BDC Common Stocks Market Recap: Week Ended April 6, 2023

BDC COMMON STOCKS

Week 14

Shortened

Maybe BDC investors should be happy this was a holiday-shortened week where common stock trading was concerned.

Things were not going their way by Thursday’s close even if the day itself ended in the black.

BDCZ – the UBS-sponsored Exchange Traded Note which owns public BDC stocks and serves as our lodestar – was down (1.3%).

So was the S&P BDC Index on a “total return” basis.

By contrast, the most popular and representative index of the broader stock market – the S&P 500 – fell only (0.1%.

Not Good

Of the 42 BDCs we track, 37 were down in price in the 4 days and only 5 were up or unchanged.

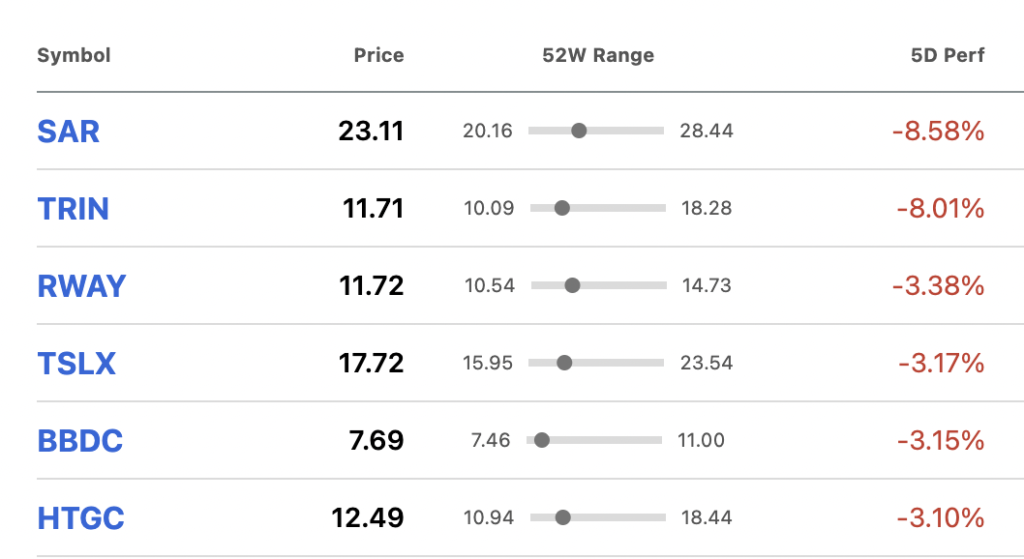

Of the BDCs in the red, 6 were off by more than (3.0%).

Here are the BDCs involved, a strange mix of middle market; venture debt, and lower middle market lenders.

Meh

Most of these BDCs have performed very well in recent quarters, but investors are always looking ahead and adjusting their enthusiasms accordingly.

Hercules Capital (HTGC) even received a thumbs-up from an analyst this week. This was covered in our BDC Daily News Feed, but the stock price slumped anyway.

Gone

Undoubtedly – and despite three weeks of higher BDC prices in the wake of the Silicon Valley Bank (SVB) collapse – the era of good feelings that began in mid-December and caused BDCZ to rise by 10% through March 6, 2023, has dissipated.

No BDC is trading within either 5% or 10% of its 52-week high and 14 – a third of the universe – are priced within (10%) of their 52-week lows.

That other favorite metric of many investors – how many BDCs are trading at a price above net book value per share – has dropped to just 6 names.

For what it’s worth, that particular metric is back to the level before the mid-December 2022 BDC rally began.

Half Full. Half Empty

We don’t want to over-dramatize because BDCZ is ever so slightly up in price in 2023 and sits 8% above its lowest closing level set in late September, but the mood has shifted.

In the last month, every single BDC is down in price and 2023 YTD only 18 are up and 24 are down.

Only “have and hold” BDC investors looking at the total return – much boosted by those record-high distributions received this year – can still smile a little.

The S&P BDC Index’s total return in 2023 – with a quarter of the year gone – is up 3.8% after registering a rare year in the red in 2022.

News Flow

The public BDCs have begun to schedule their IQ 2023 earnings release dates.

The BDC Reporter has been busy updating the BDC Earnings Calendar in anticipation of these results and the conference calls that follow.

At the moment, the earliest one is May 1, but there are many BDCs that have not yet set a date.

In less than a month, there will be the regular deluge of new data but currently, there is little in the way of market-moving news.

All The News Fit To Print In A Paragraph

CFOs at two of the larger BDCs have departed, seeking greener pastures; a lower-middle market BDC has received an investment grade blessing from Fitch; there was that upgrade for HTGC and Main Street Capital (MAIN) chose to mention a new investment booked, even though that tells shareholders very little. Finally, Runway Growth (RWAY) – one of those 5 venture-BDCs under a cloud through no fault of its own – disclosed its investment activity and repayments for the first quarter.

Lessons Learned

The BDC Reporter – as skittish as everyone else about what shoes might be ready to drop in the venture sector – jumped on the opportunity to delve into the details with a full-length article.

We came to the conclusion that RWAY was as active as you would want in the quarter that just ended and provided additional capital to a wide variety of existing portfolio companies. None of the advances seemed to aim at propping up failing businesses.

However – and as you’d expect – there was little in the way of brand-new relationships or repayments – a reflection of a venture sector in a deep freeze.

Anyway, RWAY does not report on credit issues in their quarterly updates so we’re still left waiting to see if strains are beginning to show in their portfolio.

Theme

In a general sense, “wait-and-see” seems to be what everyone is doing in the post-SVB, post-banking crisis world.

Investors – who were once begging to see risk-free rates drop and the Fed to take its foot off the pedal – have now switched to worrying about an imminent recession even as they seem to be getting their wish.

The ten-year Trasury yield is down sharply to a level not seen since September 2022 and the general consensus amongst bankers and economists is that the Fed will not raise rates again, or just once, and by 0.25% for good luck.

Not Yet Anyway

We don’t have any great insight to add to this current debate about where we’re going except to say that BDC credit conditions do not yet even begin to reflect recessionary conditions.

The Line Forms Here

What we will concede – after yet another week of getting up and close and personal with underperforming BDC portfolio companies over at our sister publication the BDC Credit Reporter – is that there’s an ever-longer line of companies with term debt or revolvers coming due in 2023 and 2024 who are beginning to sweat.

With lenders up in the leveraged finance sector more conservative than before getting those loans refinanced or extended at par is looking increasingly like Mission Impossible.

Even businesses performing pretty well – meeting lenders’ expectations when they were first booked a few years ago – are having trouble.

Time To Negotiate

This portends – rather than a rash of bankruptcy filings – a mountain of restructurings away from the bankruptcy courts where PE groups; junior lenders and even some first-lien debt will be taking substantial “haircuts” because of the great shift in how much companies can borrow.

Restructuring lawyers are being hired by an ever-growing number of borrowers and lenders, as the different sides (which include creditor-on-creditor struggles) prepare to reshape company balance sheets.

The likely result will be many worrying headlines as billions of dollars are in play here involving many famous and not-so-famous companies.

Time Consuming

Furthermore, every reorganization is different and involves multiple parties in an ever-changing economic and rate environment, which has the effect of causing these negotiations to go on and on.

This will be the credit wallpaper for the rest of the year.

Silver Lining

The good news for the many BDCs that are and will be caught up in these situations is that they are principally financing the top rungs of the companies’ balance sheets.

As a result, they will mostly be spared the large losses that will inure to the other stakeholders and will have a degree of control over how these negotiations play out.

Vulnerability

Where BDCs are most at risk is when they are second-lien lenders to these companies.

For years, the BDC sector has been seeking to shift its assets into a first lien position, but a significant minority of second lien loans remain and these are very much at risk in these reorganizations. Ditto for preferred stock, common s tock and warrants held.

In Play

Over at the BDC Credit Reporter, we’ve identified over 20 BDC-financed companies likely to undertake a financial restructuring in 2023 that might bring about a material realized loss.

The total debt at risk is over a billion dollars and the aggregate BDC second lien, preferred and equity invested is about $350mn – most of which could get written off.

Still Standing

Those sort of realized losses, should they occur, would be far greater than what we’ve experienced in the past two years but remains well within the boundaries of “manageable” and “normal” for this sector.

The key issue for the rest of the year where the BDC sector is concerned is less whether the Fed increases rates by another 0.25% or not in 2023 but whether credit losses metastasize outside of the relatively small group of BDC-financed companies that need to refinance in the next 12 months and which have material amounts of BDC junior capital underpinning them.

So Far So Good

With three months and 4 business days gone in 2023, no broad-based credit crisis has yet shown.

Like everyone else, we shall have to wait-and-see because predicting how the credit picture will play out remains impossible.

We continue to be confident credit losses will be tenable – not materially impacting BDC earnings and NAV Per Share – but we make no promise of prescience.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.