BDC Daily Update: Wednesday October 6, 2021

Premium FreeWhat’s Been Happening

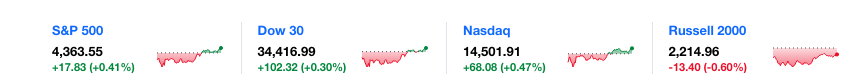

MARKETS

Apparently, some investors were worrying about the U.S. government’s debt limit after all. The major markets changed direction to the upside when a story emerged that a deal was likely to be reached. Three of the four indices – as shown above – closed the day in the black, with only the Russell 2000 ending down. The Dow, by way of example, was 459 points off before switching and ending 100 points up. The NASDAQ dropped (1.2%) but closed the day 0.5% up. You get the idea. CNBC noted the following about this volatile month:

“So far in the three prior trading sessions of October, the Dow has gained 483 points, lost 324 points and on Tuesday, jumped 312 points. On Wednesday, the Dow swung more than 550 points”.

However, there’s been far less drama where BDC prices are concerned. For three of the four days of October to date, the BDC indices have been moving up. Today, BDCZ – the UBS Exchange Traded Note which owns most BDC stocks – was up 0.34%, to $19.92. BIZD – the BDC ETF – increased by 0.47% to $17.16. So far both BDCZ and BIZD are up in October.

26 BDCs were up in price, 4 were unchanged and 12 were down on the day. Top of the heap today – but not doing very well in recent weeks – was idiosyncatic BDC Oxford Square Capital (OXSQ), up 1.74%. For a time, new BDC on the public block – Cion Invesment (CION) – looked like the big winner of the day: closing at $11.85 on Tuesday, opening the day at $11.80 before jumping as high as $12.50, but finally closing at $11.94 – just 0.76% up. Trading volume was higher than the day before, which happened to be the first day of trading.

As we anticipated in the prior Daily Update, the market was initially enamored by Saratoga Investment’s (SAR) first rate earnings announced after the close on Tuesday. The stock price reached a new high under this advisor of $30.25, before slumping back to close at $29.80 – up 1.22% on the day.

The largest percentage price loss was incurred by Great Elm Capital (GECC), off (1.88%) to $3.40. The BDC has been issuing many new shares of late – as we’ve reported on these pages – and insiders have registered to sell a good portion of the stock if the opportunity arises. No wonder that GECC’s stock has dropped (7.2%) in less than a month. Overall, though, as we’ve been noting almost daily price volatility in either direction remains modest for BDC stocks.

BDCZ is only (1.8%) away from its $20.29 52 week high, and BIZD – just off paying its quarterly distribution – is (3.1%) behind.

NEWS

Thankfully for the BDC Reporter trying to catch up with developments at SAR and learning more about CION, there was little in the way of market moving news on Wednesday. Admittedly, Horizon Technology Finance (HRZN) maintained a long standing tradition in advance of its earnings release of revealing quarterly data about originations and prepayments in the just completed quarter. Here’s an extract from the press release – which is quiet on any credit issues, non accruals or the pricing involved in any new transactions:

“We had an excellent third quarter as the power of the ‘Horizon’ brand and Horizon’s lending platform led to a quarterly record of $141 million of loan originations, including $99 million of loans for HRZN,” said Gerald A. Michaud, President of HTFM. “The Horizon Platform also ended the quarter with a committed backlog of $123 million of debt investments, including $101 million in HRZN commitments, a reflection of the fact that emerging and innovative companies and their investors continue to find Horizon’s venture loans the right solution for their capital needs. We are pleased the expanded funding capacity of the Horizon Platform resulted in the generation of high-quality loans for HRZN, while maintaining a diverse portfolio of debt investments for HRZN.”

“In addition, HRZN received $50 million in loan prepayments during the quarter, providing additional fee income and accelerated interest income and further validating our predictive pricing strategy,” added Mr. Michaud”.

On a prima facie basis, HRZN appears to have had a good quarter but absent some of the missing data we cannot say so for sure.

Otherwise, SLR Senior Investment Corp (SUNS) announced an unchanged distribution of $0.100 for the month of October. Till April 2020 SUNS was paying out $0.118. Along with many peers SUNS was hit hard from an earnings standpoint, both by the lower yields received on LIBOR-linked floating rate loans and the pandemic. That accounts for the (15%) decrease in the regular distribution since last year. The payout was reduced for the first time in May 2020. SUNS has now paid this $0.100 monthly dividend 18 times in a row.

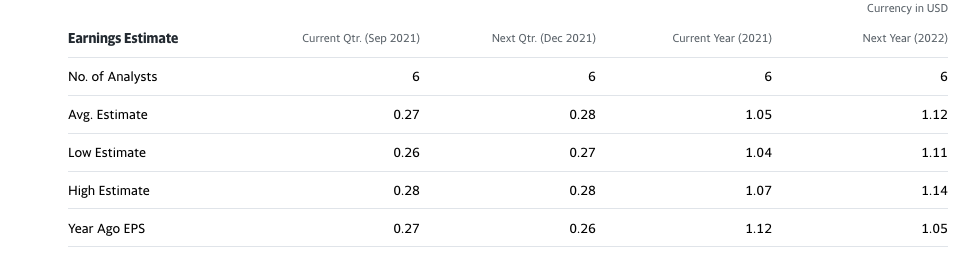

However, like many other BDCs, the BDC continues to generate recurring earnings that might not be capable of “covering” the distribution. Here is the analyst consensus for this year and next:

Investors do not seem to be panicked. SUNS is trading just (5%) off its 52 week high. The price to current earnings multiple is 16.1x.

Late in the day we heard that PennantPark Floating Rate (PFLT) was back in the unsecured debt markets and had raised an additional $85mn due in 2026. This was an add-on to an issuance we wrote about back in March. Nominally, the debt yields 4.25%, but thanks to the premium issuance price, the effective yield is 3.875%. In total, PFLT will have garnered $185mn from these two 2026 debt issuances.

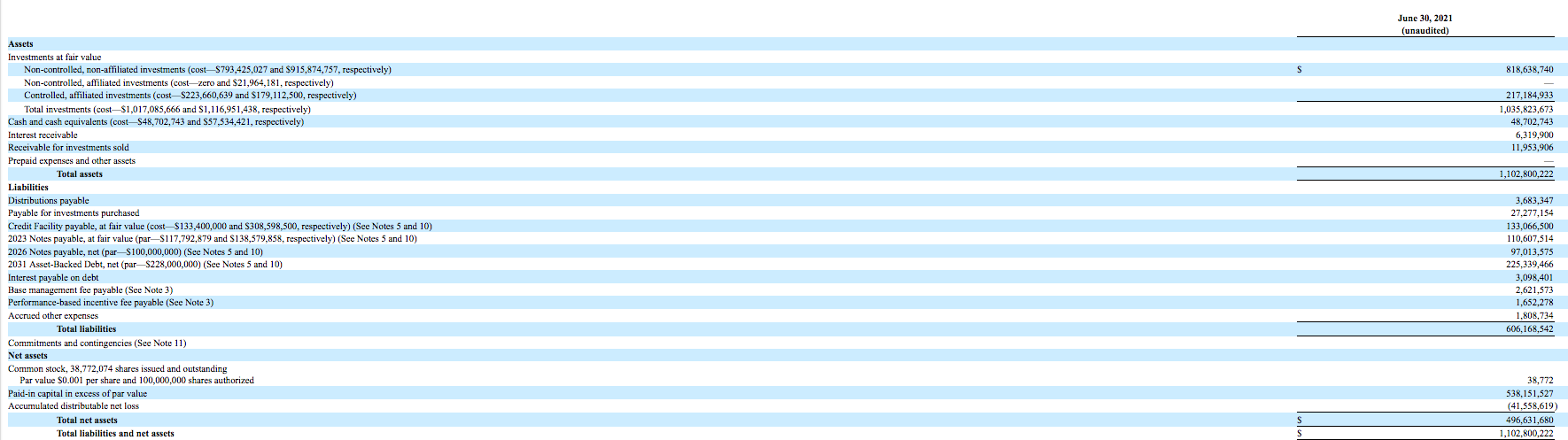

Here’s what PFLT’s balance sheet looked like as of June 2021:

Assuming the $85mn raised pays down the Credit Facility, we calculate that 52% of all debt on the BDC’s balance sheet is unsecured. For those of us with long memories that’s a drastic change for a BDC that eschewed all but low cost secured financing for many years after going public. Then PFLT tapped an inexpensive unsecured debt source in Israel starting in 2017 (see the 2023 Notes above) and the more conventional 2026 Notes earlier this year, reshaping the BDC’s balance sheet.

The 3.875% yield is still substantially more expensive than the LIBOR + 2.25% PFLT pays for its $300mn secured Credit Facility, which was renewed and re-priced in August. However, the unsecured debt does not have the restrictions imposed by senior swecured lenders. PFLT is also financed by a secured asset-backed term securitization, which costs 2.7% per annum.

This new debt should ultimately be accretive from an earnings standpoint if used to grow AUM. PFLT’s portfolio yield is 7.5%. After deducting the debt cost and the 1.0% management fee, PFLT nets 2.625%. Assuming the full cost of the 20% incentive fee, shareholders should see a 2.1% net return, not including any incremental operating costs associated with any assets acquired. Admittedly, the investment advisor benefits as much as the shareholder, but BDC investors have long ago accepted that generous division of the earnings pie by the advisor.

We also calculate that if the $85mn is eventually re-drawn under the Credit Facility and PFLT’s AUM increased by that amount, the BDC will earn just under $0.05 annually of incremental Net Investment Income Per Share. To put that into perspective, the analyst consensus for 2021 and 2022 is $1.05 and $1.12 respectively.

However, PFLT has to contend with its need to gradually pay down its 2023 Israeli notes. $21mn is due in December of this year and again in 2022 , with the remainder coming due at maturity. Also, the term securitization’s re-investment period ends in October 2023.

Chances are PFLT will be back in the unsecured debt market before too long.

By the way, the 2023 Israeli notes are priced at 4.3%, so the latest unsecured financing is the least expensive PFLT has raised to date.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.