BDC Common Stocks Market Recap: Week Ended December 29, 2023

BDC Common Stocks

Week 52

Up

2023 ended neatly on Friday, December 29, 2023, with the BDC sector up again in price for the week.

BDCZ – the UBS-sponsored exchange-traded note that we use to measure sector price performance – closed at $18.97.

That was 0.3% up for the week but would have been higher if not for a downturn on the final trading day that affected all the major indices as well.

With this (mildly) positive result, the BDC rally – which resumed on October 28 – marches on into 2024.

Like the week before 26 BDCs were up in price and 16 were in the red.

Three BDCs were up 3.0% or more and two were down (3.0%) or more.

17 BDCs are trading at or above net book value per share, unchanged from the week before.

(Check out the BDC NAV Change Table for all the details).

Measuring Tape

Here are the key full-year metrics:

BDCZ is up 13.5% in price after dropping (16.7%) the year before.

This stock price chart tells the story:

BDCZ’s lowest point was September 26, 2022, at a closing price of $15.52.

All these months later – including 3 major downswings all covered on these pages – BDCZ stands 22% higher.

Total Return

The S&P BDC Index – calculated using both price change and dividends received – ended 2023 27.6% up, very near its best result of the year, which was set on Thursday.

That’s a much better performance for this index than the (9.4%) total return loss recorded in 2022.

Over the past two years, though, the BDC sector has generated a 15.5% return or 7.75% per annum on average.

Those dividends make up for a lot of price loss and serve as a reminder that BDC investors with the fortitude to remain long through thick and thin are usually rewarded.

This is thanks to the BDC rule that requires 90% of taxable income to be distributed to shareholders, even if management would sometimes hope otherwise.

According to the long-term data we’ve reviewed, the BDC sector has never had more than one year of negative results on a total return basis.

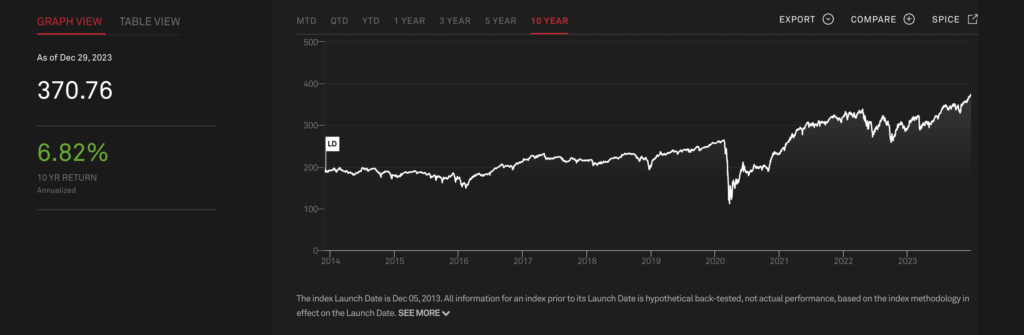

As this screenshot of the S&P BDC Index shows, the average annual return over the past 10 years comes to 6.82%.

This year, the S&P BDC Index outperformed the S&P 500, albeit very modestly: 27.6% to 26.3%.

(Over 10 years, though, the S&P 500 has the edge – increasing by an annual average of 12.0%, versus 6.8%).

Individual BDC Performance

According to Seeking Alpha data, 34 BDCs out of 42 increased in price in 2023, while 8 were in the red.

The top price gainer was Capital Southwest (CSWC) – a lower middle market-focused BDC – up 40%.

Crescent Capital (CCAP) – which operates in the middle market – follows with a 37% gain, while PhenixFIN (PFX), which just reported results that we reviewed this week, was up 36%.

As we’ve noted before, there are only 3 BDCs that are in the red on a total return basis: Portman Ridge Finance (PTMN); Monroe Capital (MRCC), and Prospect Capital (PSEC).

The troubles of these three Biggest Losers are mostly long-standing but over a three-year time frame are all solidly in the black on a total return basis.

It’s fair to say that both on a 1-year and 3-year basis, virtually all BDCs have performed well for their shareholders given the very uncertain market and economic conditions.

This reflects both the benefits of the high-interest rate environment we’ve experienced for the past two years and the low credit losses registered.

Up And Down

At the same time stock price volatility in the short term is as extreme as ever.

CSWC – despite recording the highest full-year increase twice saw its price drop by a double-digit percentage during 2023, before recovering.

We’ve reviewed the 2023 price charts of most of the BDCs we cover and have been reminded that price drops of (10%) or more have occurred 3 or more times in the last 12 months.

No wonder BDC investors seem exhausted rather than triumphant after an above-average year of price and total return gains.

All the volatility – this year at least – has come from investors seeking to get ahead of macro risks rather than anything specifically BDC-related.

In all cases, those perceived oncoming risks have proven to be mirages and investors have returned to the fold.

Fortunately or unfortunately, this is part and parcel of investing in public BDCs and we expect no change going forward.

Looking Ahead

After 15 months of an on-off upward price trend, one may wonder if there’s any more gas in the tank for the BDC sector.

However – as this 5-year price chart of BDCZ shows – we remain 8%-10% below the price heights achieved in 2020 just before the pandemic and in early 2022, before the onset of higher rates/war in the Ukraine/rampant inflation.

Furthermore, our sister publication – BDC Best Ideas – projects that distributions in 2024 should match – or even exceed – what was paid out in 2023, especially if the Fed holds out and does not cut rates till later in the year and only modestly.

Many BDCs have large reservoirs of undistributed taxable income to part with and plenty of liquidity to finance any increase in financing activity that might occur in 2024, which would boost their earnings.

There are very few BDCs that seem credit-challenged; balance sheets are strong and most are planning on growing their portfolios.

Absent that much-foretold economic slump next year, all the ingredients are there for another good year in 2024.

An 8% increase in the sector’s stock price and 12% in distributions could result in another above-average year for the BDC sector on a total return basis.

One can imagine all sorts of downside scenarios – as the markets are prone to do – but the BDCs approach the new year in a highly resilient state.

At the moment the only catalyst that we see for a price downturn is profit-taking after the recent sharp run-up but that typically sets up the sector for new heights, barring any bad news.

We wish all our readers a Happy New Year!

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.