Barings BDC: Adds Investment Risk Ratings

NEWS

Barings BDC (BBDC), in its most recent IIIQ 2023 earnings conference call announced a new regular feature in its quarterly disclosures: a “risk rating” schedule for the BDC’s portfolio.

ANALYSIS

Getting Going

The BDC first introduced the new rating system at the BDC’s recent Investor Day, drawing on portfolio data from the IIQ 2023.

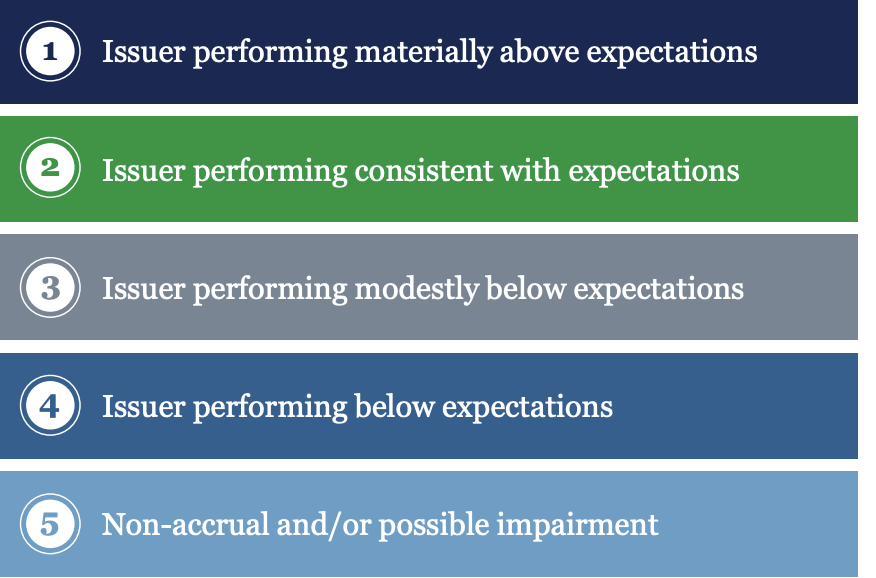

The scale being used is a typical 1-5 rating system, similar to the one used by many other BDCS and by the BDC Reporter itself.

The BDC Reporter considers categories 3 through 5 as “underperforming” and includes the assets involved in the BDC Credit Table.

Note that both BBDC and ourselves group underperforming assets by issuer and not by security, which can give different results.

Latest Results

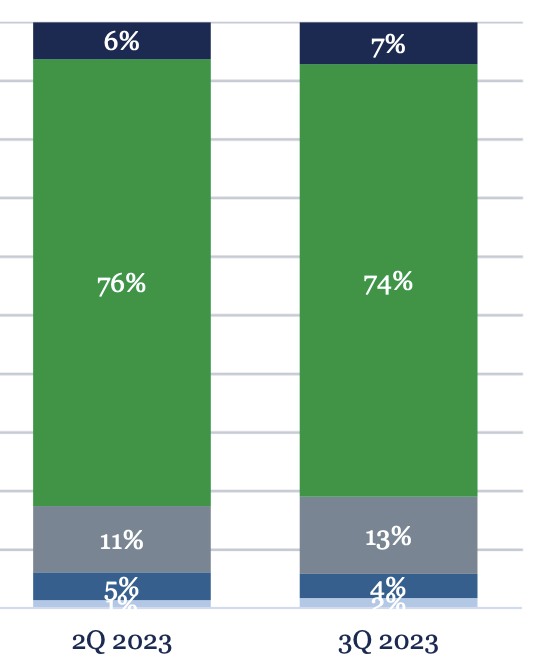

Here’s how the IIIQ 2023 compares against the IIQ 2023, with categories 3 through 5 accounting for 18% of the BDC’s portfolio at fair market value as of the IIQ 2023 and increasing very slightly to 19% in the most recent quarter.

Added

Thanks to this change, BBDC has been added to the majority of BDCs that provide this sort of periodic portfolio risk rating data – a critical element in BDC financial analysis.

There are now 29 BDCs that offer up this sort of report and 13 that do not. See the BDC Credit Table for who does and who does not provide “risk ratings”.

VIEWS

Important

The BDC Reporter believes the risk rating data is one of the most important data points that investors can access to evaluate a BDC.

In conjunction with information about non-accruals, losses booked over time, and more anecdotal information about credit performance this information provides both a snapshot of the degree of risk a BDC faces and trends over time.

That’s why the BDC Credit Table has gathered this data – when available – back to the beginning of 2020.

This move by BBDC is – in our minds – very “shareholder friendly”.

We hope all the other BDCs that do not offer risk-rating data will have a change of heart so we can review the public BDC sector in a comprehensive manner.

AFTER NOTE

In recent months, the BDC Reporter has expanded its data coverage in the BDC Credit Table for every BDC, adding metrics for quarterly realized and unrealized losses and gains and tracking the number – and even the names – of every new company on the non-accrual list.

With IIIQ 2023 results flooding in we’ve been able to update the BDC Credit Table in almost real-time, providing readers with key data about the changing credit conditions at every BDC.

We believe this range of data – especially when combined with the hundreds of articles in our sister publication – the BDC Credit Reporter – about the latest developments at the most important BDC-financed underperforming companies, provides the most comprehensive credit picture available anywhere about every BDC.

This depth and breadth of coverage is critical to properly evaluate what credit results – the most important determinant of a BDC’s success or failure – might look like in the quarters ahead.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.