BDC Common Stocks Market Recap: Week Ended November 17, 2023

BDC COMMON STOCKS

Week 46

Stranger Things

The BDC rally – after a few weeks of self-doubt – is back.

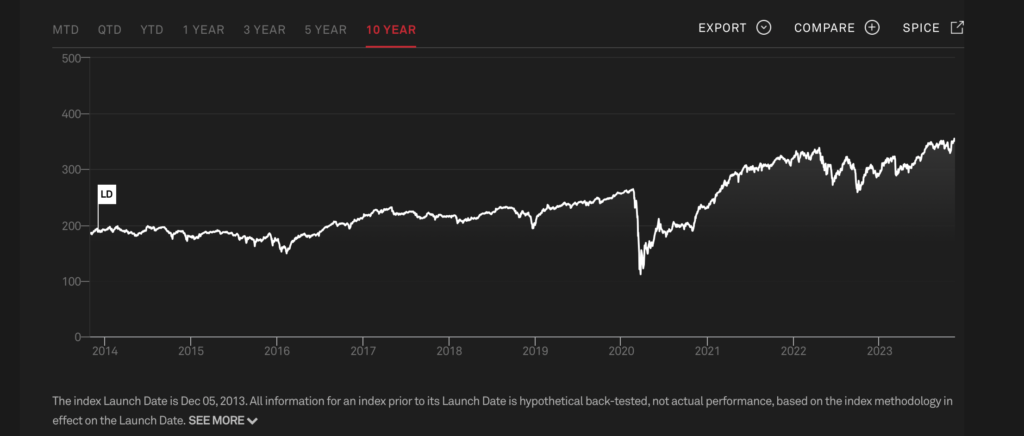

This week, one of our price guides – BDCZ – increased 0.9%.

[BDCZ is the UBS-sponsored exchange-traded note that owns only public BDC common stocks].The S&P BDC Index – calculated only on a price basis – moved up 0.6%.

The other S&P BDC Index – calculated on a total return – increased 0.9%.

Still, the BDC sector was well behind the S&P 500 index, which “shot up” 2.2%.

Mo’ Numbers

Of the 42 BDCs we track, 31 increased in price or were unchanged, and 11 were down.

5 BDCs increased by 3.0% or more and 2 dropped by (3.0%) or more.

One BDC reached a new 52-week high (Blue Owl Capital or OBDC) and one a new low (Portman Ridge Financial, or PTMN).

At the week’s end, there were 16 BDCs trading at or above net book value per share. See the BDC NAV Change Table.

This was the highest number in this category since the end of July, reflecting the recent bounce back.

Status Report

With Thanksgiving round the corner and all but two BDCs having reported IIIQ 2023 results – see the BDC Summary Results Table – we’re really coming into the final stretch of 2023.

There are still six weeks in this year – plenty of time for stock prices to oscillate – but most of what we’re going to know about BDC fundamentals is already in the hopper.

Going by the multiple debt issuances of recent days, as discussed in the BDC Reporter, there may be more BDC financings yet to come.

Market Shares

With so many BDCs trading above book, one or more secondary offerings are not out of the question.

B. Riley downgraded Sixth Street Specialty (TSLX) this week, partly because of the “potential for an equity offering”.

Many BDCs have been raising new equity all year through At The Market (“ATM”) offerings, but could yet see the value of a big, one-time, raise.

Again, the BDC NAV Change Table is a good resource for determining who the likeliest prospects might be.

Wind At Their Back

Objectively speaking, BDCs do have good reasons to raise new capital at this time – even those that are not fully leveraged.

We learned during this quarter’s earnings season – on BDC conference calls – that new loans continue to be booked on lender-friendly terms and at wider margins than in the pre-2022 period.

Nobody is predicting much in the way of renewed competition from the big banks, the “Broadly Syndicated Loan Market” and – especially – the regional banks.

(We did get the impression, though, that a lower volume of deals being closed and plenty of capital in the BDC sector has eroded some of the spread increases we saw earlier in the year).

Busy

Furthermore, you don’t need a crystal ball to foresee that with interest rates potentially about to reverse course, a flood of leveraged buy-outs might be headed this way after two years of muted activity. We might even see early evidence in the daily reports of recent loan activity from Prequin, KBRA DLD, and others.

We believe there’s a good chance that BDC assets under management, which increased from $81bn in the IQ 2020 to reach $124bn in mid-2023 could reach above $150bn by the end of next year.

With most BDCs offering annual yields in the mid-to-high teens as the 10-year “risk-free” Treasury drops back below 4.5%, the appeal of the sector is not hard to explain.

The BDC Reporter will cover any new debt or equity raise should they occur.

Finally

BDCZ closed the week at $18.14. To reach a new 2023 closing high the ETN will have to increase to $18.57 – 2.3% higher.

Already, the S&P BDC Index on a total return basis is up 21.8% and only needs a nudge up of 0.3% from price or distributions to reach a new 2023 and all-time record.

BDC-By-BDC

Going by Seeking Alpha YTD individual BDC price data 32 BDCs are in the black in 2023 and 10 in the red.

On a “total return” basis, we calculate only 3 BDCs have lost value for their shareholders in 2023.

These are Monroe Capital (MRCC); Prospect Capital (PSEC) and Portman Ridge (PTMN).

Not surprisingly, the common thread amongst this short list of underperformers is rational enough concerns about credit performance and net asset value per share erosion.

MRCC is down (5%) in terms of NAVPS in the first three quarters of 2023 and (25%) over 5 years. PSEC’s numbers are (7%) and (1%). PTMN is (7%) and (51%).

Not Alone

We should say that there are several other BDCs that have worse metrics than these 3 names but have not been punished as much by the market.

In fact, the numbers suggest 9 BDCs (including the 3 mentioned) have performed relatively poorly on an NAVPS basis in 2023 despite a growing economy and a lender-friendly environment.

All Over

Generally, BDC earnings, net book value, and credit performance over 2023 have seen wide dispersions in performance.

However, higher distributions have boosted stock prices.

Next year may be a different kettle of fish, but we’re getting ahead of ourselves.

Will They? Won’t They?

Keeping our eyes on this year, we’ll be curious to see if the BDC sector will continue its rally.

If it does, expect us to be reporting on more price records being set.

If not, we wonder how far down the sector can go with such high yields still on offer.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.