BDC Common Stocks Market Recap: Week Ended February 23, 2024

BDC COMMON STOCKS

Week 7

Two

We’ve got a couple of explanations for why the BDC sector continued to fly highish this week.

(BDCZ – the exchange-traded note that owns nothing but BDC stocks and serves as one of our measuring sticks – closed at $18.96, up 0.4%).

Maybe BDC prices were joining in the broader market enthusiasm. As reported by Seeking Alpha,” the S&P 500 advanced 1.6%, the tech-heavy Nasdaq Composite gained 1.4%, and the Dow Jones rose 1.3% for the period”. Even the Nikkei 225 index was in the news, reaching a new all-time high after thirty-four years.

Another reason – or maybe a complementary one – is that most of the BDC IVQ 2023 results being published this week were on the strong side – at or above expectations.

The BDC Reporter tracks every BDC’s results and within hours of their release, we tell you whether earnings, net book value per share, credit, and the dividend have fallen below, or met, or exceeded expectations. As the BDC Summary Results Table fills in for any given quarter, one gets a clearer and clearer idea how sector fundamentals are playing out.

Check Out The BDC Summary Results Table: IVQ 2023. There are 18 BDC results to date.

Coincidentally or otherwise, the BDC with the biggest percentage price increase this week was Barings BDC (BBDC), which reported its results on Thursday, February 22, 2024, and held its conference call the next day. BBDC was up 7.00% in price over this holiday-shortened week.

Investors appeared to appreciate the unchanged net investment income per share (NIIPS) and quarterly dividend ($0.26 for the third quarter in a row) and a modest increase in net book value per share (NAVPS).

However, the most appealing factor may have been the reduction in the number of portfolio companies on non-accrual. In the last quarter of the year, 3 loans that had been written down to immaterial values were written off.

More impressively, portfolio company Core Scientific – which we’ve written about extensively – exited from bankruptcy in January 2024 and BBDC was able to report a considerable recovery on an exposure that had been under court protection for over a year and which – initially – threatened to be a complete loss. Then – as now – valuing a crypto miner is a tricky endeavor. Instead, BBDC has received publicly traded shares in the company, which is public once again. BBDC management expects to gradually sell out of its large position in the year ahead, providing the BDC with considerable cash to re-invest into income-producing investments.

For our full review of BBDC’s IVQ 2023 results, click here.

Metrics

The BDC sector might have been up this week, but animal spirits seemed tame.

Out of 43 BDCs, 27 saw their prices stay unchanged or increase, and 16 dropped.

BBDC was the only player to see its price increase by 3.0% or more.

On the other hand, there was only one BDC which dropped by (3.0%) or more.

Not Good

That happened to be Monroe Capital (MRCC), which fell to close at $6.99 a share, a (4.2%) drop.

MRCC is the only BDC trading within 5% of its 52-week low, which is $6.69.

As this chart shows, the BDC has much under-performed the sector – in the form of BDCZ – since the summer of 2023:

Long Time

We don’t want to inundate you with charts so we’ll just add that MRCC’s troubles date back 7 years (!).

Over that extended period – as the quarterly dividend has dropped from $0.35 to $0.25 – a roughly (30%) drop – the stock price has fallen closer to (60%) – going from highest to lowest.

Nonetheless, the analyst community projects the BDC will post $1.08 per share of NIIPS in 2024, enough to cover the current distribution.

At a time when high-flying Main Street Capital (MAIN) is trading at 11.4x its projected 2024 recurring earnings, MRCC is only at a 6.5x multiple.

Tough Question

Is this opportunity or a bear trap? The current pricing suggests the markets expect that the $0.25 quarterly distribution – which has held up for 14 consecutive periods, but has failed to increase in the last two years despite the huge increase in interest rates – might get chopped before too long.

Could a (20%-30%) dividend reduction be on the cards? At an annual dividend of $0.70, MRCC would be trading at a multiple of 9.6x.

As the BDC: NAV Change Table shows us, MRCC’s NAVPS has fallen by (26%) in the last 5 years, including (8%) in the first nine months of 2023 alone. The next 5 years will have to show a better result if MRCC is to be “turned around”.

The BDC Credit Table indicates MRCC’s underperforming assets – according to their account – are slightly above a “normal” level at 16% of the total as of the IIIQ 2023. Unfortunately, that percentage is the same as reported in the IQ 2020 – when our record keeping begins and just before the impact of the COVID-induced recession.

On the other hand – as management likes to point out – the portfolio is valued at 97% of the cost – hardly a sign of serious trouble.

(This week troubled Investcorp Credit Management’s (ICMB) published its delayed 10-Q, which showed an 11% discount).

The BDC reports its IVQ 2023 results on March 11, with a conference call the next day. At that point, our sister publication – BDC Best Ideas – will be in a good position to project out earnings, distributions, and NAVPS for the next 5 years for MRCC.

BDC Best Ideas

Outlook

Year-to-date, BDCZ is still down (0.1%) thanks to the price slump in weeks 5 and 6.

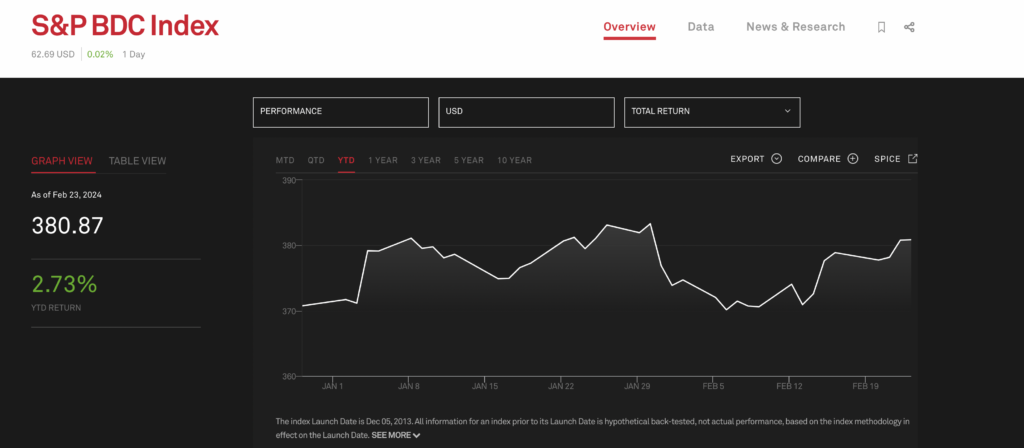

However, the BDC total return – as reflected in the S&P BDC Index which calculates both price change and dividends received – is up 2.73% – see the chart below:

Head Room

As we’ve discussed before – just last week in fact – there is plenty of room for the BDC sector to move upward – based on historical precedent.

On a price basis alone, the S&P BDC index is up 27% since September 29, 2022’s nadir but we could increase 7.3% to match the highest level in early 2020, or 8.7% to get back to April 2022, the year’s peak price before everyone (incorrectly) assumed a recession was coming and higher interest rates would rock the markets to their core (also incorrect).

Promising

Overall, the BDC results received to date provide us with confidence that earnings and distributions should remain elevated for – at least – two more quarters.

For all of 2024 – even if we get a reduction in the Fed Funds rate – later in the year – new record annual profits and payouts are likely to be set – beating out even 2023’s lofty results.

It’s hard to envisage investors pulling back much from such an opportunity barring some new existential worry emerging in the zeitgeist.

Unexpectedly

What we find most encouraging from our review of the 18 BDCs that have reported is how modest the credit challenges are at the end of 2023.

There are exceptions to the rule, but the vast majority of BDCs can rightfully claim that their credit metrics are performing above their historical averages.

Moreover – and vitally important for 2024 – very, very few new names are being added to the underperforming watch list.

Long standing troubled companies are being written off, sold, restructured or are even recovering – diminishing their importance going forward on BDC balance sheets and are not being replaced with any significant number of newly problematic companies.

Worriers

Admittedly, several BDCs on their conference calls have suggested this will not last and credit conditions will worsen but from a very low base.

Nowhere in sight as yet, though, is any of the sector-wide credit drama that historically has caused wary investors to cut and run as they did in 2007-2008, 2011, 2013, 2016, 2018, 2020 and 2022.

Add to that the existence of plenty of liquidity; strong BDC balance sheets rife with unsecured medium term debt and modest leverage levels.

Most Likely

All of which adds up to 2024 looking like another solid year for all but a few BDCs.

We still have 25 BDCs to hear from and will let our readers know if the data causes a change of heart.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.