BDC Common Stocks Market Recap: Week Ended June 23, 2023

BDC COMMON STOCKS

Week 25

Not So Magnificent 7

After an unusually long streak of six weekly price increases for the BDC sector – as measured by BDCZ, the UBS-sponsored exchange-traded note which owns only BDC public securities and serves as our guide – the BDC rally stumbled in week seven.

BDCZ dropped (1.8%) in price and the “total return” S&P BDC Index fell (2.1%).

The red ink showed up in all the major indices after weeks of a “monster rally:

The Nasdaq snapped its eight-week winning streak, its longest since March 2019, while the S&P 500 (.SPX) broke its five-week rally, its longest since November 2021.

The S&P 500 and the Nasdaq logged their biggest Friday-to-Friday percentage drops since early March, when the regional banking liquidity crisis hit.

Reuters – June 23, 2023

Root Cause

Apparently, investors grew concerned about the very same potential rate increases by the Fed that had been mentioned the week before without anyone batting an eyelash.

As they most often do, BDC prices were in broad correlation with the broader indices.

Metrics

This meant 39 of the 42 public BDCs we track saw their prices drop.

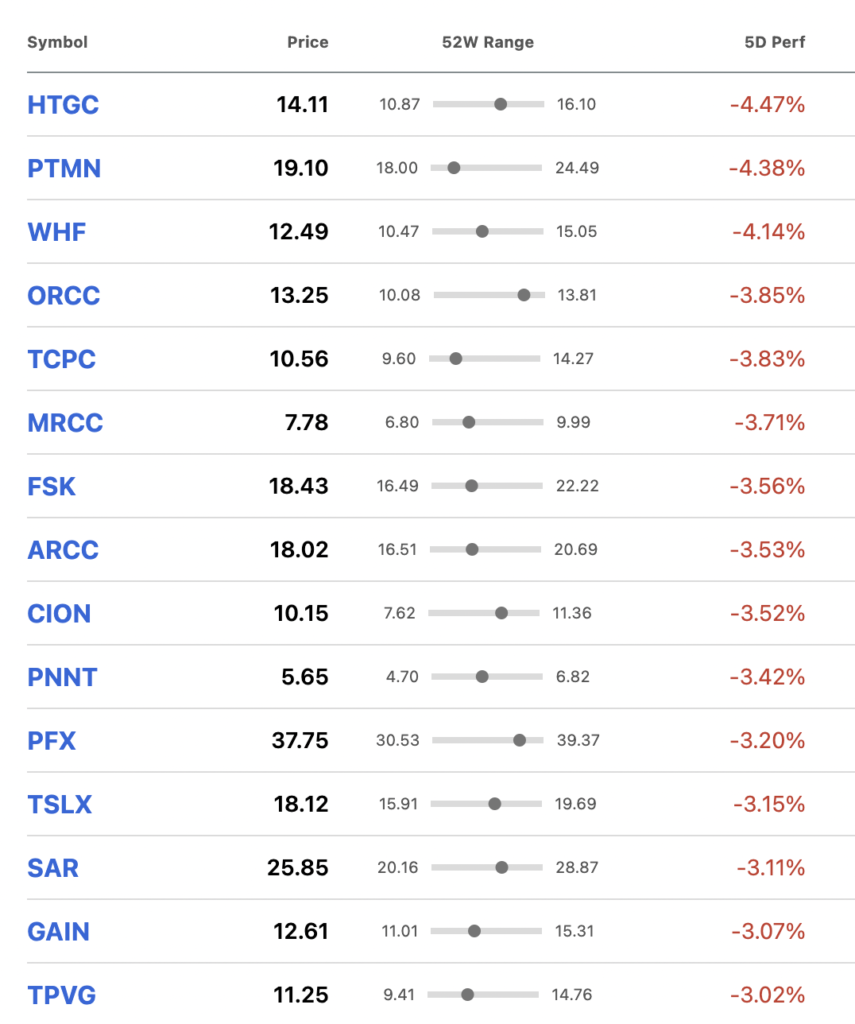

Of those, 15 fell by (3.0%) or more – the worst performance in this category since May 5, 2023.

As the list above illustrates, BDCs of all sizes and strategies were caught up in this week’s pullback.

We also note that the drawdowns involved – although numerous – were relatively modest in percentage terms.

Exception To The Rule

There is one BDC out of step with the sector right now: Blackstone Secured Lending (BXSL).

The stock price was up 4.4% this week, and reached a new 52-week high – the only BDC to do so.

YTD, BXSL is up over 20% in price and ranks as the third biggest price gainer in our coverage universe.

Apparently, investors continue to be excited about BXSL’s recent dividend increase for the third quarter.

Center Of Attention

We hashed over the subject in great detail in a full-fledged article on June 20, 2023.

The BDC’s dividend outlook was also the subject of a BDC Best Ideas article this week as we amended our estimate for what the total payout to shareholders will look like in 2023.

Still, even at the 52-week high set on Friday, BXSL was trading at only 7.3x the 2023 analyst earnings consensus – a reminder that valuations have fallen a great deal in the BDC sector thanks to competition from other yield-producing investments and concerns about a future credit slump.

Back To The Bad News

This week saw two BDCs reach new 52-week price lows.

Both involve smaller players, with idiosyncratic business strategies, tight liquidity, and chequered pasts.

We’re talking about Great Elm Capital (GECC) and Oxford Square (OXSQ).

The latter had a tough week – failing to raise through a rights offering anything close to the amounts hoped for.

The immediate consequence is that OXSQ will not be able to prepay in full the first of its three Baby Bonds closing in on its maturity date.

Even more importantly – as discussed in a BDC Reporter article – questions have to be asked about the way forward for the BDC that will be keeping both common stock and Baby Bond holders up at night.

Way Forward

By no means is the BDC rally dead and buried.

We need to see a (5.0%) drop from a recent high to make that determination.

Technically, that would be a BDCZ price below $16.6, from $17.11 at the close on Friday.

This week’s pullback got us just part of the way there.

These sorts of moments of doubt – often accompanied by profit-taking – occur a good deal during rallies.

Boring

Nothing in the broader economic, financial, and political context has materially changed.

We’re still involved the same old tired debate about whether a recession is headed this way, or not.

Market participants could just as easily return on Monday to start buying or could continue to sell off.

Stop If You’ve Heard This Before

For our part – and equally boring – we remain as concerned as ever that the continuing surge in corporate defaults and bankruptcies will bring BDC prices low.

That’s been our message for some time and which was validated last week – but not in the six weeks before.

NNot Encouraging

This week, Pitchbook reported that the “default rate for loans with financial covenants is at its highest level since 2008”.

Any juxtaposition of “2008” and anything to do with credit used to trigger investors.

That was the case till recently anyway, but markets – till this week – have not been fazed.

Long And Winding Road

Unfortunately – whether we are proved right or wrong – the time frame for this drastic re-set for inflation, interest rates, and the economy seems to stretch well into 2024 – and possibly beyond.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.