Bloomberg Article: 48-Hour Bankruptcy Rush – Impact On BDC Sector

NEWS

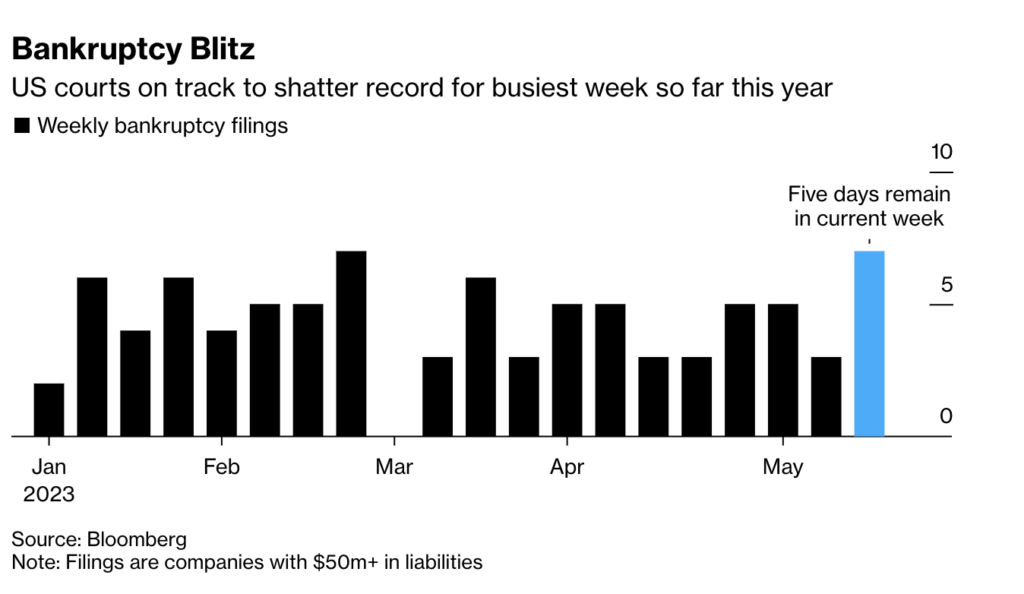

On May 15, 2023, Bloomberg published an article about the bankruptcy filings of seven larger leveraged companies that occurred in a 48-hour period.

That’s the largest number of filings on record during a two-day period since at least 2008, according to Bloomberg-compiled data on companies with at least $50 million of liabilities.

Bloomberg also indicated this week is “on track to shatter the record for busiest week so far this year”.

The article went on to provide brief details about each company involved.

The underlying theme of the author was that “firms across every sector are struggling with higher interest costs — making it more challenging to refinance loans and bonds — while corporate executives are drawing more scrutiny from investors and creditors”.

ANALYSIS

Bailiwick

Both at the BDC Reporter and our sister publication – the BDC Credit Reporter – we spend a good deal of time keeping track of leveraged company bankruptcies.

In our parochial way, we are principally interested in how any of the 42 public BDCs we track – with $125bn in assets under management – are impacted.

However, we also keep an eye on non-BDC financed company bankruptcies to learn what we can about what is happening in leveraged credit generally.

Involvement

We thought it would be interesting to show how many public and non-traded BDCs are involved in this recent spate of bankruptcies, and the financial impact likely to be involved.

Here is the largely self-explanatory table we’ve just created:

| BANKRUPT COMPANY NAME | INDUSTRY | PUBLIC BDC(S) INVOLVED | NON-TRADED BDC (S) INVOLVED | BDC EXPOSURE: FMV $MN |

| Athenex Inc. | Pharmaceuticals | OCSL | None | $25mn |

| Cox Operating | Oil Producer | None | FS Energy | $13mn |

| Envision Healthcare | Healthcare | None | NexPoint | $2mn |

| Kidde-Fenwal | Business Services | None | None | $0mn |

| Monitronics Inc. | Alarm Services | FSK | None | $73mn |

| Venator Materials | Chemicals | None | None | $0mn |

| Vice Group | Media | MRCC | Monroe Capital Income | $6mn |

| TOTAL | $119mn | |||

| Source: Advantage Data/Solve |

We’ve added a website link to every company’s name for anyone wanting to know more.

Findings

The BDC sector has exposure to 5 of the 7 companies involved.

Our subject matter – public BDCs – have exposure, though, to only 3 of the bankrupt names.

Although billions and billions of secured and unsecured debt are involved, total BDC exposure is very modest – just over $100mn in total.

Getting Granular

Over at the BDC Credit Reporter, we’ve estimated the likely realized losses that might occur to public BDCs due to the failure of these companies.

There are only two bankrupt entities that meet our materiality limit of $5mn or greater of exposure at fair market value.

These are Athenex Inc. – which we wrote about yesterday – and Monitronics International.

(Monroe Capital’s – MRCC – exposure to Vice is very small).

In both cases, we project realized losses will range between 0%-25% of the BDCs’ investments at cost, or under ($30mn) between them.

Idiosyncratic

Given our familiarity with the back story of the 3 public BDC-financed companies, we can say with some confidence that their credit troubles are long-standing and have very little to do with the current high-rate environment.

Athenex and Vice Group in particular would – in all likelihood – have filed for bankruptcy under any financial regime.

VIEWS

Reactive

Frankly, we were triggered to undertake this desktop research because we’ve seen a number of dramatic headlines about the dire state of credit and bankruptcy conditions of late.

We’re concerned that headline writers – and the authors of the articles themselves – may unduly stir the pot and cause unnecessary concerns.

Not Very Exciting

At least in the public BDC sector, when one looks behind the headlines and digs into the actual data, the credit situation remains pretty tame.

Comparisons made – as they were here – with conditions in 2008 in the Great Recession are not valid, even if this one data point (the number of bankruptcy filings in a two-day period) was technically correct.

Tiring But Helpful

Over at the BDC Reporter, we’ve just completed an exhaustive and exhausting update of the BDC Credit Table (with the exception of Capital Southwest, which has not yet been reported) for the IQ 2023.

For those of you not familiar with this ambitious project of ours, this means extracting for every BDC all kinds of credit data from the latest results, including total portfolio size, the value of underperforming assets, and the number and value of non-accruing investments and all compared with prior quarters all the way back to early 2020.

We also read every transcript of every BDC’s earnings conference call for the latest credit “color” about portfolio company financial performance and outlook.

Spoiler

We’ll be providing a full-length summary shortly but we can say here that the credit deterioration across the 41 BDCs we tracked was very modest by comparison with the IVQ 2022.

Moreover, the number of new non-accruals in the first 3 months of the year and significant realized losses from events such as bankruptcies, restructurings, and liquidations were both very low.

Furthermore, there has not been any wave yet – as there was in 2008 – in borrower amendment requests – a typical early warning signal.

(Not a conference call goes by without a worried analyst asking about amendment requests).

Covered

No BDC is yet complaining that any of their portfolio companies are unable to meet debt service requirements because of the Fed’s hiking of rates.

While debt service coverage numbers are tighter than they were in 2021, EBITDA to interest metrics remain in good shape and unlikely to be breached, especially if the Fed’s hiking is largely done.

Climbing

Maybe most surprising of all for investors fed a regular diet of bad news about the state of the economy is how many BDCs reported that their portfolio companies have been mostly continuing to see increases in revenues and EBITDA through the first quarter of this year.

Our View

If we can be so bold as to generalize about what’s been happening in BDC credit of late, we’d say a culling process is underway of many of the “zombie” borrowers who had been holding on thanks to an easy money, low rate regime.

The recent rate hikes have caused both the owners and the lenders of these businesses to rethink their capital structures and “right-size” them.

What is a very normal process culling process in capitalism was put on hiatus in the wake of the pandemic, but has now resumed.

This affects only a tiny fraction of leveraged companies and should prove a benefit over time.

In fact, many BDCs are swapping debt for equity as part of this transformative process and may yet recover or grow their capital at risk.

Caveat

We’re not saying that credit conditions are not tightening for BDC lenders because they are, but only modestly – especially by comparison with any stage of the Great Recession.

However, current conditions are entirely “manageable” in all the industry segments which BDCs finance and that includes venture lending.

Resilient

Rightly or wrongly, this is probably because the Fed has not yet managed to break/brake the economy sufficiently to cause a credit crisis amongst leveraged companies.

There has been some above-average stress in “consumer-facing” segments of the economy and in parts of healthcare, offset to a degree by gains in the energy area – once a graveyard for lenders.

Not Yet

The day of credit reckoning for public BDCs and their borrowers (and probably for leveraged lenders generally) – going by the data – is not yet here and may still not arrive in 2023.

The coincidence of a brace of bankruptcies in a short period should not cause anyone to think otherwise.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.