BDC Common Stock Market Recap: Week Ended March 13, 2020

Premium FreeBDC Common Stocks

Humongous

Fitting for a week that ended on Friday 13, BDC sector price results were terrible, even considering the rally in the final hours.

To state the obvious, this was a historic week that eclipsed during the week even the downturn of two weeks ago, when the BDC sector was down (11.5%).

This week, the Friday to Friday drop was (8.8%).

Reprieved

As our readers will already know, the downturn was even worse before the last-minute turn upwards.

The lowest point – in many ways – was on Thursday, when BDCS dropped as low as $13.84.

That was down from the pre-crisis price for BDCS of $20.54, just before the market panic began.

We were down (32.6%) in less than a month.

Group Think

However, at the Friday close all the indices – as if working in unison and dragging BDCS along – moved up, taking the BDC sector to $14.56.

Almost as impressive as the downward slide was this reversal of fortune, which saw BDCS move up 5.2%.

Up In Air

Impressive – to the mind of the BDC Reporter – because nothing was resolved even after the declaration of a national emergency.

A strong argument could be made that we are in the eye of the storm and that famous quiet that follows an initial battering, but precedes another one.

More on that when we look forward later in the article.

Memorable. Like The Hindenburg.

For the moment, let’s stick with the weekly metrics, which are amazing.

For example, no BDC was up in price on the week.

All 45 public BDCs we track were down in price.

Furthermore, all players were down (3.0%) or more.

In fact, there were BDCs out there whose stock price was more than (50%) down.

Way Off

The Biggest Loser in a week of universal losers was Garrison Capital, off (50.7%).

Next was Investcorp Credit Management (ICMB), which had held up at the beginning of the crisis, but fell (50.1%).

Overall, 44 of 45 BDCs were down (10%) or more…

On a total return basis over the last 12 months every BDC – with the possible exception of TPG Specialty (TSLX) which is only off (8.1%) in price – is in the red.

Sea Of Red

Just about everyone – frankly we lost track – reached a new 52 week low at some point in the week.

So don’t be too impressed when we report that only 9 BDCs are within 5% of their 52 week low.

That 52 week metric has been so much in retreat that its usefulness for the moment is questionable.

Above Par

More interesting is that the number of BDCs trading over book value has dropped to 3.

At February 21, 2020, there were 20 BDCs trading above book , equalling the YTD and 12 month record according to our database.

We were surprised that any BDC at all was above book – and intra-week two of the three dropped in price below their latest net asset value per share.

Those were TSLX and Hercules Capital (HTGC).

No prizes for guessing who managed to remain valued above book even in the BDC’s darkest hour: Main Street Capital (MAIN).

That popular BDC dropped as low as $24.41.

IVQ 2019 NAV Per Share was $23.91.

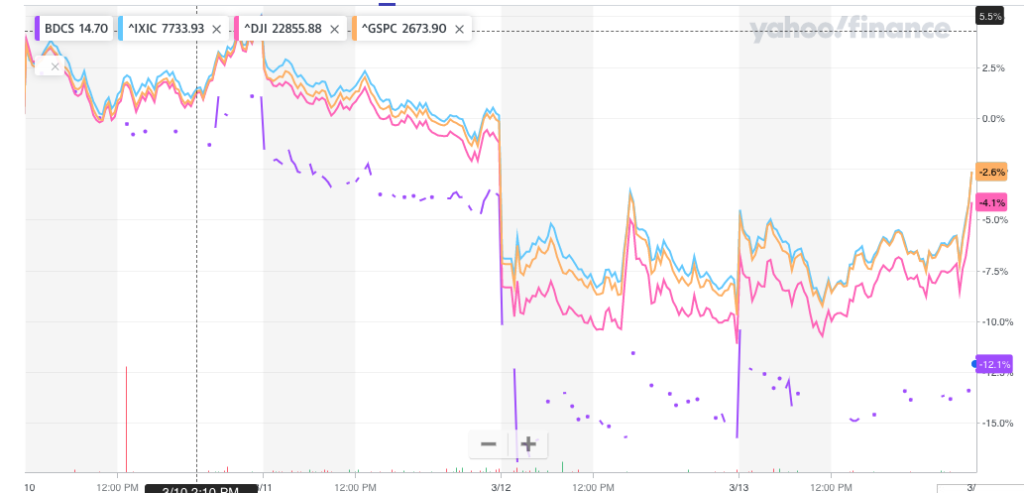

Overall, the BDC sector – which had out-performed the major indices in the early days (till February 28) of the market melt-down- fell behind during the week.

Here is the 5 day chart, comparing BDCS to the 3 major indices, which all managed to post much lower losses than the BDC sector over these 5 days.

Other Indicators

As you’d expect leveraged loan credit prices dropped by record amounts and public investors pulled capital out of the space like rarely before.

Even the bid-ask on loans that you’ll hear quoted in the financial press were more theoretical than real.

After all, what was the benefit to buyers of debt to try and catch the proverbial falling knife when their own portfolio values were being decimated ?

We’ve been looking at the price of syndicated and middle market loans on Advantage Data all week.

Obviously we have not reviewed every BDC-related name but the dozens that we have checked on all seem to have dropped by (8%-10%).

That’s for run-of-the-mill large sized B and BB companies.

Worse

Over in any of the industries on the front lines of the crisis (airlines; cruising; energy, etc) we imagine the discounts are even higher.

High yield also fell out of bed price-wise, with ETF JNK (for example) reaching the low of December 2018 in record time.

JNK, though, remains above the February 2016 level.

There’s a similar pattern in the Invesco Senior Loan ETF,with the ticker BKLN, which was down but still above the 2018 and 2016 levels.

Opinions Divided

Many commentators ratcheted up the chances of a recession coming as a result of the Covid-19 disturbances, but many thought the odds a toss-up.

The Treasury Secretary – whose job it is to keep chins high – thinks a recession is not going to happen.

Looking Forward

The BDC Reporter mentions all the above – and points to the big jumps in some BDC prices late on Friday – to get into a discussion of what happens from here to the BDC sector.

We’re on the record as being very cautious about the state of leveraged lending; BDC values and future stock prices.

Here are extracts picked from last week’s Recap which continue – despite the (8.8%) net drop last week – to be pertinent with a new week looming:

Our Jim Cramer Moment

To be candid – and to tie these comments about credit risks with this week’s stock price performance – we can’t help feeling that investors are being exceedingly complacent.

The bulk of investors seem more intent on not missing a rally opportunity than looking into the abyss of what might happen if Covid-19 plays out in the U.S. as it has in China and now Northern Italy.

…

Unfortunately – if we do get a full blown pandemic and an economy that grinds to a halt – the impact on BDC portfolio companies – and thus on BDC stocks – is likely to be much worse.

We understand – and pray – that the “worst won’t happen” but there is a reasonable and growing chance that it will, which makes the markets upside enthusiasm so disconcerting.

There may be a 10% upside for BDC stocks but there is a potential downside – if the Great Recession is any guide – of up to 80%.

Investors who will wear a mask to pick up their newspaper at the front door are prepared to tolerate much more risk where their capital is concerned.

Of course, that 10% upside is 41% from the current price to the February 20, 2020 high point.

Non Believer

Who, though, can reasonably assume that the economy; leveraged debt and the BDC sector can return even close to those heights ?

To our mind – and we’ve been whistling this refrain for a couple of weeks now – everything has changed in the key factors that impact BDC earnings and those are likely to be long lasting.

LIBOR has dropped enormously and may actually join the Fed Funds rate at almost zero.

Remember that between 2009 and 2015, 1 month LIBOR rarely bounced over 0.25%.

Down

That means BDCs – who were paying 2.50% – will see their key cost of funds indicator – drop by 95% or over (2.25%) in absolute terms.

We were at a 1 month LIBOR of 1.73% at the beginning of this quarter and have reached 0.81% at time of writing.

There’s plenty of room there – as loans get reset – for huge drops in lender investment income on floating rate loans.

(Let’s face it – though we don’t have the precise percentage – most all BDC loans are floating rate).

In the IVQ 2019 much damage to BDC bottom lines occurred due to a lowering LIBOR but that will be much worse in the IQ 2020 and going forward.

Partial Offset

Yes, many BDCs have LIBOR floors negotiated and borrow on a floating rate basis.

However, there are many exceptions to these rules as the change in LIBOR has occurred in a very short time and when borrowers have been in the catbird seat when negotiating loan terms.

Then there is all that fixed rate unsecured debt that BDCs have been booking since 2012 – and at an accelerating pace in recent months.

The institutionally placed unsecured can’t be prepaid readily without compensating investors.

The Baby Bonds can be called in in some – but not all – cases but that will play out over years, not weeks.

Moreover, that cheap unsecured debt which BDC CFOs had been licking their chops about may not be refinanced if concerns grow about credit, as we’ll discuss below.

Slower

The other factor that has changed overnight is the supply of new loans from LBOs and refinancings.

Clearly, for a period of months – or maybe longer – buyers and sellers of companies will be going back to their spreadsheets and asking themselves that same tedious – but critical – question:

Will there be a recession ?

Less M&A and refinancing activity leaves private credit lenders, still very liquid, fighting over a much smaller pie of quality transactions.

If you were a BDC – and there are many of them – who relied on fees from loans being added or repaid contributing 10%-25% of investment income, expect a big drop from that source.

Any Large Animal Will Do To Make Our Point

Finally – and the elephant sitting squarely in the room – what will happen to credit quality ?

Over the past 2 years, in a world awash in liquidity and with borrowers reporting growing sales and EBITDA quarter after quarter, 30 BDCs out of 45 managed to report lower book value per share.

That’s despite most BDCs not distributing all income earned; selling shares above book; buying back shares at a discount and a sellers market for equity stakes being sold.

Half of the 30 BDCs in the red are down by (10%) or more over the twenty four month period.

These numbers will look all the worse when IQ 2020 book value is totted up, given the massive drop in loan values.

We could see a (10%-15%) drop in aggregate BDC book value from these lower asset prices unless we get an increase by March 31.

What will happen in the rest of 2020 and beyond when economic and market conditions switch – almost overnight – from white to black and at a time when leverage levels and loan terms have been at their worse ?

Unimaginable

It beggars the imagination to expect that the economy – and the BDC sector – after a quick home stay – will ratchet back up with little impact on credit.

Even if the general economy rebounds in a short period, there are several sectors whose outlook is dire regardless for the medium and long term.

These include retail; energy; logistics; travel; segments of healthcare; aircraft leasing and more besides.

BDC lenders – rightfully – seek to invest in a broad range of industries but with so many sectors with questionable prospects, running through the credit rain without getting wet seems unrealistic.

Sisyphean

The BDC Credit Reporter has sought to quantify in real-time how many BDC portfolio companies are under-performing and place values on the amounts involved.

Very roughly, and we’re including both public and non-traded BDCs in these numbers, there are over 400 companies on our Under Performers list, with an FMV of over $10bn.

Advantage Data’s records show overall BDC AUM – which includes several players we don’t track – at $97.2bn.

That would suggest 10% of BDC assets are under-performing and at risk of further loss.

That was before the most recent shock.

Less scientifically – but based on prior experience – we wouldn’t be surprised if the number of companies and the FMV of less-than-stellar assets doubles in the quarters ahead.

We would argue that every BDC – even those who’s performed well in recent years – are a prospective turnaround story as loans and investments sour through the rest of the year.

Unavailable

Worse of all for BDC investors who just want to get back to normal is that all prior assumptions have to be shelved and re-thought, yet months may pass before we get a clear-ish picture.

Essentially BDC investors will be flying in the dark without instruments.

Some will guess right and do very well and some will crash and burn.

This not like 2016 or 2018 when markets worried about a recession for months; tanked and then changed their mind and direction.

This time there are very real economic shocks going on and no one can tell how many more are coming; their severity and the length of time involved.

Bloody Streets ?

It’s a very dangerous time to be bold but the psychology of the markets after such a huge drop in prices is that BDC stocks are cheap and available at a once in a lifetime bargain.

That may be – and we lie in bed every night musing about the potential upsides as much as anyone – but this could also be only one rung down on a long ladder.

Show And Tell

We used the history of Ares Capital’s (ARCC) stock price changes last week as an example of buyer beware.

Let’s offer another example:

Back in July 2017 ARCC investors had suffered through a (30%) decline in price since mid-February of the same year.

Then the stock moved up 16% through October of that year as ARCC and the markets seemed to bounce back.

You know what happened after that: ARCC dropped another (80%) through the spring of 2019.

Controversially Speaking

Arguably – except for the fear of the collapse of the entire financial system – economic; credit and financial conditions are worse now than in 2017-2019.

Thanks a multi-year bull market in credit; many new entrants; the loose leverage limits of the Small Business Credit Availability Act and the very short period between an economy moving at full speed and grinding to a standstill.

On the plus side, BDCs have the support of sophisticated asset manager parents; less reliance on bank revolvers and whatever lessons learnt from the Great Recession.

Multiple Options

This could go any number of ways and every new edition of the Recap will bring new developments.

Good luck to everyone involved and stay safe.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.