BDC Common Stocks Market Recap: Week Ended May 26, 2023

BDC COMMON STOCKS

Week 21

Undeterred

If American investors are afraid of Washington not being able to arrive at a compromise on the debt ceiling and plunging the country into chaos, it’s not showing up in stock prices.

This week – with the matter yet unresolved till the country runs out of money in a week or so – the markets just hopped over that particular “wall of worry”.

The S&P 500 was up 0.3%, in the black for a second week in a row.

The BDC sector – as measured on price alone by BDCZ – the exchange-traded note which owns most BDC stocks – moved up 0.5% – the third increase in a row.

The S&P BDC index – which measures both price and distribution changes – increased 0.3%.

Half And Half

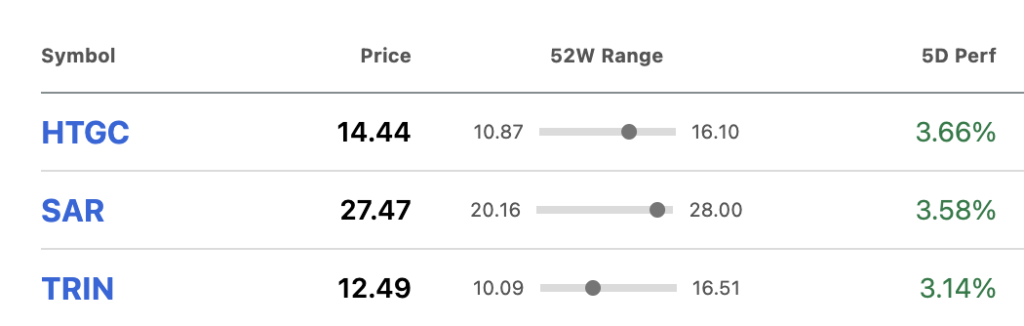

Of the 42 BDC stocks we track 21 were up, including 3 that increased by more than 3.0%.

Narrow Channel

Nonetheless, we’d characterize the BDC sector – from a price standpoint – as being “range-bound” ever since the failure of Silicon Valley Bank (SVB) – an event now more than two months away.

See the BDCZ price chart below for the period that began with SVB’s debacle:

Year-To Date

Looking back just a few months, we can clearly see 2023 can be divided into two phases.

Until SVB blew up, BDCZ was in rally mode, even outpacing the movement of the S&P 500 Index just before the San Francisco bank’s collapse.

Since SVB went bye-bye, the BDC sector by this price metric – and many others we serve up here – has remained pretty flat even as the broader index has taken off again, leaving us behind.

YTD, BDCZ is up only 0.9%, while the S&P 500 Index has climbed 9.5%, undeterred by the potential collapse of the U.S. banking system and everything else being mooted.

Having And Holding

The only glimmer of good news in this year-to-date data comes from the S&P BDC Index on a total return basis, which reminds us that those who dared to hold on to their BDC positions throughout this period have reaped a 6.9% “total return”.

Seeking Alpha indicates that 22 BDCs are showing price gains in 2023 so investors who had the right mix of BDC stocks might be doing even better than the “total return” index.

Sunshine And Roses

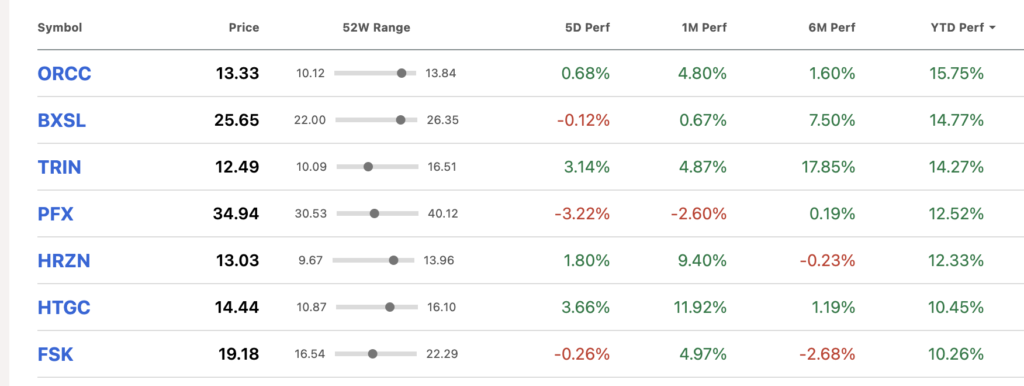

After all, 7 individual BDC shares are up 10% or more this year (see the column on the furthest right)…

Concentrated

Looking at the list of those Biggest Winners of 2023 To Date, we notice that most of the BDCs involved are either those serving the large-cap upper middle market borrowers (ORCC, BXSL, FSK) or the venture-debt sector (TRIN, HRZN,HTGC).

The current popularity of the former category we can understand given that many investors believe the larger borrowers are “safer” in any economic downturn than the middle market or lower middle market borrowers – a case repeatedly made by the BDCs that lend to those companies on their earnings conference calls.

We are agnostic on the subject, given that PennantPark Investment (PNNT) – which serves the middle market – also regularly trots out compelling arguments about how its segment of the leveraged loan market enjoys the best credit outcomes.

Also, Seeking Alpha long-term total return data shows that 6 of the 7 top performers over a 10-year period are BDCs that focus mostly on the lower middle market.

The top performer, though, is HTGC – the grandaddy of the venture-debt sector.

Our own preference – for what it’s worth – is to find the best BDCs in all 5 segments in which the sector operates: upper middle market, middle market, lower middle market, venture debt, and “hybrid”, which means multi-segment focus.

We’re Done

Circling back to the week just ended, the BDC Publications Daily News Feed (just renamed and available to all our readers and a useful way to recollect everything that happened ) shows that the BDC IQ 2023 earnings season came to a close last Monday when Capital Southwest (CSWC) reported its quarterly and annual results.

Much like most of its peers, CSWC’s financial and dividend performance was strong, both from a quarterly and annual standpoint.

Good Start

Our database shows that BDC recurring earnings increased 5.3% in the IQ 2023 over the level in the IVQ 2022, with 30 BDCs boasting an increase, 2 unchanged, and only 10 with lower earnings.

In the latest BDC dividend announcements, 11 have increased their “regular” distributions and 30 are unchanged. (PhenixFin does not pay a dividend). There have been no dividend reductions.

Even More

With the likelihood of a further increase in the Fed Funds rate during the summer and the chances of a decrease anytime in 2023 diminishing, we expect both earnings and distributions to get even better in the second half of this year.

Going by the analyst earnings consensus for 2023 and the BDC Best Ideas’ projection for distributions we’ve been projecting a full year gain in both those metrics of 11%+.

With further rate increases from the Fed becoming increasingly likely, we wouldn’t be surprised if BDC earnings and distributions this year jumped by 15% – capping a remarkable two year run.

Codicil

As we’ll discuss at greater length in our Credit Recap there are undoubtedly strains showing up amongst weaker BDC-financed companies but any income lost from that source is likely to be more than offset by the higher rates being paid by a much larger group of still solvent companies.

Exception To The Rule

Still, we did record a new 52-week low price where Oxford Square Capital (OXSQ) is concerned.

As discussed on these pages, the CLO and syndicated loan-focused OXSQ (one of those “hybrid” BDCs) is in the midst of raising a substantial amount of much-needed new equity capital.

Both for the BDC’s own shareholders and for sector-watchers generally, OXSQ’s progress in this endeavor will be well worth watching.

Can a BDC, with what can candidly only be described as a terrible record of net asset value destruction, raise new capital in this environment?

Admittedly, Great Elm Capital (GECC) was able to do so last year, giving the BDC a new lease on its life in the BDC arena.

However, should OXSQ fail to raise the new monies the way forward could become problematic.

Outlook

Speaking of the way forward, we’ll be watching in the holiday-shortened week ahead and into the summer whether BDC sector prices break out of that narrow range we discussed at the top of this article.

As of Friday, BDCZ was at the top of that range, and 4.97% above the low reached just after the SVB failure.

Maybe BDC investors are tired of worrying about all and sundry and will return the sector to the winning ways of earlier in the year, bringing the likes of BDCZ more in sync with the S&P 500…

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.