BDCs

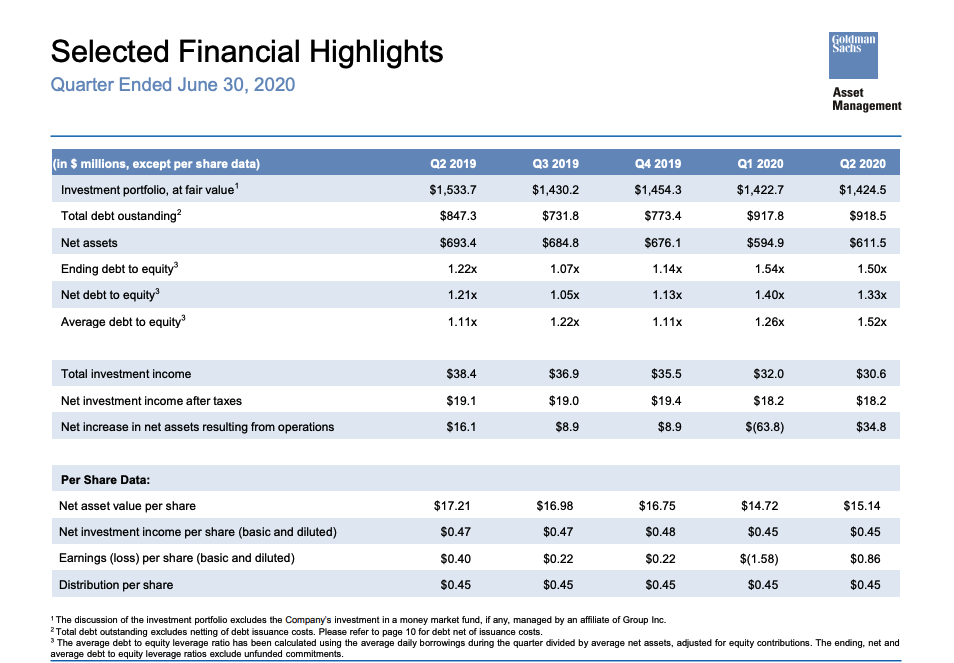

Goldman Sachs BDC

“We are a specialty finance company focused on lending to middle-market companies. We are a closed-end management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (the “Investment Company Act”). In addition, we have elected to be treated, and expect to qualify annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ended December 31, 2013. We seek to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, unitranche, including last-out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments.

We were formed as a private fund in September 2012 and commenced operations in November 2012, using seed capital contributions we received from Group Inc. In March 2013, we elected to be treated as a BDC. We have elected to be treated, and expect to qualify annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ended December 31, 2013. On March 18, 2015, our common stock began trading on the New York Stock Exchange (“NYSE”) under the symbol “GSBD”. On March 23, 2015, we closed our initial public offering (“IPO”), issuing 6,000,000 shares of common stock at a public offering price of $20.00 per share… On May 24, 2017, we sold 3,250,000 shares of our common stock at a public offering price of $22.50 per share. As a result of the Conversion, As of December 31, 2019, Goldman Sachs owned 16.06% of our common stock”.

Capital Southwest Corporation

OUR VIEW

Capital Southwest (CSWC) has a long and storied history, dating back to the early 1960’s. However, the company switched to BDC status only in 1988 and even then with a focus on equity investments in private companies. Finally, on September 15, 2015 a spin-off occurred of the company’s investment portfolio, leaving CSWC to carry on as a leveraged lender and investor. From the outset till today, the BDC has been internally managed, one of the few left. Bowen Diehl has been the CEO since the BDC’s rebranding as a leveraged lender, coming from the senior ranks of the now departed but once dominant American Capital. The rest of the senior management team arrived at about the same time, providing a stable group to build up the public BDC. From the outset – and in apparent blatant imitation of Main Street Capital – the business strategy has been to operate in both the lower middle market and in the upper middle market. In the former, CSWC seeks to lead loans and take equity positions in relatively small businesses, charging relatively high yields and hoping to benefit from eventual exits. In the latter segment, CSWC participates in much larger loans to much larger companies led by other institutions. Yields are lower but there is a bigger universe of potential borrowers and the investments are relatively liquid, if need be. In addition, the BDC has joined with Main Street – who else ? – in an off balance sheet joint venture focused on booking larger loans where CSWC is the enthusiastic junior partner. Like most every other BDC, CSWC has adopted the higher leverage rules allowed by the Small Business Credit Availability Act but has promised not to exceed debt to equity of 1.50x. So far, CSWC but has not yet got even close to reaching that self imposed ceiling. In a way, CSWC is a very young BDC and for its first few years in business had no credit losses, or even many unrealized write-downs. Furthermore, one major equity investment left over from its prior identity accounted for a disproportionate amount of its half a billion dollar portfolio. In a case of great timing, CSWC sold the business for a very great profit just before Covid-19 struck. However, as the years have gone by reality has set in and the BDC has faced – as all lenders do to varying extents – underperforming investments. As has happened with Main Street Capital, these are – ironically – principally concentrated in the supposedly “safer” larger loan group and in the JV. The Covid-19 crisis will be the first major challenge to the BDC’s credit underwriting in both segments. If CSWC is able to muddle through without too much damage, the outlook for the BDC is promising and should allow Bowen Diehl and Co to become a billion dollar BDC. Already, CSWC has received the promise of SBIC debenture funding (2% money !) and is a popular Baby Bond issuer, even attracting institutional investors – unusual for a BDC of this size. Current funding is neatly divided between secured and unsecured; providing healthy liquidity and the portfolio grows ever more diversified with every quarter. CSWC is doing most everything right except – perhaps – for its upper middle market lending which may prove an Achilles Heel. Credit skills will be the deciding factor going forward as most everything a BDC needs to be successful is already in place: a tight management team; a clear cut strategy ; ready access to both the secured and unsecured markets and sufficient liquidity to be a player whenever opportunity knocks.

OUR PROJECTION

CSWC has announced an unchanged payout through September 2020, a feat only about half the BDC universe has managed to pull off. We are projecting that the current $2.04 annual dividend – which consists both of a regular distribution of $0.41 per quarter and a special dividend of $0.10 representing capital gains already booked – will need to be reduced by (20%) two years out as credit losses from the Covid-19 crisis begin to erode earnings. That will drop the dividend to $1.6320 for the remaining period. As a terminal price, we’re assuming that CSWC will be valued at 12.5x its reduced dividend level – which should be close to earnings per share. Of course, results could be much worse or much better. On the positive side, if the BDC is able to duck a dividend reduction and is able to grab an SBIC license and occasionally book an equity gain when lower middle market companies are sold, earnings could even go higher than the current level. When we ran a Best Case scenario, the total return over 5 years was almost twice as high as what we’ve projected in the Expected Return Table. For the moment, though, we’re sticking with a modest pullback followed by earnings and dividend stability.

Click here for the Expected Return Table.

MidCap Financial Investment

ABOUT

“Apollo Investment Corporation, a Maryland corporation organized on February 2, 2004, is a closed-end, externally managed, non-diversified management investment company that has elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). In addition, for tax purposes we have elected to be treated as a regulated investment company, or RIC, under the Internal Revenue Code of 1986, as amended (the “Code”). Our common stock is quoted on The Nasdaq Global Select Market under the symbol “AINV.”

Apollo Investment Corporation operates as part of Apollo’s Direct Origination Platform which provides full service debt solutions to U.S. middle market companies. As of June 30, 2020, the Direct Origination Platform had approximately $25 billion of assets. The Apollo direct origination team consists of 200+ professionals which is bolstered by the Apollo Global Management, Inc. integrated platform. Direct origination encompasses an array of origination verticals including financial sponsors and select niche markets with high barriers to entry. In addition to sourcing direct originations, we also identify investment opportunities from Apollo’s deep relationships with Wall Street intermediaries.

FS KKR Capital Corp

OUR VIEW

FS- KKR Capital (FSK) is an unusual duck – an equal partnership between a privately-owned asset management firm with an incomparable ability to raise capital from investors (FS Investments) and the lesser known credit arm of a famous private equity group – now publicly traded – KKR & Co. However, before those partners joined together FS Investments had initially partnered up with another offshoot of a famous asset manager GSO/Blackstone, a subsidiary of Blackstone. ( In that case, GSO Blackstone was billed as sub-advisor, with FS Investments still in charge). With such a renowned family tree, you’d expect FSK’s performance since its establishment back in 2008 to be lustrous, but that’s not the case. Frankly, and we’ve been following the BDC since listing as a public entity in 2014, the results have been nothing less than poor. When GSO Blackstone was pushed or withdrew in 2017 and was replaced in December 2017 by KKR’s credit arm as external co-manager, we hoped for an improvement. Even as AUM has grown as FSK has gobbled up other non-traded BDCs managed by the two partners and by leveraging up in the wake of the relaxed leverage rules in March 2018, net book value and distributions per share have gone down and down. To the point that in 2020 FSK had to undertake a 4:1 reverse stock split to save the BDC from trading ignominiously under $5. Unfortunately all the financial engineering in the world – which includes a recently announced fund whose purpose is just to buy the BDC’s public stock – cannot readily cure FSK of its principal ailment: poor credit performance. Admittedly many of the troubled companies were booked in the Gso Blackstone days but that was years ago and still book value drops and the number of underperforming investments grows. The question has to be asked if KKR – responsible for all the investing – is capable of delivering in leveraged lending. Maybe the famous group has the wrong team or is attacking the wrong market -taking control debt positions in loans to very large borrowers or has just too much money where there are too few good quality deals. Thanks to FS Investments capital raising skills and KKR’s hallowed name amongst investors capital can always be raised. However, just because you can raise the capital should they ? In the years ahead FSK and its moneyed managers will have to prove they can stabilize credit performance and generate a steady and decent total return to shareholders. Unfortunately that critical test is occurring just as market conditions are at their worst since FS investments first brought the BDC to market.

PROJECTIONS

FSK has reduced its dividend multiple times, most recently to $2.40 a year. Nonetheless, we expect that a combination of lower LIBOR; loss of income from credit losses and the need to shrink the portfolio to stay inside leverage guidelines will force FSK to cut its payout again: to $1.20. That’s a 50% drop which seems high but the BDC does have one of the highest percentages of underperforming loans out there.

Click here for the Expected Return Table.

Page 1 of 3

Next