BDC Common Stocks Market Recap: Week Ended January 6, 2023

BDC COMMON STOCKS

Week 1

Good Start

Unlike the major indices, the BDC sector began the new year by posting higher prices.

Three days out of four, BDCZ – the UBS-sponsored exchange-traded note which owns most BDC stocks – was up in price on the day before, closing at $17.04

However, by week’s end – helped by a big jump on Friday for the major indices – everyone was in much the same place.

On this holiday-shortened week, BDCZ was up 1.9% as was the “total return” S&P BDC Index.

The S&P Index and the Dow Jones were up 1.5%. The NASDAQ increased by 1%.

Wide Participation

Most BDC stocks participated in this beginning-of-the-year optimism.

Of the 43 BDCs we track, 38 were up or unchanged in price over the last 5 days. (We don’t know if the Seeking Alpha data we use is capturing December 30 numbers in this calculation).

Only 5 were down.

Big Jumps

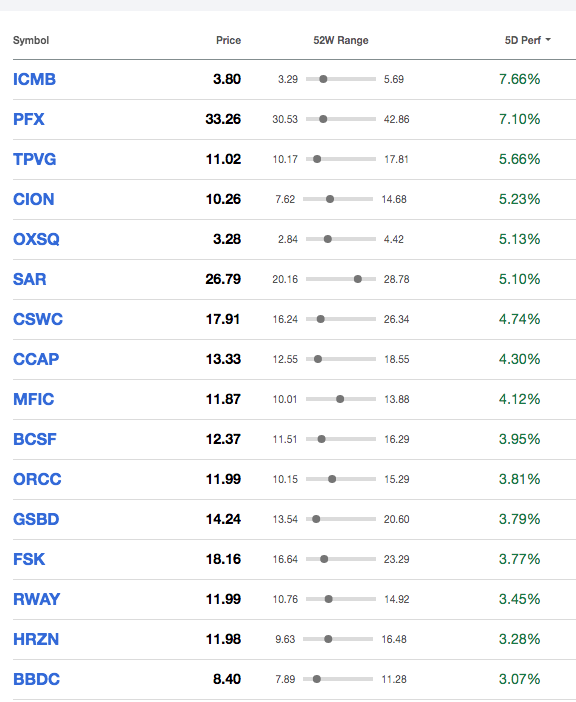

More tellingly, 16 were up 3.0% or more, which suggests some investors were eager to establish positions early in the year on the assumption of higher prices ahead.

For what it’s worth, that was the largest number of 3.0%+ plus BDC price increases since November 25, 2022.

Here are all the BDCs involved. Note that most of the largest percentage price movers are smaller players where even a small pick-up in trading volume can goose up the stock price…

Only So Far

One (shortened) week does not move the overall BDC metrics we track all that much though.

The number of BDCs trading at or above book only increased from 6 to 7 names this week, versus December 30, 2022.

Overall, the BDC sector on an unweighted basis remains firmly valued at a discount to net book value per share: 85.1%.

Furthermore, the number of BDCs trading within 5% of their 52-week high price remained at zero.

The number trading in the 5%-10% range moved up slightly from just 1 to 3.

Getting Up

Down below, in the number of BDCs trading within 5% of their 52-week low, there was greater activity.

A week ago, there were 9 BDCs so close to their nadirs, but that’s dropped to 2.

In the 5%-10% off the 52-week low group, there are 9 names where there were 5 before, as some BDCs migrate up.

Reassuring Words

For anyone worried about missing some hypothetical early 2023 BDC rally, we say: “relax, there’s plenty of upside left”.

Just to match BDCZ’s 2022 high back in April, the ETN’s price will have to increase by 21%.

Low Multiples

Furthermore, our Expected Return Table over at our sister publication BDC Best Ideas, indicates that about 80% of BDCs are trading at single-digit prices to 2022 estimated dividend multiples.

All in all, this is a very inexpensive market, especially if you buy into analyst projections showing a 5% or better increase in earnings per share coming in 2023, and more than half the BDCs pegged to increase their profits.

Elephant In Room

Of course, credit remains the BDC sector’s bugbear and the reason for this disconnect between projected earnings/distributions and prices.

Not terribly originally we believe 2023 will be the Year Of BDC Credit (t-shirts available) – the key determinant of the sector’s success or failure where prices are concerned.

As we see, investors have already priced in some substantial impact from loans going bad so we’ll need to see – or fear – an even colder credit downdraft for the BDC sector to drop much further.

We know this is pretty fuzzy talk but credit losses – actual or projected – will likely have to be 10% or more of net assets to cause BDC stock prices to drop lower than they have.

Apropos

Rather than just wait and see, the BDC Reporter has launched a new periodic article, to be written over our weekends, recapping the latest credit developments in the BDC sector.

Click here for Week 1.

Frankly, the first 4 days of credit developments were nothing to write home about, but these are the earliest of days.

Sanguine

In fact, this week – as recently as Friday – the markets were gripped with the near certainty – based on the flimsiest of economic data – that inflation is coming under control and that the Fed may not have to raise rates too much higher for too much longer.

This translated into lower medium and long-term risk-free rates, with the 10 year Treasury closing at 3.57%. Not very long ago, the rate was nearly 4.3%…

BDC Baby Bond prices – see the BDC Fixed Income Table – perked up slightly by 0.1% in what was the third week in a row of gains.

Are these all signs that the worst is past for inflation and interest rates and that a much-derided “soft landing” is around the corner ?

We don’t know, but common sense suggests that if such a Goldilocks scenario were to occur, the credit loss apocalypse that some fear would not come to pass.

In any case, this is going to be a very interesting year.

P.S.

As long expected, this week Newtek Business Services (NEWT) ceased to be a BDC as of January 6 and is now a bank holding company.

We removed NEWT from our coverage some time ago.

We wish Barry Sloane and the Newtek organization the best of luck in their new format.

For BDC investors – and the BDC Reporter – this removes an idiosyncratic player whose business model was unique and – arguably – not suited to the BDC format.

Next to go will be First Eagle Alternative Capital BDC Inc. (FCRD), to be absorbed by Crescent Capital (CCAP).

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.