BDC Common Stocks Market Recap: Week Ended April 12, 2024

BDC COMMON STOCKS

Week 15

Slumping

U.S. stocks sold off on Friday after major U.S. banks’ results failed to impress, capping a week marked by market-moving inflation data, evolving expectations for U.S. Federal Reserve policy, and looming geopolitical tensions.All three major indexes fell more than 1%, and registered losses on the week.The S&P 500 index (.SPX), opens new tab notched its biggest weekly percentage loss since January, while the Dow Jones Industrial Average’s (.DJI), opens new tab weekly loss was its steepest since March 2023.

Stephen Culp – Reuters – Wall St ends sharply lower on mixed earnings, sticky inflation, geopolitical fears – April 12, 2024

Most of the time, when the major indices get a cold the BDC sector gets the sniffles – at the very least.

That’s what happened this week even though all the chatter about a stronger-than-expected economy and fewer rate cuts this year than expected – or even another increase – is music to the ears of BDC managers.

Peak BDC earnings – once thought to be relegated to the back mirror – may yet lie ahead.

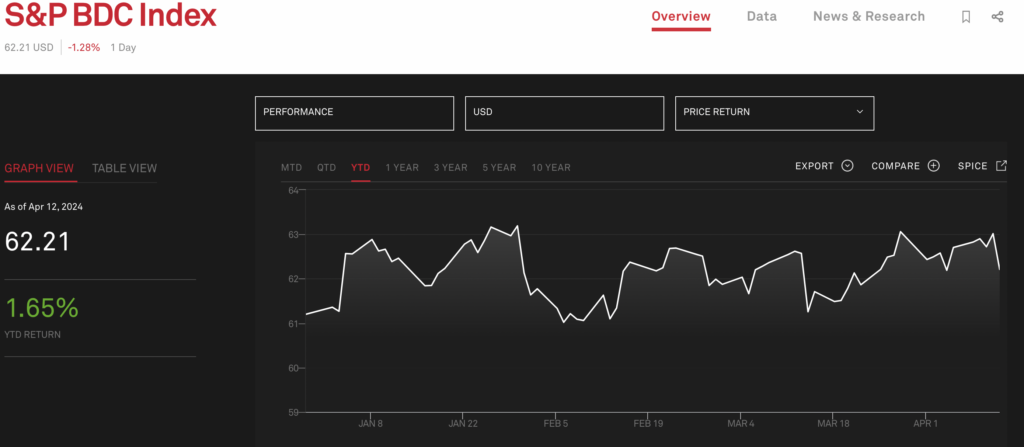

Nonetheless, the S&P BDC Index – calculated on a price only basis – dropped (0.8%) this week.

Not So Bad

However, this was no big deal: 20 BDCs increased in price, 20 fell and 2 were unchanged.

The increasing nervousness felt in the major markets has not transferred down to the BDC sector.

Two BDCs reached new 52-week highs during the week: Main Street (MAIN) and Owl Rock (OBDC).

The number of BDCs trading at a premium to net book value per share fell, but only by one BDC – from 17 to 16.

Worst And Best

The two BDCs that fell more than (3.0%) in price were thinly-traded OFS Capital (OFS) and Investcorp Credit Management (ICMB) – always volatile in both directions.

The two BDCs that increased more than 3.0% were Gladstone Capital (GLAD) and Stellus Capital (SCM).

The former bounced back a little after its 2:1 reverse stock split which caused some shareholders to sell, for reasons that still escape us.

Still, GLAD continues to underperform the BDC sector in 2024 – as represented by the ETF with the ticker BIZD, as this chart shows:

We’ll be curious to see where GLAD goes from here, and will report back.

2024 YTD

Given that there’s not much of great interest that happened this week where prices are concerned, let’s pull back and see where the BDC sector stands in 2024 at the end of Week 15.

The S&P BDC Index – on a price basis – has increased a modest 1.65%, especially when compared with the S&P 500 which is up 7.41%.

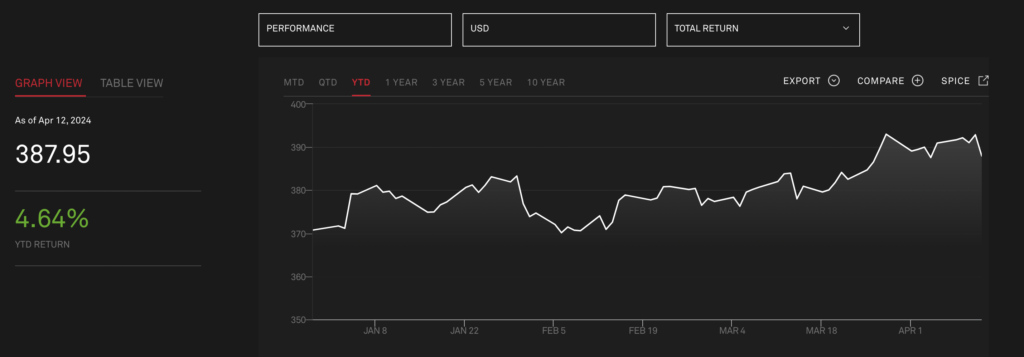

The picture is a little brighter – and more realistic – when we include dividends received. As you can see below, that raises the total return this year to 4.64% – not shabby

However, the BDC sector is still returning only 59% of the S&P 500 in this calculation.

The BDC sector has traded in a narrow channel in 2024 – no more than (3.6%) from high to low.

Speaking of the high: that was set on January 30th and will take only a 1.6% increase to get there again.

Not Great

When we look at individual BDC results, the picture is less auspicious:

Of the 41 BDCs to have traded all year (the exception is Palmer Square Capital or PSBD) only 18 are in the black/unchanged, while 23 are in the red.

That’s hardly the stuff of a broad-based rally and a little disturbing for investors hoping the long BDC run upward that began October 1, 2022 has further to run.

Not so long ago virtually any BDC you bought was highly likely to move up in price AND pay out a hefty, increasing distribution to boot. That time is gone and investors results are going to vary widely, much more than the sector data we’re shelling out.

Shocker

IIf you’ll excuse a little editorializing, it’s been a peculiar year when we dig a little deeper into the main individual BDC winners and losers.

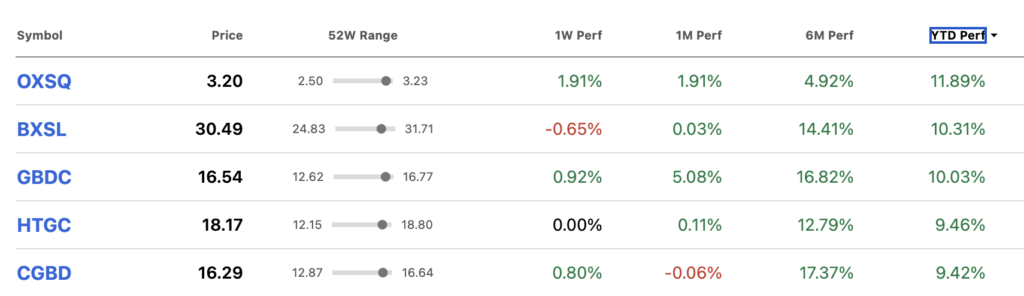

As this chart of the top 5 BDC price gainers shows, the Biggest Winner is Oxford Square Capital (OXSQ).

This BDC has one of the worst records in the BDC sector for net asset value erosion, both short term and long term. Its NAVPS has fallen (58%) in the last 5 years and (8%) this year.

Furthermore – as spelled out in a recent Credit Review – the BDC is rife with underperforming borrowers.

Nonetheless OXSQ tops the price increase chart, underscoring what readers will already know – BDC investing is hard.

Otherwise, the top price performers are i) unsurprising; ii) all four are extending price gains that began in 2023; iii)operate in many different corners of the leveraged lending market.

Beaten Up

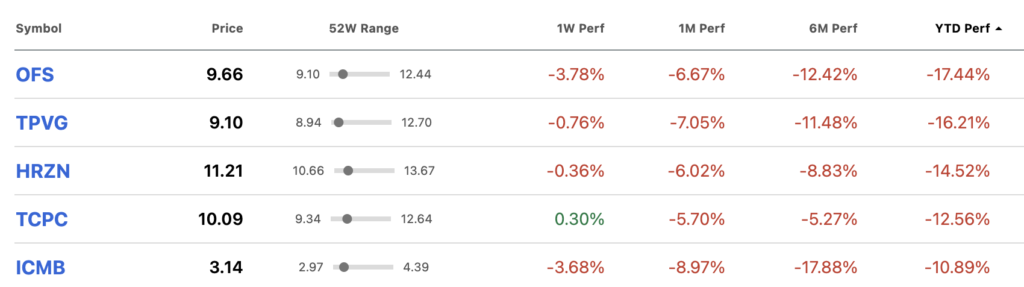

The 5 Biggest Losers – see below – all have in common the posting of disappointing results in the IVQ 2023, and have been marked down accordingly.

To be fair, all these BDCs were already slipping in terms of fundamentals before the IVQ 2023 confirmed their frailties.

TPVG – for example – has seen its NAVPS drop (34%) in the past two years and triggered many downgrades and projections of an upcoming cut in its distributions.

HRZN – operating in the same venture-debt eco-sphere has lost (17%) of its NAVPS – and is suffering from the same sort of problems.

Looking Forward

There’s still plenty of time in 2024 – with just over a quarter of the year gone – for any BDC to turn their fortunes around. Or to fall further into the abyss.

The macro-environment – as discussed above – is favorable, leading one to expect still high earnings and still low credit losses.

However, there are enough “idiosyncratic” problems of long standing in some BDC portfolios that will be coming to a “realization event” in 2024 to hurt their price performance.

A quick scan down the list of BDCs suggests to us that two-thirds of our coverage universe should have an acceptable 2024.

However, that leaves one-third of BDCs in the questionable column.

How this large minority of BDCs perform in the quarters ahead will probably determine if 2024 turns out to be a good year or not where the sector’s prices are concerned.

There’s everything to play for, but nothing is in the bag.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.