till the second half of 2023.

That’s a long time away and leaves many opportunities for BDC investors to go through many different phases.

Mood

At the moment, we’d characterize the period since September 29 – and especially since ARCC kicked off earnings season – as “muted optimism”.

Money is flowing into the better BDCs, but remains skeptical about marginal or troubled players.

Maybe in the weeks ahead we’ll see a continuing and broader based rally.

After all we’re expecting even the smaller and weaker players to see EPS and distributions boosted by higher rates and are still not expecting any rash of credit problems.

Keep The Faith

After a few weeks, though, and once BDC earnings season is in the rear view mirror – will investors be able to maintain their enthusiasm if and when the general economic picture darkens; bankruptcies pick up and headlines become ever grimmer ?

We’ll say we don’t expect that will be the case.

It seems very unlikely that if there is a recession (and the chance of that occurring is generally regarded as very likely) that BDC investors could hold their nerve because of the current high earnings through thick and through thin.

[Insert Santayana Quote Here]

It’s never happened before.

Back in March 2020, when all of us expected a global, pandemic caused, recession was coming BDCZ fell to a price of $9.26.

As of Friday, BDCZ was trading at roughly twice that level : $17.23.

Choices

In any case, that’s the question facing BDC investors at a time of record earnings and distributions: is this the beginning of a long Golden Age of BDC profitability or just a brief period before Hurricane Recession undoes all the benefits and more through credit losses and a sharp drop back in the reference rate ?

Markets are always looking forward, but sometimes the distance into the future is longer than others and the uncertainties – both positive and negative – are greater.

This is one of those times, and neither the IIIQ 2022 BDC results nor even the next couple of quarters will provide clear guidance.

Investors are going to have to do a lot of guessing for a very long time.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.