BDC Common Stocks Market Recap: Week Ended November 1, 2024

BDC COMMON STOCKS

Week 44

The week … saw a flood of economic data, which included an advance estimate on U.S. Q3 GDP growth, a reading on the Federal Reserve’s preferred inflation gauge, and the October jobs report.The overall data suggested a continued deterioration in the labor market, an economy that was still chugging along, and an inflation situation that may not be completely out of the woods yet. For the week, the S&P (SP500) slipped -1.4%, while the Nasdaq Composite (COMP:IND) slid -1.5%. The Dow (DJI) fell -0.2%.

Seeking Alpha – Wall Street Breakfast

Not So Good

Maybe BDC sector prices dropped in sympathy with the major indices or investors were disappointed by the first week of results in IIIQ 2024 earnings season.

Whatever the reason(s), Week 44 was notable for BDC price weakness almost across the board.

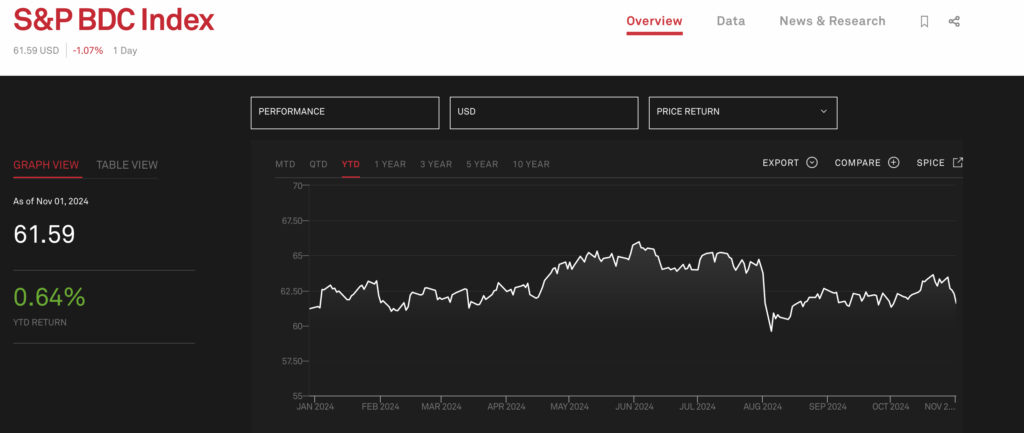

The S&P BDC Index on a price basis – which has become our favorite sector price guide – dropped (2.3%).

Regular BDC investors – and readers of this column – will know that’s a pretty sizable percentage price drop in just 5 days.

Supported

The rest of the metrics we regularly track are just as grim.

Of the 42 BDCs in our coverage universe, 39 were in the red price-wise – and only 3 were up or flat – the worst such performance since the week ended August 2, 2024.

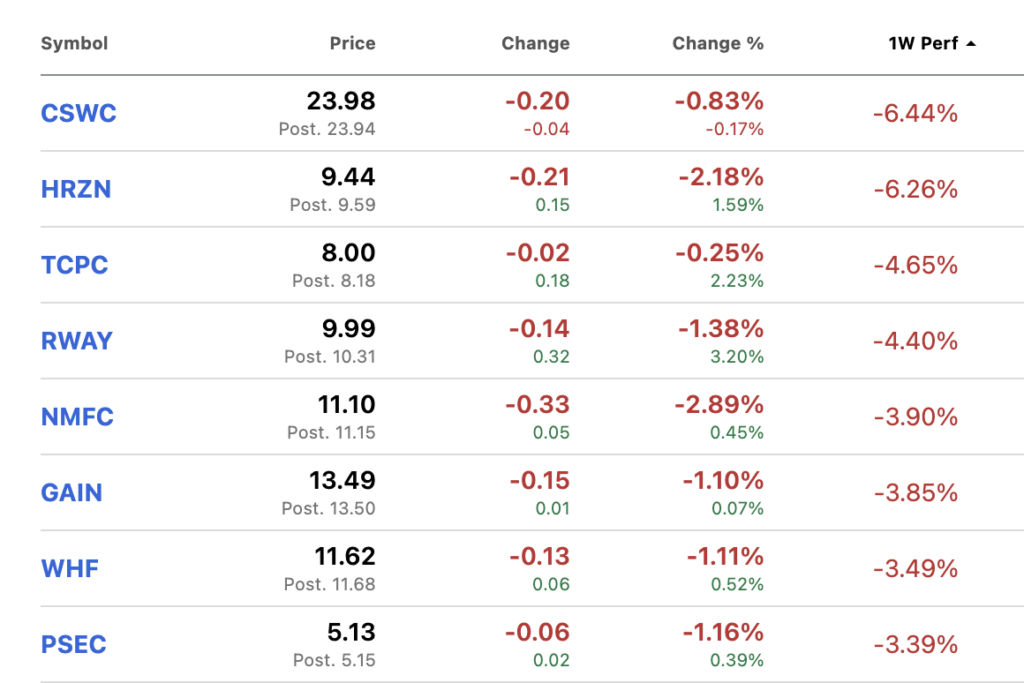

What’s more, 10 BDCs saw their price drop by(3%) or more. See the list below:

Exception To The Rule

Just 1 tiny BDC – Logan Ridge Finance (LRFC) – was significantly up in price : 4.9%.

The BDC is still benefiting in investors eyes from a recent large equity gain.

A Lot

Also a bad sign: 6 BDCs reached new 52 week lows.

That’s the second worst week all year by this metric.

Newbie

On that list of poor price performers are the usual suspects: TriplePoint Venture Growth (TPVG); Horizon Technology Finance (HRZN); BlackRock TCP Capital (TCPC) and Investcorp Credit Management (ICMB).

One of the newer casualties, though, is Goldman Sachs BDC (GSBD), quickly falling out of favor.

As recently as September 23, 2024 GSBD’s stock price was riding high-ish, closing at $14.44.

This week, GSBD closed at $13.14, nearly (10%) lower than 5 weeks.

GSBD’s price weakness is likely related to huge net losses booked in the IIQ 2024, which amounted to twice its Net Investment Income (NII) for the period.

Not unreasonably investors may be worried that red credit ink might continue to show up in the IIIQ 2024, even if recurring earnings are not expected to budge much.

For our part, we’ve rated GSBD’s prospective IIIQ 2024 performance as a 2 on our 5 point scale because we share the market’s apparent skepticism.

Where We Are

There are only 8 weeks till the end of 2024 and the BDC sector – measured in price terms – is up less than 1% – as this chart illustrates:

The sector’s performance looks a little less bleak on a total return basis : 9.7%.

However, if we compare with the total return of 21.5% for the S&P 500 over these 44 weeks, BDC investors have clearly been left far behind and with little time to catch up.

Delving

YTD, 21 BDCs are down in price and 20 are up. (PSBD does not count in these calculations).

By our estimate, if prices don’t change any more and any dividends not already announced go as expected, 10 BDCs will be able to boast of a total return close to or above the still stellar performance of the S&P 500.

All 10 have increased in price by 10% or more – and by as much as 17% – and when their dividends are taken into account they should have a Very Good Year.

Gold, silver and bronze go to Main Street (MAIN); Hercules Capital (HTGC) and Gladstone Capital (GLAD).

With the likes of Bloomberg writing incessantly about the “rise of private credit” and the role of BDCs, nary any ink has been spilled about these three very succesful long-in-the-tooth BDCs which operate under the radar of Wall Street’s journalists.

Exhibit A

By the way – and in a sort of teaching moment that explains the success that can come from operating in the unglamorous “lower middle market”, we heard that a portfolio company of GLAD’s was sold this week.

Busy as we were with the whirlwind of earnings releases, we took a time-out to cover this singular success for GLAD, which will likely show up in terms of a realized gain in the calendar IVQ 2024.

Not So Great

That’s the good news.

At the other end of the spectrum – and in a case of symmetry – there are 10 BDCs whose stock price is down by (10%) or more in 2024 YTD, including 6 by more than (20%).

These BDCs are likely to generate substantial total return losses and rain on the parade of many BDC investors.

The worst 3 – starting at the bottom and headed up – are TPVG, OFS and BlackRock TCP Capital (TCPC).

Very, very roughly that leaves about half the BDCs we track neither doing all that well or all that badly.

We also note that the number of BDCs trading at or above Net Asset Value Per Share (NAVPS) is down to 13. No so long ago – in the summer – this metric peaked at 22.

Along these same lines, and after updating every BDC’s 52 week low and high prices, we find the number of BDCs trading within 5% of their 12 month peak to have dropped to 7 while the number within (5%) of the low is at 12.

We’ve called this a “bi-furcated” market before and that continues to be the case.

No Winning

This week, though, virtually every BDC was unpopular – even those who posted results within expectations or -like FDUS – exceeded what was expected.

Every BDC that has reported IIIQ 2024 results – including Saratoga Investment (SAR) which a few weeks ago managed a rare full recovery of a deeply troubled non-accrual investment – was down in price after their reveal.

BDC investors are in a sour mood.

What Happens Next

Of course, we don’t know.

In our twenty years watching this market, we’ve seen dour weeks like this one followed by a sudden price resurgence.

After all, this just could be pre-election nerves and have very little to do with BDC fundamentals even if those are mostly just OK from what we’ve seen so far.

Will we be seeing a Christmas rally before long? We remember 2018 when just such an upsurge happened and something similar in 2021.

On the other hand, we could as readily see more red ink and an ever smaller pool of BDCs in the black – both on a price or total return basis.

Down, Down, Down

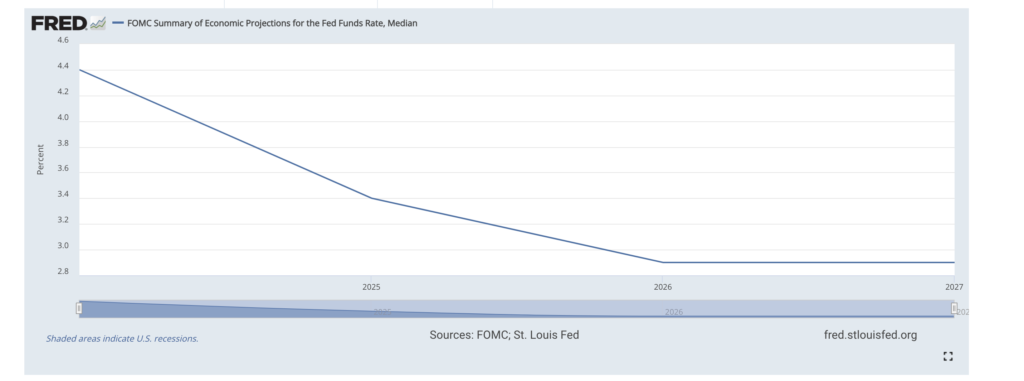

The Bears will point to the coming impact – like an avalanche rushing towards us – of the Fed’s lower interest rates. We’ve had a 50 basis point reduction already and another 25 basis points is expected this coming week and something similar in December.

BDC investors who read to the end of 10-Qs can see calculated for them what the pro-forma impact on a BDC’s earnings will look like.

Spoiler Alert! Every BDC is showing lower earnings, especially if you assume rates will drop by 100 basis points or more.

Not So Fast

The Bulls will respond that we’re not going back to a zero interest rate regime – ever. As a result, BDC yields – even when spread compression is figured in – will continue to be materially better than they were in 2021 when the average SOFR rate was 0.4%…

In fact, even when the Fed’s rate cutting campaign ends in 2026-2027 (nobody really knows when) the base rate on which most BDC loans are priced should well exceed the average rate in 2022 – which was 1.62%.

As the chart above shows, the Fed Funds rate – which translates into the SOFR rate – is expected to plateau at 2.9%

That’s a tidy (2.0%) further to go from the SOFR rate right now, but well above the 1.0% or so effective rate BDCs were using in 2021 when “floors” were figured in.

A Bull would also add – if they could get a word in at this time of increasing bearishness – that even 2.9% might be too low a final resting place for the reference rate.

A strong economy might keep most BDC portfolio companies performing well and able to sustain SOFR anywhere from 3.0%-4.0%.

Forewarned Is Forearmed

This same voluble Bull might also add that BDC managers – some of the best and brightest in the private credit industry – have been planning for lower interest rates ever since the Fed began to move them up.

The top players have piled up undistributed earnings to support their existing regular distributions over the long term and many have kept dry investment powder at hand to offset lower yields with larger portfolios.

Moreover, most BDCs will also be beneficiaries of lower interest rates in terms of their funding costs and shareholders will benefit as incentive fees come down as managers will share the pain of any NII decline.

Elephant In The Room

The biggest unknown is how bad credit might impact BDC earnings and book values going forward.

You’ve heard the apocalyptic predictions of some about some sort of systemic credit flaw in private lending brought on by under-regulation (this is usually advanced by banks and journalists) and an over-competitive, risk-ignoring cadre of leveraged lenders.

A picture is being painted that is reminiscent of the last great credit disaster – the GFC of 2008-2009.

This is very triggering for many market participants who remember the very real sense of doom that played across those years.

It’s easy enough to regard bad loans to companies like Pluralsight; Thrasio, Miami Beach Medical Group and the many others we review daily in the BDC Credit Reporter, as a sign that the Bad Old Days are making a comeback.

Nobody’s Perfect

We will concede that even some very well regarded BDCs have – with the benefit of hindsight – made some serious mis-steps and that there is some groupthink going on amidst some BDC rivals.

We’ve been a little surprised about how many top BDCs signed up for Annual Recurring Revenue (ARR) loans to software companies or believe/believed that e-commerce aggregation was a sector worth lending to and likewise willing to risk dollars on controversial industry niches like for-profit–prison businesses.

The BDCs – and their shareholders – are likely to end up paying the price in terms of realized losses and forgone income.

Yes, But

However, the BDC sector remains remarkably diversified across borrowers big and small, and located both in the US and abroad.

Moreover, most BDC exposure in 2024 – by contrast with 2008-2009 – is high up on borrowers balance sheets, providing lenders with the greatest amount of control possible when the you-know-what hits the fan.

BDC managers have the time, the capital and the personnel to fix what gets broken or – at the very least – exit with as little damage as possible.

We don’t see an elephant where BDC credit is concerned but a normal fluctuation up and down in credit performance that will remain within a containable range – as has been the case for the last 15 years.

Overall credit results might get worse and it’s quite possible that BDC managers – who are paid to be optimistic – have overstated some of the ultimate values of what they hold.

But, we just don’t see anything ahead from a credit standpoint than the normal turbulence that comes from lending to thousands of leveraged companies.

Latest

It’s a small sample but this meshes with the very new non-accruals that have shown up in the IIIQ 2024 results to date.

Many BDCs have been able to claim that the number and value of their overall under-performing investments have actually improved of late.

This includes Ares Capital (ARCC) whose portfolio accounts for nearly a fifth of all public BDC assets.

Last Word

The evidence we’ve seen suggests BDC fundamentals will remain strong and performance should outshine all but 2023 and 2024’s results.

However, that may not help BDC prices in the here and now, especially if the unsettled conditions of the last week continue.

Of course, we’ll be very interested to see how the coming week plays out with the election; the Fed meeting and Week Two of BDC earnings season.

These could be times that try our souls.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.