BDC Common Stocks Market Recap: Week Ended May 19, 2022

BDC COMMON STOCKS

Week 20

Jinxed

There’s nothing so sure to spur a BDC market surge in price than the BDC Reporter pronouncing itself as “pessimistic” about any short-term upside, as we did last week.

Viz: our normal price guide BDCZ increased this week by 2.4% – its best price performance in seven weeks.

36 of the 42 BDCs we track increased in price and only 6 decreased.

15 BDCs increased by 3.0% or more in price – the most since the week ended January 27, 2023.

Likewise, the number of BDCs trading at or over net book value per share increased to 10 from 8.

This burst of market energy has also increased the number of BDCs trading within 10% of their 52-week high to 4 (from 2) and reduced the number within (10%) of their 52-week low to 8 (from 14).

Top Dog

Most notably, Blackstone Secured Lending (BXSL) had the most to celebrate, ending the week with a stock price just (3%) off its 52-week high.

Exception To The Rule

Righting the balance a little, Goldman Sachs BDC (GSBD) reached a new 52-week low during the week of $12.75, before closing at $13.15 at Friday’s close.

Not So Far Apart

Interestingly, BXSL currently trades at a price to projected 2023 recurring earnings multiple of only 6.9x, while GSBD is not so far behind by that much-beloved metric at 6.1x.

Also intriguing is that BXSL’s multiple – albeit lofty by comparison with its own one-year level – is below the BDC sector’s7.4x average multiple, as calculated in our sister publication BDC Best Ideas. See the Expected Return Table.

Back In Black

Getting back to the main narrative, we’ll conclude by noting that this week’s price increase by BDCZ brought the UBS-sponsored exchange-traded note back into positive territory for the year – just 0.4% up.

A little more impressively, the S&P “total return” index, which includes 19 weeks of dividends received, is up 6.6%.

Year-To-Date

This week’s move has helped some of the 2023 metrics that were looking a little sour just last Friday.

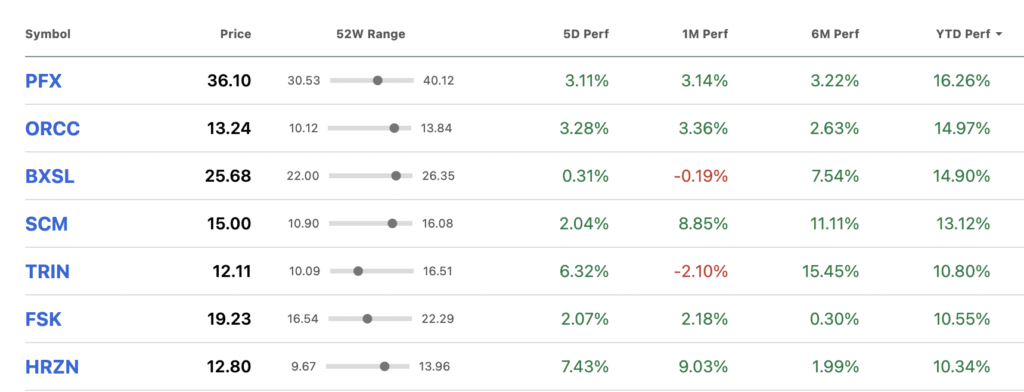

According to Seeking Alpha data, we’ve gone from 14 BDCs boasting a gain in price since the end of 2022 to 23 currently – a slight majority.

As the last column of this SA chart shows, there are 7 BDCs that have increased in price by 10% or more this year so far.

As you can see, it’s a potpourri of different BDCs of different sizes and strategies.

PFX (PhenixFin) has one of the smallest market capitalizations of any BDCs and ORCC (Owl Rock Capital) and Blackstone Secured Lending Fund (BXSL) have two of the biggest.

A couple of venture-debt BDCs are on the list, illustrating that the market is not as worried about what’s happening in Silicon Valley as you might have thought.

Outlook

A 2.4% price increase, albeit impressive and welcomed by the BDC bulls, is not yet a rally, which we have pegged at a 5.0% move.

We’ll be interested to see if this week’s momentum can continue.

Looking Good

As BDC earnings season – almost over but for Capital Southwest (CSWC) which reports on Monday, May 23 – has shown, sector fundamentals are flying high.

Our records indicate two-thirds of BDCs reported higher recurring earnings in IQ 2023 than in IVQ 2022.

In terms of dividends, 11 BDCs have reported higher regular distributions, while the rest have remained unchanged.

BDC Best Ideas continues to project that 33 BDCs will ultimately pay more in distributions in 2023 than in 2022.

A Good Book

Most remarkably of all – given the unsettled backdrop – 22 BDCs out of 41 have achieved a higher Net Asset Value Per Share (NAVPS) in the IQ 2023 over the level at the end of last year.

(We should point out, though, that this unexpectedly strong NAVPS performance has much to do with BDC managers retaining an unusually large portion of earnings to boost their metrics and liquidity in advance of the much-expected economic downturn).

Expansion

Even BDC assets under management (AUM) have continued to grow despite much lower M&A and pervasive pessimism about what’s around the corner.

24 BDCs are reporting higher AUM at the end of the IQ 2023 than as of the IVQ 2022.

In aggregate, once we hear from CSWC, we expect the sector as a whole will show a slight – but telling – increase this quarter in AUM.

Capital Raising

We have also been impressed by how many BDCs have managed to issue new shares in recent months.

There have been a few traditional secondaries by the likes of Ares Capital (ARCC) and Goldman Sachs BDC (GSBD).

However, there’s also been a steady issuance of new shares through At-The-Market (ATM) programs. These are not spectacular and don’t grab the headlines but do continue to grow the equity base of BDCs even at a difficult time.

Overall, we count 18 BDCs that have a bigger share count at the end of March 2023 than they did on December 31, 2022.

Whatever the week-to-week fluctuations in BDC prices, the market appears to be enamored with the BDC sector for the long run.

Kismet

That certainly mirrors how the BDC Reporter feels.

We may be wrong from week to week about where prices will go but we’re HIGHLY confident that in the long term as markets normalize that the BDC sector is headed much higher.

Curiosity

One of the ironies we foresee is that BDC prices may not break out to the upside until the Fed reduces interest rates.

Whatever incremental earnings benefit BDCs earn from a high Fed Funds rate is more than offset by market concerns about the impact on portfolio companies’ creditworthiness and competition on yield from risk-free investments.

While BDC earnings, NAVPS, and distributions are likely to peak in 2023 very close to their IQ 2023 levels, BDC stock prices have the potential to head much, much higher in the next year or two.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.