BDC Common Stocks Market Recap: Week Ended October 27, 2023

BDC COMMON STOCKS

Week 43

All Gone

Say goodbye to the BDC rally that began on March 7, 2023 – in the wake of the failure of Silicon Valley Bank – and peaked on September 29, 2023.

We’re using the path of the UBS-sponsored exchange-traded note which owns all the key BDC stocks – BDCZ – as our guide.

BDCZ moved up 11.5% in that 6 month+ period.

However, in the past month or so, the sector’s price has dropped (8.0%).

Likewise, the S&P BDC Index – calculated on a price basis only – has fallen (8.3%) since peaking in August.

The two data sources use different methodologies but tell the same story of decline.

Even the S&P BDC Index calculated on a total return basis peaked in late September and is now off (7.3%).

This week alone, BDCZ dropped (1.6%); the S&P BDC Index on both a price-only and total return basis fell (2.2%).

Misery Has Company

If it’s any consolation to BDC investors, they were not alone.

The S&P index came down (2.53%), “posting losses in 4 of the last 5 sessions”.

This famous index had its peak moment back in July and has dropped (10.3%).

That’s “correction” territory in Wall Street parlance, and the S&P joins NASDAQ there.

The Dow 30 is not far behind – down (9%) – declining from its 2023 high on August 1.

Assessment

Let’s review the damage done to the BDC sector.

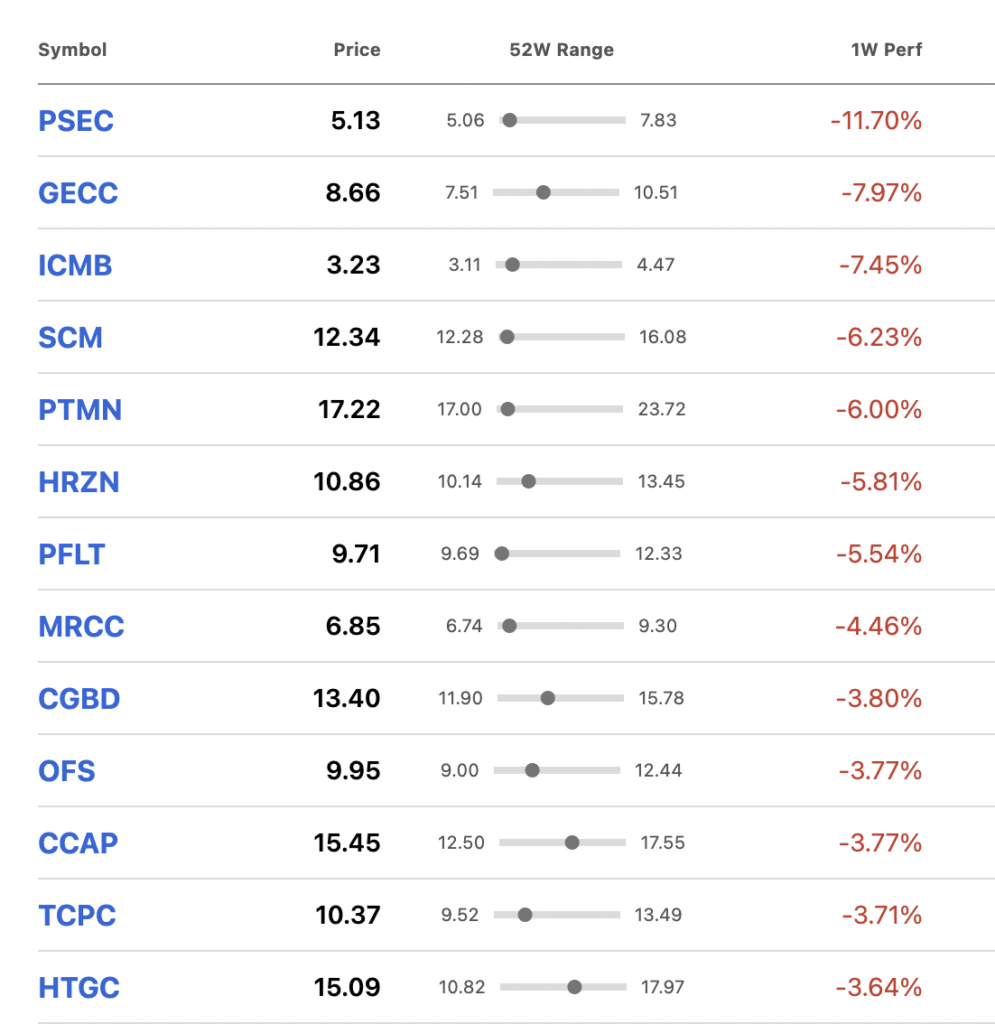

This week 38 of the 42 BDCs we track were down in price, similar to the pattern of the week before.

Of the BDCs in the red 22 went down (3.0%) or more.

As you can see from the list above, the biggest losers include all sorts of BDC sizes and strategies.

(The only exception might be BDCs operating in the upper middle market – such as ARCC, BXSL, and OBDC).

Worst Hit

Troubled PSEC took it on the chin and became one of 3 BDCs to reach a new 52-week low.

(The others were Portman Ridge (PTMN) and TriplePoint Venture Growth (TPVG) – both of whom have long-standing credit problems as well – which probably contributed to their performance).

To give you a sense of how far PSEC has fallen: the BDC is trading at less than 6.0x its expected 2023 earnings and yields 14%.

The BDC is at a 3-year low, and trading at only 56% of its Net Asset Value Per Share (NAVPS).

Market worries about the credibility of PSEC’s asset valuation and income outlook have transformed into profound skepticism.

Various Metrics

Anyway, there are now no BDCs trading within 5% of their 52-week highs, and 10 in the 5%-10% below their peak price.

BDCs trading at or above net book value per share have fallen to 9.

In the past month, the number of BDCs able to report a higher stock price is….zero.

As always in these downturns “they all go together when they go”.

Not So Terrible

However – it’s important to understand that this is a pullback rather than a rout for the BDC sector in 2023.

There are still 20 BDCs – nearly half the total – trading at a price above their year-end 2022 level.

BDCZ remains in the black: up 1.6%.

The S&P BDC Index on a total return basis is up 13.3%.

Innocence

Also worth noting is that nothing happening in the BDC sector this week – or in prior weeks – can be blamed for this price drop.

We’ve heard from two BDCs about their IIIQ 2023 earnings – including market leader Ares Capital (ARCC) this week – and both sets of results were in line with expectations.

ARCC reported an increase in “Core EPS” – its favorite earnings metric and a higher net asset value per share (NAVPS).

Even more importantly for a market worrying about the future direction of the economy despite the best GDP growth in years, ARCC reported its portfolio companies are achieving an EBITDA growth of 6.0% – above the level of S&P 500 companies.

Furthermore – as we demonstrated in a BDC article drawn from the BDC Credit Reporter – ARCC’s credit metrics improved in the IIIQ 2023 over the prior period.

Most of all, despite having hundreds of borrowers in its portfolio, we identified not one new underperformer this quarter and only a handful over the course of the year.

We See No Signal

If we’re headed into troubled economic times and credit conditions are going to darken, there’s no evidence as yet from ARCC and the broader BDC sector data we collect every day.

Maybe the markets are very wise and are seeing something in the shadows that eludes us. We’ll just have to wait and see – informed by an IIIQ 2023 earnings season that is just getting going and will shortly provide masses of new data about BDC earnings; dividends and portfolio performance.

Developments like the one this week where Gladstone Investment (GAIN) announced the sale of a portfolio company for a great gain and a huge “special” dividend of $0.88 per share argue against the pessimism now gripping investors.

Funnily enough, both market participants and observers continue to wax on about the once-in-a-generation opportunity for investors in “private credit”, even as some investors run for the exits.

Somebody is wrong.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.