BDC Common Stocks Market Recap: Week Ended December 16, 2022

BDC COMMON STOCKS

Week 51

Dreary

If there’s going to be a “Christmas miracle” or “Santa Claus rally” there’s not much time left.

Market price conditions are getting worse rather than better as the year peters out.

The S&P 500 – going by its year-to-date price drop – is back in “Bear territory” – down (2.1%) this week and (20.1%) in 2022.

Once Again Lower

The UBS exchange traded note with the ticker BDCZ, which we use to track the sector’s price movement , fell by a similar percentage – (2.2%) – and for a third week in a row.

BDCZ is now trading at its early November level, rolling back many weeks of price progression.

The S&P BDC Index – which tends to show a more favorable picture when the “total return” is calculated – was down (1.83%) this week.

Not Nice

A favorite metric: the number of BDCs trading at or above net book value per share has fallen to just 6 names.

Just a couple of weeks ago we were at 12.

Similarly, there are no BDCs whatsoever trading within 5% or even 10% of their 52 week highs.

Last week there were 3.

On the other hand, there are 5 BDCs trading within 5% of their 52 week lows.

There are several billion dollar plus BDCs in that basement.

Another 10 BDCs are trading within 5% and 10% of that 52 week lowest point – most of which set in late September.

As we said: dismal.

Slip Sliding Away

For a few weeks, we’ve been characterizing the BDC sector as being caught halfway between its April 2022 highs and those September lows.

Now, the sector seems to be sliding down the slope, much like the early stages of an avalanche.

Under 1%

With just a few trading days left in the year, the odds of the S&P BDC Index breaking even or better in 2022 – a possibility we held out just a couple of weeks ago – are extremely low.

BDCZ is clearly going to end up the year in the red. Currently, the ETN is off (16.8%).

That’s better than the S&P 500, but not by much.

Big Drops

Curiously – going by Seeking Alpha’s data – there are 4 BDCs whose price has increased in 2022 (up from 3 last week), but that still means 39 BDC stocks are in the red.

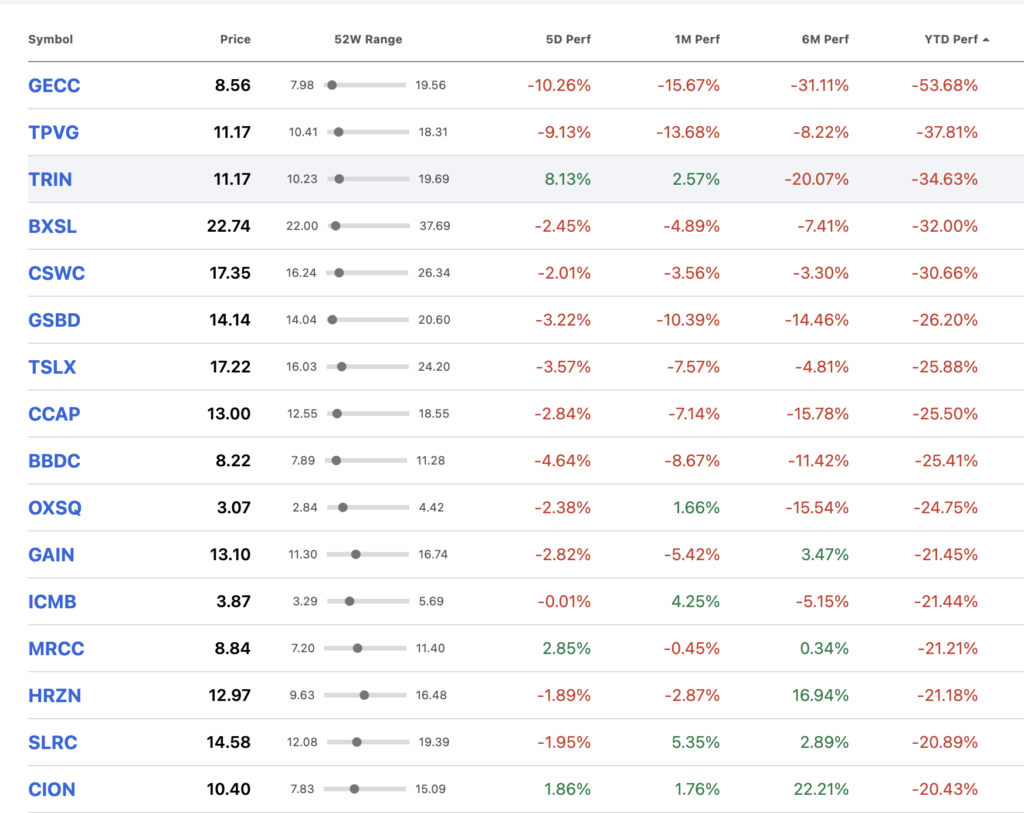

Here are the BDCs whose stock price has dropped 20% or more in 2022 YTD (look at last column):

There are many famous names in there, and representatives of every segment of the sector.

No sugar coating is possible: in this glorious year of higher BDC earnings and distributions, most everyone has seen their stock price punished.

Fed Watching

BDC investors appear to have taken no comfort from the slowing pace of Fed rate increases announced this week and the somewhat greater clarity about the future path.

Reluctantly all investors appear to be accepting – as reflected in their behavior – that some sort of recession is coming this way, replete with all the expected and unexpected consequences.

Us Worry ?

The only group that does not seem to have gotten the “things might be about to get awful” memo are the BDC managers who have been piling on loans all year.

We track every BDC’s actual leverage versus its target, and find that three quarters of the public BDC universe have regulatory debt to equity within 10% of their target.

Quite a few have overshot those targets.

In the latest quarter, 30 of 43 BDCS increased their assets under management at FMV and YTD total BDC AUM is up 4.3%.

Time Will Tell

This could either be a historic misreading of future credit conditions leading to much higher losses than were necessary or a bold choice that will only amplify earnings and distributions, already boosted up by higher rates.

Or something in-between.

Not Buying

At the moment BDC investors seem to be unconvinced.

We may need most – or all – of 2023 to see how this plays out.

Is the double digit increase in next year’s earnings projected by the analysts just a mirage, or not ?

Not There

For the moment – and just to re-iterate what we’ve been saying for months now – there is no material uptick in serious credit stress amongst BDC portfolio companies showing up in the public record of the kind that could ruin 2023.

Over at our sister publication the BDC Credit Reporter we follow the fortunes of hundreds of underperforming companies every day and are finding just the normal level of chatter about defaults; restructurings; downgrades and the like.

This week there was bad news from Avaya, Robertshaw Holdings, Carvana, Serta Simmons and Interior Define – to name some of the highlights.

Still, in a universe of 4,000 companies financed by BDCs we expect to see these sort of setbacks occurring.

Pivotal

We are still awaiting more signs that the credit apocalypse which the markets seem to be fearing has begun.

There have been many headlines projecting as much and CNBC,Fox Business and Bloomberg have had their share of guests predicting trouble ahead. The ratings agencies have upped their default forecasts.

Now we need to see actual tangible distress.

If that does not transpire, BDC stocks – by any valuation metric you choose – is deeply undervalued.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.