BDC Common Stocks Market Recap: Week Ended January 19, 2024

BDC COMMON STOCKS

Week 3

Crossed Wires

As happens sometimes, this holiday-shortened week saw the S&P 500 and the BDC sector head in different directions.

As you’ll have probably heard, the S&P 500 reached “a record high close on Friday for the first time in two years”.

By contrast, the various indices we use to measure BDC price performance recorded a (0.4%) drop.

Of the 42 individual BDCs we track, only about a fourth (11) increased in price this week, while three-quarters (31) fell.

Sidebar

We’re leaving out of our calculations for one last week the newest BDC Palmer Square Capital BDC (ticker PSBD), which came public intra-week.

As we’ve reported, PSBD is just one of four new public BDCs headed this way.

Click here for Part I of the BDC Reporter’s two-part review of Palmer Square.

Going forward, we’ll be adding the new BDCs to our data tables and our weekly recaps.

Little Drama

Anyway, this was a quiet-ish week for BDC prices, with 2 players increasing 3.0% or more in price and 3 dropping (3.0%) or more.

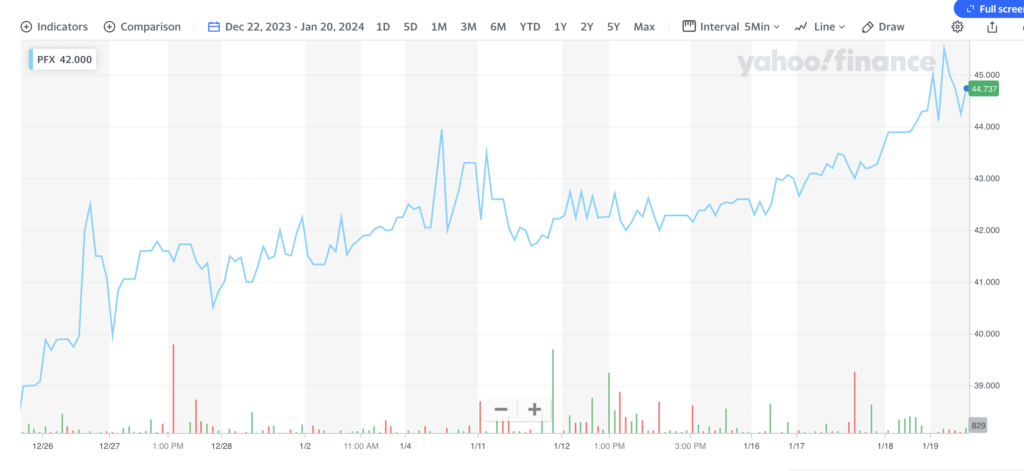

Two smaller BDCs were moving up in price. One is PhenixFin (PFX), which has been on an upward tear ever since reporting decent results – but still no regular dividend – a few weeks ago.

A chart is worth a thousand words. Here is what has happened to PFX’s price since December 22, 2023, when its fiscal year results ended September 30, 2023, were (finally) released: a 17% increase.

There can be second acts in BDC-land, whatever F. Scott Fitzgerald had to say.

For OFS Capital (OFS), this week’s burst in price is part of a more prosaic rise towards reaching a new 52-week high. OFS closed at $11.84. The 52-week limit is $12.44.

The BDC is one of 32 trading within 10% of their 52-week price record, including 18 within 5%.

Last week the numbers were almost identical except that 20 were within 5%.

The same, though, is the number of BDCs trading at or above net book value per share – a robust 17.

Makes Sense

It’s no wonder so many BDCs are coming to the public market.

There’s been a rally underway – and religiously chronicled on these pages – since October 2022 and the sector is sitting close to its highest level in nearly two years.

“If not now, then when?”.

Topped Off ?

The question pundits, investors, and investment bankers steering these new names into the public market will be asking themselves is whether prices have peaked.

Wall Street has played this exactly right in getting these new players into the market at the top, but will a drop-off immediately follow, leaving a lot of disappointed punters?

As always, we ask questions but have no definitive answers.

Influencer

However, we expect how the IVQ 2023 BDC earnings season plays out will have a great influence on what happens next and how the broader markets behave after reaching this recent apogee.

We’ve been assembling our “BDC Earnings Calendar”, which gives the date of each earnings release and the time, date, and link of every upcoming conference call. Look shortly to Subscriber Tools on the front page of the website to gain access to this handy planner.

We have another week to wait for the first BDC to report and then the numbers will come in hot and heavy through February.

What We Know

For our part, we don’t expect any great surprises overall, although individual BDCs can occasionally cause a shock and keep everyone on their toes.

We did get preliminary results – as discussed in BDC Reporter articles and on the BDC Publications Daily News Feed – from multiple players in different segments of the market.

These were Golub Capital (GBDC); New Mountain Finance (NMFC) and Main Street Capital (MAIN).

If we were to generalize, those preliminary results suggested BDC earnings remain strong, often at or close to record levels. Changes in net book value vary up and down but within an unexceptional range and dividend announcements are coming in as one might have surmised.

Finally, credit conditions remain well within “normal” boundaries.

Speaking Of Credit

By the way, the BDC Credit Reporter has only identified two bankruptcies of BDC-financed companies so far in 2024 and only was involved in any material exposure. That is Nexii Building Solutions, whose failure may explain why its lender Horizon Technology Finance (HRZN) saw its stock price drop (6.4%) this week.

On a brighter note , Core Scientific is poised to exit bankruptcy and – apparently – results in much lower losses than the two BDCs involved might have expected earlier. One of those BDCs is Barings BDC (BBDC), which is also extracting itself from another bankruptcy – Anagram Holding Corp – with only modest damage.

Trinity Capital (TRIN) has exposure to both Nexii and Core Scientific…

Either Way

All in all, there do not appear to be any obvious catalysts for a price downturn in the BDC sector except the traditional restlessness that follows a long rally as investors seek to divine what might be coming up next.

BDC prices remain below the levels reached in February 2020 and April 2022, so a further melt-up remains in the cards.

As mentioned before, much will depend on the general level of animal spirits across the markets.

This week’s price action in the BDC sector did not give us any clues as to its future direction.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.