SLR Investment: Portfolio Company To File Chapter 11

NEWS

Air Methods Corp. is preparing to file for Chapter 11 bankruptcy protection, with first-lien lenders likely to take control of the air ambulance service, according to people with knowledge of the matter.

The company plans to file as soon as the end of October, though those plans could change, said the people, who asked not be identified discussing a private matter. Air Methods already has been given extensions to remedy a missed interest payment earlier this month, said one of the people.

…

Bloomberg Law – October 19, 2023

ANALYSIS

BDC Involvement

Only one BDC is exposed to this air ambulance firm: SLR Investment (SLRC).

The amount involved is modest and non-material by our standards: $3.4mn.

As of the IIQ 2023, SLRC marked the debt at a (1%) discount.

VIEWS

Reason Why

This will be the 34th bankruptcy of a BDC-financed company in 2023.

The BDC Reporter in its weekly Credit Update is regularly tracking this metric.

In 2023, the number of bankruptcies – domestic and foreign – remains well within normal boundaries in the BDC sector.

Tough Out There

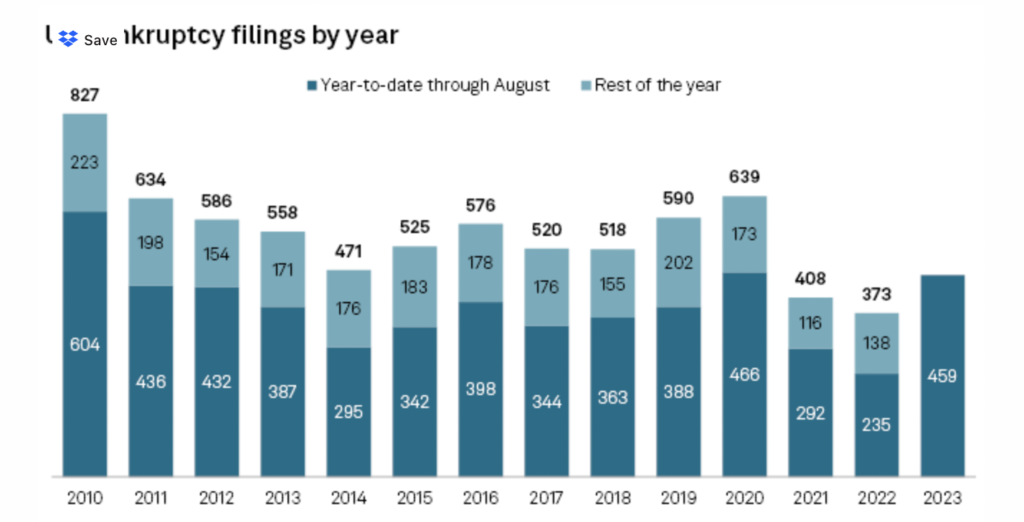

However, in the broader universe of leveraged, non-investment grade companies the number and value of bankruptcies is exploding, far exceeding the level of the past two years.

More tellingly – according to S&P – “The year-to-date figure [for bankruptcy filings] is also higher than the comparable total for all but two of the prior 13 years”.

Mystery

Exactly why the BDC sector is managing to run through the credit raindrops without getting more than a little damp is not clear.

As a result, there can be no assurance that the disparity will continue but this is a metric that BDC investors should be paying close attention to.

Unconcerned

Thankfully, this latest impending bankruptcy – due to its modest size and first lien position on the company’s balance sheet – should not move the credit needle in a week where the broader market is contending with the bankruptcy of Rite Aid, with $8.6bn in debts and facing potentially huge losses.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.