BDC Credit Recap: Week Ended March 3, 2023

Getting worse

Week 9

Introduction

Like the week before – but more so – we were busy reviewing the credit updates of the multiple BDCs reporting their IVQ 2022 results. Frankly, we are still wading through all the disclosures and have many more updates yet to post. As a result, consider this week’s Credit Recap just a partial summary of what came out. However, over this weekend we were able to bring the BDC Credit Table up to date. 38 BDCs in total have reported data to varying degrees, providing an almost full credit picture at the end of the year. More on that is below.

BDC FINANCED COMPANIES

Bankruptcy Filings

No BDC-financed company filed for bankruptcy this week, leaving the year-to-date 2023 total at 10.

Bankruptcy Expected

This category involves some judgment calls, but we believe there are many BDC-financed companies likely to file for bankruptcy protection or agree with their creditors on wide-ranging balance sheet changes. The BDC advances involved are significant: potentially in the hundreds of millions.

Nothing new this week at Carvana, Diamond Sports Group; Wahoo Fitness; Research Now Group, Lucky Bucks, and multiple others mentioned before.

However, we did learn that a famous department store – Belk’s – is in deep financial trouble with too much debt and a now negative EBITDA. The company was restructured two years ago but not all that surprisingly traditional retail remains a problematic format. The only BDC involved is FS-KKR Capital (FSK) with $71mn in first and second lien debt advanced, part of a much larger KKR-led financing. The debt is already discounted and mostly non-performing for some time. Now, certain lenders – we don’t know who – are gathering together and hiring a specialist adviser to contend with the company. Another Chapter 11 filing is a likely outcome before long. FSK might lose several tens of millions in our view. For anyone interested in all the details on this company – and hundreds of other credit-challenged BDC-financed companies – consider a subscription to the BDC Credit Reporter.

Also in trouble is another famous name – Jenny Craig. We’ve mentioned the weight management company before but this week we explicitly heard that the owners are seeking to sell the business to contend with its financial challenges. Both Cion Investment (CION) and Ares Capital (ARCC) have exposure totaling $13mn, mostly held by the former BDC. A realized loss equal to 25% of the total invested seems like a plausible outcome.

Non Accrual

This week we learned that Carlyle Secured Lending (CGBD) and Goldman Sachs BDC (GSBD) are counting troubled physical therapy chain company PPT Management as non-performing from the IVQ 2022. (Golub Capital (GBDC) had its own exposure to the company on non-accrual since the IIIQ 2022). Total BDC exposure – which also includes SLR Investment (SLRC) – is close to $100mn. The good news, though, is that there might be a lender-friendly restructuring being ironed out as we speak, which might mitigate or obviate any ultimate losses.

Not So Good

Nothing materially new this week about trending companies such as Securus Technologies (ARCC, PSEC, TCPC), 8th Avenue Food & Provisions (GLAD, PSEC), and Byju’s (OCSL).

NON-BDC-FINANCED COMPANIES

Bankruptcy Filings

There were 2 notable non-BDC financed companies filing for Chapter 11 this week – one less than the week before. However, we don’t pretend to catch every filing that occurs. To date, calculate we’ve identified 33 such bankruptcies this year., but we’re going to stop counting. Check out our credit news feed for all the companies involved, which tracks these non-BDC financed bankruptcies here.

We did happen on a very interesting – and comprehensive – article from S&P, which said the following:

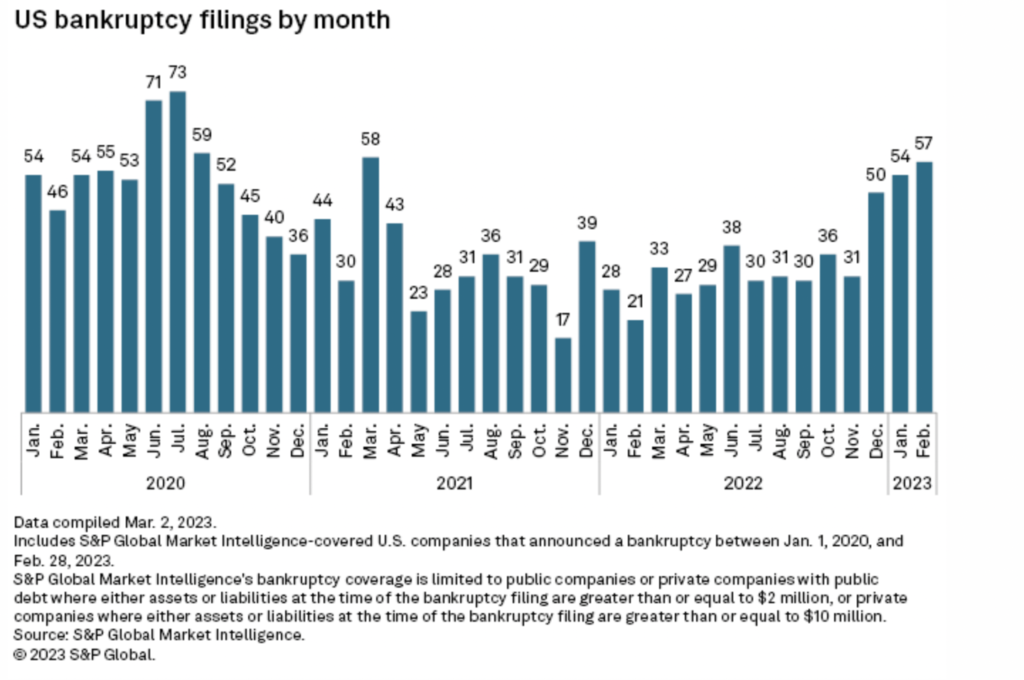

U.S. corporate bankruptcies are rising in 2023, with the first two months of the year registering the highest total for any comparable period since 2011, according to S&P Global Market Intelligence data.

Companies filed 57 bankruptcy petitions in February, while 54 were filed in January. February’s total was the most in a single month since March 2021.

We were especially interested in this chart showing the monthly count of bankruptcies:

The chart supports our oft-repeated assertion in these weekly Credit Recaps that there is a material increase in the number of credit failures underway – and this has happened very recently. Just since November 2022, the monthly number of bankruptcies has almost doubled.

The chart, though, also suggests that we remain below the level of bankruptcies in the summer of 2020 – which peaked at 73 in July of that year. At the time, almost everyone expected the credit situation to get much, much worse but the Fed and the Treasury flooded American businesses and individuals with money. causing a drastic reduction in distress.

Anecdotally we believe that many of the companies that survived the 2020 drama – either by avoiding bankruptcy altogether or by a quick rejigging of their balance sheets – are at the forefront of the current rise in distress. The difference this time is that rates are much higher; the markets far less friendly and the Fed almost deliberately wants to see them fail.

BDC CREDIT TABLE

Thanks to this week’s large influx of IVQ 2022 results, the BDC Credit Table is almost complete, with 38 of the 43 BDCs we track updated. As always, the information available varies from BDC to BDC and sometimes takes some digging to get to. A third of the BDCs won’t offer quarterly investment ratings and even amongst those who do some have chosen idiosyncratic methodologies. We standardized the ratings into a 1 through 5 grid, with underperforming assets in the 3-5 categories. Then there are the BDCs who won’t reveal the number of companies on non-accrual, leaving us peering at a screen to count up all the footnotes relating to non-performing loans in the Consolidated Schedule of Investments in the latest filing. Some BDCs tell you the number of non-accruals but not the names of the companies involved. Once again, this causes us to read through the portfolio list carefully to find out who is not paying. And so on.

At this stage, the data is very clear about BDC portfolio growth. Despite much lower levels of M&A activity – especially in the second half of the year – and a big drop in BDC stock prices from April, the public segment of the BDC sector has managed to grow assets under management. In the IVQ, half the BDCs reported larger portfolios than the period before. On a full-year basis, three-quarters of the BDC universe have grown in size – some by very large percentages. BDC managers are making the case that – from a credit and earnings standpoint – 2022 should prove a very good “vintage”. The pullback of the banks from the syndicated loan market and a generalized worry about future conditions have caused new loans booked to have more and tighter covenants; lower multiples of EBITDA and other “lender-friendly” features.

The Credit Table also shows that of the 26 BDCs that have reported results that include an investment rating, 18 have underperforming assets between 0-15% of their total portfolio – what we consider a “normal” level. That’s about two-thirds. Another 6 are between 15%-30% underperforming, which we call worrisome and 2 are over 30% by this metric, which is cause for concern. However, no one metric tells the whole story about any BDC. For example, Hercules Capital (HTGC) reports $1.075bn of “underperforming” assets or 36% of the total but virtually all are in category 3 on the 5-point scale. Nonetheless, there is a negative trend developing: HTGC’s percentage of underperforming assets – as valued by the BDC itself – has increased every quarter since mid-2021. At the current level, the percentage of underperformers has more than doubled from 18 months ago and is not so far off the level reached during the pandemic. To its credit, HTGC has a very robust valuation system that takes into account not only a portfolio company’s financial performance but the amount of liquidity “runway” left before a capital raise is needed. We expect the deterioration to be due to the lower availability of capital in the venture market.

The Credit Table also shows that 2 BDCs reported a lower level of underperforming assets in the IVQ 2022 than in the IIIQ; 15 were unchanged and 9 were worse. Those numbers suggest to us no evidence of the sort of broad-based downward credit moves associated with a recession. This jibes with our view that credit conditions may not be in Goldilocks mode and may even be deteriorating at some players, but – taken the metric by itself – is no cause for undue concern.

It’s a similar picture where non-accruals are concerned. The data seems to suggest there were more companies being added to BDC non-accrual lists in the IVQ 2022 than in the prior quarters of the year. In some cases, multiple new non-performers are being recognized. Yet, the absolute number of new non-accruals remains low when compared to the thousands of companies on the BDC sector’s books and by historical standards Moreover, there are still BDCs with no non-accruals at all, or very few – reflecting normal or even better credit conditions.

There’s a lot of great data mining to be done in the Credit Table for anyone interested in doing so, especially as we’ve been compiling numbers since 2020. Note, though, that there are times when we don’t have the data we need. If we’re working on it, you’ll see a TBD (To Be Determined notation in yellow). If the data does not exist, we mark it as N/A (Not Available). Unfortunately, you might also find some mistakes along the way, which we apologize for in advance. We’re consistently combing through the table to ensure data consistency and accuracy, but we slip up at times. Still, the Credit Table should become ever more valuable as a repository of key reported BDC credit data as we add quarter after quarter of results.

CONCLUSION

Both the S&P data regarding bankruptcies and our own narrower field of analysis for BDC-financed companies confirm that credit conditions are sharply worsening in 2023. The BDC Credit Table – now almost complete for 2022 – suggests that a downward process was beginning to show up in the IVQ 2022. (In fact, if you look back through the year, the data indicates that matters began to deteriorate from the IIQ 2022, which is not surprising).

On the other hand, both the 2022 numbers and the 2023 credit developments that we are aware of (a great deal more is likely happening behind the scenes) paint a relatively benign overall picture. That’s partly because the easy money conditions of 2020 and 2021 generally caused a great improvement in the credit status of most BDC-financed borrowers. As a result, the sector is starting to deteriorate from a low base and still has some ways to go before the bulk of players have underperforming assets and non-accruals above “normal” levels.

This is reassuring and in line with the current market valuation of the BDC sector. The risk, though, is that credit problems will accelerate even more than what we’ve experienced in the first two months and will affect almost every BDC. In past recessions, credit conditions have gone from okay to terrible in a very short period – sometimes in as little as one quarter. We’re not there yet and that may not happen. None of this is written in stone.

The good news is that if credit conditions take a big step down there’ll be plenty of evidence in the public record for those like us who care to look. There are the valuation write-downs in the BDCs’ quarterly results; the hiring of advisers; the ratings downgrades; sudden changes in management or the sale of assets or subsidiaries and so on. We’ll continue to keep tabs and report back here weekly.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.