Palmer Square Capital BDC: First Look – Part II of II

Premium FreeINTRODUCTION

This is Part II of a two-part article on Palmer Square Capital BDC (PSBD) – the newest public BDC. In the first article, we reviewed the principal features of the BDC, drawn from the prospectus and historic financial statements. In this second article, the BDC Reporter offers its opinion about what is appealing, and what is not, from a shareholder perspective.

VIEWS

Unique

There are 42 public BDCs out there already and none offer exposure to the syndicated loan market of the largest non-investment grade borrowers, as does PSBD. Given that these loans are more liquid than the traditional BDC-oriented leveraged finance, the manager can – theoretically – trade in and out of the market more easily. This is the first BDC of any size we’ve encountered whose entire portfolio is rated Level 2. Most BDC assets are Level 3. Here’s what the prospectus said regarding PSBD’s strategy:

…the investment team of our Investment Advisor, or the “Investment Team”, believes it can mitigate risk and achieve our investment objective by: (i) seeking the best relative value, which may equate to buying new loans or other corporate debt issuances at a discount or purchasing them in the secondary market, and (ii) seeking to buy loans or other corporate debt issuances that the Investment Team believes have strong fundamentals, low default risk and are capable of withstanding significant downward pricing pressure.

PSBD Prospectus – Page 3

Not So Great

There are reasons, though, that no BDC has come to market with a syndicated-loan-focused strategy. One of them is that yields and spreads are lower than more illiquid private loans. As of September 2023, most BDCs boasted of yields on their income-producing assets of 12% or more. For example, Ares Capital (ARCC) – which also lends to very large borrowers – had a yield of 12.4%. By contrast, PSBD’s yield – at cost – was 9.7%.

Slim

PSBD’s cost of borrowing on its largest secured Revolver in September 2023 was 7.4%. As a result, the spread between the yield received from income-producing investments and the borrowing cost was only 2.3%. When the 1.75% management fee; any direct operating costs and the Incentive Fee are figured in, PSBD makes very little profit on investments financed with debt.

Up And Down

Another problem with loans in the syndicated loan market is that they can be more volatile than the book and hold assets most BDCs specialize in. In 2022, two years after PSBD was launched, the BDC booked ($107mn) in unrealized depreciation on its portfolio, up from a ($9mn) unrealized loss in 2021. Then in the first 9 months of 2023, the portfolio was marked up $46mn.

The result is that PSBD’s net income has swung from a gain of $19mn in 2021 to a loss of ($75mn) in 2022 and back to a gain of $84mn in the first 9 months of 2023. Over this near-three-year period, actual net realized losses have amounted to a modest ($5mn), which underscores how much-unrealized asset values have swung around.

Leverage

Management is targeting debt-to-equity of up to 1.50x. As we’ve noted, that’s much higher than what most existing BDCs have chosen, which tends to be in a range of 1.0-1.25x. This poses an obvious risk, especially as PSBD’s assets are so volatile and could drop substantially in value in a brief period should there be a market crisis. This might cause the BDC to drop close to – or even below – regulatory requirements. This is no theoretical risk. At the end of 2022, debt to equity reached 1.8x. The corresponding “asset coverage” metric – which is supposed to never drop below 150% – reached as low as 157%.

On the positive side, PSBD will find it relatively easy to sell loan assets in a crisis to ensure leverage metrics remain within bounds, but that could entail booking significant realized losses. Thankfully at the moment the BDC’s leverage has dropped and will go even lower with the IPO. However, management has indicated only 3 months will be needed to invest all the IPO proceeds, so the issue of leverage could be back on the table later in 2024.

Bank Financed

One of the horrors of the Great Financial Crisis for BDCs was their almost total reliance on bank revolvers for their borrowings. The banks – in turn – were secured by the BDCs’ loan portfolios which dropped very sharply in value – often by a third. That caused availability under the revolvers to shrink and BDC liquidity to be greatly impacted. In the aftermath, BDCs have sought to diversify their borrowings. This has involved raising medium-term unsecured notes with few covenants; preferred stock; convertibles, etc. The result has been much more solid liability management and none of the dramas that we saw during the GFC. Virtually no BDC today relies exclusively on bank financing. Some have no bank financing at all.

Opportunity Missed

As a result, we were disappointed to see that the management of PSBD over the last 3 years has not chosen to diversify its funding sources rather than relying only on revolvers from Bank America and Wells Fargo. Both are fine lenders, but in a crisis will protect their interests. The debt markets have been closed at times but there have been many windows during this period – including in recent months – when PSBD could have “tapped” the unsecured debt or convertible market. Given that management is choosing a high target leverage AND investing in price-volatile assets, the decision to rely only on bank financing is disconcerting.

Credit

On the plus side, PSBD’s investment portfolio is 90% invested in first-lien debt. On paper, these assets are likely to perform better in terms of recovery if a borrower defaults. Also, a plus is that the 184 company portfolio is highly diversified. CSWC – a BDC with a similar portfolio size – has 94 companies.

However, it’s too early – after three years of PSBD being active in the market – to determine what long-term credit outcomes will look like. To date – as mentioned – there has been a smattering of realized losses, but well within what one should expect. There are no loans on non-accrual, which is a plus. On the other hand, the portfolio is valued at 95% of the cost. On the subject of PSBD’s likely credit performance in the years ahead, we are on the fence.

Management

Of late, the asset management groups that sponsor and manage BDCs have been getting ever-larger. This is not necessarily a Good Thing, but does mean there are very substantial human resources available to BDCs, both in identifying transactions and in managing them through the whole investment cycle, which can sometimes last 5-7 years or more. By contrast, both the size of PSBD’s parent and the BDC itself have relatively small staffs. This might be partly because both entities tend to invest in loans booked by third parties rather than originating them themselves. It’s too early to tell if that will prove a problem for PSBD.

Conflict Management

We know this might be controversial, but we’re uncomfortable that the CEO and CIO of the BDC are married to one another. Not helping is that Palmer Square has chosen not to have an independent director as “lead director”. This is very common in BDC-land, but we’d prefer to believe that there was an independent director ensuring conflicts of interest are properly managed. Also, disconcerting is that the valuation of the BDC’s assets is being left to the external manager. This is like having the fox providing security for the hen house, albeit a common occurrence in the BDC sector, which is rife with these sorts of inconsistencies.

CONCLUSION

Sorry

We don’t want to be unwelcoming, but many of the features of PSBD are not encouraging from a shareholder’s perspective.

We worry that risks will be higher than the BDC average and the returns (as measured by return on equity) lower than most of its peers.

The focus on investing in large syndicated loans (and CLOs) does not seem particularly attractive and we have no other public BDC to compare against.

Springing Eternal

However, these are early days and we will be learning much more about the capabilities of the management team; the market opportunity, and the likely earnings/dividend profile in the months ahead.

Not Alone

At the moment, investors appear to have a similar wait-and-see attitude.

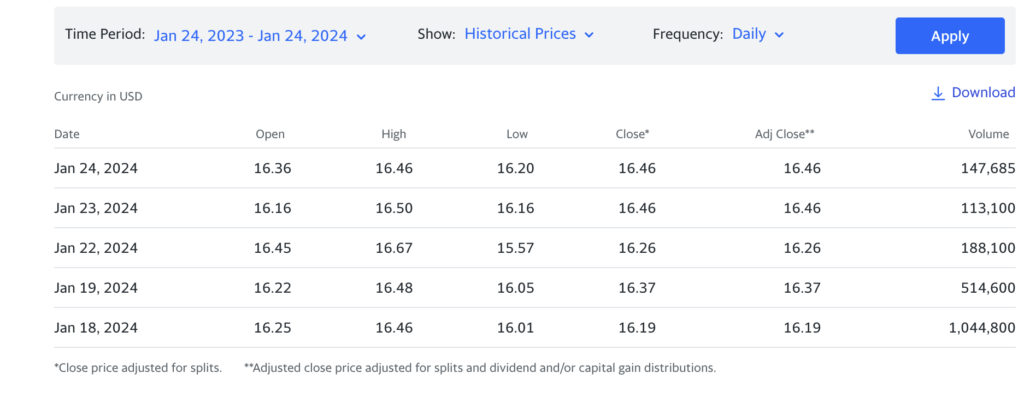

Since going public – as this Yahoo Finance Table shows – PSBD’s stock price has remained within a narrow range, and below its net book value per share:

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.