New Mountain Finance: IQ 2025 Conference Call Summary

What’s It Going To Take?

NEWS

Here is the entire summary of the New Mountain Finance Corporation (NMFC) Q1 2025 earnings call, with a first draft prepared by AI and then edited by the BDC Reporter and covering results as of March 31, 2025, with the call held on May 6, 2025.

The management of the mid-sized, upper middle market BDC covers a great deal of issues on this conference call. We’ll be discussing – in the Views section below – one important item discussed below: what the BDC is doing to revive its moribund stock price, currently trading at a big discount to book and (34%) below its all-time high.

New Mountain Finance Corporation (NMFC) Q1 2025 Earnings Analysis

NMFC reported “stable financial performance”in the first quarter of 2025, demonstrating “resilient credit quality despite market volatility”. This report analyzes key metrics, portfolio composition, strategic initiatives, and future outlook for this business development company.

Financial Performance Overview

NMFC delivered solid results for Q1 2025, with adjusted net investment income of $0.32 per share, fully covering its quarterly dividend of the same amount, but only because management – as previously promised – waived a portion of its fees. The company’s net asset value (NAV) per share declined slightly to $12.45, representing a modest decrease of ($0.10) or (0.8%) basis points from the previous quarter.

The BDC’s balance sheet remained well-structured with total assets of $3.2 billion against total liabilities of $1.9 billion, of which $1.5 billion was statutory debt. NMFC maintained a statutory debt-to-equity ratio of 1.15:1, or 1.09:1 net of available cash, positioning it in the middle of its target range of 1.0x to 1.25x.

Total investment income was $86 million, representing a (5%) decrease year-over-year, while total expenses also decreased by (4%) to $51 million, which included a ($1.5 million) permanent waiver of incentive fees in connection with the so-called “dividend protection program”, which lasts through 2026 and kicks in when operational earnings are insufficient to “cover” the $0.32 quarterly dividend. This was the first quarter the Dividend Protection Program – first instituted in 2024 – was invoked. As a result, the company was able to announce a Q2 2025 dividend of $0.32 per share. The book yield (annualized dividend to the latest NAV Per Share is 10.3%).

Portfolio Quality and Composition

NMFC’s investment portfolio demonstrated strong credit quality with 96.5% of investments rated “green” on their internal risk assessment scale, and no companies rated “red”. Only 1.2% of the portfolio was rated “orange,” representing their most challenged positions, with non accruals remaining low at just $38 million or 1.2% of total investments. Importantly, there were no negative risk rating migrations during the quarter. No new non-accrual was added either on NMFC’s balance sheet portfolio or in its joint venture.

The company’s investment strategy continues to focus on senior-secured lending, with 77% of investments being senior in nature (including first lien loans, SLPs, and net lease), up from 75% in the previous quarter. Second lien positions represent just 6% of the portfolio, while equity investments account for approximately 8%.

Industry Exposure and Tariff Resistance

NMFC maintains a diversified portfolio across 119 companies, with investments primarily concentrated in defensive, non-cyclical sectors such as healthcare, information technology, software, and business services. The company emphasized its minimal exposure to tariff-sensitive industries, identifying only one position representing 0.6% of total fair value with material exposure to foreign tariffs. This stands – according to NMFC which quotes this statistic without support – “in stark contrast to the BDC sector average of approximately 13% exposure to tariff-sensitive industries”.

The average yield of NMFC’s portfolio decreased modestly to 10.7% in Q1, primarily due to the downward shift in the forward SOFR curve and repayment of higher-yielding preferred equity investments. The average EBITDA of portfolio companies decreased to $170 million, though this was largely due to the realization of some larger companies during the quarter, partially offset by underlying growth in individual borrowers. Portfolio loan-to-value ratios remain “conservative” at 43% on average.

Strategic Initiatives and Capital Management

NMFC continues to make progress on several strategic initiatives outlined in February 2025. The company is actively reducing its percentage of PIK (payment-in-kind) income, which decreased from 19% to 17% in Q1, with management targeting further reduction to 10-12% in the future. This strategy aims to improve the quality of investment income and address market concerns about non-cash earnings.

The company successfully repriced its Wells Fargo credit facility from SOFR+2.15% to SOFR+1.95% and extended the maturity to March 2030, demonstrating its ability to optimize its liability structure. With nearly $1.2 billion available on revolving lines (subject to borrowing base limitations), NMFC maintains substantial liquidity to cover its unfunded commitments of $250 million and navigate market volatility.

Management highlighted its focus on reducing concentrated positions, with material partial repayments in UniTek and line of sight on a full repayment of Office Ally, a 2.5% position. The company’s Board has authorized a $47 million stock repurchase program, with management indicating plans to be active in the market given the current share price trading at a 21% discount to book value.

Notable Transactions and Portfolio Changes

In Q1 2025, NMFC originated $121 million of new investments, offset by $187 million of repayments and sales. Notable repayments included preferred equity investments i which represented opportunities to collect previously accrued PIK income in full. The company collected $32 million of PIK income from these partial exits.

A significant transaction involved UniTek, where NMFC received $42 million from a partial sale in a prior period while retaining a stake valued at $67 million. This transaction realized gain and monetized accrued PIK income while maintaining exposure to a company that has shown substantial growth under New Mountain’s oversight. Management indicated that UniTek has emerged as a leading service supplier to broadband companies and a rapidly growing universe of AI data centers.

Looking ahead to Q2, NMFC expects to monetize approximately $15 million of non-yielding equity through the announced sale of Office Ally, with plans to redeploy this capital into cash-yielding loans. The company’s cost basis in this investment is $2 million, highlighting the successful value creation in this position.

Market Outlook and Competitive Positioning

Management described the current market environment as challenging for new deal activity, with a pause in most M&A transactions due to recent market events. Despite this, the company sees episodic new deal opportunities and believes direct lending remains an attractive asset class that provides insulation from market volatility compared to other fixed income alternatives.

NMFC’s market positioning is strengthened by its focus on defensive growth sectors, which management believes have lower cyclicality and better prospects for consistent performance. The company’s targeted sectors align with New Mountain Capital’s private equity expertise, providing advantaged underwriting and industry insights.

Regarding interest rates, management noted that while a declining rate environment would create earnings pressure, the company is evolving its capital structure to help offset some of that impact. The loan portfolio is 85% floating rate and 15% fixed rate, while liabilities are currently 50% floating rate and 50% fixed rate, with expectations that this mix will shift toward 75% floating and 25% fixed after upcoming debt maturities.

Long-Term Performance and Future Outlook

New Mountain Finance Corporation’s management claims long-term track record demonstrates consistent performance since its IPO in 2011. The company claims to have returned approximately $1.4 billion to shareholders while generating only $29 million of cumulative net realized losses, representing an average annualized loss rate of just 7 basis points.

Looking forward, NMFC is well-positioned to navigate potential market volatility with its Dividend Protection Program in place through the end of 2026, providing up to $0.02 of additional dividend support per quarter if needed.

Conclusion

The AI Agent says “New Mountain Finance Corporation delivered solid first quarter results that demonstrate the resilience of its investment strategy amid market volatility. The company’s focus on defensive, non-cyclical sectors with minimal tariff exposure, combined with its predominantly senior-secured lending approach, positions it well for stable performance even if economic conditions deteriorate.

Management’s progress on strategic initiatives-including reducing PIK income, optimizing the liability structure, and decreasing position concentrations-addresses key investor concerns while strengthening the overall portfolio. The significant discount to NAV at which NMFC’s shares currently trade may present an attractive opportunity for investors seeking stable income with potential capital appreciation as the company executes its strategic plans and continues its stock repurchase program.

As the direct lending landscape evolves, NMFC’s disciplined approach to credit, strong liquidity position, and alignment with shareholders through management ownership provide a solid foundation for consistent performance and attractive risk-adjusted returns in the medium to long term”.

VIEWS

Eye On The Prize

NMFC’s managers are very much aware that the BDC’s stock price – as they admitted on the conference call – has traded down for an extended period and the reason – in their minds – is their high level of PIK income and assets:

“To some degree, we feel like we’ve gone out of fashion a little bit. We have a lot of really good PIK investments that are going to make our shareholders a good amount of money. But really, I think what the market wants are lower PIK levels, and we understand that, and we’re working to deliver that”.

NMFC IQ 2025 conference call

The goal is to bring PIK income down from 17% of total investment income to 10%-12%.

Some progress was made in the IQ 2025 and more is on the cards.

Buy In

Management is also tackling the subject indirectly by instituting a stock buyback program given that NMFC is trading substantially below book and with the loan markets slow and spreads still tight, this seems like a sensible strategy.

The result might also be a boost to the BDC’s NAVPS at a time when this metric is being eroded.

Enough?

Will that be enough to make NMFC “fashionable again”?

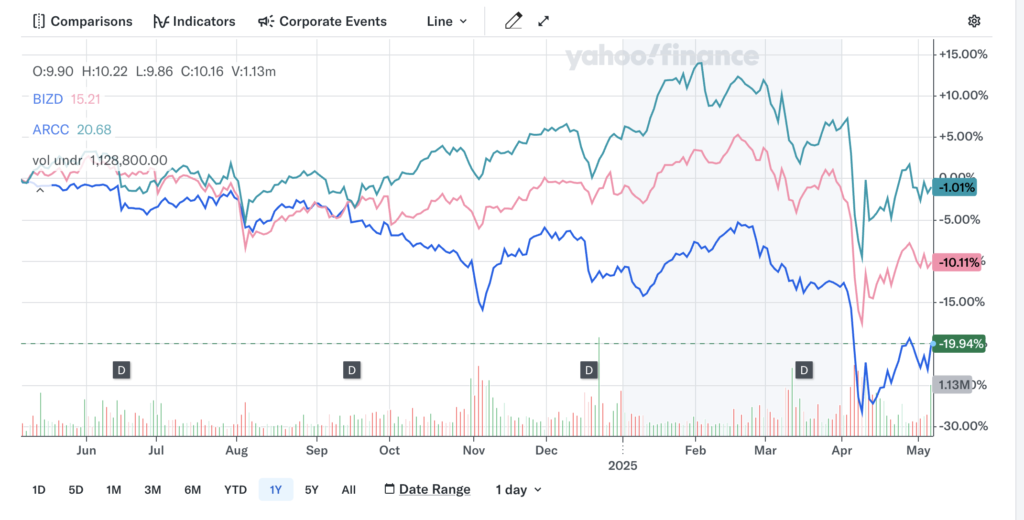

As this chart shows – comparing NMFC’s stock price to Ares Capital (ARCC) and the BDC sector (BIZD) in the last year – there’s a good deal of ground to be made up:

With NMFC’s stock price at $10.16, a 23% price increase will be necessary to get back to book value.

Missing

We’d suggest that NMFC will have to do more than “normalize” its degree of PIK income in its P&L.

As an analyst pointed out, the SOFR yield curve is pointing down and – if followed – could push investment income down later in the year (3 cuts? 4 cuts) and cause additional pressure on NMFC’s recurring earnings, already being subsidized by the manager.

(Late in 2024, NMFC was opining that the Dividend Protection Plan would not be called on, but here we are).

Deja Viewed

We’ve approached this issue before in an article back in November 2024.

Here’s are the suggestions we made then, which seem as relevant as ever:

-Undoubtedly making progress on reducing the proportion of PIK income would be greeted favorably by the market even if the perverse result might be lower revenues in aggregate, as cash loans tend to have less impressive yields.

-Good news from the SBA in the form of a new SBIC license – which would help to wrestle down overall borrowing costs.

-Exiting at a profit – or even at par – a handful of the equity investments on the books.

Further concessions by the external manager on compensation. The waivers offered of late have largely not needed to be used and are time limited. A reduction of the management fee to 1.00% of assets – similar to what Goldman Sachs BDC (GSBD) charges – would make a material difference.

-Continuing – as in the IIIQ 2024 – to not add any new non-accruals to the portfolio.

BDC Reporter – Why Is New Mountain Finance’s Stock Price Under-Performing – November 18, 2024

Since we wrote that article, NMFC’s stock price has dropped (12%).

The market clearly believes there’s a lot more to be done before NMFC can join peers like ARCC, Blackstone Secured Lending (BXSL) and Sixth Street Specialty (TSLX) trading above book value.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.