BDC Common Stocks Market Recap: Week Ended March 11, 2022

BDC COMMON STOCKS

Week 10

Apparently Not

Last week we concluded the Market Recap with the following question:

…we’ll see if the BDC sector can look through the ever increasing tension in Europe and uber high oil prices and move up in price for a second week in a row.

BDC Reporter – BDC Common Stocks Market Recap Week Ended March 4, 2022

We wrote that because the BDC sector has been not only out-performing the major indices by a long shot in recent weeks, but was even able to post a slight gain year-to-date in 2022, despite the markets concerns about high inflation; interest rate hikes and – of course – what the war in Ukraine might bring.

Judging by week 10’s BDC market performance – as reflected in the stock price of the only exchange traded note which owns most BDC stocks – BDCZ – we have our answer.

The BDC sector dropped (2.77%) – the biggest percentage drop since Week 3.

Part Of Something Bigger

This was part of a broader continuing market retreat that saw the S&P 500 also decline by (2.88%).

Only 12 BDCs out of 46 were in the black over the 5 day period, and 34 (or three-quarters) were in the red.

Downdraft

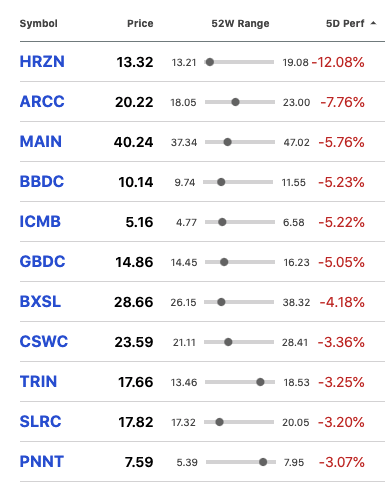

No less than 11 declining stocks fell (3.0%) or more – also the highest number since Week Three, when investors were not worried about Ukraine but about those other issues mentioned above.

Here are the 11 BDC stocks involved:

Beware What You Wish For

The biggest percentage price loser – ironically enough – was a BDC (Horizon Technology Finance) performing so well as to need to raise new common stock for growth.

As we discussed in our Daily Updates, though, HRZN did not “stick the landing” where this equity raise is concerned, resulting in much price volatility and – probably – some annoyed shareholders.

The stock was trading at $16 a share just recently, but came to market at a price of $14.35.

Investors were not pleased, and at one point HRZN traded down to $13.21, its lowest level in a year.

By Friday’s close, HRZN was at $13.32, still (7.2%) lower than what investors paid earlier in the week.

From its recent 52 week and all-time high, HRZN has dropped a remarkable (30%) in price…

Different Category

The presence of ARCC, MAIN and BBDC on the week’s list of major downward price movers suggests to us some investors have resorted to profit taking.

All three BDCs are investor favorites, have performed well in recent quarters and have increased their distributions.

In fact, we project these large BDCs should continue to offer higher payouts going forward into 2022.

Clearly some holders of these stocks are stepping away for a moment regardless, which we can’t help tying to the unsettled geopolitical and economic conditions – the most confusing we’ve experienced since March 2020.

On A Happier Note…

We should note, though, that this is not a one-way street of stock sell-offs.

This week, 3 BDCs (Great Elm, Cion Investment and OFS Capital) all recorded substantial percentage gains in price: 11.25%, 9.75% and 7.16%.

Record Breaker

We even had a BDC stock reaching a 52 week high against the general flow.

That was OFS, which reached a new record of $12.00 intra-day on Friday, boosted by recent IVQ 2021 results and a mighty dividend hike.

Where We Are

With March 2022 half gone, BDCZ is down (2.00%) on an MTD and YTD basis.

19 of 45 BDC stocks (not including Silver Spike or SSIC) are in the black or unchanged right now versus their level at 12/31/2021 and 26 in the red.

The number of BDCs trading at or above net book value per share has dropped modestly from the year end 2021, from 18 to 16 as of Friday last.level

(We can’t offer up a “total return” result as the Wilshire BDC index is “under maintenance” and not available to be checked).

These metrics suggest a 2022 BDC sector in a very modest pull-back mode.

Comparisons Are Necessary

Of course, compared to the major indices and most other sectors, the BDC industry shines bright.

YTD the S&P 500 is down (11.8%) and the Nasdaq (17.1%).

BDC performance is more akin to what’s happening in the large leveraged loan arena.

The S&P/LSTA index for 2022 is ahead by 0.004% and slightly down in March MTD.

We don’t want to sound like a broken record to those who read us regularly, but the BDC sector has proven very resilient where its prices are concerned under the current exigent circumstances.

Where We Might Be Headed

With BDC earnings season essentially completed, and the prospect of higher short term rates on our doorstep, with the Fed meeting on Wednesday, prices could readily change direction.

Earnings and distribution trends for 2022 are clearly favorable.

The BDC Reporter projects that out of 45 stocks, 21 should pay out higher distributions in 2022 than 2021, and 15 are unchanged and 2 are non-payers.

Only 7 BDCs will offer shareholders less in the way of distributions than in 2021 and in the case of 3 of those players that’s only because last year saw big “special distributions” being paid. Then there’s Newtek Business Services (NEWT) which is changing its dividend payout policy along with its legal status.

There are only 3 BDCs that we are concerned about where this year’s dividends are concerned – all of them tiny players in what is increasingly a sector dominated by giants.

Less Optimistic

We should admit that we’re not as sanguine about sector NAV Per Share – after 7 quarters in which most every BDC reported an increase – continuing to expand through 2022, and certainly in the first quarter.

In the IVQ 2021, the average increase in this much followed metric was only 0.4% – the weakest performance since the bounce back from the pandemic.

Higher spreads and lower valuations stemming from the Ukraine situation are likely to depress asset values and there might be less in the way of equity gains, both realized and unrealized.

Pretty Good. Getting Better.

However, as the BDC Credit Table shows to those who dig in, credit conditions are generally improving still as BDCs either write off troubled borrowers; restructure or even return some companies to performing status.

We may yet see more improvement than deterioration in this regard in 2022.

Money In Hand

Also, BDC liquidity is good in almost every case, which may allow many players to book new loans at higher spreads should the syndicated loan markets and banks pull back in this environment. We’ve been hearing as much from a few BDCs which held conference calls this week.

Undefined

Finally, there’s the prospect of higher investment income from those increasing short term rates which everybody is aware of but nobody knows how to value.

What is clear is that if the Fed is aggressive about tamping down inflation with the blunt instrument of higher rates, BDC economics – after a brief indigestion as borrowing costs move up while loan yields do not till “floors” are reached – will greatly improve without the need for any action by the lenders themselves.

Bottom Line

Taking all the above into account, the BDC Reporter remains sanguine about the sector’s prospects, notwithstanding this week’s drop into the red on a YTD basis.

Caveating

A deterioration in the Ukraine situation – although spelling out what that might look like is difficult – would put any upward move on hold, but only till geopolitical clarity is restored.

Already a Member? Log InRegister for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.