BDC Common Stocks Market Recap: Week Ended March 1, 2024

Premium FreeBDC COMMON STOCKS

Week 9

Out Of Sync

Not for the first time in 2024, we can’t help noticing that the major indices are headed in different directions from the BDC sector.

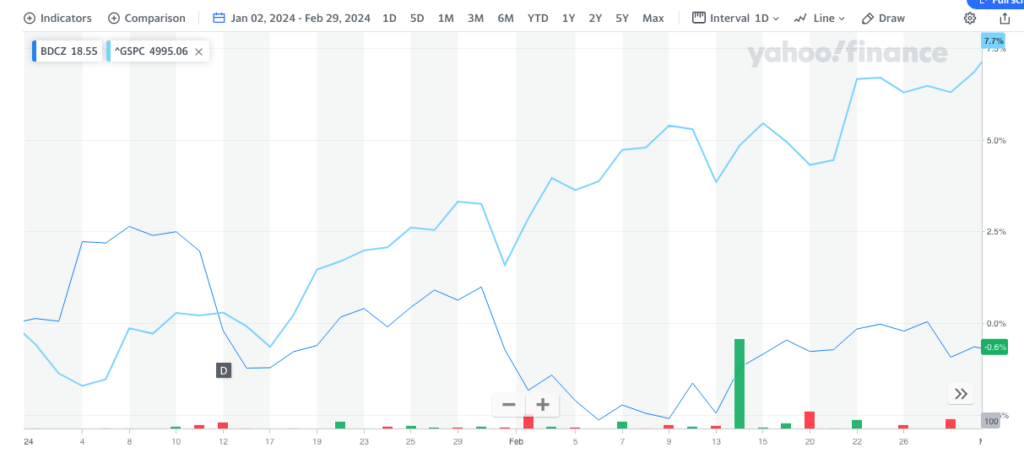

Let’s compare the price performance of the S&P 500 this week – and this year – with BDCZ, the exchange-traded note which holds only BDC stocks and which we use as a price guide for the sector.

The former increased by (0.9%) in Week 9 and is up 7.4% for the year. The S&P is regularly reaching new all-time price heights, despite interest rates still being high.

By contrast, BDCZ fell (0.7%) in the last 5 trading days and is down by a similar percentage for the year overall.

This chart of the S&P 500 and BDCZ in 2024 provides the 1,000 words promised by such things:

Even if we use the S&P BDC Index – calculated on a total return basis – the percentage increase after months and a day is “only” 1.9%.

That annualizes at 11.4%, which is hardly chicken feed but after 2023 which saw the S&P BDC Index return 27.5% and this year’s performance to date by the S&P, BDC price performance seems weak.

Rubbing salt into the wound, only 19 BDCs posted a higher price this week and the remaining 24 were in the red.

Of the BDCs that moved 3.0% in price in either direction, 2 were up but 5 were down.

Counter-Intuitive

On the other hand, and confusing the picture, 6 BDCs reached new 52-week price heights this week.

It should be said that this half-dozen group consisted of BDCs that have reported IVQ 2023 results in the last couple of weeks and all of them meeting or exceeding investor expectations.

Good performance has been rewarded but poor performance has been punished.

Beaten Down

The 4 Biggest Losers in percentage price items – from (4%) to (8%) down – were BDCs who have recently reported weak numbers for the IVQ 2023.

Top of this list is Horizon Technology Finance (HRZN), which disappointed for yet another quarter – the BDC’s Net Asset Value Per Share (NAVPS) fell (7%) this quarter and is down (15%) in 2023.

HRZN has posted a lower NAVPS for 6 quarters in a row.

Not surprisingly HRZN is trading (10%) down in price in 2024; (13%) off its 52-week high and is one-third lower than in the heady days of late 2021 when the BDC was close to breaking over $18 a share, yet was paying out a lower distribution than today.

HRZN’s shareholders may take some comfort knowing that their stock is still trading at a 23% premium to its NAVPS.

Terrible Two?

Also causing shareholders to swallow hard after the IVQ 2023 results were published this week were BlackRock TCP (TCPC) and FS-KKR Capital (FSK).

Both BDCs’ credit performance remains within “normal” boundaries, but both got materially worse in the IVQ 2023, impacting NAVPS, recurring earnings, and the number of non-accruals on the books.

These are large BDCs with famous asset managers in charge and – in the case of TCPC, on the verge of merging with a sister public BDC – BlackRock Investment (BKCC).

Both managers – as you would expect – are not conceding that they have any fundamental problem with their underwriting process, and are treating these latest credit setbacks as a passing phase.

Shareholders must be hoping that they’re right because FSK’s NAVPS has dropped by (10%) in the last two years and TCPC’s by (17%) in the same period.

That degree of capital loss is not sustainable over the long term.

The BDC Reporter addressed TCPC’s credit performance in an article this week, which provides much color about what has occurred in the latest quarter and over the longer term.

We’ll be turning to FSK shortly as we grind through the credit performance of all 43 BDCs we track.

Keep In Mind

The good news – after hearing from 32 of the BDCs this quarter – is that poor performance of one kind or another is more the exception rather than the rule.

Our Premium subscribers have access to the BDC Performance Table for the IVQ 2023 where we show key metrics and give each BDC a score of 1 to 5.

Broadly speaking, scores under 3 signify some degree of underperformance.

So far, 8 BDCs are rated 2, and 24 are rated 3, 4 or 5.

(We have no ” 1 rating” as even the underperforming BDCs managed to maintain, or even increase their total payout to shareholders in the IQ 2024 over the IVQ 2023 result).

That indicates a quarter of the BDC universe that has reported so far has underwhelmed while three-quarters have met or exceeded expectations.

The percentage of underperformers is higher than we expected, but not by a great deal.

Moreover, the market has not taken a hacksaw to anyone’s stock price yet.

The biggest percentage price loss YTD in 2024 is (9.6%) – for HRZN. That’s harsh but a modest price pullback by historic BDC standards when things go wrong.

This suggests to us that the BDC rally – admittedly long in the tooth and not going anywhere in recent weeks – continues to keep prices elevated.

Outlook

As always, we are as unsure as everyone else should be about the way forward for BDC prices.

We showed in last week’s Recap that there is plenty of room for the BDC sector to move higher based on fundamentals.

The Fed’s conservative stance about cutting rates continues to promise record-high BDC earnings for many more months to come – two or three quarters by our estimate.

Some bDC earnings will be lost to the refinancing of unsecured debt at higher yields; lower spreads on new loans, and the impact of any new non-accruals but some of that may in turn be offset by more fee and OID income as activity picks up and the occasional gain on equity owned.

For an example of the latter, check out Fidus Investment’s (FDUS) IVQ 2023 earnings, where NII came to $17mn, but was eclipsed by $20mn of net realized gains…

Pay Out

Many BDCs are still paying out “special” distributions and 4 increased their “regular” distribution recently.

As the BDC Performance Table shows, 12 BDCs that have reported – more than a third – have announced some sort of “special” distribution in the IQ 2024.

That’s more money in the pockets of BDc shareholders who might find it hard to walk away from those signaled riches.

Also – looking down the road, there is a small mountain of undistributed earnings at almost every BDC yet to be paid out to shareholders, built up over the last 2 years and likely still growing.

Warning?

On the other hand, the lackluster increase in BDC stock prices we’ve seen in 2024 even as the major markets charge forward may signal a waning of investor enthusiasm.

Another dampener would be more bad news coming out of the 11 BDCs still to report.

We looked down the list and several names have underperformed of late and may report more of the same where IVQ 2023 results are concerned.

As always, BDC stock prices in the short term could go either way in the week ahead, or just sit there.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.