Horizon Technology Finance: What’s Gone Wrong?

Premium FreeAGENDA

With so many BDCs reporting results during earnings season, we’re limiting ourselves to writing articles about those whose performance is considerably at variance with what the markets expected. Through April 29, only 3 BDCs had reported. The two earliest – Oxford Square Capital (OXSQ) and Ares Capital (ARCC) – have more or less performed to plan, and the stock price of both are largely unchanged since reporting on April 25 and April 29 respectively.

On April 30, 2025 Horizon Technology Finance’s (HRZN) stock price – in the aftermath of the reporting of its IQ 2025 results the afternoon before – fell (17%) to close at $7.44. This was an all-time low price for the BDC.

In this article we’re going to review HRZN’s latest earnings, 10-Q and conference call to determine why investors have reacted so unfavorably to the latest results. We will also ascertain – as best we can – whether any further decline in investor support is likely.

AGENDA

ANALYSIS

Everything But...

As this comparison of HRZN’s key metrics for the IQ 2025 and the IVQ 2024 shows, there was little difference in performance in the most recent period:

- NII of $10.7 million, or $0.27 per share, compared to $10.4 million, or $0.27 per share for the prior quarter period

- Total investment portfolio size of $690 million as of March 31, 2025 versus $698 million as of December 31, 2024

- Annualized portfolio yield on debt investments of 15.0% for the IQ 2025, compared to 14.9% in the IVQ 2024.

- Raised total net proceeds of $3.6 million with “at-the-market” (“ATM”) offering program versus $18.8mn

- Experienced liquidity events from five portfolio companies in both periods

- Retained undistributed spillover income of $1.00 per share as of March 31, 2025, slightly down from $1.06 per share

- Declared distributions of $0.11 per share payable in July, August and September 2025, unchanged from the first half of the year.

Exception

However, the BDC’s net asset value came to $305.5 million, or $7.57 per share, as of March 31, 2025, sharply down from an asset value of $336.2 million, or $8.43 per share 3 months before.

That was a (10.2%) decline.

Slippery Slope

Since 2019, HRZN’s NAVPS had fallen through IVQ 2024 by (29.2%), including a (13.2%) decline in all of 2024.

This latest decline is the eleventh quarter in a row and the largest single quarter loss yet.

Furthermore, we learned in “Subsequent Developments” in the filings and on the conference call, that further write downs – and a further non-accrual – are coming in the IIQ 2025, reducing NAV even further than shows in the March 31, 2025 metrics.

More on that in a minute.

Unrealized Depreciation

The BDC booked ($32.2mn) in net unrealized losses in the IQ 2025.

To put that into perspective, that’s close to 10% of the BDC’s net asset value at the end of 2024 and as much as the BDC wrote down in this fashion in all of last year and is also equal to about three-quarters of recurring earnings last year.

During the three months ended March 31, 2025, net unrealized depreciation on investments totaled $32.2 million which was primarily due to (1) the unrealized depreciation on three of our debt investments and (2) the unrealized depreciation on two of our equity investments.

HRZN IQ 025 10-Q

Name Game

We’ve done some sleuthing and determined some the companies involved seem to have been Standvast Holdings (loss of $6.8mn, mostly in debt); Swift Health Systems ($17.7mn written down, in debt and equity ) and Provivi Inc ($0.9mn written down)

At The Feet Of…

Management blamed the uncertainty around the trade rules for this sharper than expected setback:

…The macro environment, including tariff-related uncertainty over the past several weeks has dampened our optimism and directly impacted our potential recovery from some of our stressed assets, which was a significant factor in the decrease in our NAV at the end of the quarter. Until the worldwide volatility in the market subsides, the venture capital ecosystem is unlikely to return to the positive path forward, which we had hoped for earlier in the year.

More Non Performers

As of March 31, 2025, there are now six investments on non accrual status with a cost of $61.5 million and a fair value of $11.7 million versus four investments in the IVQ 2024 with a cost of $44.8 million and a fair value of $10.5 million.

The new non-accruals are Standvast and Swift Health.

We calculate about ($2.8mn) of annual income is being forgone as a result of the defaults.

Already on non-accrual previously are NextCar Holdings (also owned by Trinity Capital); Unagi Inc. (whose FMV is zero); Hound Labs and Better Place Forests.

More Underperformers

As this chart below shows, HRZN’s own rating system has identified 12 loans and $70.1mn of fair value assets in its two weakest credit categories: 1 and 2.

Summary Table: Internal Credit Ratings (as of March 31, 2025)

| Rating | Description | # of Loans | Fair Value ($M) | % of Portfolio |

|---|---|---|---|---|

| 4 | Highest quality | 11 | 159.2 | 24.7% |

| 3 | Standard risk | 30 | 414.7 | 64.5% |

| 2 | Increased risk, potential for future loss | 5 | 54.2 | 8.4% |

| 1 | Deteriorating quality, high risk of principal loss | 7 | 15.5 | 2.4% |

A quarter before there were 11 loans valued at a rating of 1 or 2 with a FMV of $59.3mn.

Independent

The BDC Credit Reporter undertakes its own review of HRZN’s portfolio.

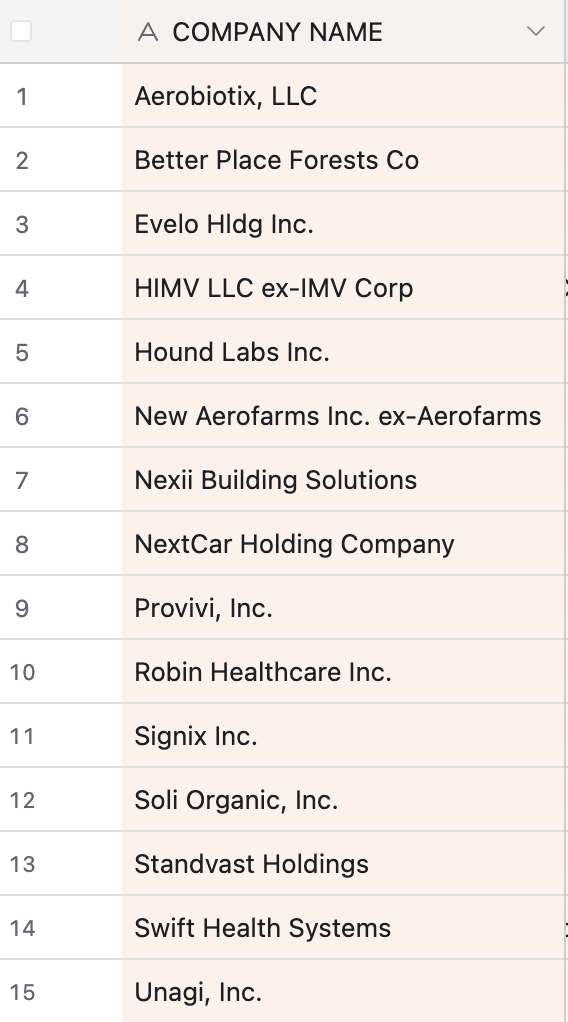

Out of 55 borrowers in the HRZN portfolio, we believe 15 are distressed. We maintain company files on all these names, which we are in the process of updating.

Of the 15, many have already been restructured in some way in recent years and – in some cases – partial realized losses already booked.

Here is the list, alphabetically arranged:

Latest. Not Greatest

As mentioned earlier, one of these companies – Soli Organic – has encountered new difficulties since the end of the IQ 2025, which is likely to change its next valuation and cause the company to be added to the non-accrual list.

Here’s the “Subsequent Events”:disclosure:

On April 28, 2025, the assignee of Western Alliance Bank’s loans to Soli Organic, Inc. (“Soli”) issued a “Blockage Notice” to Horizon under a certain Subordination Agreement by and between Western Alliance Bank and Horizon. The Blockage Notice stated that a default occurred under the assignee’s loan to Soli and that Horizon was blocked from receiving any payments from Soli in connection with Horizon’s debt investment in Soli until the assignee was repaid in full and that Horizon was blocked from exercising any rights or remedies with respect thereto for a period of up to 180 days.

This is how management explained the situation on the latest CC:

So we’ve been working with the senior lender, the management team and the investors on Sole for a number of quarters now. As new capitals come in, they look for external investors or an acquisition of the company that’s been occurring for — that’s been a process that’s been ongoing for a while. And we continue that dialogue now and there is activity going on.This late notice that we got from the senior lender was just part of that process. And as they get to the finish line on some of these situations that are evolving and we believe we’ll be successful the senior lender needed to take this action. So we needed to disclose it and we did. But their dialogues have continued to happen with all parties.

Management – in an answer to an analyst’s question – conceded the valuation would need to be reduced in the IIQ 2025 and the loan placed on non-accrual.

Daniel Raffaele Trolio Horizon Technology Finance Corporation – Executive VP, CFO & Treasurer

So as related to non accruals, this just occurred as far as getting the blockage and looking into the default and looking into that currently. So if we don’t collect any interest payments as has been noted in the blockage, then yes, that will have to be a non accrual

The consequences are likely to be material.

HRZN has invested $22.6mn at cost and has been generating over $3mn of annual interest income.

If the investment – currently valued at $20.4mn – were to be written to zero, the value per share would be ($0.51), bringing HRZN’s NAVPS to $7.06 – a further, pro-forma (6%) drop from the IQ 2025 level.

Also on a pro-forma level, this might reduce HRZN’s $0.27 per share in NII to $0.25.

More Value Erosion

Of course, the future valuations of the distressed companies are not known.

We can report, though, that 7 of the 15 companies we’ve identified saw their latest values materially fall in the IQ 2025 over the IVQ 2024 level.

This suggests the odds are high that further write-downs are ahead that might shortly take HRZN’s NAVPS down below $7.0 a share just in 2025.

VIEWS

Not Unreasonable

The huge drop in HRZN’s stock price is a rational response to a very real – and material – reduction in HRZN’s income generating capabilities and book value.

Furthermore, the damage was not isolated but involved multiple companies, continuing a multi-year downward credit and income drift at the venture BDC.

In And Out

Frankly, we’ve been surprised/impressed that management has managed to raise over $170mn in new equity since its NAVPS began to deteriorate in the IIIQ 2022.

Our calculations, though, suggest losses have amounted to approximately ($160mn) in that period of time.

That leaves HRZN with net assets of $305mn at the moment, only marginally higher than $290mn in mid-2022, but with 65% more shares outstanding.

Net Investment Income Per Share (NIIPS) was $0.35 in mid-2022 and is now nominally $0.27, but should probably be considered to be on a $0.25 a quarter running rate after adjusting for Soli.

Further income could be lost if matters deteriorate at Provivi Inv. ($14mn of loans) or Aerobiotix Inc. ($5.2mn of loans) to name two underperformers still current.

Then there is always the possibility that one or more of the 40 companies not in distress might slip into the underperformers column.

New York Minute

Unfortunately, companies can go from being fully valued – in HRZN’s system – to being greatly discounted and on non-accrual in a very short period – sometimes just one or two quarters.

For example, Hounds Labs debt was valued at par in the IQ 2024. By the IIIQ 2024, the debt was in default and discounted (34%).

Dangerous

This makes HRZN the epitome of a “falling knife” for BDC investors because there is so much uncertainty about the quality of the investment portfolio.

The BDC has a new owner – French asset manager Wendel – but the same management team and investment strategy that has caused its NAVPS to drop a possible (40%) since mid-2022.

There is every reason to believe that the deterioration in HRZN’s NAVPS will continue and for an indefinite period.

Not A Good Time

Adding insult to injury, the current high level of uncertainty in the markets is making only more likely that further shoes will drop.

Management conceded as much on the CC:

in the last couple of quarters, we’ve come very close on a couple of our portfolio companies from getting what looked like reasonable exits. And the buyers essentially pulled back, especially over the last 90 days, just literally pulled back.

And the reasons we got were basically they were frozen. They needed more indications about overall market volatility before they were willing to move. So that’s the market we operate in today. And it’s frustrating at times. But again, to some of the quality portfolio companies we have, there is interest in high-quality technology companies. Because at the end of the day, the kinds of companies that buy these companies need new technology as they move forward.So there is a bit of a pull toward those kind of companies. But there just isn’t enough in the market today to be able to say with great confidence, what’s going to happen over the next couple of quarters. We need greater certainty in a lot of the macro issues that everybody is quite aware of.

Can’t Continue

The BDC’s stock price may yet fall further, especially as it seems unlikely that the BDC will be able to come close to “covering” its quarterly distribution of $0.33 a share in the rest of the year.

The analysts are projecting IIQ 2025 NIIPS will be $0.28, but we expect that projection to be revised downward.

$64,000 QUESTION

“Value investors” must be asking themselves – after such a big drop in HRZN’s stock price – whether a buying opportunity has opened up. seven times since October 2021 – when the stock was last at a peak – we’ve seen an uptick in the price only for it to slump back. have we reached a turning point, or at least a plateau? thats the question bdc best ideas will be debating shortly in an article for its premium subscribers.

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.