BDC Common Stocks Market Recap: Week Ended March 31, 2023

BDC Common Stocks

Week 13

On the other hand, if our banking system is “sound” as promised by our leaders, BDC prices – even in the face of weaker economic conditions – are likely to continue rallying back.

A lot of ground was lost two weeks ago and many BDC investors will not be able to stay away with many yields in the mid-teens, just as risk-free rates are dropping.

BDC COMMON STOCKS MARKET RECAP -Week Ended March 24, 2022

That’s how we closed out the Recap last week and that’s pretty much how the just-ended current week played out.

The S&P 500 was up 3.5%; the NASDAQ had its best performance since 2020 and the BDC sector jumped 3.0% in price – going by BDCZ – the exchange-traded note which owns most BDC stocks.

Most Everyone

As you’d expect given the relatively material percentage sector price increase, a rising tide lifted most boats: 36 BDCs were in the black or unchanged.

That’s the same number as last week.

The number of BDCs up 3.0% or more was at 14, the best performance in this category in 10 weeks.

Interesting

Only 2 BDCs dropped (3.0%) or more: Horizon Technology Finance (HRZN) and Trinity Capital (TRIN).

Both are venture-debt BDCs which may or may not mean anything, given that their peers Hercules Capital (HTGC) and TriplePoint Venture Growth (TPVG) were sharply up in price and Runway Growth Finance (RWAY) was modestly in the red.

Coming Back. Sort Of.

At this point, BDCZ has made back just over half of what was lost when Silicon Valley Bank (SVB) failed and spooked the financial sector into a major sell-off.

Reflecting the continuing concerns in the markets about the health of the banking system – a subject we were unusually vocal about last week – BDC investors seem to be a little slow jumping back into the market.

In the past, we’ve seen much sharper price movements down and then up, as one bullet or another gets dodged.

At this point, with the SVB-triggered crash (which you’ll remember was one of the biggest short-term reverses in BDC history) three weeks away, the number of BDCs trading above net book value per share is only 7.

Comparisons

That’s less than half the number at the beginning of March and in line with the beginning of the year when the BDC rally was just getting going.

If we look back just one month – thanks to Seeking Alpha data which tracks such things – only 3 of the 42 BDCs we track are up in price.

On a YTD 2023 basis, which includes both the rally and the crash, 23 BDCs are up in price and 19 are down.

However, just before SVB went boom, virtually every BDC (38 of 42) could boast a higher price than at the end of 2022.

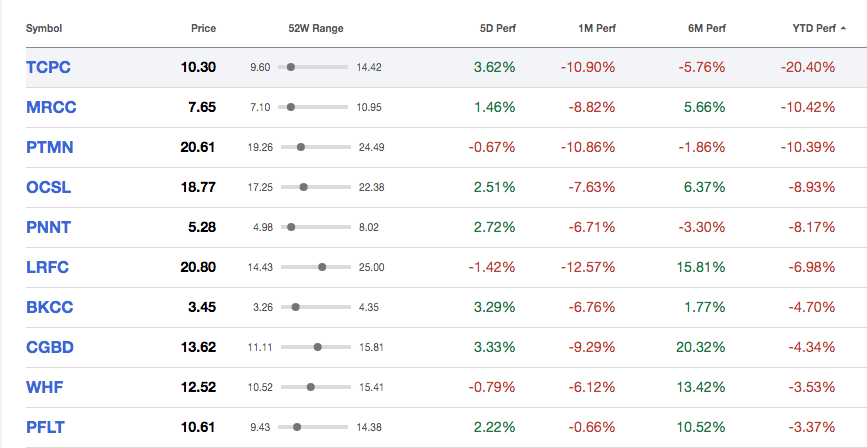

In fact, as this table shows, 10 BDCs are still (3.0%) or more down in price as the first quarter comes to a close, the recent pick-up notwithstanding:

Winners And Losers

You might be surprised to note that none of the venture-BDCs – cousins to SVB and lenders into a segment of the market that many have raised questions about – are on the list above.

For that matter, nor are any of the large-cap BDCs that target the very largest borrowers or the key players serving the smallest companies.

Setting aside tiny PhenixFin (PFX), which leads the sector in percentage price gain, the next four 2023 winners to date are two big borrower lenders (BXSL and ORCC) and two venture lenders (TRIN and TPVG).

There may be all sorts of lessons in that data, but we have to move on.

IQ 2023 Summary

The first quarter ended very neatly on Friday after thirteen weeks – as we’ve discussed – of both gains and pains.

BDCZ, which was once roaring ahead, ended up at $16.98, from $16.72 at the end of 2022.

That’s just 1.6% up YTD.

Looks Better From This Perspective

For the buy-and-hold investor, the performance of the S&P BDC Index – calculated on a “total return” basis that takes into account dividends received”, is more pertinent.

In IQ 2023, the index was up 5.2%.

Those huge distributions that are being paid out by just about every BDC and the momentum of the earlier rally have offset the price damage caused by the SVB crisis.

Still, at one point, this particular index was up 10.0%…

Then And Now

Just a couple of weeks ago, 22 BDCs were trading within 10% of their 52-week lows.

Now there are 12, and only 3 of them are within (0-5%) of their 52-week nadirs.

On the other hand, no BDC is trading within 10% of its 52-week high price. Not so long ago there were 10.

Looking at the metrics that we gather every week to write these gripping Recaps, we’d have to say that the BDC sector at the end of the IQ 2023 looks much more like the first week of 2023, than it did for the weeks in between.

Looking Forward

Despite coming off three weeks in the black – albeit just 0.1% up in the week ended March 17- chances are BDC prices will rise again in the first week of April.

For the moment – and despite much new analysis showing huge losses on the banks’ books coupled with deposit flight – investors seem to be shrugging off concerns that gripped them only a few weeks ago.

After all, First Republic Bank is still standing and the banks’ emergency borrowings from the Federal Reserve are “moderating”.

This is likely to translate into more BDC buying, as investors in the sector switch back to the very high dividend yields on offer, and the continuing promise of ever-higher earnings coming in the first and second quarters of 2023.

Favorable

We imagine that many BDC investors will be delighted that the Fed may be close to maxing out its interest rate increases.

Yes, that means lower pro-forma earnings that might be the case if the Fed Funds rate was to be raised to 6.0% or more – as was being bandied about before the SVB setback.

On the other hand, BDC managers have repeatedly reassured shareholders that at a Fed Funds rate of 5.0% or so, the vast majority of portfolio companies can handle having their pockets being picked for additional debt service.

Our View

If you’re looking for a BDC Goldilocks scenario it’s a mix of the Fed Funds rate ranging between 4.5%-5.0% for a year or more; inflation slowly grinding downwards and modest economic growth- as reflected in stable-to-slightly increasing borrower EBITDA.

BDCs will also be delighted if there’s a measured pullback in lending by the regional banks and continued cricket sounds from the syndicated loan market.

This will allow private credit – which the BDCs are the most important component of – to take market share not only in “normal” leveraged lending but also in other segments such as venture, asset-based lending, and in larger deals.

Less competition – even at a time with a much lower level of new financing – will allow BDCs to continue to add higher-spread loans, with ever tighter covenants, to their portfolios.

It’s times like these that allow BDCs to also get ever more selective about new borrower relationships and the terms with which they will continue with existing companies.

At least for the moment, the BDC sector should be able to have the pick of the leveraged litter – all of which should both boost profitability and lower credit risk.

In the past, these market opportunities have lasted for only short periods but the current “lender-friendly” environment has been with us for 9 months or more and could yet linger into 2024.

Farther Down The Road

That’s a great benefit both for the BDC in 2023 and in years to come, even if rates do materially fall and competition resumes as before.

It will take a strong economy, easy money, and much market optimism to undo the benefits private lenders are gaining in the current environment.

Loans have 5-7 year nominal durations but tend – on average – to turn over in 3-4 years.

We’d argue that even if the world returns to “normal” in 2024, the benefits that the BDCs are currently enjoying will last through 2027, probably in a diminishing way as debt is refinanced and repaid down the road.

Of course “normality” – itself a controversial construct – cannot be so easily scheduled, so the timeline might be even longer.

Besides Goldilocks, There’s A Bear

That’s our Goldilocks “bull case” but great uncertainty remains about how “sticky” inflation will be; what the policies of the Fed will look like and whether the baby gets thrown out with the bath water in the form of a deep and damning recession.

Then there’s the viability of the banking system which remains – in our view and that of many of our betters – something of a question mark.

A question mark over the banking system is like flying in a plane with a questionable engine – not a small thing.

Unfortunately, that nightmare can recur at any time or could go away like the last one for another decade.

Anyway, the next quarter and the rest of the year – as long as rates remain unusually high – should be full of the tensions and uncertainties that characterized this first quarter of 2023.

If the Fed and the government lose control of the narrative, the jumps and bumps we’ve experienced lately could seem mild by comparison.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.