BDC Common Stocks Market Recap: Week Ending March 15, 2024

BDC COMMON STOCKS

Week 11

Mixed Messaging

The BDC sector – going by the price of BDCZ, the exchange traded note which owns most of the public stocks – was flat on the week.

BDCZ began and ended at a price of $18.99.

However, that round trip does not really tell the story.

Monday through Wednesday, BDCZ was climbing in price, reaching $19.22 at its peak – up 1.1%.

Furthermore, 4 BDCs reached new 52-week high prices.

Perhaps tellingly all the record breakers were BDCs serving the upper middle market and with large trading volumes.

Just the sort of BDC you might expect institutional investors to gravitate towards…

The major indices, too, were headed northwards for the first 3 days of the week.

Just Like That

Then, on Thursday, the producer price index was published showing a 0.6% increase in wholesale inflation.

That was twice as much as the economic consensus and more than Wall Street could bear.

Bond yields rose and stock prices dropped, including BDCZ.

In the small mercies category, BDCZ ended up dropping slightly less than the major indices.

The S&P 500 and Dow were down (0.1%) on the week, and the interest-rate sensitive NASDAQ fell (0.7%).

Head Fake

Where BDCs are concerned, though, the unchanged level of BDCZ over the week is misleading as are those 52-week highs.

Of the 43 BDCs we track (this is the last hurrah for BlackRock Investment or BKCC, which will merge into BlackRock TCPC, or TCPC, on March 18, 2024 according to an official filing) 28 dropped in price and only 15 remained unchanged or were in the black.

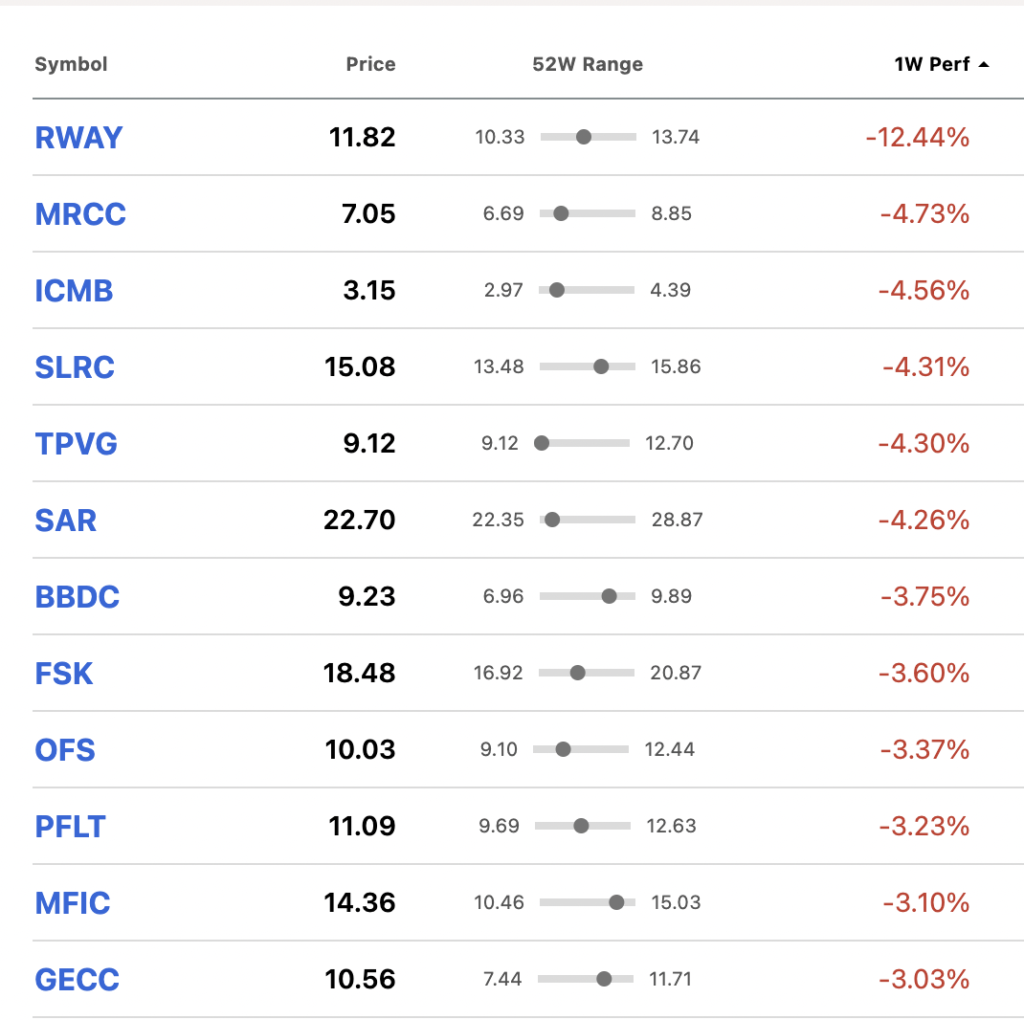

Even more pointedly, 12 BDCs were down (3.0%) or more in price and none increased by a corresponding percentage.

That’s a lot of getting out of Dodge and included all kinds of BDCs, both those reporting their latest results as earnings season came to a close and some which had opened their books some time ago.

Here are the 12 BDCs involved:

Something Is Happening Here

This had some of the hallmarks of an end-of-season market re-pricing, now that results are all up to date.

As we said last week – and can be seen by a glance at our BDC Summary Results Table for the IVQ 2023 – the number of underperforming BDCs has been surprising.

By our count – and we’re just about done updating the Table – roughly a quarter of the BDC universe disappointed in the most recent quarter.

This is all the more surprising given that underlying interest rates from September through December 2023 were at their highest level in the cycle and a strong economy kept credit conditions pretty tame.

Credit Update

Over in another Investor Tool of ours – the BDC Credit Table – we’ve been keeping track of new companies moving to non-accrual and found very few – 19 so far – in the IVQ 2023. (There are often multiple BDCs involved so the number of new non-performing companies is even lower).

Other metrics are also favorable: 26 BDCs reported increased net book value per share in the IVQ 2023, almost unchanged from the quarter before, and the sector as a whole saw this metric sink only (0.4%).

Lower

Investors – going by this week’s behavior at least – were not satisfied.

The number of BDCs trading at or above NAVPS dropped to 14, from 17 in each of the last 4 weeks and a preak number of 18 early in the year.

We also recorded our first BDC at a new 52-week low in a long time: TriplePoint Venture Growth (TPVG).

For a long time, hope trumped everything else as the venture-debt’s credit performance weakened quarter after quarter but the stock price held up.

This week, though, TPVG reached that new low, which is more than (50%) below the highest price in 2021 before the rot set in:

What’s Happening Here

The harsh reality is not that the BDC sector is performing poorly – earnings and distributions are at all-time highs and – as discussed – net book values in aggregate are holding strong and credit metrics remain well within normal boundaries.

The problem – if that’s the right word – is that there is a wide disparity in performance between the denizens of the public BDC sector.

This has always been the case, but the higher yield environment and a stronger-than-expected economy, have allowed weaker participants to patch over cracks in their performance.

As rates and the economy plateau, those cracks are beginning to show and investors appear to be noticing.

Not Normal

At our sister publication – BDC Best Ideas – we spent a good deal of time reviewing all the credit information we’ve gathered in the BDC Reporter and the BDC Reporter and rated the credit status of every player. We divided them into two categories: performing normally or below normal.

We looked at a variety of data both recent and long term: NAVPS changes; net realized losses; cost versus value of the portfolio; the number and value of non-accruals and much more.

As subscribers to BDC Best Ideas can see our semi-scientific analysis found that 11 BDCs were performing “below normal” where credit was concerned.

Every BDC is going to have to contend with lower interest rates – most likely from the second half of this year. Adding to that above normal credit losses will impose great strains on some BDCs performance and stock price.

Popular

The “better” performing BDCs, though, continue to be favored. There are still 14 BDCs trading within 5% of their 52 week highs, and another 14 are within 5%-10% of that high..

The Summary Results Table shows 13 BDCs out-performing “expectations” in the IVQ 2023 where earnings, net book value, credit and distributions are concerned.

Times They Are A’Changing?

The days of wine and roses in the BDC sector may be over. Or maybe this latest quarter was atypical and the IQ 2024 will far fewer BDC underperformers.

We can’t really tell at this stage.

The BDC Reporter suggests our readers pay close attention in the weeks and months ahead.

BDCZ is trading at only (5%) below its 52-week high and three-quarters of the universe is trading at a higher stock price than a year ago.

The BDC sector has been “rallying” since October 2022 and – on paper – has plenty of room to push up further.

On the other hand, the picture is getting more complex and all scenarios should be considered.

Now that BDC earnings season is over, we’ll be writing a series of articles about the most credit challenged BDC names, spelling and quantifying as much as possible the risks they – and their shareholders face.

With a fourth of BDCs “below normal”, we expect to be busy.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.