Trinity Capital: IIQ 2023 Distribution Announced

NEWS

PHOENIX, June 15, 2023 /PRNewswire/ — Trinity Capital Inc. (TRIN) (Nasdaq: TRIN) (“Trinity Capital” or the “Company”), a leading provider of diversified financial solutions to growth-stage companies, today announced that on June 14, 2023, its Board of Directors declared a cash dividend of $0.53 per share with respect to the quarter ending June 30, 2023, consisting of a regular quarterly dividend of $0.48 per share and a supplemental cash dividend of $0.05 per share. The dividend represents an increase of 2.1% over the regular dividend declared in the prior quarter.

The Company’s Board of Directors has authorized the supplemental cash dividend in order to comply with regulated investment company tax requirements for distributing its undistributed taxable income from fiscal 2023.

This supplemental dividend will be paid out of Trinity Capital’s undistributed taxable income (taxable income in excess of dividends paid) as of December 31, 2022.

Summary of Second Quarter 2023 Regular and Supplemental Dividend:

| Declaration date | June 14, 2023 |

| Record Date | June 30, 2023 |

| Payment Date | July 14, 2023 |

The Company’s objective is to distribute four quarterly dividends in an amount that approximates 90% to 100% of its taxable quarterly income or potential annual income for a particular year in order to qualify for tax treatment as a regulated investment company under the Internal Revenue Code of 1986. In addition, during any particular year, the Company may pay additional supplemental dividends, so that the Company distributes approximately all its annual taxable income in the year it was earned, or it may spill over the excess taxable income into the coming year for future dividend payments.

Trinity Capital – Press Release – June 15, 2023

ANALYSIS

Agenda

Let’s briefly review TRIN’s dividend payout track record in recent years; as well as 2023 to date, and what the analysts are expecting in terms of IIQ 2023 Net Investment Income Per Share (NIIPS):

Dividend History

TRIN is one of the newest public BDCs and one of 5 venture-debt players.

The BDC came public on February 2, 2021.

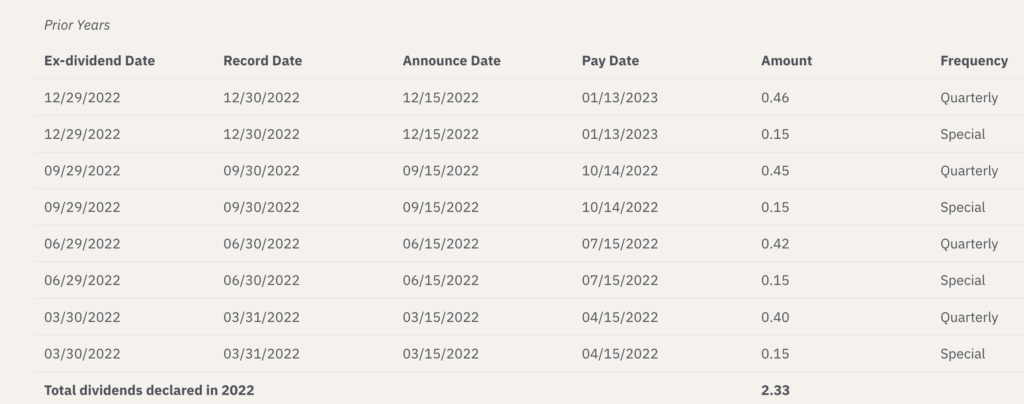

TRIN paid out $1.26 per share in 2021 and $2.33 in 2022.

NIIPS in those two years was $1.50 and $2.26 respectively.

Plenty Left Over

Spillover income at the end of 2022 came to $1.64 per share.

This Year

In IQ 2023 TRIN announced a $0.47 “regular” quarterly dividend and no “special”.

The latest announcement sees the “regular” dividend increased by 2.1%, but the total payout go up by 12.8%.

The most recent “regular” dividend increase is the 10th in a row.

With half of 2023 gone, TRIN has made or announced $1.000 per share of distributions.

Returning

This latest dividend announcement returns to the pattern of 2022 in which both “regular” and “special” dividends were announced in every quarter:

IIQ 2023 Earnings Vs Distributions

The current analyst NIIPS consensus for the IIQ 2023 on a diluted basis is $0.53, up from the $0.52 achieved in the IQ 2023.

(Management likes to discuss “basic” NIIPS, but the analysts use “diluted” NIIPS for their projections).

Return On Equity

As of IQ 2023, TRIN’s Net Asset Value Per Share (NAVPS) was $13.17.

The annualized latest distributions – both the “regular” and the “special” – comes to $2.12.

The return on equity (ROE) is 16.1% – one of the highest in the BDC sector.

Even the “regular” distribution alone – often thought to represent what the BDC can earn over the long term even if rates drop – results in an ROE of 14.3%.

Not so long ago, most BDCs were only able to deliver ROE’s in the high single digits.

VIEWS

Not Done Yet

Understandably, TRIN’s dividend has been systematically increasing as the BDC grew in size following its IPO.

TRIN’s portfolio size at fair market value has doubled since the IQ 2021 – in just two years. See the BDC Credit Table.

However, even now that TRIN’s size has flattened out (AUM has increased less than 4% over the last 3 quarters), the BDC continues to up its payout to shareholders.

Like many of its peers, the BDC is benefiting from higher rates – a process that is not yet over if we’re to believe the latest Fed statements.

Outlook

Over at our sister publication – BDC Best Ideas – we’ve projected since March 15, 2023 that TRIN will pay out $2.5000 per share in 2023.

This was an increase from an earlier projection of $2.0000, made in September 2022.

Admittedly, the latest projection seems unduly bullish given the $2.12 annualized pace of the IIQ 2023 payout and the $2.1400 analyst NIIPS projection for 2023.

Defending Ourselves

However, we were assuming that under the tax rules TRIN might need to fork over some portion of that $1.64 in “spillover income” – resulting in distributions exceeding earnings.

We assumed this might happen in the latter half of 2023, so we’re still waiting and seeing.

High Hopes

Further down the road, we’re projecting TRIN will be able to consistently achieve $2.50 a year of NIIPS and a similar annual payout.

That bold projection was partly based on the $0.62 of “basic” NIIPS achieved in the IVQ 2022.

But lower repayments received in the IQ 2023 brought NIIPS down to $0.55 ($2.20 annual pace) after we had made the projection.

Debated

Will TRIN consistently achieve the $0.62-$0.63 per quarter of NIIPS necessary to pay out $2.50 a year in distributions ?

Here’s how BDC Best Ideas stubbornly defends its aggressive payout projections:

Despite the modest $0.53 of NIIPS projected by the analysts for both the June and September 2023 quarters, BDC Best Ideas believes the actual numbers could be substantially higher.

Benefiting the BDC will be the impact of the most recent Fed rate increase of May and the delayed impact of the two earlier increases which sometimes take time to show up in the investment income line.

Furthermore, there’s a chance that recoveries at bankrupt Core Scientific, non performing GoFor Industries and – to a lesser degree – from ex-portfolio company FemTec Health, can be re-invested, which would boost earnings.

If you’re interested in a comprehensive assessment of TRIN’s credit performance, we recommend subscribing to the BDC Credit Reporter which has recently published an in-depth article on the subject:

Trinity Capital: IQ 2023 Credit Highlights

After two underwhelming credit reviews of venture-debt BDCs, the BDC Credit Reporter turns to one more: Trinity Capital. We found the results surprising.

You can also access a database that includes all the underperforming companies in TRIN’s portfolio

BDC CREDIT REPORTER

There are a host of other factors to consider as well where future earnings are concerned including any benefit to be derived from a new joint venture program; any shift in the income producing & non-income producing profile of the portfolio, as well as the bottom line impact of any stock repurchases.

Then, in the second half of the year, there’s the potential impact of two pro-forma Fed rate increases.

Interesting Times

All to say that there’s much to play for in the rest of 2023 and TRIN may yet achieve the levels of earnings and distributions built into the BDC Best Ideas estimates.

Even if both those metrics only match 2022’s level, TRIN’s ROE and Return On Assets (ROA) remain amongst the best in the industry.

Valuation

At the closing price on June 15, 2023 of $13.16, TRIN traded at a PE multiple – using the analyst consensus of $2.14 NIIPS in 2023 – of 6.1x.

The yield – annualizing the latest combined dividend payout of $0.53 (or $2.12), the yield is 16.1%.

Going by the BDC Best Ideas projection of $2.5000, the yield is 19.0%.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.