BDC Common Stocks Market Recap: Week Ended July 28, 2023

BDC COMMON STOCKS

Week 30

Relentless

For yet another week, this BDC rally rolled on.

Our regular guide – BDCZ, the UBS-sponsored exchange-traded note which owns most of the public BDC stocks – moved up to a price of $18.22.

That’s a substantive 1.6% gain and all the more impressive after weeks and weeks of higher prices.

Like That Rabbit

This rally – by our way of measuring these phenomena – is 3 months long already.

Since the market downturn that began in the spring of 2022, we’ve had 6 price rallies before, but none have lasted as long as Lucky Number Seven.

We had to go back to January-June 2021 to find a longer period of sustained BDCZ price increases.

Pattern

We get the impression from the charts – and our own experience dating back to before the GFC – that there is usually a considerable time gap between when the most intrepid investors return to the market and then everyone else.

The latter tend to wait for an all-clear signal.

That has seemed to come in recent weeks with the drop in inflation indicators; a strong GDP “print and an almost universal belief that the Fed is very, very close to the end of its historic rate-raising program.

Those are the macro factors but also – finally – contributing to the rally are the highest BDC earnings and distributions in memory; tame credit losses and – by our estimate – even better days ahead due to those high rates; wider spreads on new loans and the sector’s increasing market share.

Metrics

This week, 38 of the 42 BDCs we track increased in price.

As is common in BDC rallies, almost every BDC has been caught up in investor euphoria.

Over the last month – for example – 41 BDCs are in the black and only 1 BDC has been left out of the party.

(That happens to be PhenixFin – PFX – one of the smallest BDCs).

Moving Numbers

A metric we don’t use very often is how many BDCs are up in price over their 50-day “simple moving average”.

Seeking Alpha tells us that number is also 41. (PFX is – once again – left outside).

Even using a 200-day SMA, 37 BDCs are in the black.

All In This Together

Rarely has the expression “a rising tide lifts all boats” been more appropriate.

This phenomenon is partly explained by investors seeking relative value amongst the various BDCs on offer but is also due to the superior performance fundamentals of every player across the industry.

For a variety of reasons – BDC mergers; a flood of liquidity; low-interest rates in 2020-2021; an industry-wide push in recent years into “safer” assets – there are very few “walking wounded” BDCs that investors might shy away from.

Depending on where you might draw the line, we’d say there are 2 to 4 “suspect” BDCs by our lights.

All are smaller in size and market capitalization and barely impact the sector as a whole in terms of assets under management.

Good Year

The result of all this is that BDCZ is now trading at its highest level of 2023, and 9% above the level at year-end 2022.

YTD, 35 BDCs are up or unchanged in price and only 7 – or 20% of the universe – are in the red.

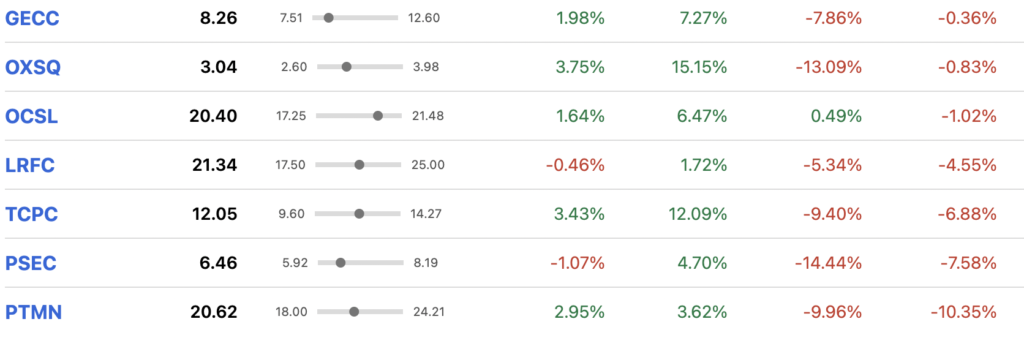

Here are the bottom of the 2023 barrel BDCs, drawn from Seeking Alpha’s data. Use the last column.

On a “total return basis” we’d estimate that there are only 4 BDCs that are in the red at this point – 10% of the universe.

Where To?

Investors must be asking themselves if the BDC bull is getting tired or has further to run.

We can tell you that 12 BDCs are trading within 5% of their 52-week highs and another 13 between 5%-10%.

16 BDCs are trading at a price above their net book value per share.

In the past, we’ve seen even better metrics for both these calculations.

Raising The Bar

Furthermore, the last 52-week period was a relatively weak one to compare against.

More appropriate might be to compare and contrast over a 2-year time frame, including where BDCZ and BDC stocks traded before the fear of a U.S. recession gripped investors.

Yes, rates remain much higher than they were, but the market will begin to look ahead to a lower-rate environment.

Anyway, BDCZ will need to increase another 13% in price to match the highest heights of the spring of 2022.

Is that a plausible scenario?

We think so, especially if the macro metrics continue to blow in the right direction.

Longer-term – going by the projections at our sister publication “BDC Best Ideas” – we anticipate that BDC prices could increase by 48%...

Obviously, this seems unbelievable but depends on two key assumptions playing out over a 5-year period: the general level of interest rates dropping back substantially AND BDC earnings/distributions falling only modestly from their likely 2023 levels.

The first assumption is pretty much in line with the Fed’s plans over the long term – dropping the neutral rate to 2.5% in 2025 or beyond.

Hold Firm

The second assumption is more controversial because most BDC assets are floating rate and income should drop with the Fed Funds rate, rolling back most of the incremental BDC income gains of 2022-2023.

However, BDC Best Ideas argues that BDC dividend-paying power will be maintained by surplus profits earned in recent quarters and which most BDCs have been storing up; the higher spreads earned over the last two years and for some time yet on new loans booked; the harvesting of equity stakes once the economy opens up again; a higher level of fee income as investment activity picks up and – in some cases – larger portfolio sizes throwing off more income.

We’ve Only Just Begun?

The bottom line, though, is that Best Ideas believes this current rally is only the beginning of a BDC super-cycle that could yet see total returns (dividends received and change in prices) – on a pro-forma basis – exceed 100% over the next half-decade.

Stops and starts should be expected, but there’s an argument being made that there are still brighter days ahead over the long term, even if BDC earnings peak in 2023.

For our part, we’ll continue to take things one week at a time and see where BDC investors end up.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.