BDC Common Stocks Market Recap: Week Ended February 10, 2023

BDC COMMON STOCKS

Week 6

No Shock

We were not terribly surprised that the BDC sector – and most BDC stocks – dropped in price this week.

BDCZ – the UBS Exchange Traded Note which owns most BDC stocks and which serves as our easy-to-use price guide – fell (1.3%) to $17.63.

The “total return” S&P BDC Index dropped (1.5%).

Both indices had posted a price gain 5 weeks in a row – a very rare occurrence.

We’ve been tracking BDCZ’s price changes since 2018 and only once has there been a seven-week streak of increasing prices, and two 6 week streaks.

In this case, we lasted 5 weeks – the best performance since May 2021.

The major indices, too, could not sustain their rally either.

The S&P 500 was down (1.1%), following a flying start to 2023.

Not So Bad

For the stock market generally – including the BDC sector – this turned out to be the worst week since mid-December 2022.

You don’t need to shed too many tears for BDC stocks, though, because the downdraft in individual stocks was not too drastic.

Seeking Alpha data indicates 31 BDCs dropped in price over the span of the week, and 12 were still up.

The worst part is that 8 BDCs of the 31 in the red dropped more than (3%).

That’s the highest number since …mid-December – a subtle reminder that the BDC sector for all our sector-specific analysis is just an adjunct of broader investor sentiments.

“Where they go, we go.”

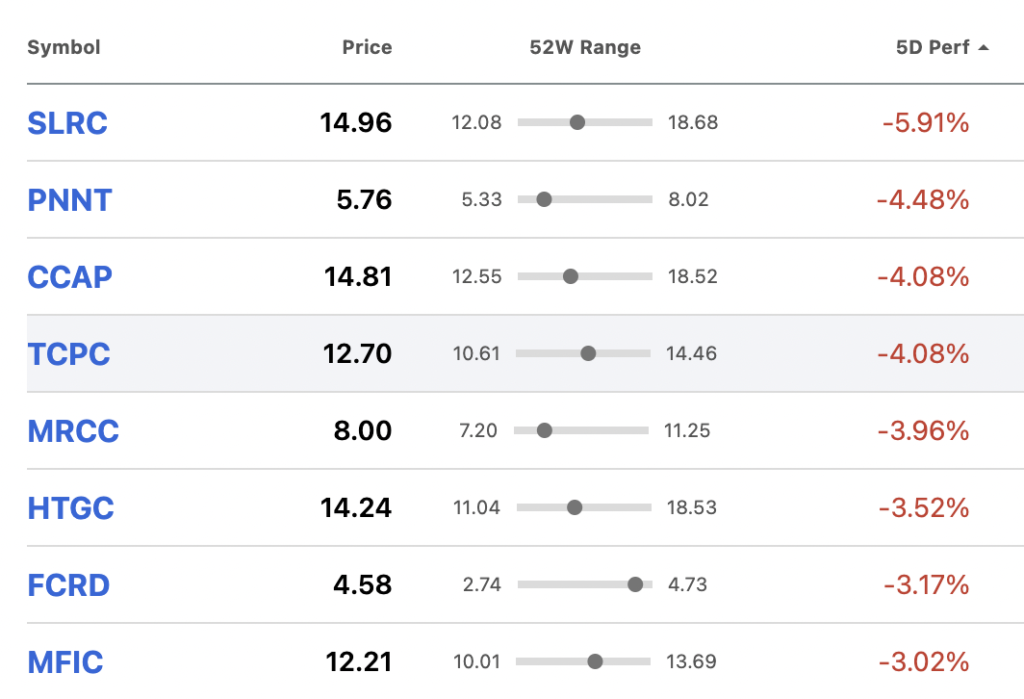

Worst Of The Week

Here are the 8 BDCs involved:

Parsing

Seven of the BDCs above have not yet reported IVQ 2022 earnings, so we’ll assume these price drops have more to do with investor “positioning”.

You could argue that the red ink suggests the market is not expecting great things from these names.

However, we checked analyst EPS projections and 4 of the BDCs are expected to post higher earnings than in the IIIQ 2022, 1 is expected to be unchanged and just 3 may be down.

We’ll find out shortly.

Voted Most Intriguing

The most intriguing story of the week was PennantPark Investment’s (PNNT).

The BDC reported IVQ 2022 results which included lackluster earnings and – counter-intuitively – a big jump in its quarterly distribution. Most of all, though, the middle-market-focused BDC saw its NAV Per Share drop (14%).

BDCs very rarely post NAV Per Share drops over (5%), let alone (14%) – so this was Breaking News.

We flagged the matter at the time in the BDC Daily News Feed and promised to circle back to explain what happened after reviewing the BDC’s filing and conference call transcript.

We did as much on Friday while annotating the conference call.

Reasons Why

In a nutshell – 85% of the decrease came from two large write-downs – the sale at a much lower than anticipated price of RAM Energy after more than a decade of hoping, praying, and injecting new monies to make this oil drilling company succeed. That was all in vain and a big blot will shortly be removed from PNNT’s balance sheet.

The other drop in value was in the public stock price of Cano Health, which was once a high-flying stock but is currently a bit of a dud. That may change but this quarter the price drop hurt PNNT’s net book value.

Forth And Back

Initially, investors fled PNNT’s stock in droves – down more than (10%) only to return, cutting the drop in half.

Maybe investors worked out that the loss of NAV was not accompanied by any damage to PNNT’s income-generating power as both investments are in equity.

Au contraire, the $35mn pittance PNNT will receive for RAM Energy’s assets can shortly be re-invested into yield-producing assets at a time when yields are around 12%, and boost future income.

Nor is there any sign that the loss of RAM or the drop in Cano tells us anything about PNNT’s fundamental credit underwriting skills, except that management made a misstep but has promised – literally – never to invest in these sorts of energy companies again.

Amen.

As a result – and as that chart up there shows, PNNT was not even the worst-performing stock of the week.

Earnings Season Update

Outside of PNNT, we heard from 6 other BDCs this week, reporting IVQ 2022 results.

We provided brief thoughts on each in the BDC Daily News Feed as we sought to keep up with the flow of new information.

Thankfully, outside of PNNT’s massive book value drop, there were few surprises.

As everyone (viz. the BDC Reporter and the analysts) expected, earnings were generally higher than the IIIQ 2022 and several BDCs increased their distributions.

Stuck

One of the exceptions was Prospect Capital (PSEC), which continued to pay the same old $0.06 per share monthly distribution – now for 68 months in a row.

We need to dig into the BDC’s results and conference call to understand why PSEC – and its shareholders – have been left behind at a time when interest income on leveraged loans is very high.

Looking Forward

At this point, one-quarter of BDCs have announced results and we have several weeks yet to go of a deluge of results.

The trends, though, are very clear and pretty much as we anticipated going in:

As mentioned, earnings are trending higher helped by loan yields not seen in years, and with most BDCs close to, or even above, their targeted debt-to-equity multiples.

New investment activity and repayments – as you might expect – have slowed down, but are not a stop as borrowers and private equity groups keep themselves busy with “bolt-on” acquisitions and even new buy-outs.

The buyers in these situations are putting up big chunks of equity, giving these newly booked loans very attractive metrics from a BDC lender’s perspective.

Similar

NAV Per Share results are not dissimilar to the IIIQ 2022 – reflecting modest asset value decreases but no large-scale realized losses. (Obviously, we’re excepting PNNT).

In fact, of the BDCs that have reported IVQ 2022, there are more boasting net realized gains than net realized losses.

The value of underperforming assets and the number of companies on non-accrual is slightly worse than in the IIQ 2022, but only by the thinnest of margins.

All in all, from what we’ve experienced so far, and at a time when most other industries are reporting poor performance, the BDCs are performing very well.

Whatever struggles the BDCs might face in 2023 are not yet showing up in their IVQ 2022 results.

Carrying On

This is also reflected in the tone of the conference calls that have occurred since earnings season began.

Managers of BDCs of every size, shape, and strategy appear to be united in quiet confidence about their outlook going forward.

Complacent?

Is everybody in denial or is the seeming confidence justified?

Much will depend on what happens to BDC credit results in 2023.

Income is going to benefit from high or higher rates all year and – potentially – well into 2024 and even 2025.

Most BDCs will also continue to benefit from their low-cost unsecured debt booked in 2020-2021.

Portfolio sizes are likely to remain fully booked as repayments drop.

One Thing

Only credit losses can spoil this party through outsized realized and unrealized losses to asset values and the loss of investment income.

Just six weeks into 2023, the jury is out as to whether credit problems will come front and center.

We have a lot to say in our weekly Credit Credit Recap, which we’ll be writing next.

Long story short, there’s an undeniable uptick in BDC-financed companies and non-BDCfinanced companies (we track both categories) getting into trouble of late.

What the data cannot yet show in such a brief period is whether this is the beginning of a huge wave of distressed companies or just a modest surge that will barely impact the BDC sector.

Boiled Down

How this issue resolves itself will be the key determinant of what happens to BDC common stock prices in the months ahead.

Unfortunately for anyone anxious to get this matter resolved once and for all, we don’t believe it’s likely that peak negative credit conditions will show up till the second half of 2023.

As a result, expect many more months of the BDC Reporter equivocation about the sector’s outlook.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.