BDC Common Stocks Market Recap: Week Ended June 2, 2023

BDC COMMON STOCKS

Week 22

Relieved

The most crucial factor affecting BDC stock prices in this holiday-shortened week was what DIDN’T happen in Washington D.C. – a debt limit debacle.

BDCZ – the UBS-sponsored exchange-traded note that we use to track the sector’s price level – increased by 2.1%.

As this BDCZ chart shows, prices spiked at week’s end when investors were certain all would be right with the world – till the next time the debt limit needs lifting.

The S&P 500 went up 1.8% as well and the NASDAQ reached a 52-week high.

That’s a big sigh of relief you hear.

For all that, the BDC sector was hardly off to the races.

Yes, three-quarters of the BDC stocks we track were in the black.

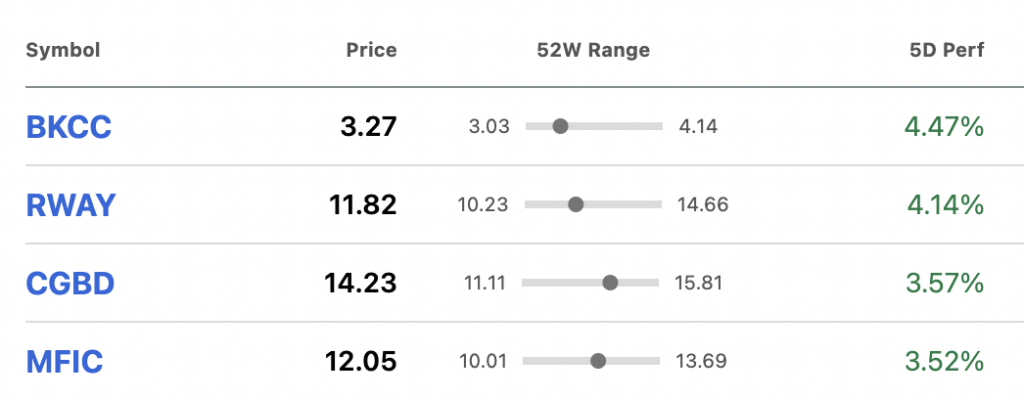

However, only 4 BDCs increased by (3.0%) or more this pivotal week.

Downers

There were also two BDCs that fell more than (3.0%), but one was Horizon Technology Finance (HRZN) whose price was deflated by its latest equity issuance, which we reviewed on these pages.

This is a common enough occurrence: a BDC’s stock price magically rises for a few days – probably with a little help from its friends (and advisers) – announces an equity issuance and faces a big drop:

HRZN is already in recovery mode but closed the week at $12.05, well below the $12.50 secondary.

Over at the BDC Credit Reporter, we undertook a full-fledged credit review of HRZN this week. We used the credit information from the BDC’s IQ 2023 results, as well as our own company-by-company research into the most important underperformers. These include Evelo BioSciences, which was added to the underperformers list only this quarter. Unfortunately, our takeaway from this credit survey was mixed, and caused us at BDC Best Ideas to place our projections for HRZN’s distributions and Total Return on hold.

BDC Credit Reporter + BDC Best IDEAS

Sector Status

With this week’s price increase, the BDC sector is up 5.25% since the week ended May 5 – the last time we were in the red.

By our standards, that puts the sector back in rally mode, even if a fitful one.

BDCZ is a clear 12% above its two-year low of $15.40, set in September of last year.

Just a few weeks ago, when BDCZ dropped to $15.85 intra-day, there seemed to be a chance the sector would “re-test” those September lows.

Investors now, though, seem to be looking up rather than down.

This is also reflected in how the number of BDCs trading within (10%) of their 52-week low prices has dropped from 18 in early May to just 3 on June 2.

Likewise, the number of BDCs trading within 10% of their 52-week high has increased to 10 from a flat zero on May 5.

So Far

With that said, the sector has a very long way to go before looking like the NASDAQ.

Just 9 BDCs are trading at or above net book value.

(We’ve just updated the BDC NAV Change Table for anyone interested in investigating who is – and who is not – on that short list).

As the chart below shows, BDCZ will have to increase by 20% to return to its 2-year high set all the way back in April 2022.

Behind

Using a 12-month tape measure, only 7 BDCs are able to show a price increase, with 35 in the red, including 24 down by more than (10%).

Moreover, during the last year, BDC earnings and dividends have increased drastically and “should be” – arguably – – trading 20%, or more, higher than they were at the time of the last peak.

This is all to say that 4 weeks of BDC price increases leave the sector with much yet to do.

Unchanged

Now that the debt limit “crisis” is out of the way, BDC investors face the same macro conundrums as they have for months – as made evident this week in the latest economic data released.

Is the economy on the verge of a recession – as so many economists and pundits are preaching or are the employment levels a sign that this curious GDP growth will continue?

Will They Or Won’t They?

The mystery wrapped in that enigma is how the Fed reacts and raises rates or does not.

The latest market favorite notion is that the Fed will punt – “skipping” a raise but leaving the possibility of a future hike on the table.

This will only extend the agony.

Soap Box

We continue to be unconvinced that the Fed can bring down inflation by raising rates, as the evidence of nearly a year and a half has proven.

This continues to be a perilous experiment taking us into unknown territory.

We’ve long ago given up all hope of presuming to know what the Fed, the economy, inflation, etc will go.

We Believe

Our only semi-certainty that is relevant to our purposes is that the base rate is likely to remain elevated through 2023, and could yet scoot higher.

We are not budgeting for a cut this year beneath the current level of 5.00%.

This means that BDC earnings will reach ever higher heights in the last 3 quarters of 2023 and distributions should continue to rise.

Corollary

That salutary fact, though, is likely to extend the period that leveraged companies with debt coming due will face very harsh refinancing challenges.

As we’ve discussed in the BDC Credit Recap in prior weeks, this has tripped up a host of BDC-financed companies in recent weeks including Jenny C; Serta Simmons, David’s Bridal; Monitronics (Brink’s Home Security); Nielsen & Bainbridge and many more.

(Admittedly, most of the companies unable to refinance their debt so far have also had business model flaws).

Longer Runway

However, as the time frame in which companies will have to contend with high rates persists, the universe of those unlikely to get refinanced without the benefit of a drastic balance sheet restructuring or bankruptcy will increase.

As with everything else, this is a risk that is well nigh impossible to quantify but you can be sure that there are now companies with loans coming due in 2025 that are beginning to sweat.

Of course, if the Fed does actually manage to trigger a recession to save us all from inflation, the number of underperforming companies will also greatly increase, taking us from the current realm of “manageable” to something far less comfortable.

All we can do is watch and wait to see what the Fed brews up with its chemistry set.

Timely

BDC investors getting caught up in the enthusiasm of this latest rally may want to look a little further down the road and decide where they stand on these macro issues which could swing BDC prices in any number of ways.

We’ve had 5 significant price drops and 5 “rallies” since the BDC sector price peak in April 2022.

More likely than not, there is at least one more swoon to come before the Fed gets the situation under control.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.