BDC Daily Update: Thursday October 21, 2021

Premium FreeMARKETS

Thursday October 21, 2021 is notable for the fact that the S&P 500 reached a new all-time intra-day and closing highs, ending up 0.30%. As you can see above, the Dow Jones index was ever so slightly in the red, while the NASDAQ and Russell 2000 increased.

As has been the case more often than not, BDC common stock prices as a group moved up as well. BDCZ – the UBS Exchange Traded Note which owns all of the material BDC stocks – increased by 0.22%. BIZD – the only ETF exclusively composed of BDC stocks – moved up 0.17%.

21 BDCs moved up in price, 2 were unchanged and 19 were in the red. There was one notable price move – and in the wrong direction – by WhiteHorse Finance (WHF). That was to be expected as the BDC undertook a secondary offering which typically causes some owners of the stock to dash for the exits. WHF closed at $15.15 a share, down from $16.22 at yesterday’s close before the news came out. That proved to be the lowest level of the day, and brought the price below the BDC’s latest net book value per share.

WHF ended up issuing 1.9mn shares at a price of $15.81, and raised a new $29.1mn in new equity capital. Given that the BDC targets debt to equity of 1.25 to 1.00, assets under management should increase by $36.4mn. Adjusting for that hypothetical target leverage for all WHF’s equity, the portfolio should grow in size from $670mn as of June to $750mn or so. If achieved, that would grow the BDC by 12%. The current yield – using all distributions received in 2021, both regular and special – is 10.2%.

Getting back to the day’s most interesting metrics we counted 5 BDCs reaching new 52 week highs. Ares Capital (ARCC) – still the biggest BDC despite much competition for this title from other players – reached $21.19. The BDC has been beating its own price records regularly of late. Also at a new height was an investor favorite amongst mid-sized BDCs: Capital Southwest (CSWC), which reached $28.33. The BDC is priced at a 68% premium to book value and traded at that apogee at 16.1x CSWC’s annualized projected Net Investment Income for the IIIQ 2021. Or, in other words, the BDC is not cheap by any standard, as you might expect when discussing a 52 week high.

Also breaking their 52 week price record Oaktree Specialty Lending (OCSL) and TriplePoint Venture Growth (TPVG), both of which we’ve mentioned before in recent dispatches in this context. A new name today , though, was SLR Investment Corp (SLRC), which reached $20.04 for the first time, breaking through the $20 barrier. The BDC is trading just (2%) off its June 2021 net book value. The price multiple there – assuming a $0.37 NIIPS for IIIQ 2021 annualized – is 13.5x.

We find amusing – and interesting – the wide difference in price to earnings and price to book multiples that even well performing BDCs trade for. Even after 20 years investing in this market we cannot readily account for these differentials. Maybe some BDC managers are better at telling their stories ?

Anyway, the BDC sector remains – from a price standpoint – right on the verge of breaking to a new 52 week high. However, both BDCSZ and BIZD – either at the close or intraday – are not quite there yet. BIZD, though, has to rise only 0.8% to set a new 52 week price record, 4 months after the last peak…

NEWS

Besides what was happening with WHF and its stock price there wasn’t much new to report on. OFS Capital (OFS) – as we alerted readers on Tuesday – proceeded with its offering of new unsecured notes. We didn’t learn – at time of writing – the amount raised or the yield paid or any of the juicy details readers might want to know. However, we did learn that OFS will be tapping the public debt market for this capital. As a result, expect to see a new Baby Bond turn up in the BDC Fixed Income Table shortly with the ticker OFSSH, which will trade on NASDAQ.

However – as we’ve known all along, the existing OFS public Baby Bonds – OFSSI and OFSSG – will be redeemed on November 2, 2021. Any extra funds lying around from the new debt after the Baby Bonds are called in will repay the BDC’s revolver – as is standard. Here’s an extract from a press release which gives all the useful numbers involved:

“As of October 19, 2021, the Company had approximately $25.0 million aggregate principal amount outstanding, plus accrued interest, of 6.25% Notes due 2023, which mature on September 30, 2023, and bear interest at a rate of 6.25% per annum. The Company’s 6.25% Notes due 2023 will be redeemed on November 1, 2021. As of October 19, 2021, the Company had approximately $54.3 million aggregate principal amount outstanding, plus accrued interest, of 5.95% Notes due 2026, which mature on October 31, 2026, and bear interest at a rate of 5.95% per annum. As of October 19, 2021, the Company had $78.1 million of indebtedness outstanding under the BNP Facility, which bore interest at rates from 1.84% to 2.60% as of such date. The BNP Facility matures on June 20, 2024”.

OFS Press Release – October 21, 2021

We’ll look a little closer at the OFS balance sheet once this latest offering is complete.

CREDIT

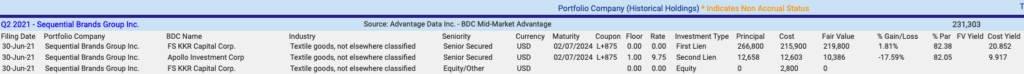

As this table copied from Advantage Data may or may not show (the image quality is poor unfortunately) two BDC lenders (FS KKR Capital – FSK- and Apollo Investment -AINV) have considerable exposure to bankrupt Sequential Brands.

We’ve wondered for some time if the value of Sequential’s coterie of brands would be sufficient to ensure the BDC lenders – who’ve also participated in a debtor in possession financing – will emerge from this imbroglio without loss. FSK has valued its debt at par while AINV has applied a (17%) discount.

Now the auction day has arrived and press reports indicate the combined value of bids already pledged amount to $444mn (and this number may go higher) while funded debt of Sequential appears to be $426mn-$435mn. (Admittedly, some of Sequential’s lenders – presumably including FSK and AINV – are helping the bidding process by financially supporting the “stalking horse” buyer of many of the brands). In any case, we’ll know shortly if these two BDCs will be dodging a realized loss bullet.

WEBSITE PROBLEMS

We’ve heard back from the website consultant about his diagnosis of what ails the BDC Reporter’s systems. Apparently, there’s much fixing to be done but he seems optimistic a solution can be found,although no date has yet been set. To ensure as smooth a user experience as we can we’re making all articles free to all readers till we can resume distinguishing between premium and free subscribers. Also, today we also made all the BDC Reporter’s Subscriber Tools available to all. Just go to the website file and click.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.