Oxford Square Capital: IV 2023 Credit Review

Read in conjunction with the BDC Credit Table.

PORTFOLIO

Oxford Square Capital’s (OXSQ) portfolio valued at fair market value dropped by (7%) in the IVQ 2023 compared with the prior quarter. At cost, the portfolio shrunk as well. Since we began keeping records, OXSQ’s portfolio has barely budged in value, despite the BDC raising additional capital through a Rights Offering and from an At-The-Market Program. Total shares outstanding have increased by 20% since early 2020.

We only evaluate the loans, preferred and equity on the BDC’s books and not the CLO investments which account for 31% of the $272mn portfolio, or $82mn The total number of portfolio companies – which have an aggregate value of $185mn – decreased this quarter from 20 to 19, according to filings. That means average exposure per company is close to $10mn.

UNDERPERFORMING ASSETS

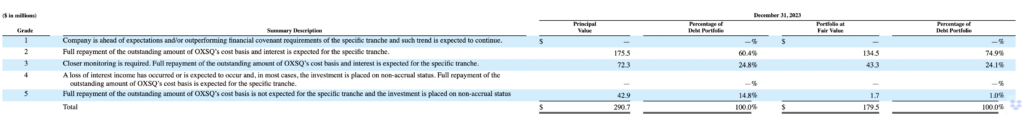

The BDC does offer its shareholders a quarterly investment rating, but only of the non-CLO assets, in a standard 5-point system where ratings 3 through 5 are deemed underperforming to varying degrees.

As those of you with good eyesight can work out from the table above, the FMV of underperforming assets comes to $45.0mn. However – going by OXSQ – virtually all these assets are in category 3 and “Full repayment of the outstanding amount of OXSQ’s cost basis and interest is expected for the specific tranche”. The BDC Reporter’s reading of the data is not as optimistic, as we’ll discuss.

Also worth noting is that the underperforming assets have already been discounted by (61%) from their “principal value”.

The $45mn of underperforming assets at FMV accounts for 16.9% of the total portfolio – a percentage we consider higher than normal for a BDC. As OXSQ’s own table shows, the underperforming debt investments represent 25% of total debt – clearly a high level by anyone’s standard.

NON ACCRUAL

OXSQ admitted on its IVQ 2023 conference call that a new portfolio loan had been placed on non-accrual in the IVQ 2023, but would not offer up who was involved even though the information is public knowledge and other BDCs involved have revealed their investment. The company is Careismatic Brands – which we flagged for our readers back in late January, quoting from our sister publication – BDC Credit Reporter:

On January 23, 2024, Careismatic Brands filed for Chapter 11. The company “is a trusted global leader in medical apparel, footwear, and accessories, with a distribution platform that spans 70 countries”. There are three BDCs involved, with a total exposure of $42mn. The two public players involved are FS-KKR Capital (FSK) and Oxford Square Capital (OXSQ)– the former for $30mn and the latter for $12mn.However, FSK is in first-lien loans only, and OXSQ is in second-lien. FSK has barely written down any of its debt but OXSQ has taken a (62%) discount already.

Here’s the BDC Credit Reporter’s damage assessment for OXSQ.

We’d bet dollars to doughnuts (love that expression) that the $12mn of second lien debt held by OXSQ will be fully written off… That’s going to sting because – as we warned previously – that would result in the “loss of ($1.5mn) in annual investment income. That’s equal to about 6% of the BDC’s annualized net investment income“.

BDC Credit Reporter

We were almost right, as OXSQ wrote down its position by (90%) to $1.2mn and placed the loan on non-accrual from October 1, 2023. For the quarter, the unrealized loss was ($3.4mn) and for the year ($6.2mn) – the second highest write-down of 2023.

Remaining on non-accrual is Premiere Global Services where a “Replacement Revolver” (please don’t ask) with a value of $05mn remains non-performing. In toto, OXSQ invested $23.7mn in Premiere so this remaining value is mostly of academic interest.

Of greater interest is the BDC’s preferred interest in Unitek Holdings, non-performing for a long time. $27mn has been advanced overall but is valued at $5.3mn. OXSQ has been forgoing cumulative dividends that range from 13% to 20% annually, depending on the tranche. The good news is that the value of the preferred increased in 2023 by some $0.9mn. Is there hope for some sort of recovery?

UNDERPERFORMING COMPANIES

Unfortunately, outside of the 3 companies on some sort of non-accrual, there are 8 others which are still current on their obligations, but seem to be in trouble. We won’t discuss every name here, but we’ll be listing all the borrowers that fit the BDC Credit Reporter’s definition of an Important Underperformer – rated 4 or 5 on our 5 point investment rating scale and with an FMV greater than $5mn – in the IMPORTANT UNDERPERFORMERS tab of the BDC Credit Table. If you’re looking for the portfolio companies of OXSQ – or any BDC – that might cause MATERIAL damage in terms of book value or income loss in the (near) future, this should be your destination.

If you’d like to go the extra mile and understand what is going wrong at each business and get an assessment of what the ultimate outcome might look like for the companies – and BDCs – involved, we suggest adding a subscription to the BDC Credit Reporter, which is committed to tracking and writing about every Important Underperformer in the public BDC universe. We are at 103 names already. A Premium subscription only costs $50 a month – a good investment if you want a heads up as to what might go wrong – or right – in your favorite BDC’s portfolio in the quarters ahead.

Not including Unitek, we have identified 7 Important Underperformers which have an aggregate value of $67mn. To put that into context, OXSQ’s net asset value is $151mn. There are several second lien loans involved which – like Careismatic – seem vulnerable to very large write-offs. 4 of the companies were on the list of most significant unrealized losses in 2023. Magenta Buyer LLC (McAfee) – for example – was the largest write-down last year at ($6.3mn) and is currently valued at only half its cost. There are several other names which we also have grave concerns about.

MANAGEMENT RESPONSE

OXSQ’s external manager held its conference call on March 15, 2024, before the issuance of the 10-K. The session involved repeating the main metrics for the quarter and a high level report on the state of the leveraged loan market, quoting Morningstar data. As mentioned, management declined to identify the new non-accrual and did not discuss the underlying performance of its portfolio companies – or CLOs for that matter – or any of the credit underperformers.

CONCLUSION

This Credit Review is hot off the presses as OXSQ’s 10-K has just been released. We will shortly be digging into the individual Important Underperformers at the BDC Credit Reporter to evaluate which companies might reach a “realization event” in 2024 and what the ultimate losses and recoveries might look like. However, this preliminary data does indicate OXSQ’s credit performance is below what we would consider “normal”. We point to the 25% of credit investments operating in distress territory; the addition of Careismatic to the non-performers list and the ($42mn) of total net realized losses across its entire portfolio in the past 5 years. (That’s another metric we’ve recently being adding for each BDC and comparing against the NII achieved in the same period – a useful assessment of “total return”). OXSQ has seen one-third of its net investment income offset by realized losses, which is high.

Most telling of all is that the BDC’s net asset value per share – see the BDC NAV Change Table – has fallen (66%) in the last 5 years, including (8%) in 2023 and (48%) since the end of 2021. The 5 year NAVPS performance is the second worst of any BDC – admittedly made worse by the way CLO investments erode in value over time even while generating a positive “total return”. However, the fact that more than half the BDC’s borrowers are in some sort of credit trouble makes clear that our concerns are well founded.

We are moving OXSQ from a Credit Status (see column C in the BDC Credit Table) of NORMAL to BELOW NORMAL following this review. There are currently 14 BDCs which the data suggests are underperforming. That seems high – a worrisome – but that’s a subject for another time.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.