OPINION: The BDC Reporter Disagrees With Bloomberg Regarding The State Of The BDC Sector

Premium FreeINTRODUCTION

We rarely get this way but we’ve been peeved for several days about an article in Bloomberg called “BDCs, Private Credit’s Most Popular Funds, Are Drawing Scrutiny”. The piece is part of a broader phenomenon we’ve been noticing in our readings that seeks to conflate what is going on in the world of non-investment grade credit with developments in the public BDC market.

Below we will de-construct the entire article and make our case about where we believe the authors have gone wrong. Our purpose is provide a different perspective on a trend in the financial zeitgeist right now which argues that “cracks” are appearing in leveraged credit which could have serious consequences for the American – or even – global economy. We’ve already experienced significant drops in prices in different segments of the market as the drumbeat of “concern” grows louder.

We can’t speak to the entire non-investment grade credit universe. However, we can strongly suggest that the way Bloomberg – and others – are using what is happening to the public BDC market as a proxy for a much broader subject is wrong headed and may cause investors to draw the wrong conclusions.

Here we go. First we will copy the article section by section each time followed up with our own commentary, leaving it to our readers to decide if they agree or disagree with our critisahq.

BDCs, Private Credit’s Most Popular Funds, Are Drawing Scrutiny

By Olivia Fishlow and Davide Scigliuzzo

October 18, 2025 at 8:00 AM PDT

“One of private credit’s favorite fund structures has emerged as a new battleground for traders and Wall Street executives looking for signs of weakness in the market.

Publicly traded business development companies, which bundle private credit loans in a fund that can be traded like stocks, are getting hit in the wake of the bankruptcies of Tricolor Holdings and First Brands Group. That’s reigniting fears about underwriting standards and valuations across the $1.7 trillion private credit industry.

This is a matter of “correlation is not causation”. Bloomberg has the timeline all wrong. BDC stock prices – which we write about every week in this publication – peaked in mid July and began to decline weeks before the first rumors began to appear about Tricolor in early September and First Brands in mid-month. The most likely “causation” of the sector’s price drop was the ever growing certainty – which ultimately reached almost 100% of economists polled – that interest rates were going to be cut – and repeatedly. Proving the point even more is that while the broader credit markets have been wringing their hands about “credit conditions” in recent days, BDC prices have actually been moving up – 4.5% in the past week from the sector’s 52 week low. The BDC sector’s price swoon has little to do with credit fears, which sort of defeats the point of the rest of the article. Nonetheless, we shall carry on…

BDC REPORTER

While Tricolor and First Brands both raised significant financing in the public markets and were backed by banks, problems for both companies originated in opaque and complex funding instruments that drew investor skepticism and put markets on edge over other problems that could be lurking. BDCs have become a place to express those fears.

See the above. Also – as the authors appear to concede – neither Tricolor nor First Brands had much to do with public BDCs. The former involved no BDC whatsoever, being purely a matter for the banks, who seem to have been hoodwinked. First Brands is a much bigger credit disaster with more than 10x more capital invested. Yes, a number of BDCs were caught up in what was most almost certainly a massive fraud but the dollar amounts involved were modest in a relative sense – probably less than 2% of all the debt of one sort or another advanced to the company. JP Morgan will probably end up booking a biggest loss on Tricolor than all the BDCs with exposure to First Brands combined. Nor were the BDCs involved in “opaque and complex funding instruments” but in a traditional syndicated Term Loan. These sort of reverses happen in leveraged lending on occasion. Remember Pluralsight last year, which involved 400% more BDC capital. However, we should point out that all the biggest asset managers running public BDCs managed to avoid getting involved with First Brands, which might reflect well on their credit underwriting process. Or maybe they were just lucky.

BDC reporter

“Ultimately, a lack of transparency means we don’t know what’s happening in these private credit portfolios; hence we are flying blind to some extent,” said Michael Anderson, global head of credit strategy at Citigroup Inc.

We don’t know in what context Mr Anderson made that comment above. We don’t know if he was even talking about public BDCs. However – as any BDC investor or analyst will tell you – public BDCs are highly transparent. Every investment in their portfolio is valued by an independent firm every quarter and the data made available to one and all. Moreover, BDC managers are constantly providing updates about the credit status of borrowers fallen on hard times on their conference calls. Great Elm Capital (GECC) – one of the BDCs involved with First Brands for about $50mn went so far as to provide hyper detail about their likely losses of capital and income in a press release last week. True “Private Credit Funds” might lack transparency but not the $150bn in BDC investment assets. If anything, we’d say public BDCs are the most transparent of all the different kinds of credit segments out there.

BDC reporter

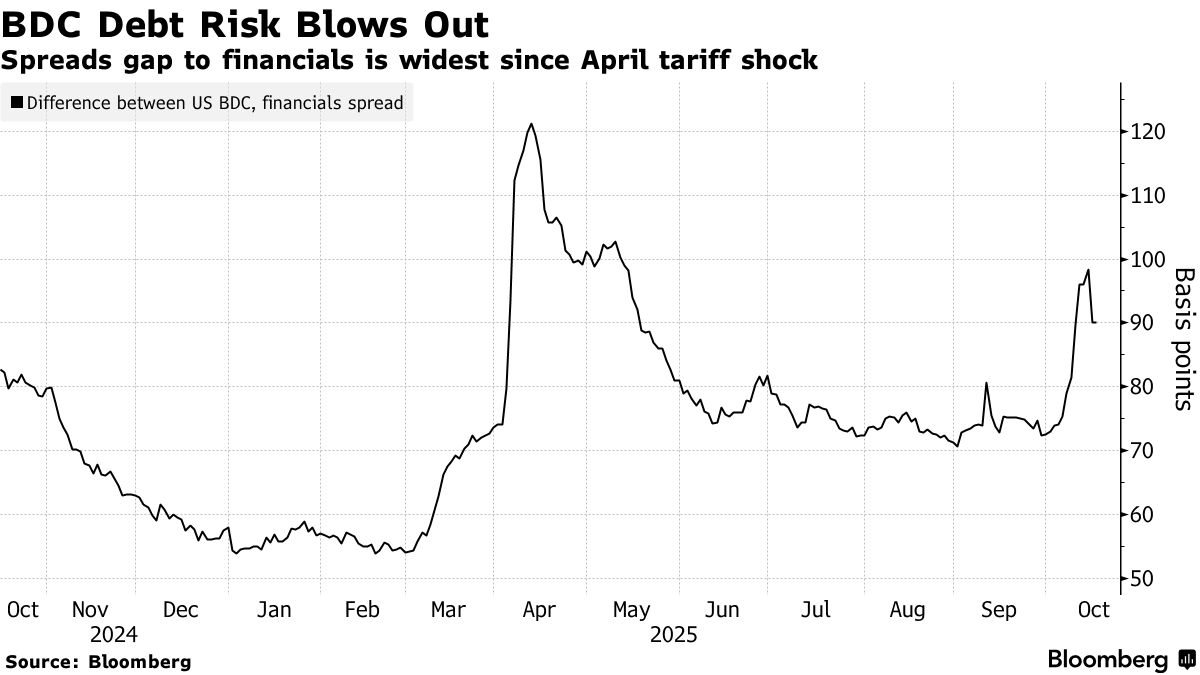

BDC stocks have dropped to multi-year lows in recent days, while spreads on the bonds the vehicles — issued to boost their investing firepower — have widened, in some cases to the highest levels since April’s global tariff turmoil.

Meanwhile, concessions on newly minted bonds — the extra yield that issuers offer to entice buyers — have more than doubled since January, rising from around 3 to 5 basis points to more than 12 basis points, according to data analyzed by Bloomberg News.

Bloomberg seems to be suggesting that this supposed change in BDC bond spreads indicates some profound loss of favor. We can’t speak to the data mentioned and the article is somewhat vague as to what source material is being quoted. However, the BDC Reporter does track weekly changes in BDC Baby Bonds – a subset of the unsecured debt being discussed here and we’ve not witnessed any great price movements that might suggest some deep unease. In fact, BDCs have been borrowing both from the Baby Bond and institutional debt market at a record pace this year and with some very favorable outcomes. For example, Ares Capital (ARCC) issued 2031 unsecured notes in September – just as the problems were occurring at Tricolor/First Brands – and only paid a yield of 5.1%. That’s cheaper than what the BDC would pay on a secured, shorter term bank revolver. BDCs might well be paying 12 basis points on new bond “concessions” – rather than 3-5 bps – but that’s still a long way from being a valid market signal.

BDC reporter

The market selloff did ease a bit this week, though investor anxiety persists over the quality of loans held in BDC portfolios. That leaves investors nervously awaiting BDC earnings disclosures in the coming weeks.

Adding fuel to the fire, JPMorgan Chase & Co.’s Jamie Dimon called out the steep discount to book value at which many BDCs are trading as an area where investors should do more homework. That prompted a quick retort from Blue Owl Capital Inc.’s Marc Lipschultz, who said Dimon better look for trouble in his own house.

Read More: Dimon Cockroach Barb Bursts Uneasy Truce With Private Credit

As Jamie Dimon knows better than most – and Bloomberg should know – a stock selling at a discount to book has a lot more to do with its anticipated earnings power over time than as a commentary on credit loss expectations. Again we refer you to the market view that short term rates will be dropping and – as everyone knows – BDCs loan yields are tied to those rates. Lower yields translates into lower earnings and then into lower distributions. No wonder BDC prices have been dropping. Mr Dimon’s comments are disingenuous.

bdc reporter

While pressure on the stock price of BDCs only becomes an issue for investors looking to withdraw their money, elevated credit spreads on the vehicles’ own debt ultimately raise the cost of funding for managers and can make it harder for them to underwrite deals at rates that are attractive for borrowers.

The authors have now gone from noting a slight increase in BDC unsecured debt borrowing costs to presuming this will translate into a full blown spread crisis when making new loans, making “it harder for them [the BDCs] to underwrite deals at rates that are attractive to customers”. This is patently over-dramatic. First of all – even if true – BDC CFOs have access to new capital on their floating-rate secured Revolvers and on-balance sheet securitizations which often account for 50% or more of their debt. Those facilities are already dropping in cost and – if you believe the market consensus – are going to be getting a great deal cheaper as the Fed cuts and cuts. Then there’s all the cash many BDCs are sitting on, ready to be deployed and – even now – At The Market (“ATM”) new common shares to be issued. There is simply no liquidity or spread crisis in the BDC sector and the impact of any widening in BDC borrowing costs for unsecured debt – should it even continue – will have no material impact .

BDC reporter

“Softness around BDC debt issuance could be explained by a slower equity growth outlook for the asset class,” Finian O’Shea, an analyst at Wells Fargo & Co., said in an interview, arguing that he doesn’t see the move as a sign of a credit issues, but rather softening demand for the asset class.

The comment of the only BDC denizen quoted in this entire article – the redoubtable Finian O’Shea – does not even support the authors thesis that something is awry in BDC-land where credit is concerned, but “rather softening demand for the asset class”. Even that is likely to be temporary. BDC AUM growth has been spectacular in recent years. Three years ago – according to Advantage Data – the total cost of all BDC investments was $247bn. As of the IIQ 2025, the total had expanded to $484bn. We wouldn’t bet against further growth ahead.

BDC reporter

Some managers have made the case that publicly traded BDCs, which allow investors to trade in and out of portfolios on a daily basis, unnecessarily expose holders to swings in market sentiment, forcing them to take steep losses if they decide to sell their shares when the stock is trading at a steep discount to the net asset value of the fund.

“You’re just adding equity risk to your credit book,” John Christmas, co-head of business development at HPS Investment Partners said this week during a panel at the CAIS Summit, a gathering of alternative investment professionals in Beverly Hills, California.

We’re not sure what the ability of public BDC investors “to trade in and out of portfolios on a daily basis” has got to do with the subject of the article. However, we have to point out that the liquidity which public BDCs offer their common stock investors is one of their most appealing features. The BDC format takes a pool of illiquid assets, with maturities between 5-7 years and makes them available to all and sundry for either a short or long term hold. Moreover, as we’ve argued above, the BDC format provides investors with a great deal of transparency about what they are invested in. The public BDC format – to our way of thinking – is far superior to the equivalent non-traded vehicles where liquidity is concerned. Only a fraction of shareholders in non-traded BDCs can “get out” during times of stress, depending on the manager for repurchases which come with a cost and which can be suspended. Criticizing the ability of investors to trade “in and out” is like being against “motherhood and apple pie”. Maybe the fact that HPS Investment Partners sponsors a non-traded BDC but not a public one has something to do with their perspective.

bdc reporter

CONCLUSION

Bloomberg – and the rest of the financial press – rarely write about the BDC sector, except in passing. On this occasion – and in preceding articles we’ve read – we can’t help feeling that the journalists and editors involved have a superficial understanding of how this corner of the financial markets works. That’s a little surprising given that BDCs have been around in their current form – principally as financiers of leveraged buyouts – for over 20 years. The BDC format itself is even older, dating back to 1980 and an act of Congress.

Its a shame because Private Credit has become a Big Thing in recent years and BDCs are an important component of that $1.7 trillion phenomenon. What Bloomberg and others do not seem to understand, though, is that Private Credit is just a catch-all category and that its many components – including BDCs – are very different one from the other in many ways. This incudes how they are regulated; the sort of borrowers served; the nature of the facilities offered; the economics involved for both the managers and investors and the risk taking involved. As a result, this attempt to look into the belly of the Private Credit beast through a public BDC lens was always doomed to fail.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.