BDC Daily Update: Thursday October 28, 2021

Premium FreeMARKETS

Notwithstanding weaker GDP growth than previously expected, the markets forged ahead, with all the four top indices in positive territory. As illustrated above, from the Dow to the Russell 2000, prices were up between 0.68% – 2.02%.

The BDC sector was up along with everyone else. Both BDCZ and BIZD – one the UBS sponsored Exchange Traded Note and the other a Van Eck sponsored exchange traded fund, and both invested in most of the BDC stocks – were up 0.69%. BDCZ closed at $20.13 and BIZD closed at $17.63.

36 BDCs were up in price, 2 were unchanged and only 4 were in the red. For some reason, Investcorp Credit Management BDC (ICMB) was out of favor with investors, dropping (3.11%), on twice normal trading volume. As the chart below shows, since reaching a high in July, ICMB has fallen and not been able to get back up, dropping (17%) in aggregate:

We don’t know what sparked this most recent price pullback. Admittedly, the BDC issued a draft prospectus yesterday. Maybe some investors are worried that ICMB – already trading at a (32%) discount to book value – might be considering a dilutive Rights Offering ? We’re just guessing. Otherwise, there’s been no material development to speak about.

Despite the broad rally, BDC investors kept their heads about them, with no player increasing by 3.0%, or more, in price on the day. Leading the pack with a gain of 2.61% was – once again – Cion Investment (CION), which is gaining some ground in advance of its first bow on the public stage, scheduled for November 15, 2021. Still, CION remains at a (26%) discount to net book value.

3 BDCs reached new 52 week highs. As is an almost a daily occurrence, Ares Capital (ARCC) climbed to a new height: reaching $21.74. For anyone interested, we calculate that ARCC trades at 11.6x its just announced $0.47 Core EPS quarterly result annualized. New on this VIP list is PennantPark Floating Rate (PFLT), which reached $13.52, and now trades at 12.5x the BDC’s annualized IIIQ 2021 expected earnings and at a 5% premium to book. PFLT is up 7.5% in the last 5 weeks. Finally, Stellus Capital (SCM) moved up to a new $13.98 record, just in advance of reporting its IIIQ 2021 results after the close. There, too, the price to the projected IIIQ 2021 earnings annualized is 12.5X.

All of this leaves the BDC sector very close to breaking through the 52 week highs set by BDCZ and BIZD in the summer: less than 1%. There’s just one day left in October for some sort of new high to be set at the close or intra-day. Still, even at today’s closing price and despite paying out a quarterly dividend of $0.381 earlier, BDCZ is up 2.7% on the month. BIZD is up by a similar MTD percentage. According to Seeking Alpha, 35 BDCs are up in price in the last 1 month, 2 are unchanged and only 5 are down – and modestly at that.

We continue to believe BDCZ and BIZD will find reach new price heights but admit it’s been an excruciating month, with minuscule gains gradually adding up to where we stand today. We’ll be more interested than usual to see how Friday plays out.

NEWS

Both Hercules Capital (HTGC) and SCM reported their results after the close. The venture-debt BDC has already held its conference call. SCM follows suit tomorrow. For our part, we’ve only had the opportunity to scan the earnings releases: HTGC here, and SCM here, and input the latest NAV Per Share data into the BDC: NAV Change Table and what numbers we can readily find into the BDC Credit Table. (Check back regularly as we are in constant update mode).

Most investors will notice off the bat that HTGC – despite reporting Net Investment Income Per Share (NIIPS) in line with the analyst consensus of $0.33 and higher than the $0.32 in the IIQ – saw its NAV Per Share drop slightly to $11.54, a fall of (1.5%). Although HTGC boosted its regular dividend and broke multiple records for investment origination, this might stick in the craw of some investors.

We also noticed when inputting the value of HTGC’s underperforming investments – as per their own analysis – that the absolute dollars and the percentage of the portfolio metric were headed in the wrong direction. The former increased from $414mn to $468mn. Underperformers as a percentage of the total portfolio reached 18.6% from 16.4%. We should hasten to add that 98% of those underperformers are in the least worrisome category – 3 out of 5 on the HTGC scale. (1 is out-performers and 2 is for performance to expectations).

Also, HTGC did manage to book net realized gains of $21mn this quarter and has now $15mn in gains for the nine months year to date. Finally, there are only 3 companies with debt on non accrual – same as last quarter – and the absolute dollars of these non performers is a negligible $8mn. Still, of the 7 BDCs that have reported IIIQ 2021 net book value, HTGC is the one and only in the red and the first not to meet our expectation of booking a gain in this category. If time allows, we’ll seek to annotate the BDC’s conference call transcript – as we’ve already done for Horizon Technology (HRZN).

SCM’s metrics were positive across the board, with NIIPS, NAV Per Share and AUM all increasing. Shareholders will be the most interested in an increase in the regular quarterly dividend to $0.28 from $0.27. The relatively complex allocation of payouts was discussed in the press release, which we quote below:

“During both the three months ended September 30, 2021 and 2020, we declared aggregate distributions of $0.58 per share ($11.3 million and $10.9 million, respectively) for each quarter. Of the $0.58 declared during the three months ended September 30, 2021, $0.27 relates to our regular distribution and was paid to shareholders during the third quarter, $0.03 relates to a special distribution and was paid to shareholders during the third quarter, and $0.28 relates to our regular distribution and will be paid to the shareholders during the fourth quarter. Tax characteristics of all distributions will be reported to stockholders on Form 1099-DIV after the end of the calendar year. None of these dividends are expected to include a return of capital”.

Stellus Capital Press Release October 28, 2021

If we’ve counted right – and we’re still not sure after re-reading the year’s press releases – SCM will have paid out $1.08 in distributions in 2021. Despite two increases this year that’s still below the level of 2020, which aggregated to $1.15. In 2019, SCM paid out $1.36. That indicates shareholders are still getting (20%) less than 2 years ago even as NAV Per Share is now equal with the IVQ 2019 level.

SCM’s share price at its highest point in 2021 remains (6.2%) behind the intra-day peak in February 2020, just before the pandemic wreaked havoc on its economics.

Elsewhere, Ares Capital (ARCC) – right after announcing its IIIQ 2021 earnings – issued $700mn in privately-placed unsecured notes. Interestingly – and rare – the debt has a ten year maturity. The yield achieved by the BDC is 3.20% and is – as always – investment grade rated.

Back in June, ARCC raised $850mn of similar notes but with a 7 year maturity and paid out a yield of 2.875%, while in January $650mn was raised for the standard BDC 5 year tenor at a record breaking low yield of 2.150%. Within less than a year, the leading BDC has achieved an impressive laddering – even while redeeming its Allied Capital-inherited unsecured debt that matured in 2047.

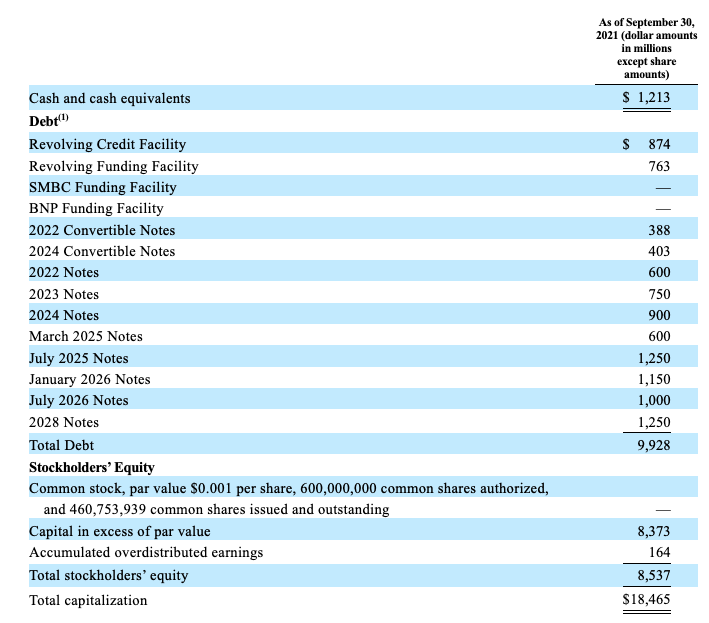

Here is the BDC’s capitalization as of September 30, 2021. As you can see, unsecured debt of different types and different maturities already dominate, with secured borrowings representing only $1.6bn of the $10bn in total debt:

Given that the new $700mn 10 year offering will be used to repay secured borrowings initially, total debt will not change, but secured outstandings will drop to only 8% of all borrowings. All the rest will be unsecured, spread over a remarkable 11 different issuances that reach out to 2031.

This underscores our point that for ARCC – and most BDCs – this post-pandemic period of very low borrowing rates in fixed income should provide the dual benefits of inexpensive cost of capital and stronger balance sheet construction for years to come. If rates do eventually rise – not a given whatever you’ve heard from the pundits – BDCs that have locked in lashings of unsecured debt at these historically low rates should benefit for a long time. We expect many other BDCs – even the smaller ones – to imitate ARCC as best they can and continue to raise incremental new unsecured debt – even if currently more expensive than secured borrowings – as long as possible.

In other BDC business, we discovered on Thursday that Saratoga Investment (SAR) – not satisfied with managing a CLO – will be launching a joint venture as well. No press release was made, but an 8-K filing offered these tid-bits:

“On October 26, 2021, Saratoga Investment Corp. and TJHA JV I LLC entered into the Limited Liability Company Agreement (the “LLC Agreement”) to co-manage Saratoga Senior Loan Fund I JV LLC (“Saratoga JV”). Saratoga JV is a joint venture that is expected to invest in the debt or equity interests of collateralized loan obligations, loans, notes and other debt instruments“.

Saratoga Investment 8-K Issued 10/28/2021

We did scroll through the legal agreement between the partners for more color on the new venture but found little of interest except that the JV’s fiscal year will match that of SAR and that quarterly distributions of net investment income and capital gains are envisaged.

Mostly, though, we know very little about what SAR is up to, or even the identity of its partner. Also not clear is the intended size of the JV; the capital to be committed; what the portfolio might look like; how governance will work in real life and – most importantly – what benefit the BDC’s shareholders might derive. This could be a significant news story for the BDC’s shareholders or not much of anything. We’ll only know when the advisor gets round to providing some flesh on the bones of this disclosure.

Speaking of BDCs making disclosures that only beg for further information, Gladstone Capital (GLAD) issued an “Other Events” 8-K of its own on Thursday that offered up some preliminary IIIQ 2021 metrics. The BDC Reporter has already analyzed the subject in a full article, so we won’t rehash the issue here.

However, subsequent to writing that article and as we suspected, GLAD issued new unsecured debt. This was a private placement of $50mn, with a maturity in 2027 and at a yield of 3.75%.

Regular readers of the BDC Reporter and/or GLAD investors will know the BDC is redeeming its last remaining public debt security – ticker GLADL – on November 1, 2021. Some $39mn in principal and any accrued interest will be repaid. GLADL – nominally maturing in 2024 – yields 5.375%.

The latest unsecured debt issued is at a record low yield for what we call a “mid-sized BDC (which means a portfolio size of $0.5bn to $1.0bn). As recently as December 2020 and March 2021, GLAD issued 2026 notes with a yield of 5.125%. This latest debt is (27%) less expensive.

Given that GLAD has already announced its secured borrowings outstanding were $50.5mn, we surmise that the BDC’s debt capitalization – after this latest issuance occurs and is used to pay down the revolver – will consist almost exclusively of unsecured notes due in 2026 and 2027. That’s not quite as “laddered” as ARCC, but is an even greater percentage of total borrowings in the form of unsecured notes.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.