BDC Common Stocks Market Recap: Week Ended April 19, 2024

BDC Common Stocks

Week 16

Divergent

There are a lot of glum faces in the main stock and bond markets of late.

The S&P 500 (^GSPC) fell about 0.9%, notching its sixth consecutive losing day, and suffering its worst losing streak since October 2022. The benchmark index lost more than 3% for the week. The tech-heavy Nasdaq Composite (^IXIC) slid 2.1%, falling more than 5% for the week.

Yahoo Finance – April 19, 2024

The S&P 500 has retreated more than (5% )from its record closing high notched on March 28, 2024.

Here’s the chart of the 10 Year Treasury yield – apparently on its way back to the heights of October 2023 when inflation was raging, rates were shooting up and everyone was freaking out:

We tell you all this to contrast with what is happening in the BDC sector where prices and sentiment is concerned.

Typically, when the major indices lose their composure, this affects BDC investors – but not this time.

This week, BDCZ – the exchange traded note which owns most BDC stocks and is one of our price guides for the sector – increased 1.50% to $19.04.

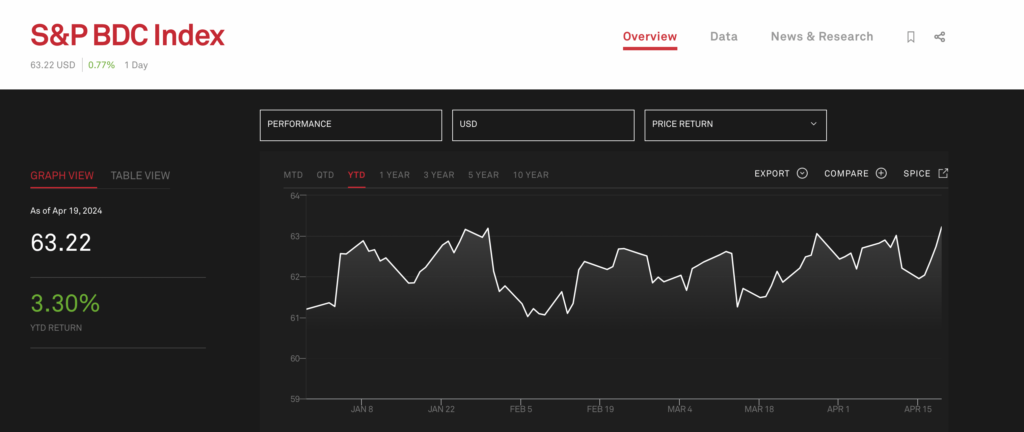

Another guide we use is the S&P BDC Index – calculated on a “price return” basis – and that reached a YTD high this week, and is up 3.30% as of Week Sixteen.

The S&P BDC Index – calculated on a “total return” basis – moved up 1.7% this week, and has increased 6.4% YTD.

With the S&P 500 headed south and the BDC sector headed north, the latter – on a total return basis – is now ahead 6.4% to 4.6%.

Wasted?

Over at BDC Best Ideas we wrote an article this week arguing that the latest bout of “higher for longer” where rates are concerned – and speculative talk about the Fed Funds rate ultimately being raised to 6.5% – should be regarded by BDC mavens as an opportunity, even if investors in the major indices did not.

We were partly compelled to state what might have seemed obvious because the last time interest rates rose – in the fall of 2023 – BDCZ dropped by almost a tenth between the end of September and the end of October 2023. See the BDC Market Recap for the week ended October 27, 2023.

(Thereafter – as rates moderated – BDCZ went on a 10 week rally, increasing by 15%).

Anyways, we probably shouldn’t have bothered because BDC investors do not seem fazed by the seeming change in the inflation/interest rate agenda.

This week, 36 individual BDCs saw their prices increase and only 6 decrease.

Moreover, there were at least 3 BDCs recording new 52-week highs.

Amongst the 36 BDCs up in price, 6 moved up 3.0% or more.

No BDC fell (3.0%) or more, which is unusual.

At one point, TriplePoint Venture Growth (TPVG) – much out of favor in recent months due to a series of credit losses – reached a new 52-week low (to $8.88) but by week’s end bounced back up (to $9.50) on very heavy trading volume.

Clearly, the “value buyers” were out looking for bargains.

Looking Forward

As we’ve seen, the S&P BDC Index on a price basis is at a YTD high but is also at a 52-week high.

BDCZ is only (8%) off its own 52-week record.

17 BDCs are trading within 5% of their 52-week high and another 15 within 5%-10%.

That means three-quarters of BDCs are flying high price-wise.

Also worth noting in the same vein – and very important to some investors – 19 BDCs are trading at or above net book value per share.

That’s notable because we scrolled through the weekly metrics we’ve been keeping for ages and found this to be the highest number since April 2022.

That coincides with the latest BDC high in the last cycle – just before the Fed began its rates rises and when everyone and their dog presumed a recession was forthcoming.

BDCZ only has to move up by approximately 8% to match its prior price heights in 2022 and in 2020. To get to the 2018 heights, BDCZ will need to move up 10%.

Believing

Is that possible?

We don’t see why not.

BDCZ is paying out a substantially higher distribution now than in those prior periods, and the macro environment appears to be promising that – at the very least – those high flying payouts will continue through 2024.

Could we see this long standing BDC rally breakout and set even more records?

We wouldn’t rule out the possibility, especially if inflation continues to dig in its heels and the whole timeline of expected rate cuts gets upended and we move into uncharted territory.

Fundamentals Matter

Also important will be how IQ 2024 BDC earnings season turns out.

The IVQ 2023 saw many more credit setbacks than most investors had expected and kept a number of BDCs from joining the rally.

Here’s how much below their 52-week high are the BDCs we rated as underperforming (a score of 2 on a 5 point scale) in the last quarter in our proprietary Quarterly Performance Table.

BlackRock TCP (TCPC) is (22%) off; FS-KKR Capital (FSK) is (8%) off; Horizon Technology Finance (HRZN) is (16%) off; Investcorp Credit Management (ICMB) is (29%) off; Logan Ridge (LRFC) is (6%) off; Oaktree Specialty (OCSL) is (9%) off; OFS Capital (OFS) is (24%) off; Prospect Capital (PSEC) is (23%) off; Runway Growth (RWAY) is (9%) off; Saratoga Investment (SAR) is (21%) off; TPVG Capital (TPVG) is t(25%) off and WhiteHorse Finance(WHF) is (7%) off.

Musings

Imagine what might happen to the BDC rally if most of those underperformers can demonstrate improved performance, especially the larger players such as TCPC; FSK, OCSL and PSEC.

We’ll be watching out for all sorts of things when IQ 2024 earnings season gets here, but how these 12 players perform will be a central theme.

A sector rally can march on without them but if the number of BDCs performing at or above expectations broadens, we might see a Great Leap forward both in the price of individual BDCs and the likes of BDCZ and the S&P BDC Index.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.