BDC Common Stocks Market Recap: Week Ended November 24, 2023

BDC Common Stocks

Week 47

Thanks!

In line with the spirit of the season, BDC sector prices continued to rise on this holiday-abbreviated week.

Our usual price guide for the sector – the exchange-traded note which owns only BDC stocks, with the ticker BDCZ – increased 1.2%.

(That slightly outdid the S&P 500, which moved up 1.0%).

That other index we like to use – the S&P BDC “total return” – moved up 1.2% as well.

36 of the 42 BDCs we track increased in price, with only 6 in the red.

There were very few significant price moves as investors were busy elsewhere, chowing down on turkey and getting their Christmas lights out.

Two BDCs increased by 3.0% or more and one fell by more than (3.0%).

On the plus side were Runway Growth Finance (RWAY) and BlackRock Capital (BKCC.

The only significant loser was Monroe Capital (MRCC), down (3.6%), to $7.01.

Poor old MRCC has been in almost constant decline since 2017 when its stock price closed at $16.10.

As of last Friday, the BDC had dropped to $7.01 and has been as low as $6.69.

Highest to lowest that’s a (58%) decrease in price.

In the intervening 7 years, MRCC’s annual distribution has dropped from $1.40 per share to $1.00 – a (29%) decrease.

Net Asset Value Per Share (NAVPS) – often a useful indicator over the long run – has fallen (34%) since the end of 2016.

Unfortunately for this smaller-sized BDC with half a billion dollar portfolio, investors do not seem convinced that its troubles – mostly relating to credit – are over.

Where We Are

Anyway, with just 5 weeks to go, 2023 is looking (almost) certain to be a bumper year for BDC investors.

That’s despite two big dips – one of which lasted for 4 months – that tested investors’ mettle.

The Silicon Valley Bank (SVB) fall-out saw BDCZ drop (12%) at its worst point, yet turned out to be much ado about nothing with the benefit of hindsight.

The more recent episode of “the sky is falling” was triggered by October’s rapid rise in interest rates, followed by an equally rapid descent in November.

That caused a (9%) price drop, virtually all of which has been made up in recent weeks.

At Friday’s close of $18.35, BDCZ is only (1.1%) behind the year’s highest closing price of $18.56.

No wonder that 17 BDCs are trading within 5% of their 52-week highs. These include Golub Capital (GBDC) and Blue Owl Capital (OBDC) which set new price records this week.

There are another 11 BDCs trading 5%-10% beneath their 52-week peaks.

Left Behind

Obversely, there are only 2 BDCs within 10% of their 52-week lows. There’s the aforementioned MRCC and another smaller BDC with credit troubles – Portman Ridge Finance (PTMN).

The latter was the only BDC to reach a new 52-week low over Thanksgiving.

These two players – and the much larger Prospect Capital (PSEC) – are the only BDCs that are down in price by double-digit percentages in 2023.

PSEC and MRCC have not been able to increase their distributions in 2023 at a time of record high-interest rates and a generally favorable economic backdrop.

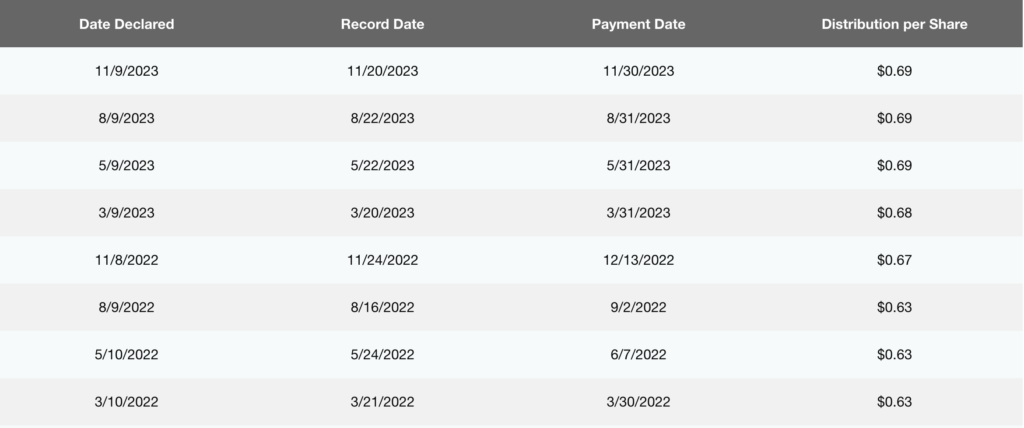

PTMN, though, was able to increase its quarterly dividend sharply – as this chart shows – but is still down the most in price: (27%).

These are the exceptions to the rule of what promises to be a very good year, barring a third market swoon before we ring in 2024.

Anything Left?

With BDCZ up 9.7% this year in price alone, and the S&P BDC Total Return up an impressive 23.3% (outpacing the S&P 500, up 20.5% by this same metric) you might wonder if there’s anything left in the BDC tank for the year ahead.

On paper, there is.

Price-wise, the BDC sector – as measured by BDCZ – can yet move up 12% just to match its early 2022 high before the war in Ukraine; the onset of higher rates; the economist community’s certainty a recession was coming and all those other black swans – real and imagined – came along.

Moreover, BDC stocks – also measured by BDCZ – are paying out 18% more in distributions now than they were then:

Sanguinity

Yes, we might have reached a peak for the Fed Funds rate, but if you believe the messaging about “higher for longer” and remember the huge reserves of undistributed taxable income the sector has squirreled away during these fat times, there may be even higher aggregate payouts ahead.

Our sister publication – BDC Best Ideas – projects 2024’s dividends will exceed 2023’s by 1%.

That’s not much, but if short and long-term rates are on the descent, the BDC sector should compare favorably with many other yield-producing investments.

We wouldn’t be surprised – especially if we continue to dodge the recession that so many pundits seem determined to wish upon us – to see the BDC sector punch out another double-digit total return in 2024.

Dark Days

At the same time, we’ve seen BDCZ plunge 4 times since April 2022 as investors have sought to “get ahead” of bad weather ahead.

Similarly, the sector dropped just over (50%) in 2020 in a matter of a month due to the fear of a pandemic-induced recession.

The evidence shows that BDC investors – as a group – have hair-trigger fingers to the downside and take a lot of reassurance and confirmation to the upside.

A Good Thing

We’re not complaining. As we discuss in BDC Best Ideas, this creates many buying windows for would-be investors.

Chances are good that if you miss one BDC-buying bus another will be along shortly thereafter.

We undertook a little chart analysis for BDCZ since 2015 and found 8 times where the ETN dropped (5%) or more .

These included 4 “corrections” (10%-20%) and 2 “bear markets” (more than 20%).

Food for thought for the patient would-be BDC investor and reassurance to anybody long the sector when a period of turbulence hits.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.