BDC Common Stocks Market Recap: Week Ended May 2, 2025

BDC COMMON STOCKS

Week 18

Wall Street closed out a strong week on a historic note, with the benchmark S&P 500 index (SP500) on Friday notching a nine-day win streak—its longest such run since November 2004.

For the week, the S&P (SP500) advanced +2.9%, while the tech-heavy Nasdaq Composite (COMP:IND) climbed +3.4%. The blue-chip Dow (DJI) rose +3.0%.

source: seeking alpha – wall street breakfast – may 3, 2025

Left Out

Sorry BDC investors but you were left out of the broader rally in the markets this week.

As the quote above illustrates, the major indices were on an upward march but the BDC sector – as measured by the price performance of its only exchange traded fund with the ticker BIZD – headed in the opposite direction.

BIZD was off (0.9%) and the S&P BDC Index – price only – slipped (1.0%).

Furthermore, 34 of the public BDCs we track dropped in price and only 12 were up or unchanged.

This broke a two week “streak” – if that’s the right word – of higher BDC prices.

At The Extremes

Only Palmer Square Capital (PSBD) increased in price by over 3.0% – 3.2% to be exact.

That will be little comfort to most of its shareholders who’ve seen the (relatively) newly public BDC reach an all-time low price as recently as April 21, 2025.

Just looking at PSBD’s stock chart and the eleven times the BDC has found a new price low since February 7 of this year does not inspire much confidence that this week’s price bounce will last.

Biggest Loser

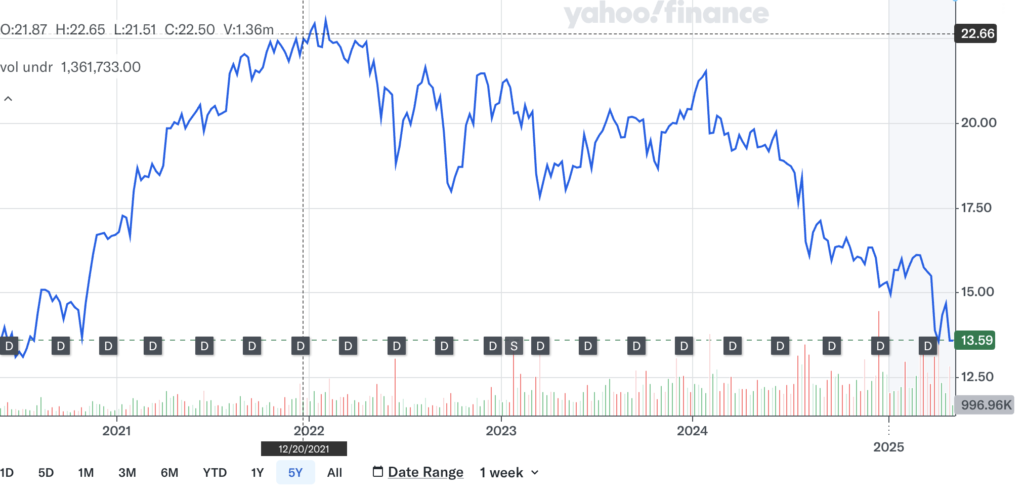

The worst percentage price performer was Horizon Technology Finance (HRZN), down (15.7%).

That’s in no way surprising given the BDC’s just published results, which we discussed at length in a Premium article this week.

The venture-debt BDC’s shareholders must be wondering when their stock price nightmare will end.

It began in November 2021 when HRZN’s stock exchanged hands at close to $18 a share and then began to drop, and drop, and drop:

HRZN reached a new YTD, 52 week and all-time low price of $7.12 this week, and closed at $7.38.

As the BDC NAV Change Table shows, the BDC’s Net Asset Value Per Share (NAVPS) – one of our favorite metrics for measuring the long term health of any BDC – has dropped (35%) since the end of 2021.

Nearly one-third of that drop was booked just in the most recent quarter.

Unfortunately – in our opinion, following an in-depth review of HRZN’s remaining portfolio and given the difficult market conditions – the bottom has not yet been reached. Here’s a telling line from our article which says it all:

There is every reason to believe that the deterioration in HRZN’s NAVPS will continue and for an indefinite period.

Source: BDC Reporter

Ditto

Another BDC that posted poor results this week was Oaktree Specialty Lending (OCSL), which deserves its own spotlight but time constraints have kept us from penning a full review.

The BDC’s own NAVPS dropped (5.0%) in the IQ 2025; (11%) in the last year and (24%) since 2021.

Since OCSL began its own – choppy -price descent which we date back to January 2022, the stock price is off (41%).

Little Hope

Bleakly, we don’t have much hope for OCSL either after an initial look into its under-performing loan portfolio, which includes two new non-performers.

Over at the BDC Credit Reporter, we’ve written about the Mosaic Companies default, which is interesting from a number of perspectives.

First, the company’s problems – and the potential significant loss of capital and income forthcoming – are being directly blamed on the changing tariff regime.

Secondly, the loan involved went from being carried as performing normally to non-accrual status in just one quarter.

Imagine if that should happen more frequently at OCSL – or at any other BDC.

Investors will be unable to assess the level of credit risk they’re taking and might assume the worse, sharply driving down BDC prices.

These sudden shifts from light to darkness have been occurring more and more of late and cause us concern.

Another OCSL portfolio company – Dominion Diagnostics – suddenly slumped in value and went on non-accrual in the prior quarter, also covered by the BDC Credit Reporter. Here’s an extract from our article of April 2, 2025:

We have a new Important Underperformer, which happens to be in the Healthcare sector, and held by only one BDC – Oaktree Specialty Lending (OCSL). Unfortunately, this is one of those situations where the company was on our Watch List – rated 3 on our 5 point scale since 2022 – but needed a two notch downgrade in the IVQ 2024. That’s when OCSL – a lender since 2010 – placed 3 loans due in August 2025 on non-accrual. Moreover, a relatively mild discount of the debt – (18%) as of the IIIQ 2024 was increased to (72%).

Source: BDC Credit Reporter

Investing is all about confidence and when that gets sapped investors tend to flee to the sidelines.

Where We Are

Betwixt

The BDC sector is neither hot nor cold right now.

BIZD is trading 14% above its 52-week price low but also the same percentage off its 52-week high.

Outside of HRZN, no BDC dropped to a new low this week and – need it be said? – none reached a new high.

Only 2 BDCs are trading within %% of their lows and 6 in the 5% -10% range.

On the other hand, no BDC is within 0%-5% of its highest point and only 2 within 5%-10%.

Only 10 BDCs are trading at or above their NAVPS even though the book value bar has been dropped for all 8 BDCs that have reported their IQ 2025 numbers.

GPS

BIZD is trading (7.6%) down in price in 2025 and the S&P BDC Index calculated on a “total return” basis is down (5.6%).

A month ago, the deficits were twice as high, so we can be thankful for small mercies.

However, 41 of 46 BDCs are in the red in 2025 YTD – a not very great place to be with a third of the year gone.

Moreover, BIZD’s performance is beginning to diverge all the more from that of the S&P 500, which is now down (2.9%) on a total return calculation in 2025.

Even a month ago, BIZD was way out-performing the senior index.

Where We’re Headed

Something In The Air

This is not a scientific statement, here seems to be a higher-than-usual level of anxiety about what the future holds for BDCs.

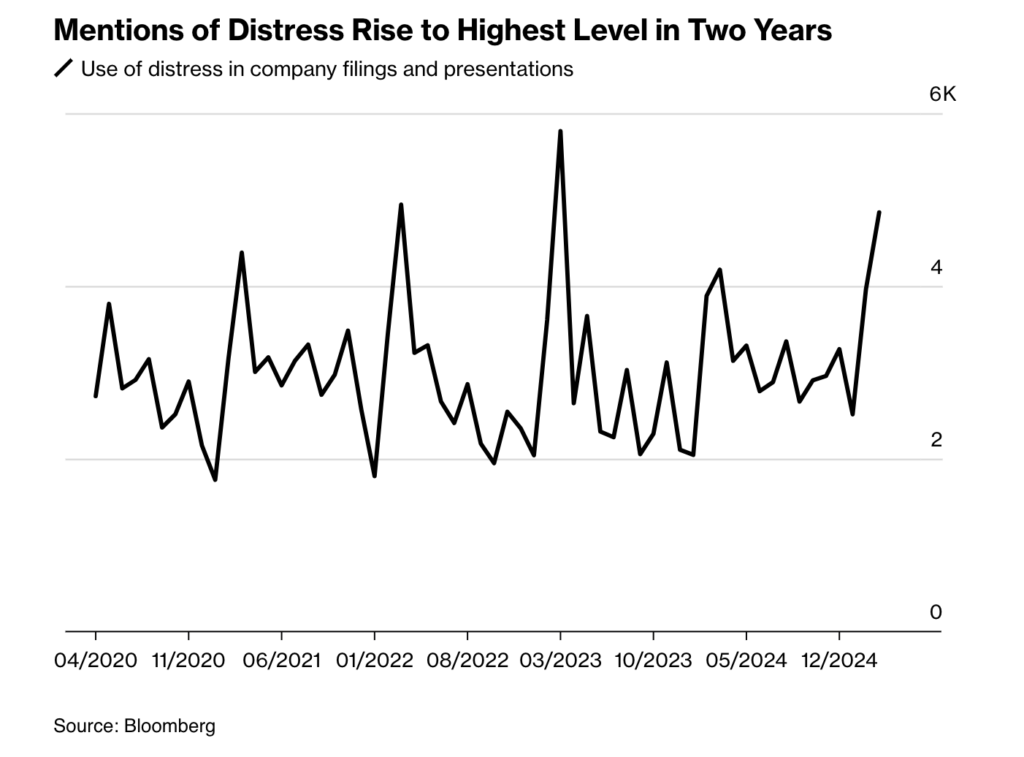

One good example of what we’re noticing is this article from Bloomberg, which begins this way:

Hedge funds are betting that trade wars, a shrinking economy and rising strain among borrowers will begin to hit private credit in the US. So far, the gamble’s paying off.

Bloomberg has even been able to quantify what we cannot by graphing the mentions of “distress” in company filings, which – as you can see – are on the rise.

Tropes

We’ve heard all the warning signs mentioned in the Bloomberg article before: concerns that lenders have portfolios stuffed with zombie companies which are being deliberately over-valued; higher PIK balances reflecting ever more borrowers unable to pay their debt in cash and most lenders having no prior experience of a sustained economic downturn.

That’s all old hat and painting a complex “private lending” landscape with a broad brush and could have been said a year ago when BDC credit results were in unusually fine shape where most participants were concerned.

Lest We Forget

However, we’ll concede that the jury is still out as to whether the administration’s trade approach will result in a significant increase in credit difficulties amongst BDC-financed companies.

We are keeping very close tabs on what the BDC managers are telling us and tracking anecdotal developments like the default at Mosaic Companies.

The BDCs have done their homework and been in close contact with their borrowers and are ready to swear that very, very few of their companies are in the direct line of fire from tariffs, let alone to be materially damaged if they are.

Both Ares Capital (ARCC) and Sixth Street Specialty (TSLX) had a go on their calls at quantifying the exposure, which we’ll discuss in a future article.

Sucker Punching

Harder to evaluate are the indirect blows to borrower profitability that could impact their creditworthiness.

If these are to occur en masse, we’re probably months away from getting any hard data.

Many investors, though, won’t want to wait around for the BDC credit report card, and a darkening mood could depress prices in the short term whatever is happening on the front lines.

On the other hand, it should be said that neither the price of BIZD nor of the 46 BDCs we track suggest investors believe a recession is on the immediate horizon.

As is so often the case, this could go either way this spring and summer.

Admission

For our part – despite the most attractive pro-forma BDC yields we’ve seen in years – we’re more worried than usual about the ability of the BDC sector to continue business – and earnings and NAVPS – as usual.

We’ll be leaning more than ever on what we turn up in the BDC Credit Reporter, and listening between the lines on the many conference calls to come.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.