BDC Common Stocks Market Recap: Week Ended February 24, 2023

Divergent

BDC COMMON STOCKS

Week 8

Out Of Sync

The major averages .. ended the week with their biggest losses in 2023. The S&P 500 was down 2.7%, marking its worst week since Dec. 9. The Dow fell almost 3.0% this week — its fourth straight losing week. The Nasdaq closed 3.3% lower, notching its second negative week in three.

CNBC – February 24, 2023

In sharp contrast was the behavior of the BDC sector.

BDCZ – the UBS Exchange Traded Note which owns most public BDC stocks – slipped back only ($0.10) per share, or (0.6%).

On a “total return” basis, going by S&P’s BDC Index, the drop was only (0.1%).

When we look at the price behavior of the individual 43 BDCs in our coverage universe, it was a close-run thing, with 21 increasing in price over the 4 days involved and 22 decreasing.

Further Evidence

Interestingly – on a nominally “down” week – no BDC stock dropped by (3.0%) or more this week, but 4 increased by 3.0%+.

Variety Pak

As is often the case, this was a mixed bag.

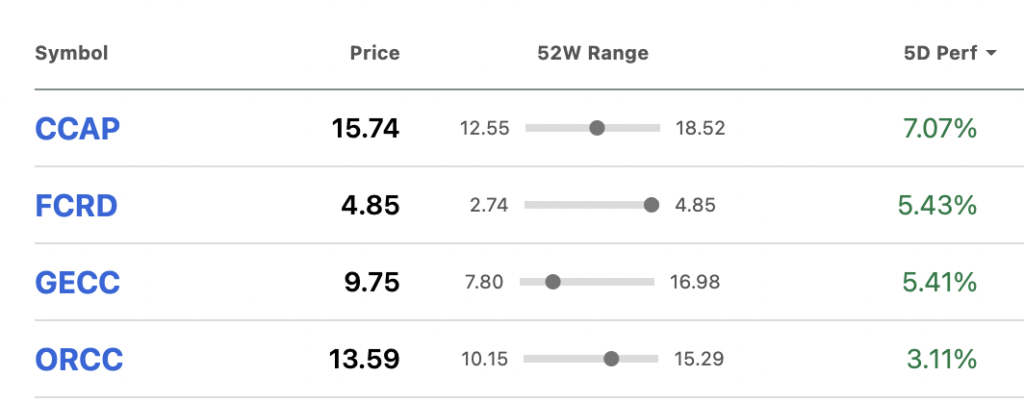

Crescent Capital (CCAP) and Owl Rock Capital (ORCC) both announced IVQ 2022 results, which may account for their popularity this week.

First Eagle Alternative Capital BDC Inc. (FCRD) is about to be bought up by CCAP and reached a new 52-week high price in anticipation.

[As a side note, Stellus Capital – or SCM – found its way to a new 52-week high and all-time high as well. The BDC’s price rise of late has truly been meteoric, up 24% since mid-December 2022 – three times the pace of the BDC sector].Why Great Elm Capital (GECC) is on the leaderboard escapes us, but the tiny BDC remains much closer to its 52-week low than the corresponding high.

On Its Own

In any case, our key point is that the BDC sector – which typically follows the whims of the broader markets – is currently “doing its own thing”.

In our opinion, the reason is obvious.

Good Times

With BDC IVQ 2022 earnings season halfway done, we’ve seen an almost universal reporting of higher recurring earnings, plumper distributions, and even some increases in net book value per share.

[Premium subscribers can check out the BDC Daily News Feed where we track and comment on every material development in almost real time. This was a very busy week with many highlights where earnings are concerned, but also in regards to BDC Fixed Income; a major change of management between two BDCs, and much more.]Looking into 2023 – going by what the BDCs themselves suggest and the analyst consensus confirms – this trend is expected to continue.

Grim

Out there in the “regular” world, all the talk is about an “earnings recession”, both now and later.

Ironically, those lower earnings for most companies are – partly – due – to higher borrowing costs being siphoned off by lenders like the BDCs.

This week and last, it became abundantly clear to most commentators that the Fed does not have inflation under control and interest rates are likely to trend much higher than expected previously and over a longer period of time.

Consequence

The result will be even higher earnings for the BDC sector than what is already baked into the analysts’ projections.

In effect, the Fed has set up a situation where lenders are being used to deploy its interest rate weapon of mass destruction in order to bring down economic activity and – thus – inflation.

The result has been – and will continue to be – a huge transfer of wealth from companies to lenders.

The Future Is Now

We’re already seeing BDCs boast of achieving record ALL-TIME profits in the IVQ 2022 or for last year as a whole.

A few BDCs are pointing to returns on equity – calculated by dividing Net Investment Income by net book value – of over 20% – and rising.

Over at our sister publication BDC Best Ideas, we do our best to keep track of the changing analyst EPS consensus for 2023 – not an easy task as the numbers are constantly changing, especially during earnings season.

Upward Trending

By our count, Net Investment Income Per Share increased by 9.8% in 2022 over 2021 thanks to higher rates.

Currently, the numbers suggest a further 9.3% increase in overall NIIPS this year.

However – our non-yet provable guess is that 2023 may see BDC dividends increase 15%-20% over the already bountiful 2022 and by a third or more over 2021’s levels.

Data Dependent

Are we crazy? We don’t think so.

Ares Capital’s (ARCC) currently projected EPS for calendar 2023 is $2.38, 18% higher than 2022’s actual performance and before any re-assessment related to a higher for longer rate curve.

Blackstone Secured Lending (BXSL) is expected to earn $2.89 per share in 2022, and then go to $3.48 in 2023: a 20% jump. Compared to its EPS of $2.43 in 2021, BXSL will have increased EPS by 43%. Even that could yet go higher.

Venture-debt leader Hercules Capital’s (HTGC) earnings are expected to grow 20% in 2023 over 2022 and by 33% when comparing 2023 with 2021.

The pro-forma ROE in 2023 using that earnings to net book value calculation would be 16.2%.

Selective

Yes, we are cherry-picking amongst the BDCs because not everyone promises to deliver such impressive earnings growth metrics.

However, the three BDCs named are major players and there are many others we don’t have the time to discuss in much the same boat.

If Only…

If that was the end of the story BDC stock prices would be headed to the moon right now.

However – as we all know – these ever-higher rates are potentially a double-edged sword.

Eventually – the argument goes – higher rates will have their desired effect and cause the economy to slow and leave leveraged borrowers with unsustainably high-interest costs.

All Over The Place

By the time the Fed “comes to the rescue” by undoing what itself has wrought by lowering interest rates, the landscape may be littered with the bankruptcies of BDC borrowers that could not keep up.

If you believe the most pessimistic observers – the Fed will have to induce a very serious recession to achieve its goals – i.e. many, many bankruptcies.

First in the line of fire will be all those leveraged companies that the BDCs are feasting handsomely off right now.

Neither

So far, BDC investors have not yet “bought into” the direr scenarios, nor have they embraced the prospect of a huge increase in earnings and distributions.

There’s a lot of watching and waiting going on.

Pushed Off

Unfortunately, the consensus is growing that we won’t reach “max rates” till late into 2023, or even early 2024. More importantly, the wave of bankruptcies which the Fed seems willing to engender if need be, might not occur till next year.

As a result, the BDC sector might not be fully credit tested for another 4-6 quarters.

If Past Is Prologue

You can only imagine how many different directions stock market investors might head during such a long period in their attempt to “get ahead” of the ultimate outcome.

This is going to make being long BDC stocks a very “sweet and sour” experience this year as investors keep on wondering whether they have been lured into a trap by the promise of riches that will implode as the Fed brings down inflation by skewering the economy.

Uncertain

This week, BDC investors held firm.

Next week or month could be an entirely different story.

For BDC investors – to paraphrase Rudyard Kipling – rarely have we been in a period where “keeping your head when all about you are losing theirs” will be as important as the next many months.

Guess right and you’re golden. Guess wrong and you could get hammered.

Frankly, BDC credit performance through the end of 2022 remains in very good shape by historical standards. Like the weather in California right now, though, conditions can change from sunny to snowy very quickly. If you’d like to stay ahead of what is happening to the credit quality of public BDC portfolios, we’d suggest subscribing to our sister publication: the BDC Credit Reporter. For just $50 a month during our Charter Membership drive, you’ll get a daily briefing of what is happening to the hundreds of underperforming borrowers in BDC portfolios. No more waiting around for a quarterly update from the BDCs themselves. Don’t get surprised by what may lie ahead.

PROMO FOR THE BDC CREDIT REPORTER

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.