BDC Common Stocks Market Recap: Week Ended August 11, 2023

A Little Tired

BDC COMMON STOCKS

Week 33

Pause

The hard-charging BDC rally took a bit of a rest this week.

Overall, BDCZ – the exchange-traded note which owns most BDC stocks and serves as a price guide – dropped (0.8%).

Also marginally lower was the “total return” S&P BDC index – down (0.9%).

By the way – and probably an indirect factor – the S&P 500 and the NASDAQ were also down for a second week in a row.

Premature

However, it’s way too early to suggest the BDC rally – which began on May 5, 2023, and has seen BDCZ increase by 20% – is over.

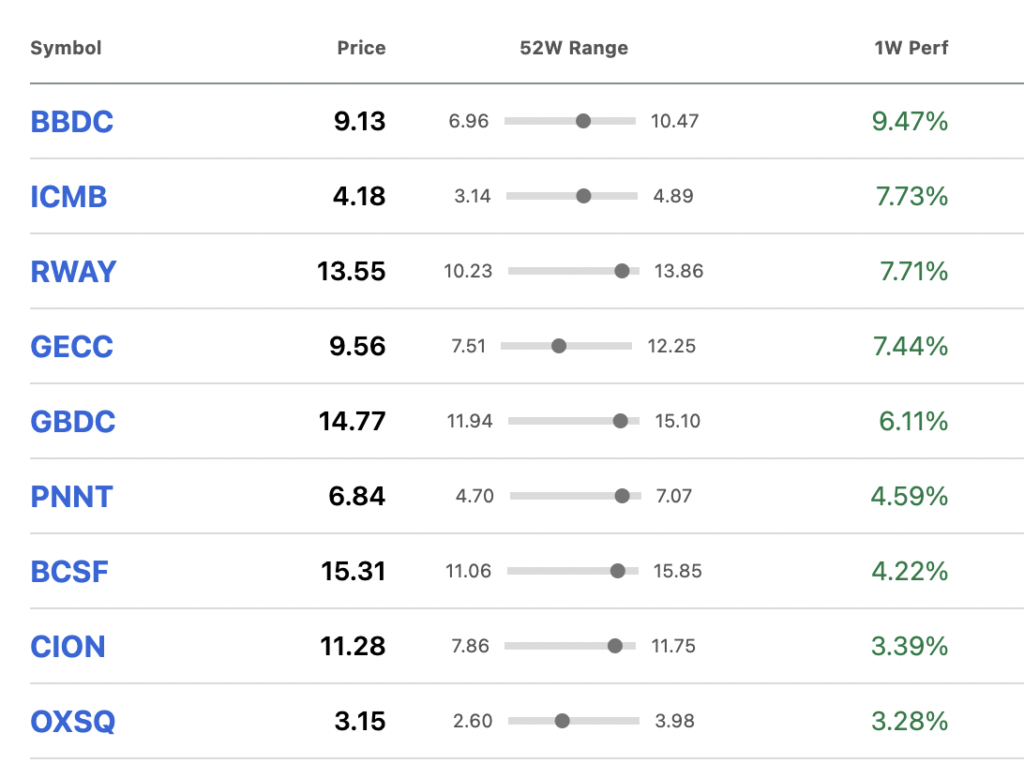

This week, more BDCs increased in price than dropped -24 to 18.

Of the BDCs in the black, 9 were up 3.0% or more – usually a sign of animal spirits amongst investors.

The number of BDCs trading at or above net book value per share – a favorite metric amongst investors – was 14 – unchanged from the week before.

Furthermore, 7 BDCs reached new 52-week highs this week:

Like A Snowflake

For each BDC involved, there’s a different reason why the stock reached a new 52-week price record.

Mostly the BDC involved reported IIQ 2023 results that caught investors’ fancy, but Investcorp Credit (ICMB) is one of two BDCs that has not yet been announced.

Unusual

Golub Capital (GBDC) – long an investor favorite – reported strong results but also announced a permanent decrease in its management fee. That boosts likely earnings going forward.

The BDC’s manager’s rationale for this unexpected act of munificence is that its scale had greatly increased over the years – and thus its overall compensation – making appropriate the fee concession.

Not Alone

By that logic – which we fully agree with – there should be many BDCs eligible for fee reductions going forward.

Every BDC manager claims to be “shareholder-friendly” but “walking the walk” in the way GBDC has unilaterally chosen to do is rare.

We keep track of every public BDC management fee level. Out of 37 with an external manager, only 4 (including GBDC) charge a management fee of 1.00% or less.

(MidCap Financial -MFIC – has the most attractive offering of all).

With higher interest rates, and with BDC portfolios mostly maxed out to their target leverage levels, the external managers are in a “Golden Age” of compensation – both in terms of management and incentive fees.

Maybe someone else besides GBDC will step up and offer to “share the wealth”?

Back To Our Regular Programming

The IIQ 2023 BDC earnings season is all but over. 40 of the 42 BDCs we track have reported their results.

We are only waiting to hear from ICMB and Prospect Capital (PSEC).

(By the way, PSEC – one of the biggest BDCs out there – remains out of favor with investors – down (10%) on the year – the second worst performance of any BDC).

We’ve spent untold hours in the last two weeks just keeping up with the flow of results and updating the BDC NAV Change Table and the BDC Credit Table – a process now completed.

Educational

There’s a great deal to learn from both tables about both an individual BDC’s performance and the sector as a whole.

In terms of NAV changes this quarter, we’re on the record as expecting very little change compared with the prior quarter.

That’s been the case, as we calculate the average change in net asset value per share has come to (0.2%), with 22 reporting an increase, 1 unchanged, and 17 down.

Interestingly, only 6 BDCs NAVPS moved 3.0% or more in either direction – underscoring how stable the IIQ 2023 has proven to be.

Number One

The biggest gainer by this metric was micro-BDC PhenixFin (PFX), up 6.9%.

Exactly what that consists of we can’t yet say nor can PFX itself which remains the only public BDC we track that does not hold a regular earnings conference call.

Worst

The biggest loser in terms of NAVPS remains TriplePoint Venture Growth (TPVG) as we’ve discussed in earlier reports, that reported on August 2.

TPVG’s NAVPS dropped (8.5%) – a reminder that not all is yet well with the venture eco-sphere.

As this chart shows, TPVG’s stock price has fallen and has not fully recovered since its IIQ 2023 results were announced and remains about (10%) below the August 2 level.

Interestingly, the analyst earnings consensus for TPVG in 2024 has decreased very modestly in the last 30 days: down to $1.75 from $1.77.

Anyway, we’ll cover some of the findings in the BDC Credit Table in our Credit Recap article for the week.

Unmoved

We’ll only say that the stability of the BDC sector’s NAVPS is also reflected in this quarter’s credit performance.

There are always individual credit stories – both setbacks and recoveries – but in a universe of 5,000 or so BDC-financed companies, the number of new non-accruals is tiny and the change in underperforming assets is modest.

However, there is one under-discussed credit metric that is high, but we’ll leave chewing on that to the Credit Recap.

Looking Forward

Understandably enough, analysts, investors, and the BDC Reporter are not waiting for ICMB and PSEC’s results and are looking forward to the IIIQ 2023 and beyond.

Everyone is anticipating that with rates at or close to as high as they’re going to go, the BDC sector is approaching “peak earnings”.

If that occurs, we should also expect BDC dividends – which have increased by 20% in 2022-2023 – to level out.

Even more important – and probably unknowable – is what will happen to rates, earnings, and dividends in the years ahead.

This ties into what is happening to inflation, the shape of the global economy; the thinking at the Fed; the state of employment and so much more.

Months Ahead

We’ll leave that hot potato alone for the moment but in the shorter term, there are still opportunities to see BDC earnings and payouts increase to even higher heights than we’ve seen in the first half of 2023.

An obvious catalyst that will benefit every BDC is the 0.25% rate increase announced in July which should boost lender yields. Another potential 0.25% increase in November would add further impetus.

Most BDC managers are reporting a pick-up in M&A activity, which might result in more transactions being booked in the months ahead – boosting fee income.

In a few cases, BDCs have been hinting at getting back to harvesting equity gains even in this unsettled market environment.

Even in the IIQ 2023, 6 BDCs reported net realized gains of $2mn or more.

Prediction

“Peak earnings” – every quarter – are most likely to occur in the IVQ of this year.

Currently, the analyst community is projecting in almost every case that 2024 BDC earnings will be lower than in 2023, and roughly (6%) overall.

We’ll go out on a limb – now that we’re beginning to generate our own annual earnings projections and not relying only on the analysts – and contend that there is more than an even chance that the BDC 2024 EPS could yet exceed the record-breaking 2023 level.

Admittedly, we’re in the “higher for longer” camp where the Fed Funds rate is concerned.

In any case, we believe 2024 distributions will compare very favorably with the 2023 level – most of which are already paid or announced.

If we’re right – and the markets come to a similar conclusion – BDC stock prices will continue to get the support of fundamentals.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.