BDC Common Stocks Market Recap: Week Ended February 9, 2024

Premium FreeBDC COMMON STOCKS

Week 6

Divergent

Most of the time – and often to the frustration of investors – where the S&P 500 goes, the BDC sector follows.

After all, if BDCs are just going to track the much bigger, much better-known, and much more liquid index why bother?

(Of course, matters are a little more complicated than that, with the BDC sector offering a much richer yield than the S&P 500).

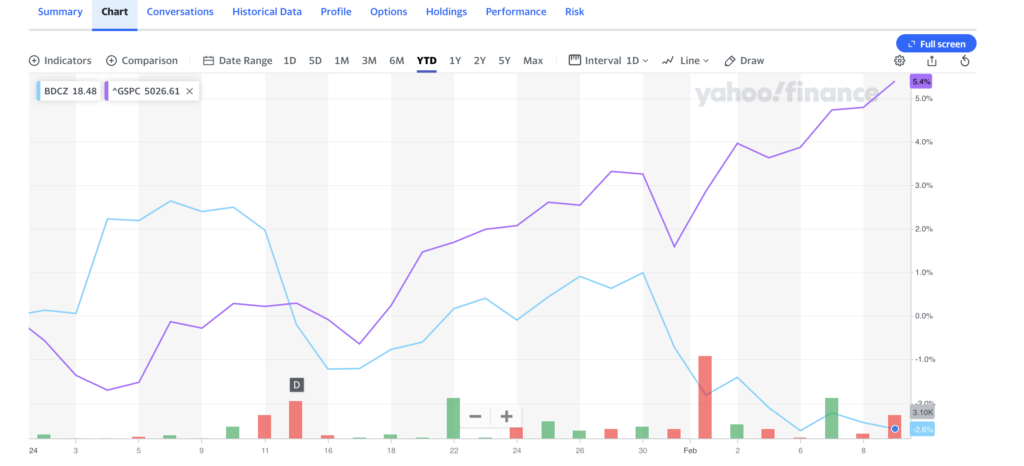

This week – and this year – though, BDC prices have zigged while the S&P 500 has zagged, as this 2024 YTD comparison chart shows:

This week, the S&P rose 1.4% while BDCZ – the exchange-traded note that holds most BDC stocks and serves as one of our price guides – dropped (1.2%).

BDCZ has now fallen in price two weeks in a row while the S&P has climbed for 5 weeks following a week starting at the beginning of 2024 that was met – at the time – with much hand wringing and gnashing of teeth.

Impact

This week roughly one quarter of all BDC stocks increased in price or were flat and three quarters were in the red.

No individual BDC stock managed to increase in price by more than 1.4%.

On the downside, there were 3 stocks off by (3.0%) or more – the arbitrary threshold we use to measure above-average price volatility.

Punished

The Biggest Loser – and by a wide margin – was Prospect Capital (PSEC), down (7.7%).

The reason was obvious enough: the BDC reported underwhelming financial results for another quarter.

As the NAV Change Table will show you, PSEC’s NAVPS dropped (3.6%) in the period and is down (10%) in calendar 2023.

Of all the BDCs that have reported their net book values for 2023, PSEC has the biggest drop in this favored metric.

Another data point favored by investors – Net Investment Income Per Share (NIIPS) – fell even more dramatically: (23%).

Nonetheless, the BDC continued to pay out its long-in-the-tooth monthly $0.06 per share dividend, now promised through April 2024, which will be the 80th.

Left Unsaid

Disappointingly – but true to form – management did not address these setbacks on their conference call.

Likewise, analysts Finian O’Shea of Wells Fargo and Robert Dodd of Raymond James – the only two to participate in the Q&A – did not broach the reverses that brought recurring earnings and NAVPS well below their level of a year ago.

We’ve undertaken only a partial analysis of the results but understand that the NAVPS drop is principally due to major reductions in the unrealized gains previously booked for PSEC’s REIT and finance company subsidiaries.

Reduced

To give an example: PSEC valued its controlled National Property REIT subsidiary at $632mn as of September 30, 2023, which had an equity cost of only $15mn.

This quarter, the cost increased to $20mn and the value dropped to $571mn – a ($61mn) devaluation in 3 months. That’s ($0.15) a share on one investment.

There were none of the credit hi-jinx of the prior quarter. PSEC did not book any material realized loss or any great devaluation of a borrower’s debts.

Loss

In recent quarters we’ve seen the BDCs quarter of a billion-dollar investment in PGX Holdings result in a realized loss of ($180mn), booked in the IIIQ 2023.

The BDC continues to have an interest in the post-bankruptcy company – now called Credit.com – with a cost of $82mn.

PSEC already values its equity stake in Credit.com at a $10mn premium…

Walking Away

Unfortunately, the BDC Credit Reporter’s first cut review of the portfolio suggests there may be further credit losses coming into the portfolio.

As to the valuation of PSEC’s “control” companies – like the REIT – these are “black boxes” whose values can swing in any direction and are a major reason why our sister publication – BDC Best Ideas – will be abandoning coverage of this very large BDC this quarter.

Projecting what a BDC might earn and might be worth is hard at the best of times. The opaque disclosures and large single investment concentrations make the job impossible and unpalatable.

The BDC Reporter and BDC Credit Reporter, though, will continue their coverage of this idiosyncratically-run BDC.

Looking Forward

The BDC rally – in just two weeks – has been knocked on its back heel.

BDCZ has dropped (3.5%) in this last fortnight to $18.48.

On a year-to-date basis, BDCZ is down (2.6%).

The S&P BDC Index – on a price-only calculation – is down (0.3%).

The “total return” S&P BDC Index is also in the red: (0.04%).

BDCZ is now (7.6%) away from its 52-week high.

Not As Good

At this stage, 16 BDCs out of 43 are trading at or above book – not the highest number of late, but still on the high-ish side.

28 BDCs are still trading in the black over the last 12-month period, but only 17 in 2024.

12 BDCs are trading within 5% of their highs, but that’s down from 20 just a few weeks ago.

Debatable

Technically – if you use a greater than (5%) change in the BDCZ stock price from its latest high to the current level – to claim a rally is done, we’re there already.

From a high on January 8, 2024 – just a month ago – BDCZ is down (5.2%).

However, the S&P BDC Index on a price basis is off (3.4%), so we’ll hold off a little calling the end of this rally that began on October 28, 2023, and saw the BDC sector move up nearly 15% at its highest point.

Further Back

If you start counting from the lowest point BDCZ reached in this cycle that began in the spring of 2022 when the Fed began its rate-increasing policy, the sector gained 25% from lowest to highest.

Those are robust price increases but remember that BDCZ – despite paying out record levels of distributions of late – still sits more than (10%) below its end-of-last cycle in the spring of 2022.

Both Sides Now

This is all to say that both bulls and bears could make arguments about what happens next to BDC prices.

As always we are too humble – and too often wrong – to play that parlor game.

Bit Of Both

What we can offer – after hearing from one-quarter of the public BDC community about their IVQ 2023 results – is that “individual performance varies”.

Look at the BDC Reporter’s IVQ 2023 Results Summary Table and you’ll see earnings have fluctuated widely from quarter to quarter between different BDCs.

At one end of the spectrum is the previously mentioned PSEC whose NIIPS dropped (23%). Oaktree Specialty Lending (OCSL) and Saratoga Investment (SAR) left their shareholders disappointed as well.

On the other side of said spectrum, Gladstone Investment (GAIN); Capital Southwest (CSWC), and – most importantly – Ares Capital (ARCC) posted substantially higher earnings.

Ditto

Net asset values per share have also fluctuated a good deal.

GAIN was (7.3%) down, but that’s the result of booking a huge realized gain and paying out the proceeds to its shareholders.

Tiny PhenixFin (PFX) – another BDC like PSEC that is covered in mystery – boosted its NAVPS by 3.4% after years of capital erosion.

Unexpectedly

What has been more stable so far – with one notable exception – is credit. Looking through the BDC Credit Table, you’ll see that the value of underperforming assets – where reported by the BDC involved – is not much changed from the IIIQ 2023.

Nor are there many new troubled companies getting on the BDC Credit Reporter’s radar, including very few new non-performers.

The credit outlier is Oaktree Specialty Lending (OCSL) – a BDC that prides itself on its underwriting, which added 4 new companies on non-accrual this quarter, bringing the net total (after one removal) to 7.

Anyway, what happens to BDC stock prices in the next few weeks might be affected by results yet to come from three-quarters of the universe we track.

With that said, both Gladstone Capital (GLAD) and CSWC performed well in the IVQ 2023 but were still each down (4%) in price this week, trailing only PSEC.

As we said, it’s hard to know what investors favor in the short run.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.