BDC Common Stocks Market Recap: Week Ended November 10, 2023

BDC COMMON STOCKS

Week 45

Calm?

Going by the numbers, this was a very quiet week for the BDC sector following the buffeting of the prior weeks.

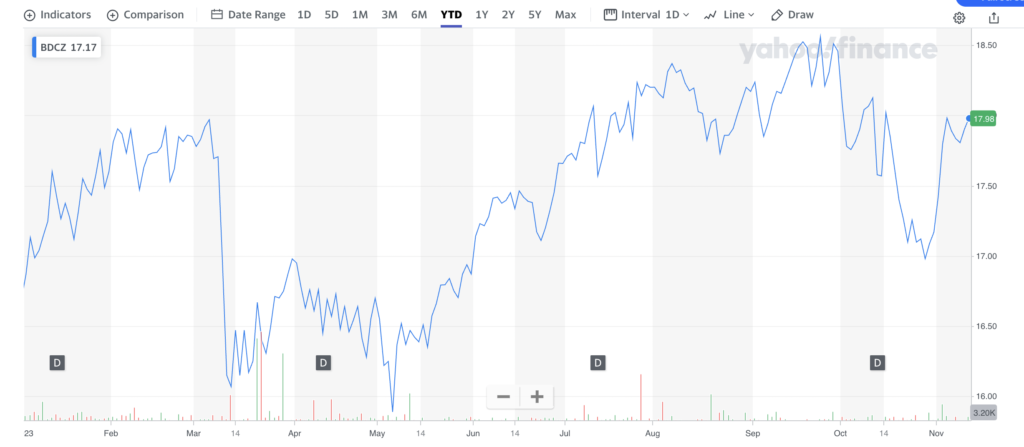

Just a week before, BDCZ – the exchange-traded note that owns most of the constituent BDC stocks – increased by a fearsome 5.9%.

This week, BDCZ’s percentage price change was exactly zero.

Even if we rely on another measuring stick – like the S&P BDC Index, calculated only on a price basis – the change was only 0.1%.

Busy

At the same time, we also noticed that there was plenty of activity amongst the 42 individual public BDC stocks we track that belies the sector-wide numbers.

30 BDCs were up in price and 12 were down, which itself contradicts the unchanged BDCZ performance.

Furthermore, of the stocks in the black, 12 moved up 3% or more and there was one in the red down by greater than (3%).

In fact, this was a week with many, many BDCs reporting IIIQ 2023 results – typically a recipe for BDC price changes as investors re-set their expectations based on the latest data.

Gainers

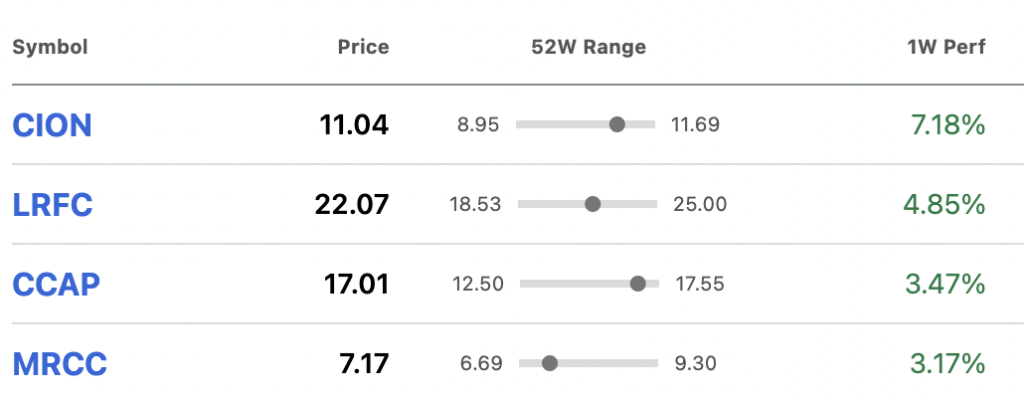

As the table below shows, the 4 biggest movers all reported results this week and received a boost:

Rational

We understand the increase in CION Investment’s (CION) price.

The BDC Reporter has been tracking the key earnings, net book value per share (NAVPS); credit performance, and distribution of every reporting BDC.

In the case of CION, Net Investment Income Per Share (NIIPS) was up 28% over the prior quarter and NAVPS by 3.2% – the third-best performance by this metric of any BDC this quarter.

To add icing to the cake, the BDC’s credit performance – as measured by the percentage of its underperforming assets – improved.

Even though there was no change in CION’s dividend quarter over quarter, investors could not help being impressed and gave the stock price a 7.2% boost.

This enthusiasm began even before the results came out and has caused CION’s stock price to increase 13.1% since a low on October 27, 2023.

Similar

Along the same lines Logan Ridge Finance (LRFC) posted an earnings boost of 13% and importantly – increased its quarterly distribution by 15% over the last period, to reach $0.35.

LRFC – which for some time paid no payouts at all – will have paid out $0.96 per share in 2023.

Obverse

The situation is different at Monroe Capital (MRCC) – whose results have been mediocre for some time.

Adjusted NIIPS fell (10%) to $0.25 – just covering the dividend which has remained unchanged since the IIQ 2020.

Adding insult to injury, MRCC’s NAVPS dropped as its already unusually high level of underperforming assets increased further.

“Value buyers” may have given MRCC’s stock a boost this week but, as this chart shows, the BDC’s stock price remains close to its 52-week low:

Way Forward

BDC earnings season is almost over, with 7 BDCs still to report earnings.

As we reported last week, the sector remains within spitting distance – i.e. 3% – of its 2023 high, going by BDCZ.

The S&P BDC Index – calculated on a “total return” basis – is up a very respectable 20.7%.

This week, two more BDCs reached 52-week highs: Barings BDC (BBDC) and Blue Owl Capital (OBDC).

At week’s end, 17 BDCs were trading within 1-% of their 52-week highs and only 5 were within 10% of their 52-week lows.

These include MRCC and Portman Ridge (PTMN) – which reached a new 52-week low on Wednesday.

14 BDCs are trading at or above their net book value per share and 31 are in the black price-wise this year.

With just 7 weeks to go, the sector looks likely to record a mostly positive year, reflecting generally positive earnings and credit fundamentals.

Balanced

Nonetheless – as we’ve shown – there are a number of exceptions to the rule where fundamental performance and price action are concerned.

These are mostly smaller players but bigger BDCs are also involved, including Prospect Capital (PSEC), with $7.7bn of assets, and BlackRock TCP Capital (TCPC), down (12%) in price this year and trading at a big discount to net book value notwithstanding its famous manager and impending merger with BlackRock Capital (BKCC).

In Our Opinion

More generally, there is an undercurrent of unease in the market which we’ve seen expressed in two major slumps in the BDCZ stock price in 2023.

The first followed the failure of Silicon Valley Bank (SVB), which was misread as a trigger for a broader financial system collapse (shades of 2008-2009) and which lasted for two months before animal spirits revived.

More recently, the sector fell nearly (10%) over a month when long-term interest rates took off at the end of September, causing all sorts of discomfort about what the future environment might look like, even though BDCs will generally benefit from a higher cost of capital.

We’re just exiting this last moment of doubt and who is to say if there will not be a third downturn before the year is out?

Not Excited

What we can report with more assurance is that BDC investors – despite enjoying in many cases record earnings and distributions from their investments – are in no way gripped by any sort of “irrational exuberance”.

Maybe the relentless projections by a wide swathe of the financial community of a recession on our doorstep have had their effect.

We are well into year two of those projections being proven wrong. Even the BDC managers themselves – based on comments they make on their conference calls – are a little surprised that matters have gone so well.

For what it’s worth – which is probably very little given their track record – those same BDC managers are far from optimistic about 2024’s economic and credit outlook, but all expect to muddle through.

Gloomy Gus

We can’t help feeling that if we get even a scent of a slowing economy or some sort of financial crisis in the SVB vein, there might be an early run for the exits by many investors trying to “get ahead” of the change in the cycle.

Just thread two or three economic metrics together and one can make a plausible case about anything and that could happen here.

The good news for have-and-hold BDC investors is that all the data of the latest earnings season has confirmed that most BDC balance sheets are “strong”; liquidity plentiful; credit in good shape and portfolios as diversified as they’ve ever been.

Comparisons Are Odious

Anybody expecting a re-run of 2008-2009 will be sorely disappointed.

BDC lending has come a long way in the last 15 years and even a serious economic contraction is unlikely to have anything like the impact of yesteryear when some BDCs came close to collapse; many reduced or suspended their distributions and even the most famous names often lost 80%-90% of their market cap.

If anything, many of the more experienced BDCs are positioning themselves to benefit from a prospective downturn – loading up on liquidity and undistributed earnings – and preparing to book new loans and investments on highly favorable terms.

As we’ve witnessed of late, though, many investors run away first and come back later.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.